What is the Crypto Fear and Greed Index?

In this comprehensive guide, we'll break down what this index is, why it matters, and how it can help you make informed decisions in crypto.

TABLE OF CONTENT:

- What is the Crypto Fear and Greed Index?

- How is the Index Calculated?

- Why Does the Crypto Fear and Greed Index Matter?

- Components of the Crypto Fear and Greed Index

- Real-World Impact

- Where Can You Access the Crypto Fear and Greed Index?

- The Crypto Fear and Greed Index vs. Other Indicators

- Advantages of the Crypto Fear and Greed Index

- Challenges of the Crypto Fear and Greed Index

- Tips for Using the Crypto Fear and Greed Index Effectively

- Closing Thoughts

- FAQs

When it comes to cryptocurrency, there's more to consider than just the coins themselves. Like traditional finance, the crypto market has its own tools and indicators to help investors navigate the rollercoaster of prices and sentiments.

One such tool is the Crypto Fear and Greed Index. The index was developed to respond to the need for a dedicated sentiment analysis tool in the crypto space, where traditional financial indicators often need to catch up on capturing the whole picture.

In this comprehensive guide, we'll break down what this index is, why it matters, and how it can help you make informed decisions in crypto.

What Is the Crypto Fear and Greed Index?

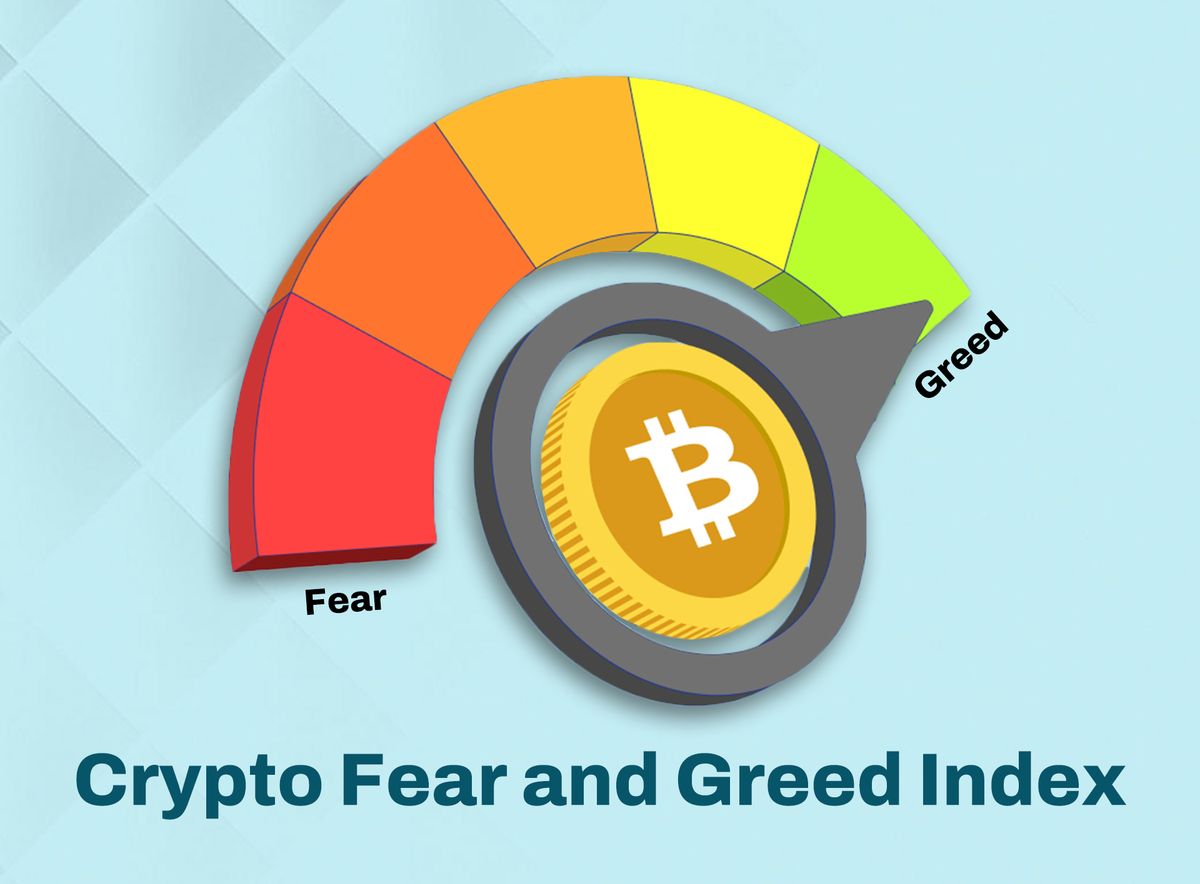

Imagine the crypto market as a pendulum, swinging back and forth between fear and greed.

The Crypto Fear and Greed Index is like a thermometer, measuring the temperature of this market sentiment. It provides a single number on a scale from 0 to 100, indicating whether the market is currently gripped by fear (panic selling) or driven by greed (buying frenzy).

Here's how it works:

1. Extreme Fear (0-20): Investors are extremely fearful when the index is at the lower end. They might be selling off their holdings (coins, tokens, NFTS, etc.), and the market may be experiencing a downward trend. This could be an excellent time for traders looking for discounted or low-priced crypto assets.

2. Fear (21-40): In this range, fear's still in the air but not as intense. Investors are cautious, and prices may still be dropping, but at a slower rate.

3. Neutral (41-60): The market sentiment is relatively balanced when the index is in this range. Investors are neither overly fearful nor overly greedy. Prices may be relatively stable during these times.

4. Greed (61-80): In this zone, greed starts to take over. Investors become more confident, and prices are generally on the rise. It's a period of optimism and potential gains.

5. Extreme Greed (81-100): You have extreme greed at the top of the scale. Investors are ecstatic, and prices may be overvalued. This could signify that a market correction or a bearish trend is on the horizon.

How is the Index Calculated?

Factors and Metrics Considered

The Crypto Fear and Greed Index collects data from various sources to calculate its sentiment score. Some of the key metrics and factors considered include:

- Volatility: High volatility (how much and how quickly the value of crypto can change unexpectedly) often corresponds to market fear.

- Market Momentum: Rapid price increases may signal greed.

- Social Media Activity: Sentiment on platforms like Twitter and Reddit can influence the index.

- Market Dominance: The dominance of Bitcoin and other major cryptocurrencies can affect sentiment.

Each factor is assigned a certain point in the index's calculation. For example, volatility may have a higher weight than social media activity. The methodology can vary among different index versions, but the goal is to provide a balanced and accurate representation of market sentiment.

Why Does the Crypto Fear and Greed Index Matter?

Now that we understand how the index works let's explore why it's crucial for crypto investors:

1. Emotional Insight: Cryptocurrency markets are highly influenced by human emotions. Fear and greed are the driving forces behind many buying and selling decisions. By monitoring the Fear and Greed Index, you gain insights into the overall sentiment, allowing you to make more rational investment choices.

2. Timing Your Entry and Exit: The index can be a valuable timing tool for those looking to buy low and sell high. When the market is in a state of fear, it might be an opportune moment to buy, while extreme greed could signal to consider taking profits. Remember Warren Buffett's famous advice: "Be fearful when others are greedy, and be greedy when others are fearful."

3. Risk Management: Understanding market sentiment helps you manage risk. If the index shows extreme greed, it's a reminder to exercise caution and not get caught up in the hype. Conversely, during times of fear, you can plan your risk management strategy accordingly.

4. Avoiding FOMO and Panic: Fear of Missing Out (FOMO) and panic selling are common pitfalls in crypto. The index can counterbalance, helping you resist impulsive decisions and stick to your investment plan.

Components of the Crypto Fear and Greed Index

The Crypto Fear and Greed Index uses a combination of the following five key components to assess whether investors are feeling fearful or greedy:

- Volatility (25%): This component measures how much Bitcoin’s price fluctuates in the short term. It compares Bitcoin’s current price movements to the average changes seen over the space of 30 and 90 days. When there’s a significant spike in volatility, it typically signals fear in the market. Investors become nervous when prices are unpredictable, leading to more caution in trading.

- Market Momentum/Volume (25%): Market momentum and volume track the buying or selling activity in the market. By comparing current trading volumes to the average volumes over the past 30 and 90 days, this component helps identify whether the market is moving up or down. High buying volume in an upward market usually indicates greed, as investors are eager to buy, driving prices higher. On the other hand, low volumes can signal fear or uncertainty.

- Social Media (15%): Social media is a powerful tool for measuring sentiment in real-time. The index monitors Twitter activity related to Bitcoin, tracking posts with popular Bitcoin-related hashtags. It looks at the frequency of these posts, the level of engagement (likes, retweets, etc.), and the overall sentiment of these interactions. When social media buzz is high and positive, it often suggests speculative behaviour, reflecting a greedy market. When the conversation turns negative or people start expressing concerns, it points to fear.

- Dominance (10%): This refers to Bitcoin's share of the entire cryptocurrency market. This component tracks how much of the total crypto market is made up of Bitcoin compared to other altcoins. A rising Bitcoin dominance typically suggests fear, as investors prefer the stability of Bitcoin over riskier altcoins. On the other hand, a decrease in Bitcoin dominance indicates growing interest in alternative cryptocurrencies, which is often a sign of greed and speculation.

- Trends (10%): The trends component tracks how often people are searching for Bitcoin-related terms on Google. A sudden increase in search volume for terms like “Bitcoin” or “buy Bitcoin” often signals that more people are jumping into the market, driven by either fear or greed. If there’s a surge in searches after a significant drop in price, it may indicate fear and panic selling. A rise in searches during a bull market, however, can indicate growing greed as people rush to join the upward trend.

- Survey (15%): While currently paused, the survey component was originally designed to gather direct input from the crypto community. This part of the index used surveys to measure investor sentiment and how they felt about the current state of the market. This direct feedback was valuable in assessing fear and greed from the perspective of those actively trading or investing in crypto.

Real-World Impact

Let's take a look at a couple of real-life scenarios to illustrate the power of the Crypto Fear and Greed Index:

Scenario 1: Extreme Greed

Imagine the Crypto Fear and Greed Index is hovering around 90, indicating extreme greed in the market. During such times, prices of many cryptocurrencies are soaring to new all-time highs. While jumping in and chasing the gains might be tempting, experienced investors might exercise caution and consider taking profits or diversifying their portfolios to manage risk.

Scenario 2: Extreme Fear

Conversely, if the index dips below 10, signaling extreme fear, the market might be in a state of panic. Prices could plummet, and novice investors might be selling their assets in fear of further losses. Seasoned investors, however, might view this as a buying opportunity, knowing that markets often recover after such periods of fear.

Where Can You Access the Crypto Fear and Greed Index?

The Crypto Fear and Greed Index is easily accessible online, and there are several platforms where you can check it regularly.

The most popular source is the official website, Alternative.me, which provides the most up-to-date and accurate readings of the index.

On this site, you can view the current score, which ranges from 0 (extreme fear) to 100 (extreme greed), giving you a clear picture of market sentiment.

Additionally, the website provides historical data, so you can track how market emotions have shifted over time.

Many crypto news platforms and trading apps, such as CoinTelegraph, Binance, and others, also feature the Fear and Greed Index, often updating it in real-time for their users.

This means that no matter where you are or which platform you use, you can always keep an eye on the mood of the market and adjust your strategies accordingly.

The Crypto Fear and Greed Index vs. Other Indicators

Comparative Analysis

While the Crypto Fear and Greed Index is a valuable tool, using it with other indicators and analysis methods is essential. Each tool can only provide a partial picture of the crypto market. Other indicators to consider include:

- Technical Analysis: Analyzing price charts and patterns.

- Fundamental Analysis: Assessing the underlying technology and adoption of cryptocurrencies.

- Market Sentiment on Social Media: Monitoring sentiment expressed by users on platforms like Twitter and Reddit.

Advantages of the Crypto Fear and Greed Index

1. Helps Understand Market Sentiment:

The Crypto Fear and Greed Index shows if investors are feeling fearful (and thus might be selling) or greedy (and more likely to buy).

This can give traders a better idea of what to expect in terms of price movements and how others are reacting to market conditions.

A high level of greed, for example, might suggest that the market is overvalued, while fear may indicate that prices are too low.

2. Assists in Decision-Making:

The Crypto Fear and Greed Index can aid in making better investment decisions.

When the index shows extreme fear, it might present an opportunity to buy when prices are low, as the market is likely undervalued.

On the other hand, extreme greed could signal that it’s time to sell, as prices might be inflated.

This makes the index a practical tool for timing your entries and exits in the crypto market.

3. Offers a Simple Visual Indicator:

The index is displayed as a simple, easy-to-understand gauge ranging from 0 to 100, with clear labels for different levels of fear and greed.

This makes it accessible to both beginners and experienced investors.

The visual representation helps users quickly grasp the current sentiment in the market without needing to analyse complex data.

4. Signals Potential Market Trends:

The Crypto Fear and Greed Index can also signal potential market trends.

For example, when fear levels are very high, there may be an opportunity for a price rebound as panic selling slows down.

On the other hand, periods of high greed may indicate a market correction could be near.

5. Provides Real-Time Data:

The Crypto Fear and Greed Index is updated regularly, giving users access to real-time market data.

This timely information is crucial, especially in the fast-moving crypto space, where prices can change quickly.

Investors can track how sentiment shifts throughout the day, providing them with up-to-the-minute insights that can influence their trading strategies.

Challenges of the Crypto Fear and Greed Index

1. Subjectivity in Sentiment Analysis:

The Crypto Fear and Greed Index is based on sentiment analysis, which can be subjective.

It looks at factors like social media trends, news headlines, and market volatility, but these factors can vary widely.

Different people might interpret the same news or market movement in different ways, leading to varying opinions on whether fear or greed is driving the market.

2. Over-Simplification of Complex Market Sentiment:

The index reduces a wide range of market factors into a single score.

This can sometimes oversimplify the complexities of the market.

Crypto markets are affected by numerous factors, including regulation, technology developments, and macroeconomic conditions, which the index might not fully capture in its score.

3. Lag in Data Response:

The Crypto Fear and Greed Index may not always respond quickly enough to sudden shifts in market sentiment.

Crypto markets can change rapidly, and the index may take time to reflect those changes, especially if it's based on outdated data or slower-to-update sources like social media sentiment.

4. Influence of External Events:

Events such as regulatory changes, government actions, or significant technological breakthroughs can drastically shift the sentiment in the market.

However, the index may not always account for the long-term effects of these events, which can distort its accuracy during such times.

5. Manipulation and Bias:

Since part of the index is based on social media and news sentiment, there's always the risk that large groups or individuals might attempt to manipulate the results by spreading exaggerated positive or negative information.

This can distort the fear and greed readings, making them less reliable.

6. Limited Historical Context:

The Crypto Fear and Greed Index is a relatively new tool, and it doesn’t have as much historical data as other market indicators.

This can make it difficult to assess its true effectiveness in predicting long-term trends, especially in a highly volatile market like cryptocurrency.

Tips for Using the Crypto Fear and Greed Index Effectively

1. Pay Attention to Extreme Fear and Greed Levels:

When the index shows extreme fear (below 25), it may signal that the market is oversold, and prices could be lower than their actual value.

On the other hand, extreme greed (above 75) suggests that the market might be overvalued, and a correction could be on the way.

By identifying these extremes, you can spot potential buying opportunities in fear and selling opportunities in greed.

2. Combine with Other Indicators:

While the Crypto Fear and Greed Index is a great tool, it shouldn’t be used in isolation.

Combining it with other market indicators like technical analysis or volume trends can provide a clearer picture.

For example, if the index shows fear, but the price is holding steady, it might indicate a good time to buy, while fear combined with declining prices could suggest waiting for a more favourable entry point.

3. Track Long-Term Trends:

The Crypto Fear and Greed Index fluctuates frequently, but it's important to look at longer-term trends.

If the market is showing consistent fear or greed over several weeks or months, it could indicate a more significant trend.

Tracking these shifts over time helps you make decisions based on the bigger picture, rather than reacting to short-term market noise.

4. Use It for Risk Management:

The index can help you manage risk by guiding your investment strategy. If fear dominates, it may be a time to reduce exposure or hold off on buying risky assets.

In periods of greed, you might consider locking in profits and being cautious about adding new positions.

By using the index as part of your risk management strategy, you can avoid emotional decision-making and better protect your investments.

5. Don’t Let It Guide Your Every Move:

While the Crypto Fear and Greed Index is useful, it's important not to rely on it too heavily.

Cryptocurrency markets are volatile and influenced by many factors.

Use the index as one tool in your decision-making process, but balance it with your own research and understanding of market fundamentals.

The index can provide insights, but it shouldn’t be your only guide.

Closing Thoughts

In the ever-changing world of cryptocurrency, the Crypto Fear and Greed Index is a valuable compass, helping you navigate the tumultuous seas of market sentiment. Understanding this index and incorporating it into your investment strategy allows you to make more informed decisions, manage risk effectively, and avoid the emotional pitfalls that often plague crypto investors. So, next time you're considering a crypto investment, check the Crypto Fear and Greed Index to see which way the pendulum is swinging and let it be your guide in the exciting world of digital currencies.

FAQs

- Is the Crypto Fear and Greed Index accurate?

The index provides a snapshot of market sentiment but may not always accurately predict future price movements. It's best used in conjunction with other analysis methods.

2. How often is the index updated?

The index is updated daily, providing current sentiment readings for the cryptocurrency market.

3. Can I use the index for long-term investing?

While the index can offer insights into short to medium-term sentiment, there may be other tools for long-term investment decisions, which often require a focus on fundamentals and adoption.

4. Is the index suitable for all cryptocurrencies?

The index primarily focuses on major cryptocurrencies like Bitcoin and Ethereum. It may not provide accurate sentiment readings for smaller, less-liquid coins.

5. Where can I find the Crypto Fear and Greed Index?

You can find it on various financial news websites or cryptocurrency analysis platforms.

6. Does the index consider external events or news?

Yes, the index factors in external events and news that can impact cryptocurrency sentiment. However, it may not capture all relevant information, so staying informed about current events is still crucial.

7. Can the index predict specific price movements?

The index provides sentiment, not precise predictions; always use it alongside other indicators for trading decisions.

8. Is the index suitable for day trading?

Day traders can use the index to gauge short-term sentiment shifts, but it should not be the basis for day trading decisions. It's essential to consider other real-time data and indicators.

9. Is the index free to access?

Yes, the Crypto Fear and Greed Index is typically freely available on various financial websites and platforms.

10. Are there similar sentiment indicators for other financial markets?

Yes, sentiment indicators exist for traditional markets like stocks and forex. They serve a similar purpose in assessing investor sentiment.

Disclaimer: This article was written by the writer to provide guidance and understanding of cryptocurrency trading. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.