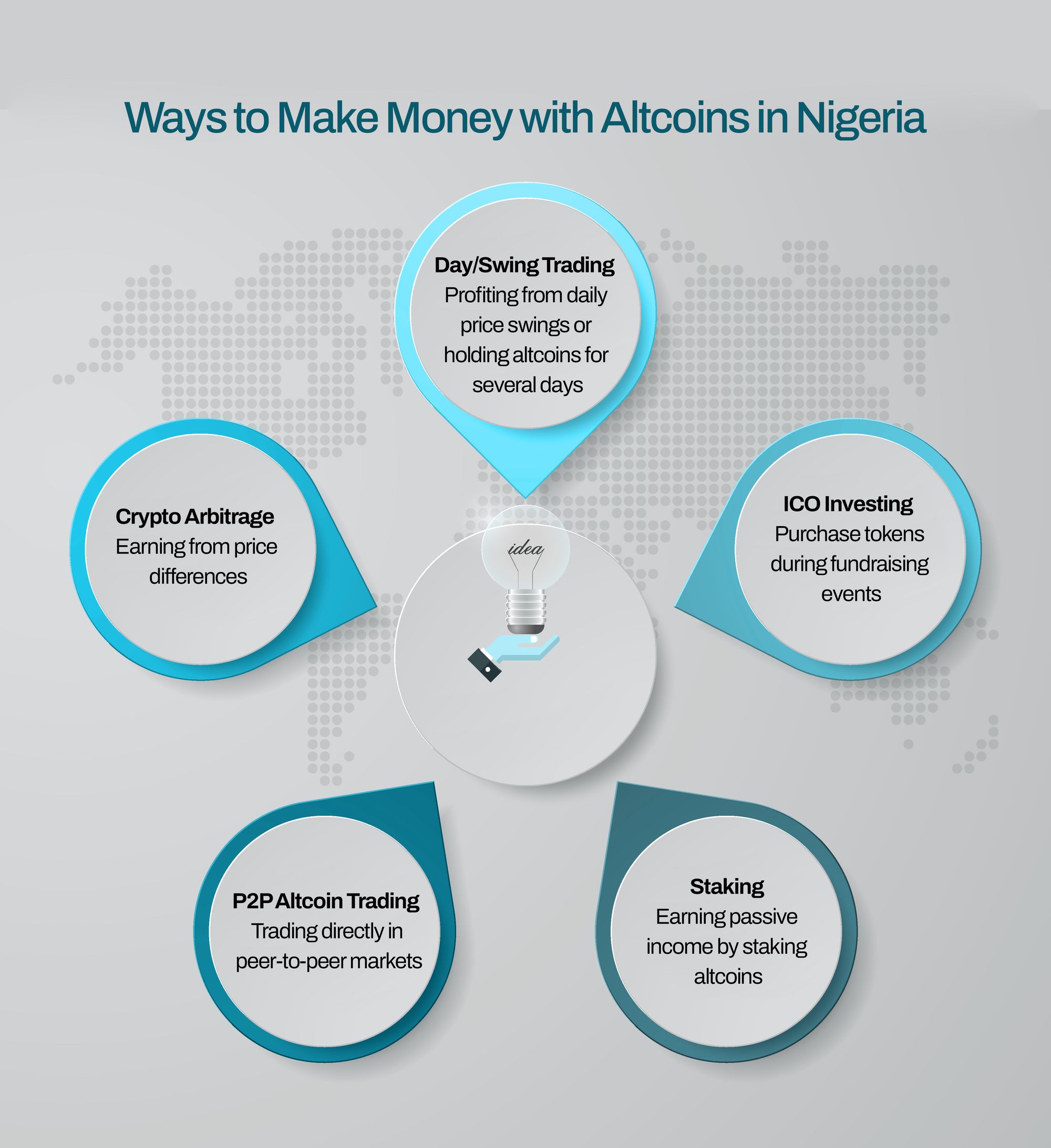

TL;DR: Nigerians can make money with Altcoins through day or swing trading, investing in initial coin offerings, staking altcoins, p2p altcoin trading, and crypto arbitrage.

Each method has risks, including volatility, security threats, and regulatory concerns, but proper research and choosing the best platform to trade on can help deal with them.

Table of Contents

- How Profitable Are Altcoins?

- 5 Ways to Make Money with Altcoins in Nigeria

- Day/Swing Trading

- Investing in Initial Coin Offerings (ICOs)

- Staking Altcoins

- P2P Altcoin Trading

- Crypto Arbitrage

- How to Identify High-Potential Altcoins

- Popular Altcoins in Nigeria

- Tools for Altcoin Trading

- Why Obiex is the Best Platform for Nigerian Traders

- FAQs

While Bitcoin is the most well-known cryptocurrency, many Nigerians are now turning to altcoins to earn profits.

But how can you actually make money with altcoins? Are they profitable? Which ones should you buy?

This guide will answer these questions, providing different methods to profit from altcoins in Nigeria.

How Profitable Are Altcoins?

Altcoins can be very profitable because they often experience huge price increases.

Some altcoins, like Shiba Inu, have gained over 100x in value within a short period. While not all altcoins perform this well, many have delivered 5x, 10x, or even 50x returns to investors.

Altcoins are also more volatile than Bitcoin, meaning their prices can rise or fall quickly. While this can be risky, it also means there are more opportunities to make money.

With the right strategy, traders can take advantage of price swings and earn profits.

Interestingly, you don’t necessarily have to rely only on price increases to make money from altcoins.

You can earn through staking, lending, Initial Coin Offerings (ICOs), and spot trading.

These methods allow you to grow your funds even when prices are not increasing.

Why Are Altcoins Popular in Nigeria?

- Lower Prices Compared to Bitcoin: Many Nigerians find Bitcoin too expensive. Altcoins, however, are much cheaper, making them more accessible.

- Faster Transactions and Lower Fees: Some altcoins offer faster transaction speeds and lower fees than Bitcoin. For instance, Litecoin (LTC) and Ripple (XRP) process transactions within seconds, while Bitcoin transactions can take several minutes or hours, especially when the network is busy.

- Huge Community Interest: Nigeria has a strong and active crypto community. Many Nigerians are interested in trading and investing in altcoins due to discussions on social media, Telegram groups, and crypto events. This large interest contributes to the demand and liquidity of altcoins in the country.

Who Is This Guide For?

- Crypto Beginners Looking to Make Money: If you are new to cryptocurrency and want to learn how to make money with altcoins in Nigeria, this guide will help you understand everything in simple terms. You will learn about the best altcoins to buy, how to trade them, and how to reduce risks.

- Traders and Investors: If you already trade Bitcoin and want to explore altcoins, this guide will teach you how to make money with crypto spot trading and find profitable coins. You will also learn about ICO tokens and how to invest in new projects.

- People Looking for Alternative Income Streams: This guide will provide you with different ways to earn alternative income through crypto, including staking, trading, and investing in early-stage projects.

Understanding Altcoins and Their Profit Potential

What are Altcoins?

Altcoins, short for "alternative coins," refer to all cryptocurrencies other than Bitcoin. They were introduced to address Bitcoin's limitations and offer alternative solutions.

Popular altcoins include Ethereum (ETH), Solana (SOL), Cardano (ADA), Avalanche (AVAX), Polkadot (DOT), and Polygon (MATIC).

These projects offer unique solutions such as scalability, interoperability, and energy efficiency, making them prime opportunities for investors.

Why Trade Altcoins in Place of Just Bitcoin?

- Diversification: Investing in altcoins allows for a diversified portfolio, reducing the risk associated with relying solely on Bitcoin.

- Higher Profit Potential: Some altcoins have demonstrated significant growth, sometimes exceeding Bitcoin's returns. For instance, in the past couple of years, Solana (SOL) and XRP have seen triple-digit gains, with SOL up 150% and XRP surging over 460%.

- Innovative Features: Many altcoins introduce new technologies and use cases, such as smart contracts and decentralised finance (DeFi) platforms, offering investors exposure to emerging sectors within the crypto space.

- Accessibility: Altcoins often have lower entry prices compared to Bitcoin, making them more accessible to investors with limited capital.

5 Ways to Make Money with Altcoins in Nigeria

1. Day/Swing Trading Altcoins

Day trading entails purchasing and selling altcoins within the same day, aiming to capitalise on short-term price movements. Traders closely monitor market trends and execute multiple trades daily to exploit small price changes.

Unlike day trading, swing trading involves holding altcoins for several days or weeks to benefit from anticipated upward or downward market swings. Traders analyse market cycles and trends to identify optimal entry and exit points.

How to Do It:

- Select a reputable cryptocurrency exchange that supports a variety of altcoins and offers secure trading services.

- Formulate a clear plan outlining your trading goals, risk tolerance, and preferred analysis methods. You can use technical analysis, which focuses on price charts and indicators, or fundamental analysis, which evaluates the underlying value of an altcoin.

Example:

Day Trading:

- Suppose a trader notices that an altcoin like Ripple (XRP) is experiencing increased volatility. By buying XRP at a lower price in the morning and selling it at a higher price later in the day, the trader profits from the price difference.

Swing Trading:

- Suppose a trader observes a positive trend in Ethereum's (ETH) price due to upcoming technological upgrades. He purchases ETH and holds it for several weeks, selling it after the price appreciates.

Risks & Solutions:

- Market Volatility: Altcoin prices can be highly volatile, leading to significant gains or losses. To manage this risk, avoid investing more than you can afford to lose and use stop-loss orders to limit potential losses.

- Regulatory Uncertainty: The regulatory environment for cryptocurrencies in Nigeria is evolving, which can affect trading activities. Stay informed about local regulations and choose exchanges that comply with Nigerian laws.

- Security Risks: The cryptocurrency market is vulnerable to scams and cyber threats. Protect yourself by using secure wallets, enabling two-factor authentication, and avoiding untrusted platforms.

2. Investing in Initial Coin Offerings (ICOs)

An Initial Coin Offering (ICO) is a fundraising system where a company or project offers digital tokens to investors in exchange for capital.

These tokens often represent a stake in the project or can be used within the project's ecosystem.

Unlike traditional shares, tokens may not grant ownership rights but can provide access to the project's services or potential future profits.

How to do it:

To participate in an ICO in Nigeria, follow these steps:

- Identify ICOs that align with your investment goals. Thoroughly review the project's whitepaper, team credentials, and community feedback.

- Ensure the ICO complies with Nigerian regulations.

- Set up a digital wallet compatible with the token standard of the ICO.

- Acquire the cryptocurrency accepted by the ICO, typically Ethereum (ETH) or any other altcoin.

- Follow the ICO's instructions to transfer funds and receive tokens.

Example:

Consider a Nigerian tech startup launching an ICO to fund a decentralised finance (DeFi) platform.

The company issues a whitepaper detailing the project's objectives, tokenomics, and roadmap.

Nigerian investors interested in the DeFi space can participate by purchasing tokens during the ICO, potentially benefiting from the platform's growth and token value appreciation.

Risks & Solutions:

- Fraud and Scams: Some ICOs may be fraudulent, leading to significant investor losses. Conduct thorough due diligence, verify the legitimacy of the project, and ensure it complies with SEC regulations.

- Regulatory Risks: ICOs operating without proper registration may face legal challenges, affecting investors. Invest only in registered ICOs to ensure compliance and investor protection.

- Market Volatility: Cryptocurrency markets are highly volatile, and token values can fluctuate dramatically. Invest only what you can afford to lose and diversify your investment portfolio to mitigate risks.

3. Staking Altcoins

Staking is similar to earning interest on a savings account but within the cryptocurrency ecosystem.

When you stake your altcoins, you lock them up in a wallet to support the security and operations of a blockchain network that uses a Proof-of-Stake (PoS) consensus mechanism. In return for this support, the network rewards you with additional coins.

This process not only benefits you but also enhances the network's stability and security.

How to do it:

- Select a reliable cryptocurrency exchange or platform that offers staking services.

- Buy the specific altcoins you wish to stake. Ensure these coins are compatible with staking and supported by your chosen platform.

- Transfer your purchased altcoins into a staking-enabled wallet on the platform.

- Choose between staking individually (running your own validator node) or joining a staking pool. Joining a pool is often more feasible for beginners, as it requires less technical expertise and investment.

- Once your coins are in the staking wallet and you've selected your staking method, initiate the staking process. Your coins will be locked for a certain period, during which you'll earn rewards.

Example:Let’s say you want to stake Cardano (ADA):

- Acquire ADA through a cryptocurrency exchange that supports staking.

- Move your ADA tokens to a wallet that supports Cardano staking.

- Choose a reputable staking pool to delegate your ADA tokens.

- By participating in the staking pool, you'll receive a share of the rewards generated by the pool, typically ranging from 5% to 6% annually.

Risks & Solutions:

- Market Volatility: The value of staked coins can fluctuate, affecting the overall value of your holdings. Don't stake all your holdings in a single altcoin. Diversify to mitigate risks associated with any one coin's volatility.

- Lock-Up Periods: Some staking programs require you to lock your coins for a specific period, limiting liquidity.

- Validator Risks: If you're staking individually, running a validator node requires technical expertise and constant uptime. Downtime or errors can result in penalties or reduced rewards.

- Use well-established and secure platforms or staking pools to minimise operational risks.

4. P2P Altcoin Trading

P2P altcoin trading allows individuals to buy and sell cryptocurrencies directly with each other without the need for intermediaries like banks or centralised exchanges.

This method became particularly popular in Nigeria after the Central Bank's restrictions on cryptocurrency transactions through traditional financial institutions.

How to do it:

- Select a reputable P2P platform like Obiex that supports altcoin trading.

- Register on the chosen platform and complete any necessary verification processes.

- Look for offers to buy or sell altcoins that match your requirements.

- Contact the buyer or seller, agree on terms, and proceed with the transaction.

- Use the platform's escrow service to ensure security until both parties confirm the trade.

Example:

Imagine you want to sell 0.5 Ethereum (ETH) for Nigerian Naira (NGNX):

- On the P2P platform, locate a buyer willing to purchase 0.5 ETH at a favourable rate.

- Discuss and agree on the payment method (e.g., bank transfer) and the exchange rate.

- The platform holds your 0.5 ETH in escrow while the buyer transfers the agreed amount in NGN to your bank account.

- Once you confirm receiving the payment, the platform releases the ETH to the buyer, completing the transaction.

Risks & Solutions:

- Fraudulent Traders: Some individuals may attempt scams. To manage this, use platforms with strong verification processes and check user reviews before trading.

- Lack of Regulation: The absence of regulatory oversight can lead to disputes. Engaging in direct P2P trades without a trusted intermediary increases the risk of fraud.

- Security Concerns: Always use the platform's escrow service to protect your assets during transactions.

- Market Volatility: Cryptocurrency prices can fluctuate rapidly. Stay informed and set clear terms to avoid unexpected losses.

5. Crypto Arbitrage

Crypto arbitrage involves taking advantage of price differences of the same cryptocurrency across different platforms or markets.

These differences can occur due to variations in demand and supply, liquidity, or regional restrictions.

In Nigeria, such opportunities may arise because of differences in exchange rates between local and international platforms.

By monitoring these differences, traders can identify moments when buying low on one platform and selling high on another is possible.

How to Do It:

- Monitor multiple cryptocurrency exchanges to spot differences in cryptocurrency prices.

- Ensure that the exchanges you plan to use are reputable and have sufficient liquidity to handle your transactions.

- Due to the volatile nature of cryptocurrency markets, price differences can vanish rapidly. Quick action is crucial to capitalise on these opportunities.

- Account for any fees associated with buying, transferring, and selling cryptocurrencies, as these can impact your overall profit.

Example:

Suppose Ethereum (ETH) is trading at ₦1,500,000 on Exchange A and ₦1,520,000 on Exchange B.

A trader could purchase 10 ETH on Exchange A for ₦15,000,000 and then sell them on Exchange B for ₦15,200,000, resulting in a gross profit of ₦200,000.

After deducting transaction and transfer fees, the net profit might be around ₦180,000.

Risks & Solutions:

- Market Volatility: Cryptocurrency prices can change rapidly, potentially erasing arbitrage opportunities before trades are completed. To reduce this, use automated trading bots that can execute transactions faster than manual methods.

- Exchange Reliability: Not all exchanges are trustworthy. Some may have security vulnerabilities or could be fraudulent. To avoid scams, use well-established exchanges with positive reputations.

- Transaction Delays: Network congestion or technical issues can delay transactions, causing missed opportunities. To reduce this risk, choose exchanges like Obiex, which is known for efficient operations, and consider the current network load before initiating transfers.

- Regulatory Changes: The legal landscape for cryptocurrencies in Nigeria can change, potentially affecting the feasibility of arbitrage strategies. Stay informed about local regulations and ensure compliance to avoid legal complications.

How to Identify High-Potential Altcoins

1. Check the Market Capitalization:

Market cap refers to the total value of all the coins in circulation. Coins with higher market caps tend to be more stable, while those with smaller market caps can offer bigger returns, but they come with more risk.

To find a promising altcoin, look for those with a market cap between $50 million and $1 billion. They are big enough to have real potential but still small enough to grow significantly.

2. Examine the Project Behind the Coin:

A good project should solve real-world problems or improve on existing systems.

For instance, Ethereum (ETH) is a popular altcoin because it provides a platform for decentralised applications, which solves the issue of centralisation in the tech industry.

Before investing, read about the coin's whitepaper, check the development team, and assess whether the project has a clear roadmap and a community that believes in its success.

3. Look for Strong Community Support:

A strong and active community can indicate the potential for long-term success.

If an altcoin has a dedicated community actively supporting its growth, it is more likely to succeed. You can find these communities on social media platforms like Twitter, Telegram, and Reddit.

4. Check the Coin's Utility and Use Case:

The best altcoins often have a strong utility—meaning they offer something that makes them useful within the crypto space.

Chainlink (LINK), for example, is highly valued because it provides real-world data to smart contracts.

When choosing which altcoin to buy, ask yourself: What does this coin do? How does it stand out from others? Coins with clear, useful applications tend to have better potential for growth.

5. Review Historical Price Action and Volatility:

Analysing past price movements can help identify trends and patterns in a coin’s performance. High volatility means the price can change quickly, but it also presents opportunities for high profits.

If an altcoin has had steady growth or consistently performs well during bull runs, it could indicate strong future potential. However, beware of coins with erratic price swings that have no solid fundamentals behind them.

6. Research the Team and Partnerships:

Check the background of the developers and the company behind the coin. Coins backed by experienced teams with a proven track record in technology or finance are more likely to succeed.

Partnerships with big companies or organisations can also provide stability and credibility to the coin.

7. Watch for Innovative Features:

Altcoins that offer something new or improve on existing solutions have a greater chance of thriving.

For example, Cardano (ADA) is often considered an innovative altcoin because it uses a unique proof-of-stake consensus mechanism, which is more energy-efficient than Bitcoin’s proof-of-work system.

Coins that innovate can attract more investors and developers, driving up their value.

8. Evaluate the Tokenomics:

Tokenomics refers to the economic structure of a cryptocurrency, such as the total supply of coins and how they are distributed.

Coins with a limited supply and strong demand tend to see price increases over time.

On the other hand, coins with a high supply that is distributed unevenly can lead to inflation and lower value.

Coins like Binance Coin (BNB) have a strong tokenomic model, where coins are burned periodically to reduce supply and increase scarcity.

9. Regulatory Environment:

The Nigerian government has placed restrictions on cryptocurrencies, but they are still widely used.

Choosing altcoins that comply with local regulations or have plans to do so in the future can reduce risks. Regulatory clarity is a sign of a trustworthy and sustainable cryptocurrency.

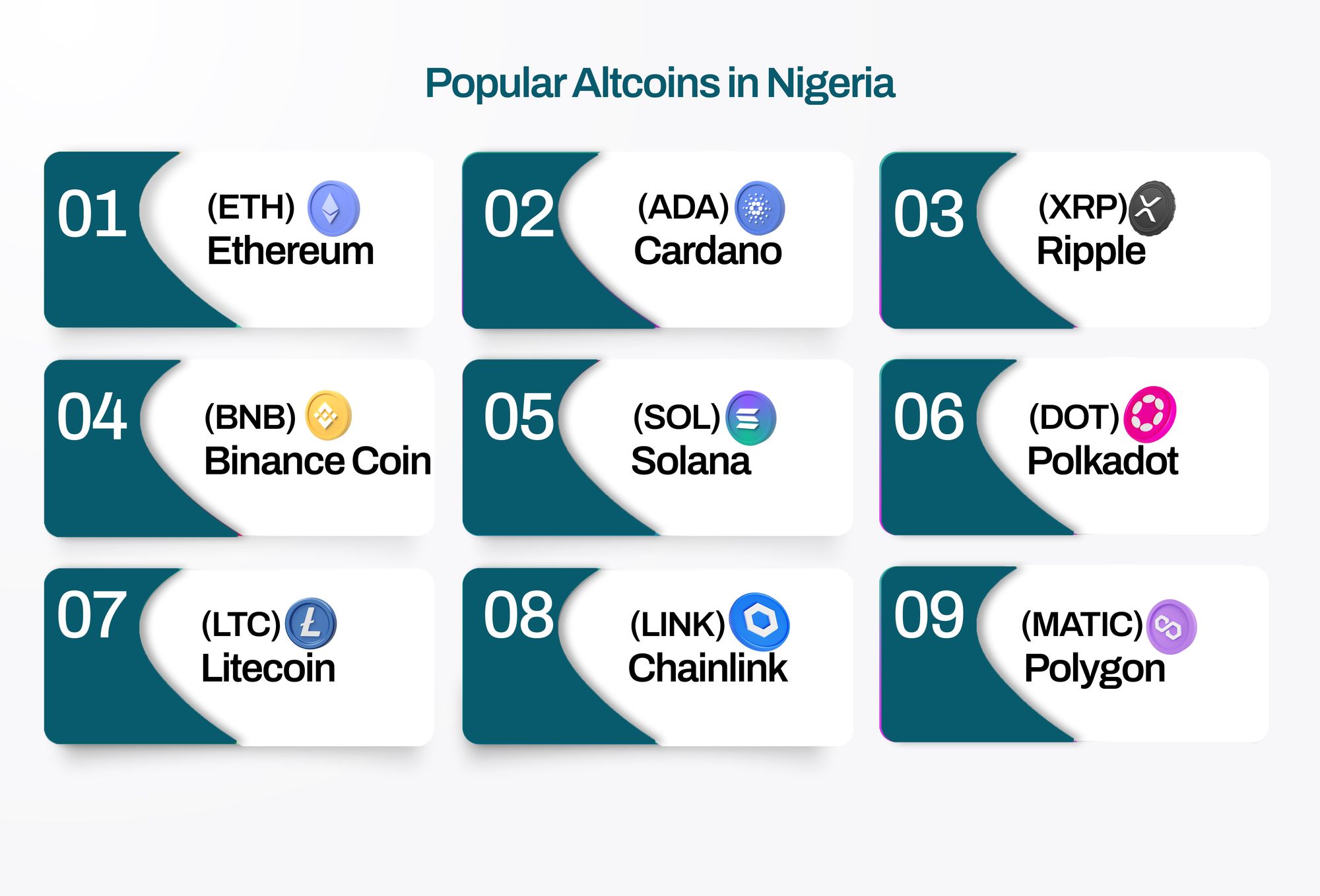

Popular Altcoins in Nigeria

1. Ethereum (ETH):

Ethereum is the second-largest cryptocurrency by market capitalisation. It serves as a platform for decentralised applications (dApps) and decentralised finance (DeFi) projects. ETH is currently priced at $2,015, with a 4% rise from its last close.

2. Cardano (ADA):

Cardano is recognised for its energy-efficient proof-of-stake consensus mechanism. It supports smart contracts and aims to provide a scalable and secure platform for dApps. Currently, ADA is priced around $0.73 USD, with a 2.7% rise from the last close.

3. Ripple (XRP):

Ripple facilitates fast and cost-effective cross-border transactions, making it popular among financial institutions. XRP is currently trading at approximately $2.45 USD, showing a 7.2% increase from the previous day.

4. Dogecoin (DOGE):

Initially created as a meme coin, Dogecoin has gained a substantial following due to its active community and use in tipping and microtransactions. DOGE is currently valued at about $0.174 USD, marking a 3.7% rise from the last close.

5. Binance Coin (BNB):

As the native token of the Binance exchange, BNB offers benefits like reduced trading fees and participation in token sales. It is currently priced around $625.47 USD, reflecting a 1.2% increase from the previous close.

6. Solana (SOL):

Solana is known for its high transaction speeds and low fees, making it a preferred choice for DeFi applications and NFT projects. SOL is trading at approximately $133.02 USD, with a 5.8% rise from the last close.

7. Polkadot (DOT):

Polkadot enables interoperability between different blockchains, allowing for a more connected and scalable network. DOT is currently valued at about $4.46 USD, showing a slight decrease of 1.8% from the previous day.

8. Litecoin (LTC):

Often referred to as the silver to Bitcoin's gold, Litecoin offers faster transaction times and lower fees. LTC is trading at approximately $93.47 USD, reflecting a 3.5% increase from the last close.

9. Chainlink (LINK):

Chainlink provides reliable tamper-proof data for complex smart contracts on any blockchain. LINK is currently priced around $14.66 USD, marking a 5.5% rise from the previous close.

10. Polygon (MATIC):

Polygon aims to scale Ethereum by providing Layer 2 solutions, enhancing transaction speeds and reducing costs. MATIC is trading at about $0.218 USD, showing a 2.5% increase from the last close.

Tools You Need for Altcoin Trading

1. Cryptocurrency Exchanges:

Cryptocurrency exchanges are platforms where you can buy, sell, and trade altcoins. Obiex, for example, allows you to trade a variety of altcoins and offers easy-to-use interfaces and mobile apps, making it ideal for beginners.

By registering on Obiex, you can access real-time market data, track coin prices, and place orders to buy or sell altcoins.

2. Wallets:

To store your altcoins safely, you'll need a crypto wallet. There are two types of wallets: hot wallets (online) and cold wallets (offline).

Hot wallets like Trust Wallet and Metamask are convenient for active trading, as they allow quick access to your coins.

Cold wallets like Ledger Nano S or Trezor are more secure for long-term storage of altcoins.

It's important to choose a wallet that is secure and compatible with the altcoins you want to invest in.

3. Trading Bots:

If you're looking to automate your trading, trading bots are a great tool. These are automated software that buys and sells altcoins based on specific algorithms or trading strategies.

3Commas and CryptoHopper are popular trading bots that work with some exchanges. They can help you trade 24/7 and take advantage of market fluctuations, even while you're asleep.

Using trading bots can improve efficiency and potentially increase your profits in the highly volatile crypto market.

4. Market Analytics Tools:

Market analytics tools are essential for tracking price trends, understanding market sentiment, and finding profitable altcoin trading opportunities.

Websites like CoinGecko, CoinMarketCap, and Messari provide real-time data, including coin prices, market cap, trading volume, and price charts.

These tools also help you discover the latest altcoins to buy and can even alert you to coins that may experience rapid growth, which could help you understand how to find coins that will increase in value.

5. Decentralized Finance (DeFi) Platforms:

DeFi platforms allow you to earn money from altcoins by lending, staking, or providing liquidity. Platforms like Uniswap, Aave, and Compound are popular choices.

By using DeFi platforms, you can lend your altcoins to other users for interest, or stake them in liquidity pools to earn rewards. These platforms provide opportunities to make money from altcoins without needing to actively trade them, and they are an increasingly popular option for Nigerian traders.

6. News and Information Sources:

Keeping up with crypto news is essential for making informed trading decisions. Websites like Cointelegraph, CryptoSlate, Decrypt, and even the Obiex blog provide the latest news, trends, and updates on altcoins.

In Nigeria, local resources like Bitcoin Nigeria or NaijaCrypto offer updates on the Nigerian crypto market. Staying informed about the latest market developments can help you decide which altcoins to buy today and how to make money with new coins.

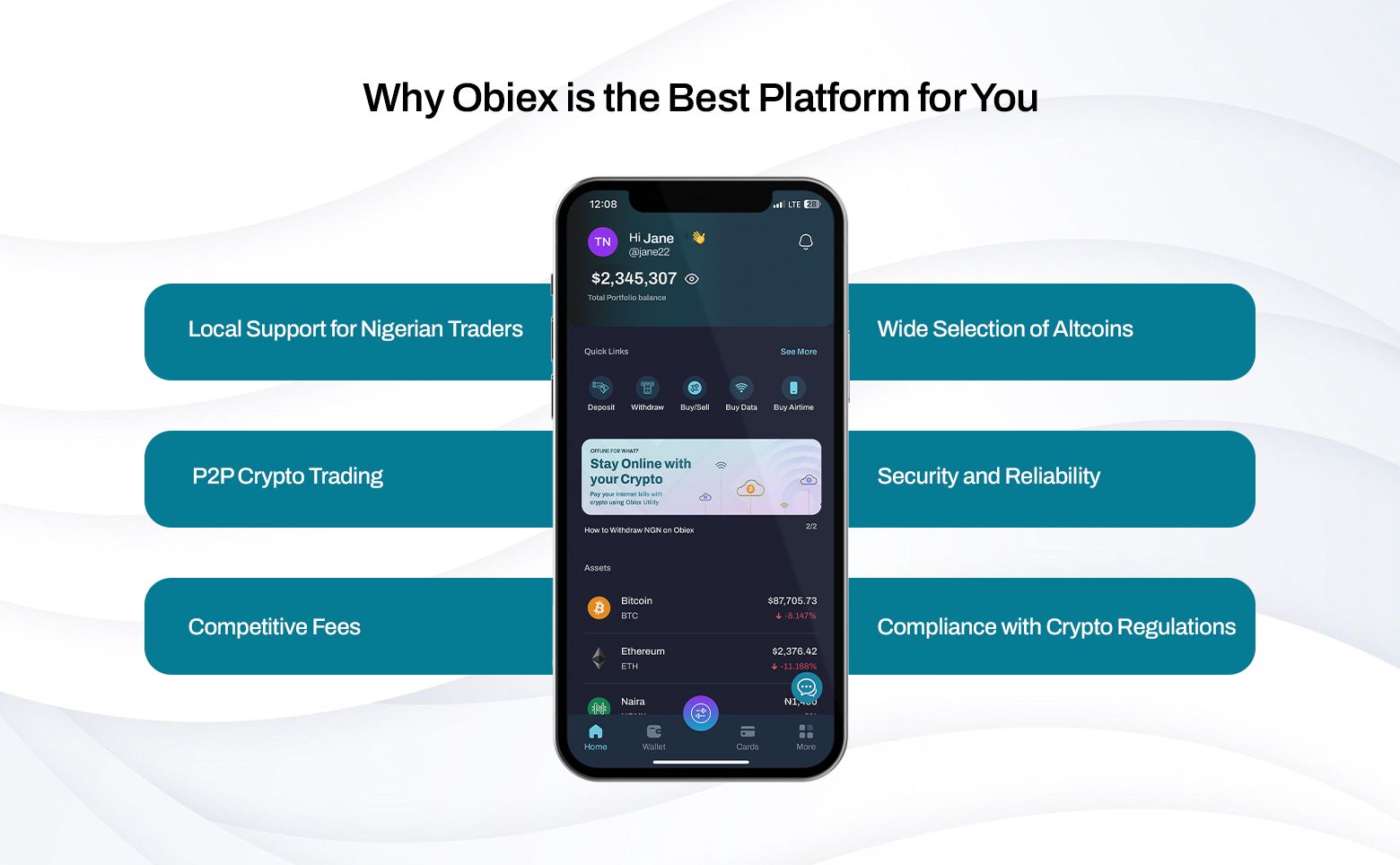

Why Obiex is the Best Platform for Nigerian Traders

Obiex is an excellent platform for Nigerian traders who want to make money with altcoins. Here's why it stands out as the top choice:

1. Local Support for Nigerian Traders:

Obiex understands the unique needs of Nigerian traders, especially when it comes to payment preferences and customer support.

Whether you're buying or selling altcoins, the platform offers support tailored to Nigerian users, making it easier to navigate the system.

If you have any issues or questions, local support ensures quick resolution through calls and texts 24/7.

2. Wide Selection of Altcoins:

Obiex provides a wide variety of cryptocurrencies, with over 30 altcoins available for trading.

This variety gives Nigerian traders the opportunity to explore different investment options.

Whether you’re interested in popular altcoins like Ethereum or looking to discover new, emerging coins, Obiex has options that suit different trading strategies.

3. P2P Crypto Trading in Nigeria:

Peer-to-peer (P2P) trading is one of the most popular ways to buy and sell cryptocurrencies in Nigeria. Obiex supports P2P crypto trading, allowing users to trade directly with others.

This method offers flexibility, better rates, and gives traders full control over their transactions, making it ideal for Nigerians who prefer decentralised trading.

4. Security and Reliability:

The Obiex platform uses strong encryption and two-factor authentication to ensure your crypto assets remain safe. With rising concerns over online security, Obiex’s robust security measures offer peace of mind to Nigerian traders, knowing their investments are protected.

5. Competitive Fees:

Obiex offers lower fees compared to many international platforms. This is especially important for Nigerian traders who want to maximise their profits while keeping transaction costs low. Whether you're buying or selling altcoins, Obiex ensures that you don’t lose a significant chunk of your gains to high fees.

6. Compliance with Nigerian Crypto Regulations:

While crypto regulations in Nigeria are still developing, Obiex is committed to staying compliant with local laws. This ensures that Nigerian traders can trade with confidence, knowing that the platform operates within the legal framework of the country.

To Recap

- Altcoins can be highly profitable, often offering significant price increases and potential for higher returns compared to Bitcoin.

- Methods to make money with altcoins include day/swing trading, investing in ICOs, staking, P2P trading, and crypto arbitrage.

- Day trading involves buying and selling altcoins within a day to profit from price fluctuations, while swing trading focuses on holding altcoins for several days or weeks.

- ICOs allow investors to purchase tokens during a fundraising event, offering potential future profits.

- Staking involves locking altcoins to support blockchain networks in exchange for rewards, providing a steady income stream.

- P2P trading enables buying and selling altcoins directly between individuals, often providing better rates and faster transactions.

- Crypto arbitrage takes advantage of price differences across different exchanges to earn profits.

- Obiex is a recommended platform for secure, easy trading of altcoins, offering tools and support for Nigerian traders.

- Start trading altcoins today and take advantage of the profit potential available on Obiex!

💡Sign up on Obiex to start trading now!

FAQs

Q1. How do I make money with altcoins in Nigeria?

You can buy day or swing trading, investing in initial coin offerings, spot trading, p2p altcoin trading, and crypto arbitrage.

Q2. How much Bitcoin can I buy with 5000 Naira?

With 5000 Naira, you can buy a fraction of a Bitcoin, as Bitcoin's price changes. At current rates, you may get approximately 0.0002 BTC.

Q3. How can beginners make money with Bitcoin?

Beginners can start by buying Bitcoin when the price is low and selling when the price increases. You can also earn through Bitcoin faucets or by staking Bitcoin.

Q4. How do I find coins that will 100x?

To find coins with high potential, research promising projects, check for active communities, and analyse their use cases. Keep an eye on coins listed in ICOs (Initial Coin Offerings) or new altcoins.

Q5. How can I make money from ICO tokens?

ICO tokens can be bought early at a low price, then sold for a profit if their value increases after the ICO. Look for reputable projects and perform due diligence before investing.

Q6. How do I make money with crypto spot trading?

In crypto spot trading, you buy and sell digital currencies at current market prices. You profit by selling when the price goes up and buying when it goes down.

Q7. Can I make money with altcoins?

Yes, you can make money with altcoins by buying them at low prices and selling them when their value increases. Many people also trade altcoins for short-term gains.

Q8. What are the best altcoins to buy today in Nigeria?

Popular altcoins like Ethereum (ETH), Binance Coin (BNB), and Cardano (ADA) are some of the top choices in Nigeria. Research current market trends before buying any altcoin.

Q9. Can altcoins make you rich?

While some altcoins have made investors wealthy, altcoin investments are risky. You need to research well and understand market trends before investing significant amounts.

Q10. How do I make money with new coins?

New coins can be profitable if bought early before they gain value. Keep an eye on new crypto projects through ICOs or listing platforms and evaluate their potential.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.