How to Invest in Web3

Want in on Web3? Learn where to buy tokens, how to evaluate projects, and build a diversified portfolio in the decentralized internet era.

TABLE OF CONTENTS:

1. Introduction

2. What is Web3?

3. Why Invest in Web3?

4. How to Invest in Web3

5. Risks and Challenges of Investing in Web3

6. How to Get Started with Web3 Investments

7. Strategies for Successful Web3 Investing

8. Closing Thoughts

9. FAQs

In recent years, the term Web3 has been buzzing around, promising a new era of the internet.

Some people may have already gotten the hang of it and have become active participants in the Web3 world, including becoming agents for its advancements.

But, for others, Web3 is another ambiguous term that rolled in with cryptocurrency and its cohorts.

What exactly is Web3, and how can I invest in it?

In this article, we'll break down the basics of Web3 and provide simple steps for investing in this exciting new space.

To start, let’s answer the first burning question.

What is Web3?

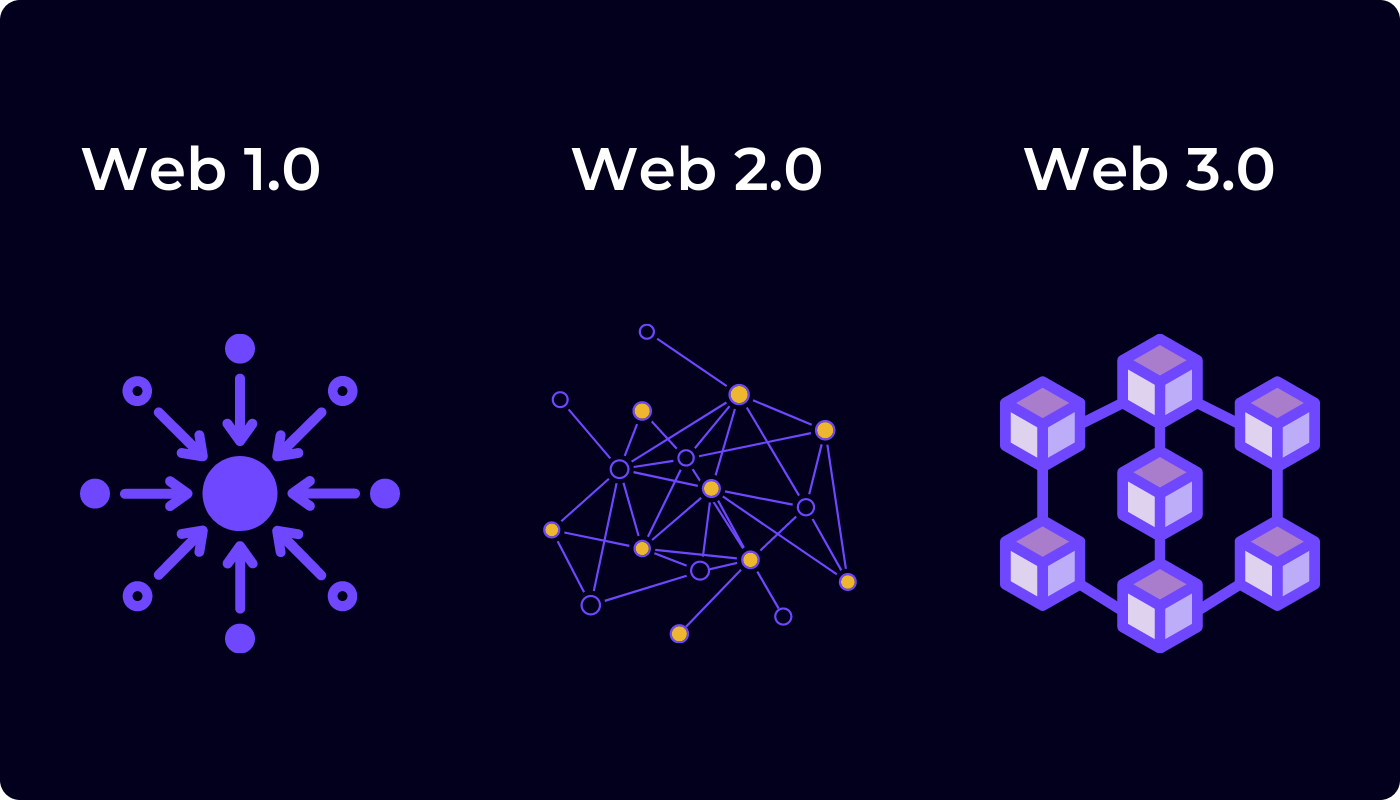

Before understanding what web3 is, let us look at its predecessors.

Web1, often referred to as the "read-only" web, emerged in the early 1990s. It was primarily characterised by static web pages where users could only consume information but couldn't actively contribute or interact.

Then came Web2, known as the "read-write" web, which saw the rise of dynamic content, social media, and user-generated platforms like Facebook, Twitter, and YouTube. Web2 allowed users to not only consume content but also create and share their own, nurturing a more interactive and collaborative online environment.

Now, with the arrival of Web3, we're witnessing the evolution towards a decentralised, user-centric internet.

So, what is Web3?

Web3 is a term used to describe the next generation of the internet, built on blockchain technology and decentralised protocols, aiming to empower users with greater control over their data and online interactions. Key features of Web3 include decentralisation, interoperability, transparency, security, and ownership.

Decentralisation: Web3 aims to move away from reliance on centralised bodies like corporations and governments by distributing control and ownership among its users. This is achieved through blockchain technology, which enables peer-to-peer transactions and eliminates the need for intermediaries.

Interoperability: In the Web3 model, different platforms and applications can seamlessly communicate and interact with each other, regardless of their underlying technology or protocols. This interoperability enables a more connected and integrated digital ecosystem.

Transparency: One of the fundamental principles of Web3 is transparency, where all transactions and interactions are recorded on a public ledger, such as the blockchain. This transparency ensures accountability and trust among users, as they can verify the integrity of the system independently.

Security: With decentralised architectures and cryptographic protocols, Web3 offers enhanced security compared to traditional centralised systems. By removing single points of failure and using encryption techniques, Web3 reduces the risks of data breaches and unauthorised access.

Ownership: Unlike Web2 platforms, where users often surrender ownership of their data and digital assets to centralised bodies, Web3 empowers users to retain ownership and control over their personal information and digital belongings. Through these autonomy and decentralised storage solutions, users can manage their data autonomously and decide how it is shared and monetised.

Why Invest in Web3?

1. Potential for Massive Growth:

Investing in Web3 presents an opportunity to tap into a rapidly expanding market. With Web3 technologies such as blockchain, decentralised finance (DeFi), and non-fungible tokens (NFTs) gaining traction, the sector has the potential for substantial growth.

For instance, the global blockchain technology market size was valued at $3.67 billion in 2020 and is projected to reach $39.7 billion by 2025, growing at a compound annual growth rate (CAGR) of 67.3%.

2. Disruption of Traditional Industries:

Web3 has the capability to disrupt traditional industries by providing innovative solutions to longstanding problems. Blockchain technology, for example, offers transparent, secure, and permanent record-keeping, which could transform sectors like finance, supply chain management, healthcare, and more. The potential efficiency gains and cost savings from adopting Web3 solutions make it an attractive prospect for investors.

3. Democratisation of Finance:

One of the key principles of Web3 is the democratisation of finance. Decentralised finance (DeFi) platforms enable anyone with an internet connection to access financial services traditionally reserved for the privileged few. Through DeFi, individuals can borrow, lend, trade, and invest without the need for intermediaries such as banks or brokers. This opens up investment opportunities to a global audience and reduces barriers to entry.

4. Ownership and Control:

Web3 promotes the concept of autonomy, where individuals have full ownership and control over their digital assets. In traditional centralised systems, users are at the mercy of intermediaries who can censor, restrict, or manipulate their assets. With Web3 technologies like blockchain, users have cryptographic proof of ownership and can transact peer-to-peer without relying on third parties, enhancing security and autonomy.

5. Innovation and Experimentation:

The Web3 ecosystem promotes innovation and experimentation, leading to the development of groundbreaking applications and use cases. NFTs, for instance, have opened up new avenues for creators to monetise digital content, from artwork and music to virtual real estate and collectibles. As developers continue to explore the possibilities of Web3, investors have the opportunity to participate in pioneering projects with transformative potential.

6. Hedge Against Inflation:

In an era of economic uncertainty and inflationary pressures, Web3 assets can serve as a hedge against traditional fiat currencies. Cryptocurrencies like Bitcoin and Ethereum, which form the backbone of many Web3 platforms, have finite supplies and are resistant to inflationary measures such as quantitative easing. As central banks around the world continue to print money, digital assets offer a store of value that is immune to government manipulation.

How to Invest in Web3

Here are some accessible avenues through which you can invest in Web3:

1. Investing in Cryptocurrencies:

Cryptocurrencies are digital currencies that operate independently of traditional banking systems. Bitcoin, Ethereum, and other altcoins are examples. Investing in cryptocurrencies involves buying these digital assets with the hope that their value will increase over time. For instance, if you had invested $100 in Bitcoin in 2010, it would be worth millions today! However, it's important to remember that cryptocurrencies can be unstable, meaning their prices can fluctuate dramatically. Before investing, research the technology behind each cryptocurrency, its potential applications, and the team behind it.

2. Investing in Decentralised Finance (DeFi):

Decentralised Finance, or DeFi, refers to financial services built on blockchain technology without traditional intermediaries like banks. Investors can participate in various DeFi platforms to earn interest, lend, borrow, trade assets, and more. For instance, you could provide liquidity to decentralised exchanges (DEXs) like Uniswap and earn fees in return. DeFi offers opportunities for higher returns than traditional finance but comes with risks, so you should carry out thorough research and understand the risks before investing.

3. Investing in Non-Fungible Tokens (NFTs):

Non-Fungible Tokens (NFTs) are unique digital assets representing ownership of items like artwork, music, videos, and virtual real estate. Unlike cryptocurrencies, each NFT has distinct properties and cannot be exchanged on a one-to-one basis. Investing in NFTs involves buying and holding these digital collectibles with the expectation that their value will appreciate over time. For example, in March 2021, an NFT artwork by digital artist Beeple sold for $69 million at Christie's auction house. However, NFT markets can be speculative, and the value of NFTs can be highly subjective. It's essential to carefully evaluate the authenticity, uniqueness, and potential demand of NFTs before investing.

4. Investing in Web3 Startups:

Investing in Web3 startups involves funding early-stage companies that build decentralised apps (dApps), blockchain infrastructure, or innovative technologies within the Web3 ecosystem. Venture capitalists and angel investors often support these startups in exchange for equity or tokens. Investing in Web3 startups can offer significant returns if the projects succeed, but it also carries high risks, as many startups fail to gain traction or face regulatory challenges. Conduct thorough due diligence to assess the team's expertise, market potential, and competitive landscape before investing in Web3 startups.

5. Participating in Initial Coin Offerings (ICOs) and Token Sales:

Initial Coin Offerings (ICOs) and token sales are fundraising methods used by blockchain projects to raise capital by selling tokens to investors. Investors purchase these tokens in the hope that their value will appreciate once the project launches or gains adoption. However, ICOs and token sales are speculative investments and have faced regulatory scrutiny due to fraud and investor protection concerns. It's important to research the project thoroughly, including its whitepaper, team, roadmap, and tokenomics, before participating in ICOs or token sales.

Risks and Challenges of Investing in Web3

1. Instability in Cryptocurrency Prices:

One of the primary risks associated with Web3 investment is the instability of cryptocurrency prices. Cryptocurrencies like Bitcoin and Ethereum can experience significant price fluctuations within short periods. For instance, Bitcoin's price surged from around $3,500 in January 2020 to over $60,000 in April 2021 before dropping to around $30,000 in July 2021. Such rapid changes can lead to substantial gains or losses for investors, making it important to approach with caution.

2. Regulatory Uncertainty:

Another challenge facing Web3 investors is regulatory uncertainty. Governments around the world are still grappling with how to regulate cryptocurrencies and decentralised finance (DeFi) platforms. Regulations could potentially impact the legality, taxation, and overall operation of Web3 projects, introducing uncertainty into the investment landscape.

3. Security Risks:

Security risks pose a significant threat to Web3 investments. Decentralised platforms and smart contracts are vulnerable to hacks and exploits, leading to the loss of funds. In 2021. alone, DeFi platforms suffered losses of over $10 billion due to security breaches and vulnerabilities. Investors must carefully assess the security measures in place before committing funds to any Web3 project.

4. Technological Complexity:

Investing in Web3 requires a solid understanding of complex technologies such as blockchain, smart contracts, and decentralised applications (DApps). For many investors, understanding these concepts can be challenging and may require substantial time and effort. Without sufficient technical knowledge, investors may struggle to evaluate the viability and potential of Web3 projects accurately.

5. Market Saturation and Competition:

As interest in Web3 continues to grow, the market becomes increasingly saturated with new projects and platforms. This heightened competition can make it difficult for investors to identify promising opportunities amidst the noise. Additionally, the spread of low-quality projects and scams underscores the importance of thorough due diligence before making any investment decisions.

How to Get Started with Web3 Investments

1. Understanding Web3:

Before diving into investments, understand what Web3 is. In simple terms, Web3 represents the next generation of the internet, where users have more control over their data and interactions. Unlike Web2, which is dominated by centralised platforms like Facebook and Google, Web3 aims to decentralise these services using blockchain technology.

2. Educate Yourself:

The first step in getting started with Web3 investments is education. Take the time to learn about blockchain technology, cryptocurrencies, decentralised finance (DeFi), and non-fungible tokens (NFTs). There are plenty of online resources, courses, and communities where you can deepen your understanding. The Obiex blog is always here to educate you on whatever you need to know.

3. Risk Assessment:

Like any investment, Web3 comes with risks. The crypto market can be highly unstable, with prices fluctuating wildly in a short period. It's essential to assess your risk tolerance and only invest what you can afford to lose. Diversification is also key to minimising risk, spreading your investments across different projects and assets.

4. Choose a Wallet:

To invest in Web3, you'll need a digital wallet to store your cryptocurrencies and tokens securely. There are different types of wallets, including hardware wallets, software wallets, and online wallets. Research and choose one that fits your needs and offers robust security features.

5. Select an Exchange:

Next, you'll need to find a reputable cryptocurrency exchange where you can buy, sell, and trade digital assets. Obiex provides you with the best exchange platform to enhance your trading experience. Its platform is user-friendly, has a good reputation, and offers a wide range of assets to trade.

6. Start Small:

When you're ready to make your first investment, start small. It's tempting to put all your money into a single asset, but it's safer to start with a small amount and gradually increase your investment as you gain more experience and confidence in the market.

7. Stay Informed:

The Web3 space is constantly evolving, with new projects and developments emerging regularly. Stay informed by following news outlets, blogs, and social media channels related to blockchain and cryptocurrency. Being aware of market trends and developments will help you make informed investment decisions.

8. Long-Term Mindset:

Finally, approach Web3 investments with a long-term mindset. While it's possible to make significant profits in the short term, the most successful investors are those who hodl (hold on for dear life) their assets through market ups and downs. Patience and persistence are key to success in the world of Web3 investments.

Strategies for Successful Web3 Investing

1. Long-term Holding:

One of the most straightforward strategies for investing in Web3 is long-term holding. This approach involves purchasing digital assets like cryptocurrencies or tokens and holding onto them for an extended period, regardless of short-term fluctuations in price. By adopting a long-term mindset, investors can potentially benefit from the overall growth of the Web3 ecosystem over time. For instance, Bitcoin, the pioneering cryptocurrency, has demonstrated significant appreciation over the years despite experiencing periodic instability. By holding onto assets with strong fundamentals and utility in the Web3 space, investors can potentially capitalise on the long-term growth trajectory of the decentralised economy.

2. Dollar-Cost Averaging:

Dollar-cost averaging (DCA) is a strategy that involves investing a fixed amount of money at regular intervals, regardless of the asset's price. This approach helps smooth out the impact of market instability and allows investors to accumulate digital assets over time. For example, instead of investing a large sum of money all at once, an investor could choose to purchase a fixed dollar amount of a cryptocurrency every week or month. By consistently buying in smaller increments, investors can potentially reduce the risk of mistiming the market and benefit from the average price over time. Dollar-cost averaging is particularly suitable for investors looking to gradually build a position in Web3 assets and reduce the impact of market fluctuations on their overall investment.

3. Diversification:

Diversification is a fundamental principle of investing that involves spreading investment capital across different assets to reduce risk. In the context of Web3 investing, diversification can help reduce the risk associated with individual cryptocurrencies or projects. Investors can diversify their portfolios by allocating capital across various digital assets, such as cryptocurrencies, tokens, and decentralised finance (DeFi) protocols. By spreading investments across multiple assets with different use cases and risk profiles, investors can potentially minimise the impact of adverse events affecting any single asset. Diversification is essential for building a resilient Web3 investment portfolio that can withstand market instability and capitalise on emerging opportunities within the decentralised ecosystem.

4. Staking and Yield Farming:

Staking and yield farming are strategies that allow investors to earn passive income by participating in blockchain networks and decentralised finance protocols. Staking involves locking up digital assets in a cryptocurrency wallet to support the operations of a proof-of-stake blockchain network and validate transactions. In return, investors receive rewards in the form of additional tokens. Similarly, yield farming involves providing liquidity to decentralised exchanges or lending platforms in exchange for rewards, such as interest or governance tokens. By staking or yield farming, investors can generate a steady stream of income while contributing to the security and liquidity of Web3 networks.

Closing Thoughts

Investing in Web3 offers exciting opportunities for those willing to explore the potential of decentralisation, blockchain technology, and user empowerment.

By educating yourself, diversifying your portfolio, and staying informed, you can position yourself to potentially benefit from the next evolution of the internet.

Remember to invest responsibly and stay patient as you familiarise yourself with the world of Web3.

FAQs

Q1. What is Web3?

A1. Web3 refers to the next evolution of the internet, characterised by decentralisation, blockchain technology, and user empowerment.

Q2. How can I invest in Web3?

A2. You can invest in Web3 through cryptocurrencies, decentralised finance (DeFi) platforms, decentralised applications (dApps), and companies developing blockchain technology.

Q3. Is investing in Web3 risky?

A3. Like any investment, investing in Web3 comes with risks, including instability, regulatory uncertainty, and technological challenges. It's essential to do your research and only invest what you can afford to lose.

Q4. What are some popular cryptocurrencies in the Web3 space?

A4. Bitcoin and Ethereum are two of the most popular cryptocurrencies in the Web3 space, serving as the foundation for many decentralised applications and blockchain projects.

Q5. What is decentralised finance (DeFi)?

A5. DeFi refers to a range of financial services, including lending, borrowing, and trading, that operate without traditional intermediaries like banks or financial institutions.

Q6. How can I stay updated on Web3 developments?

A6. You can stay updated on Web3 developments by following industry news and influential figures in the space, and joining online communities like forums and social media groups.

Q7. Should I consult a financial advisor before investing in Web3?

A7. If you're unsure about any aspect of your investment strategy or the risks involved, it's a good idea to consult with a financial advisor who can provide personalised guidance.

Q8. What is the long-term outlook for Web3?

A8. While the Web3 space is still in its early stages, many experts believe it has the potential to transform various industries and reshape the internet as we know it.

Q9. Can I invest in Web3 without technical expertise?

A9. Yes, you can invest in Web3 without technical expertise by using user-friendly platforms, following simple investment strategies like diversification, and staying informed.

Q10. Is it too late to invest in Web3?

A10. While the Web3 space has seen significant growth in recent years, many believe it's still in its early stages, with plenty of opportunities for investors to get involved.

Disclaimer: This article was written by the writer to provide guidance and understanding of cryptocurrency trading. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.