Why bitcoin is still the gold standard of crypto assets

When Bitcoin was launched, it caught on quickly as it filled a need that had been present for a while. Despite Bitcoin’s success, it still had some flaws such as a limited supply, high transaction fees, slower transaction rates, and the amount of energy needed to mine it.

What is Bitcoin?

At this point, Bitcoin needs very little introduction. Launched in 2009 by Satoshi Nakamoto, it was the first crypto asset and was created to address issues like the public's growing distrust of governments.

The idea behind Bitcoin was that by creating a method of exchange operating on a decentralized network, people would be able to make direct, secure transactions without needing intermediaries. The idea worked, and 12 years after its launch, Bitcoin is the biggest crypto asset in the world, with a current value of $48,236.75.

The rise of altcoins

The only constant in life is change and as the needs of crypto users evolved, several altcoins were created to improve on the flaws of Bitcoin. Some of those altcoins created are: Ethereum, Litecoin, Binance coin, Tether etc. These Altcoins are all similar to Bitcoin due to their decentralized nature but also have unique features different from Bitcoin’s.

Because of these improvements, huge leaps have been made in the crypto community. The regular updates that have been made to the crypto assets that came after Bitcoin have made things like Decentralized Finance (DeFi), Decentralized Applications (dApps) Non-Fungible Tokens (NFTs) and Smart contracts a reality.

How well has the crypto world taken to altcoins?

When Bitcoin was launched, it caught on quickly as it filled a need that had been present for a while. Despite Bitcoin’s success, it still had some flaws such as a limited supply, high transaction fees, slower transaction rates and the amount of energy needed to mine it.

For this reason, several altcoins were created over the years to first address the shortcomings of Bitcoin and then later, to fix the issues it had. As a result, most altcoins now have faster transaction speeds, lower transaction fees, more features and require significantly less energy to mine than Bitcoin.

An example of one of such altcoins that innovated to provide what Bitcoin couldn't is Ethereum. This altcoin introduced the idea of smart contracts which are automated programs stored on the blockchain that execute contracts involving multiple parties as long as preset conditions are met. Ethereum's ability to host other crypto assets on its own blockchain is another game changer which essentially elevates it from a crypto asset to an application in its own right.

In 2018, Singapore airlines launched its blockchain-based loyalty program for their most loyal customers. This loyalty program meant that unlike previously when frequent flyer miles could only be used limitedly on the airline, they could now be converted to cryptocurrency on the blockchain and used at businesses the airline had an agreement with.

Right now, the uses of crypto assets are varied; you can write programs and smart contracts, play video games and earn rewards, trade collectibles and of course, trade them the way Satoshi intended when he created the first viable crypto asset.

Another reason altcoins have become popular is their volatility. The crypto market is famously volatile with Bitcoin itself changing in value regularly. However, these altcoins are even more volatile and prices can fluctuate several times in one day. While this may be seen as a disadvantage to some, savvy operators have learned to take advantage of the volatility of coins and flip that into profits by applying sevral strategies including the Day-trading strategy.

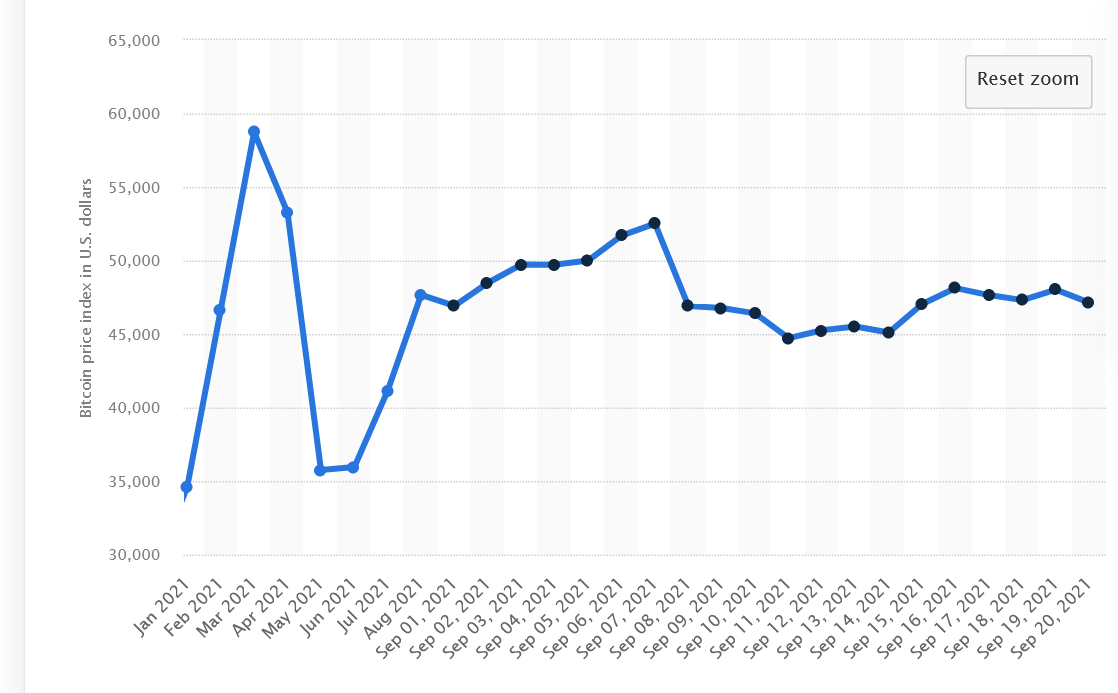

Recent Bitcoin fluctuation

Even in an (in) famously volatile market, Bitcoin has had an eventful year. After reaching an ATH value of $64,805.00 on April 14, 2021, the value nosedived until May when it held steady for the first week before dropping again. Since then, its value dropped almost constantly until early August when the value started to rise again and hold steady more often than it dropped.

September began with the value of Bitcoin hovering around the $48,000 mark before rising to ≈ $52,000 in a week. The next four days saw a $4,000 drop to a value of ≈ $44,000 before rising again to a value of $47,721.3 on the 16th of September.

Despite this volatility, experts still believe that the value of Bitcoin will soon reach its ATH, pass it and keep climbing until the value of the coin passes $100,000 as we mentioned here.

Why Bitcoin remains the Gold standard

The altcoin that has the best chance at catching up to Bitcoin is Ethereum, with its smart contracts and the fact that it is essentially already a network in which many other cryptocurrency assets are issued.

However, while Ethereum makes a strong case as the closest challenger to Bitcoin’s dominance, the #1 crypto asset is not resting on its oars waiting to be overtaken. 12 years after its launch, it still is the preeminent crypto asset.

As other crypto assets have adapted, so has Bitcoin. In 2017, Bitcoin Cash, an altcoin based on the original Bitcoin, was created to address issues the original coin had. Also, as there is a fixed amount of Bitcoin available, financial experts have labeled it a fixed asset, just like gold.

The biggest crypto investors favor Bitcoin over other crypto assets. With a Market cap of $894.31 billion, it is twice as large as its nearest competitor, Ethereum. The level of interest in Bitcoin will also continue to sustain its push to soon cross the trillion market cap threshold.

The biggest indication of Bitcoin's influence on the crypto market, however, is the phenomenon called Bitcoin Dominance. While at 41.82%, it's much lower than it used to be in the cryptocurrency early years, Bitcoin still takes up a large chunk of the cryptocurrency market and as such, is seen as the crypto market's reserve currency by investors. This means that a Bitcoin crash would essentially cripple the crypto market.

The inverse is also the case. A sustained Bitcoin bull market is good news for other crypto assets. For this reason, even the most die-hard adherent of a rival crypto asset who sees it as a dinosaur of a coin wants it to do well because the future of their coin is tied closely to Bitcoin's.

Conclusion

Market monopolies are never beneficial to customers, as the product that has a monopoly can, among other things, reduce the likelihood of innovation in that particular market. In crypto, the rise of altcoins has provided several alternatives to Bitcoin and ensured that the crypto market is constantly adapting to the needs of its consumers.

This competition has benefited crypto traders enormously, as seemingly every day, a new crypto asset is created to meet an already-existing need. However, none of these competitors have even come close to surpassing the behemoth that is Bitcoin, and it looks set to stay that way for a very long time.

What do you think? Do you see any altcoin surpassing Bitcoin in the near future?

Disclaimer: This article was written by the writer to provide guidance and understanding of cryptocurrency trading. It is not an exhaustive list and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.