Introduction to Scalp Trading

What is Scalp Trading? Scalping is a short-term trading strategy that involves stretching out numerous, small trades over a day to benefit from small price changes. Scalping is based on the premise that smaller moves are easier to get and more frequent than larger moves.

Like most people around the world, you were probably perplexed the first time you heard the term "cryptocurrency."

You probably dismissed it out of hand as another internet fad that would soon be replaced by another, and then smugly nodded as the term faded from public consciousness, seemingly proving you correct.

However, it returned, shocking you, and this time it grew so large that it changed the lives of many people and was adopted by several governments around the world.

There are crypto exchanges all over the place now, and the way crypto is discussed on your social media timeline makes you feel as if you've just arrived in a new city where everyone speaks a different language.

At this point, your interest has been piqued; you need an additional source of income to supplement your finances, so you decide to ride the crypto wave.

What do you do when you go to live in a foreign country where the language is different from yours? You learn the language, or at least the basics, so that you can communicate more effectively.

The basics of crypto trading were discussed in the introduction to spot trading article, with several trading strategies highlighted. One of the previously discussed trading strategies, known as "scalping," will be expanded on in this article.

WHAT IS SCALP TRADING?

Every trader's goal is to make as much profit as possible with as little risk as possible, and scalping is no exception.

Scalping is a short-term trading strategy that entails spreading out numerous small trades over the course of a day in order to capitalize on small price changes.

Scalping is predicated on the idea that smaller moves are easier to obtain and more frequent than larger moves. Traders who favor this trading strategy are not interested in larger profit opportunities, but rather in making an easy, quick killing in a variety of trades in the hope that, if executed correctly, these small trades will add up to a profit greater than the sum of their parts.

It’s also a way for traders to hedge their bets because this type of trading is less risky than going for a huge profit.

For those who are familiar with the concept, an easy way to explain this is through football betting.

Consider two punters who want to place bets with $100 in one day. One wants to go for a 10-game accumulator full of risky bets such as Wolves defeating Manchester City, Leganes defeating Barcelona, and so on, and places the entire amount on that bet.

The other prefers to place five separate bets of $20 each; Liverpool to beat Arsenal. Bayern Munich is capable of defeating any German team. Sheffield United will be defeated by any EPL team.

Each has a different betting strategy, with the former having a better chance of winning more money by betting on underdogs to win. However, he is taking more risks, and there are too many variables at play, so he is unlikely to profit from that bet.

The latter has a better chance of winning because he placed safer bets on the most likely outcomes, and while football is a game where anything can happen, he has a better chance of winning more than half of his bets and profiting on his initial bet.

This strategy, while yielding significantly lower profits than the former, has a higher chance of success and, in the long run, is the safer option.

Scalping works in the same way; scalpers must first understand the comparatively safer bets to place while also combining quick, precise decision-making with market knowledge. It is a good way for new traders to start their trading journey until they understand the complexities of the market better.

WHAT SCALP TRADING STRATEGIES CAN YOU USE?

Successful scalp trades necessitate traders being able to detect exact market changes and having the courage to exit trades when the exact moment to strike and make the trade has passed.

To execute this strategy successfully, a trader must be patient enough to wait for the right opportunity to pull the trigger on the perfect trade, by determining the right time, and having the discipline to walk away if the exact moment to make the trade is missed.

There are several scalping strategies traders can use to ensure their scalp trading is more successful than not.

FIVE STRATEGIES TO EXECUTE TO MAKE YOUR SCALP TRADING A SUCCESS:

1. Crypto Range Trading: The range is the price movement between high and low steady price levels over a specific time period. When traders use this strategy, they tend to go long and short (at different times) depending on the price's position within that range.

When the trader has identified the ideal trading range, he can manually enter positions by buying at support and selling at resistance*. When the market reaches a support level (a price that the company almost never goes below), scalpers can easily send limit orders** to long crypto at a lower entry price within the range. In level markets, scalpers can easily exchange ranges.

For example, if Dogecoin is available on the Obiex app for $0.26 dollars and you believe its value will rise to $0.80 dollars, you can choose to obtain several quantities of $Doge and trade in a range of $0.26 to $0.80 dollars. This means you buy Dogecoin at its normal price, sell it if it rises to around $0.80, and repeat the process until you believe the stock will no longer trade in that range. This is referred to as "going long."

To take a short position, you decide to sell some/most/all of your dogecoin if you believe the value of the dogecoin will fall. If the value falls as predicted, you can begin purchasing dogecoin again when you believe it is about to begin trending upward. The (lower) amount you buy back in comparison to the value you sold it for indicates that you profited from taking a short position.

You use the crypto range trading strategy to profit from markets that fluctuate within a narrow range of consistent highs and lows. Avoid the trade if the swings are inconsistent and too abrupt.

2. Arbitrage/Exchange: Because of how much prices fluctuate and vary across exchanges, this strategy is popular in crypto trading, allowing a savvy trader to make quick profits by buying and selling the same asset(s) in different exchanges.

If, for example, 1 $BTC is available on the Obiex app for $34,435.71, but Bitcoin is available on another trading platform for $34,234.71, you could buy the bitcoin on the other trading platform and sell it on Obiex to make a quick $210 profit.

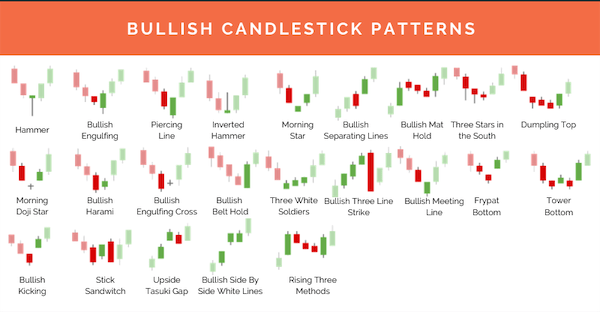

3. Price Action: this strategy is based on traders studying (seeing and interpreting) the asset price movement to create trade ideas. There are several tools that can be used to analyze price action such as: line chart, bar chart and the Japanese candlestick chart.

Using the tools mentioned here, along with some practice, you will be able to read the market, predict and make trading decisions based on readily available data. For more information about how to utilize the ‘price action’ strategy, check here.

4. Bid-Ask Spread: this strategy is the difference between the highest price a buyer will pay for an asset and the lowest price a seller will accept.

As an example, suppose you want to buy 1$BTC from someone and you offer them $33, 000 for it. If the person refuses and insists on selling the Bitcoin to you at $34,900, the spread is $1,900.

In layman's terms, your bid represents the demand, while the counter-offer of $34,900 represents the supply. The bid-ask spread is the difference between the asking and offering prices of a cryptocurrency coin/transaction.

5. Margin Trading: This strategy entails using third-party funds to boost profits, allowing traders to invest larger sums and leverage their positions, potentially leading to higher profits. When a trader initiates a margin trade, he or she must commit a percentage of the total order value, which is known as the margin.

If you want to buy Bitcoin because you believe its value will rise, you can either buy the corresponding amount of bitcoin or leverage a trade on the trading platform.

The rate you're offered will tell you how much of your own money you'll need to invest. For a 10:1 leverage, this means that for every $10, you must invest $1 from your account, with the rest covered by the trading platform you use.

BEST TOOLS TO SCALP CRYPTO WITH

Even the most seasoned traders require specific tools to execute trades more quickly and efficiently. Here are some tools to help you better scalp trade cryptocurrency:

1. Crypto Trading Bots: This is the most widely used software tool for traders. Trading bots such as Pionex and ApexTrader automate trading by using predefined criteria and set instructions. With these, a trader can make continuous trades while the bot increases the likelihood of success and decreases the likelihood of failure.

2. Crypto Trading Charts: Crypto trading charts, such as price and volume charts, provide traders with all of the information they require, making it impossible to trade or even scalp without consulting trading charts.

3. Crypto API Tools: Crypto APIs enable traders to perform a variety of tasks, including wallet integration, market price tracking, and transaction support. They can even assist traders in conducting academic research on cryptocurrency and developing trading bots. LunarCRUSH and Messari are two examples of Crypto APIs.

PROS AND CONS OF CRYPTO SCALP TRADING

Pros: The risks to traders are lower as smaller price positions are targeted, making it easier to record a higher success rate since small price movements occur with a higher frequency than large price movements.

Scalp trading can also be easily automated, allowing the trader to make continuous trades while the bot increases the rate of success and decreases the possibility of failure.

Cons: Scalping necessitates quick decision making in order to trigger trades at the precise moment the trade should be executed, resulting in a very narrow window of opportunity. If that window is missed, the success rate plummets dramatically.

Profits are also quite low, and it takes a large number of trades (sometimes hundreds) to turn a decent profit.

FAQs

1. Is crypto scalping a viable trading method for a beginner?

This depends on the qualities you possess. If you’re impatient and prefer to make your profits quickly, then this trading technique is not for you as it requires patience, discipline and very good timing.

2. Is crypto scalping illegal?

No it isn’t. Unlike regular scalping where scalpers buy game tickets and resell them at inflated prices, crypto scalping is a perfectly legitimate way to make profits off cryptocurrency.

3. Is crypto scalping the same as forex scalping?

There are similarities between both kinds of scalping such as the supply & demand, the digital platforms they’re both available on and the fact that you can use trading bots to trade both forex and crypto.

There are also differences however as cryptocurrency is more volatile than forex and forex requires an intermediary to trade while crypto trading does not use middle men.

Cryptocurrency trades can also be made 24/7 while forex markets are not available over the weekend.

4. Will I be charged a trading fee?

As scalping requires you to make hundreds of trades to turn a profit, you will use many different exchanges, some of which will charge trading fees per transaction. This is where Obiex has a clear advantage over other trading platforms - you will not be charged a trading fee on Obiex.

5. What trading platform should I pick?

Obiex, of course. We're the best🙂

CONCLUSION

It is important to know that scalp trading isn’t for everyone as it requires people with the patience to sit through hundreds of small trades and the discipline to do that without jumping the gun and taking a huge risk. However, if you possess both these qualities, crypto scalping is a good place for you to begin your crypto trading journey.

Good luck! 👍🏽

*Support and Resistance: Support is the price level reached where the value of a particular cryptocurrency drops and the demand for it suddenly increases. This is caused by the concentration of demand which will arrest the decrease in value of the particular coin.

Resistance refers to the zones that are created by selling interest as prices increase.

** Limit orders: A limit order is a command given to buy or sell crypto for at least a specific rate. Limit orders will only be filled if the value of the cryptocurrency is at least a particular value or more, never less.

They help to ensure traders do not pay more/receive less than a price you set and are very useful if you're not in a trade, making it perfect for scalp trading.

Disclaimer: This article was written by the writer to provide guidance and understanding of cryptocurrency trading. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.