What is Fundamental Analysis in Cryptocurrency And How to Do It

Crypto fundamental analysis means finding out the critical details about a cryptocurrency.

The internet is an endless tunnel of information where you can find out anything from how to pronounce Ecclesiastes to how to perform brain surgery.

Yet many new and old traders don’t take advantage of the voluminous information on Cryptocurrency available online.

While it is true that crypto is volatile (and occasionally does what it wants regardless of your strategy), you still need to have a working knowledge of the coins you trade or hold.

This is where fundamental analysis comes in to save the day.

This article will explain the fundamental analysis of Cryptocurrency and its ten pillars.

What is fundamental analysis in Cryptocurrency?

Crypto fundamental analysis means finding out the critical details about a cryptocurrency. For example, you might dive into a coin’s utility, market capitalisation, price trends since launch, circulating supply, etc. This analysis aims to estimate the general value of a digital asset. You may use the information to adjust your trading strategy, add a coin to your portfolio, or add it to your mental arsenal.

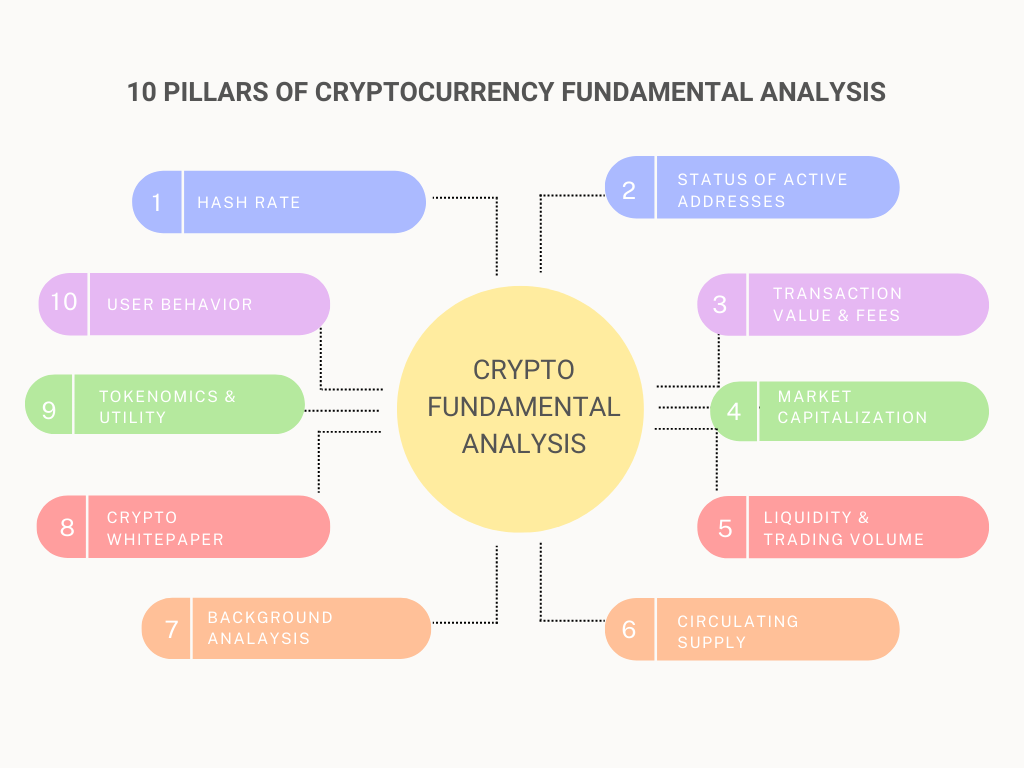

The Ten pillars of Fundamental Analysis in Cryptocurrency

Crypto analysis can seem overwhelming if you don’t know where to start. These ten pillars can serve as pointers to finding the information necessary for determining an asset’s value.

- Hash Rate

The hash rate is the total energy or computation power used during mining to perform proof of work calculations on the blockchain. Hash rates are approximated based on publicly accessible data on the blockchain. However, we may never know the real hash rate of a cryptocurrency.

Many crypto investors see the hash rate as proof of a coin or token’s health. The higher the hash rate, the more miners are encouraged to mine coins & tokens on the blockchain. The more miners a blockchain has, the more secure it becomes.

However, when the hash rate of a cryptocurrency falls, it leads to miner capitulation. Mine capitulation is when miners find a coin unprofitable and sell off their hardware. It typically happens in a bear market when prices fall low. A low hash rate can discourage investors and lead to a fall in the coin or toke’s market cap.

- Status of Active Addresses

A way to measure the number of active blockchain addresses is to sum up the amount of sending and receiving addresses over several periods. Once you get the total amount of active addresses over weeks or months, you can compare the growth patterns to estimate the activity status of the Cryptocurrency. Another way to assess the active address status is to total the number of unique addresses within set periods and compare the results from each period.

- Transaction Value and Fees

If there were 10 Ethereum transactions of $100 each on the same day, the daily transaction value would be $1000. A steadily high transaction value means a cryptocurrency is in consistent circulation.

Comparing the transaction values of two different cryptos or transaction values of one Cryptocurrency over different periods can reveal a future market pattern. Transaction fees show how much demand a cryptocurrency has or how many transactions join the blockchain. Eth’s gas fees are a popular example of transaction fees.

Every cryptocurrency has its unique transaction fee. Evaluating the total fees paid over time can provide an idea of the coin or token’s security level. However, these fees can rise as time progresses, leading to reduced mining rewards. When mining rewards drop too low, miners typically drop off the blockchain to avoid losses. As we mentioned earlier, the fewer miners a cryptocurrency has, the less profitable it is.

- Market Capitalisation (Market Cap)

The market capitalisation value is the total network value of a cryptocurrency. To calculate the market cap, multiply the coin’s current price by the coin supply in circulation. However, the market cap can be misleading if you don’t factor in metrics like liquidity.

Investors generally believe that coins with low market cap have huge growth potential while those with high caps have more lasting power. We may never know the exact amount of coins a cryptocurrency has in circulation because of lost wallets and forgotten keys. Nonetheless, the market cap provides a relatively accurate estimate of a cryptocurrency’s value.

- Liquidity and Trading Volume

Liquidity is an estimate of how easy it is to trade a digital asset. The liquidity is solid if people can easily buy or sell a coin or token without severely affecting its market value. A liquid crypto typically has many sellers and buyers trading consistently.

Trading volume is a measure of the number of assets that have been bought and sold within a particular period. If a coin has a rising value supported by high trading volume, that’s a good sign. Conversely, if its price keeps fluctuating without substantial trading volume, that’s a red flag.

- Circulating Supply

Circulating supply refers to the number of coins in active supply that people can buy or sell. Unlike total supply, which is static, circulating supply changes as time progresses because coins get burned.

- Background Analysis

A cryptocurrency’s website should have a list or profile of its team members. It can be helpful to research the team’s track records to gain insight into their authenticity. That may be a bad sign if you cannot find adequate information about the team behind a coin or token. A genuine crypto project should have team members, advisors and early investors with clearly documented work experience.

- Crypto White Paper

A crypto white paper is a document explaining a cryptocurrency project’s purpose. Always scrutinise the white paper and read or watch external reviews about the project.

A standard crypto white paper should contain the following details:

- Team Information

- Blockchain technology details

- Use cases

- Features

- Potential Upgrades

- Token economics

- Sale information

- Tokenomics and utility

Tokenomics is the economics of a crypto coin or token’s demand and supply. Demand and Supply drive value. Hence, the higher the demand against supply, the higher the price. Tokenomics also involves the incentive set-up for motivating mining, investing, and trading on a blockchain network.

The utility of a cryptocurrency means what the crypto can do or be used for. For instance, Eth and Sol are used for trading NFTs, and USDT and USDC are stablecoins for bill payments. A cryptocurrency with real practical uses is likely to have a solid user base and potential for growth.

- User Behavior

User behavior can be affected by something as regular as a tweet. For instance, all Elon Musk has to do is post a similar tweet like the one below, and the market will move.

User behaviour can be challenging to predict. However, it is not impossible to have at least a general idea of how people can move in the market. Social media, especially Twitter and Reddit, are excellent places to observe crypto users, non-users, influencers, observers, and critics. You can also evaluate user behaviour from the marketing a crypto coin or token uses to sell.

Additionally, a crypto project’s follower count and online engagement can indicate userbase commitment. Be careful though; social media engagement can be a sham or scheme to trap users into investing in a scam.

To Wrap Up

Fundamental analysis of a cryptocurrency can show the current and potential value of a coin or token. “Do Your Own Research” is a cliché, but it’s a true one.

The same way you wouldn’t cross the road without looking both ways is the same way you should take fundamental analysis seriously as a trader.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.