Introduction to Day Trading

Day Trading is a trading strategy implemented on a day-to-day basis which involves the buying & selling of crypto assets in a very short time period (usually in a day or less). The term itself comes from traditional stock market practices when assets trading was done only during business hours.

A detailed guide for beginners on the day trading strategy.

In the volatile world of cryptocurrency trading, knowing which trading strategies to implement at different points in the market can mean the difference between making a profit and losing everything you've invested.

After discussing trading strategies such as Scalp Trading and Dollar-Cost Averaging, we will now discuss the Day Trading strategy and how both novice and experienced traders can implement it.

Unlike the day trading strategy, many trading strategies are typically implemented over week, month, and year-long time periods. In this post, we will explain how this works and how to best take advantage of it so that by the end of this article, you will be able to safely invest your hard-earned money in the crypto market using this strategy.

What is Day Trading?

Day trading, as the name implies, is a trading strategy that is used on a daily basis and involves the buying and selling of cryptocurrency assets in a very short period of time (usually in a day or less). The term derives from traditional stock market practices in which assets were traded only during business hours.

How does the day trading strategy work?

Because the primary goal of day traders is to profit from daily price changes, extensive market knowledge is required, as well as some trading experience. Furthermore, traders will need to abandon fundamental analysis because that type of long-term approach contradicts the goal of day trading, which is to profit from daily market volatility.

Traders will also need to stay informed about events taking place around the world. For example, if Elon Musk or Tesla acquires a large amount of Bitcoin, you will most likely want to buy some right away before the price rises predictably. It also works the other way around: if a country cracks down on Bitcoin and miners, the value of the crypto asset is likely to fall as soon as the news hits the mainstream.

As a day trader, you must also ensure that you have sufficient funds to execute trades at any time. Day traders benefit from using Obiex because they do not have to wait for confirmation before executing trades. This buys you the valuable extra minutes or seconds you need to make a profit that day or lose most of your investment(s) because you had to wait for your transaction to be confirmed.

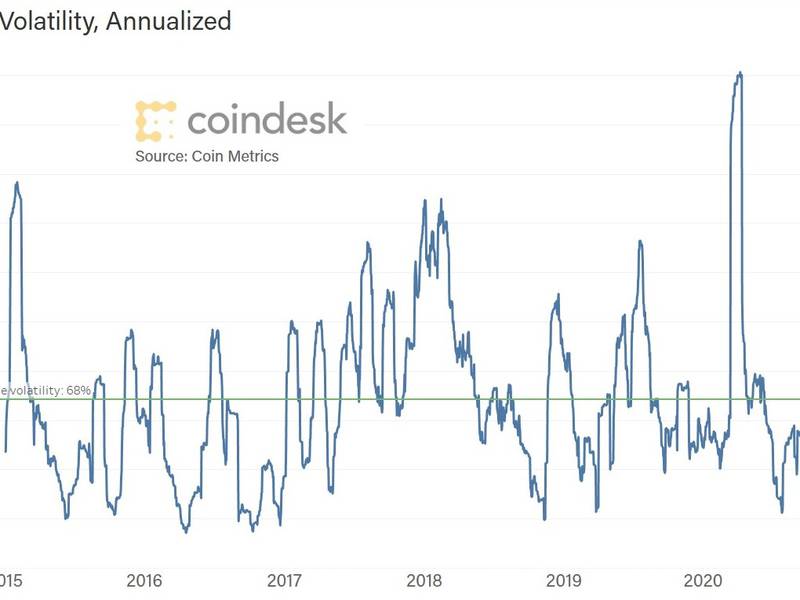

Another important consideration is to only invest in coins that are highly volatile and have a high liquidity. This is due to the fact that you are trading within a condensed time frame, and as such, you require the asset you are trading to increase or decrease in value within that same time frame. Bitcoin is an example of a highly volatile crypto coin, but for other options, see this Yahoo! Finance list.

What is the best way to execute the day trading strategy?

Because day trading is about taking advantage of the crypto market's daily swings, you can borrow from other trading strategies and scale down for the short period of time you want to execute your daily trades. Among these strategies are:

Scalp Trading: As previously discussed, scalp trading is a short-term trading strategy that entails spreading out numerous small trades over the course of a day in order to capitalize on small price changes. This strategy is based on the well-known fact that smaller moves are more common than large moves and are also easier to obtain.

Because traders who favor this strategy prefer quick, easy profits over long trades, it's an excellent strategy for day traders to employ as well.

To properly execute this strategy, you will need to combine precise decisions with knowledge of how the market works, as well as stay up to date on all crypto-related developments as they occur.

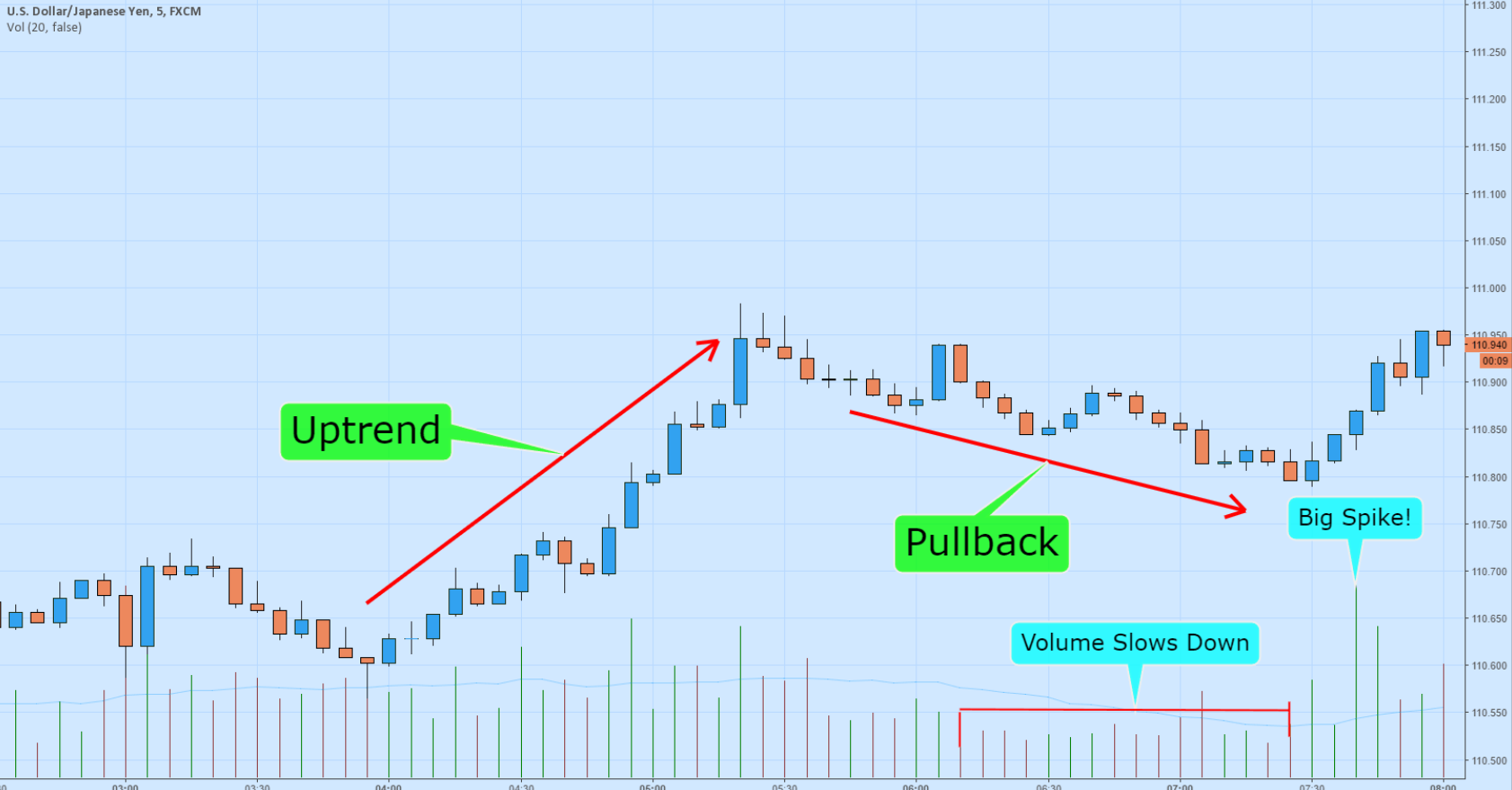

Range Trading: Traders who use this strategy look for price movement between high and low price levels on a given day. This basically means that as a day trader using this strategy, you can go long or short depending on the position of the asset price within the set range.

The key to this strategy is to buy when the asset price reaches the set support level and sell when the asset price reaches resistance.

Support is the price level reached when the value of a specific cryptocurrency asset falls while demand for it rises. This is due to the concentration of demand, which will halt the decline in the value of the specific coin.

The zones created by selling interest as prices rise are referred to as resistance zones.

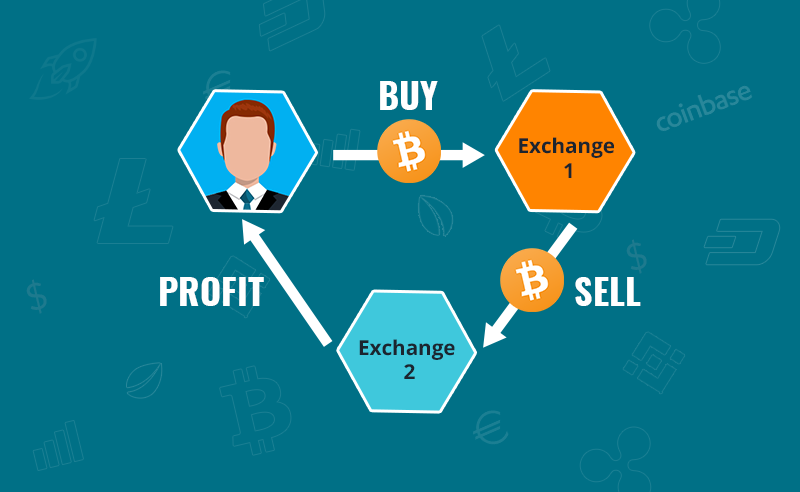

Arbitrage: One of the benefits of trading cryptocurrency is that the value of crypto assets varies between cryptocurrency exchanges; for example, the value of Bitcoin on Obiex may differ from the value of Bitcoin on Quidax. This allows savvy traders to make a quick profit by purchasing cryptocurrency at a lower rate on one exchange and selling it at a higher rate on another.

Sentiment-based trading: This strategy entails predicting the direction of the crypto market based on publicly available data.

As previously stated, both positive and negative news, such as Elon Musk tweeting positively about Dogecoin and China destroying mining rigs, can affect the price of whatever crypto asset you hold.

Staying on top of the news and ensuring you're in a position to act on it before the rest of the market can yield very favorable returns for smart traders.

Pros and cons of Day trading

Pros: there are some benefits to day trading such as -

Market Volatility: While crypto markets are notoriously volatile, astute day traders can make consistent profits simply by understanding how to capitalize on that volatility and flipping their crypto assets several times per day.

Constant Market Access: While the term "day trading" is derived from traditional stock market trading, the strategy in the crypto space is slightly different because, unlike the stock market, the crypto market never truly closes.

This means that while day traders continue to operate on a daily basis, they can still observe market trends even when no trades are being executed. This can assist them in staying on top of developments and putting them in a position to strike and execute their preferred trades at the right time.

Cons:

Market Volatility: While this can be advantageous for a savvy day trader, it can also be detrimental. Because of the crypto market's notoriously chaotic nature, a tweet from a CEO or any other market disruptor somewhere can turn the market on its head and leave you with a loss if you aren't ahead of whatever is causing the volatility at any given point.

Smaller profits: While there is the possibility of making small profits in a short period of time, the market does not move enough in a day trade to yield a significant profit. This means that when crypto assets experience a bull run, day traders will only receive a small portion of the profits.

FAQs

1. Can I execute the day trading strategy on the Obiex app?

Yes, you can! The beauty of the day trading strategy is that you can try it with almost any strategy and it will pay off as long as you’re patient and move to execute trades without any hesitation.

It also helps that our platform allows you to execute your trades without confirmation, allowing you to complete your trades in time and take advantage of the volatile swings of the crypto market.

2. What crypto coins are best for day trading?

The best coins for day trading are liquid and volatile which means Bitcoin is always an option for day traders. For a comprehensive, daily list of volatile crypto assets, check out this Yahoo! page.

3. Are there any restrictions to my day trading?

No, there aren’t. To begin day trading, simply create an Obiex account (if you haven’t done that already) and start trading. However, keep in mind that you need to plan your approach before you start day trading.

4. Are there any extra fees I will need to pay?

Not on Obiex, no there aren’t. You can start your day trading without worrying about paying any extra fees, trading volatile coins for stable coins are free on Obiex.

Disclaimer: this article was written by the writer to provide guidance and understanding of cryptocurrency trading. It is not an exhaustive list and should not be taken as financial advice. Obiex Finance will not be held liable for your investment decisions.