What Is Crypto Staking and How to Earn Money From It

Crypto staking means locking your cryptocurrency for a specific period to help validate blockchain transactions and earn rewards.

If you search YouTube for how to make passive income from crypto, you'll find loads of videos and ads about crypto staking.

However, most are not entirely genuine about what is involved in staking cryptocurrency.

This article will explain cryptocurrency staking, how much you can typically earn, and the risks involved.

What is Crypto Staking?

Crypto staking means locking a cryptocurrency in a wallet for a specific period to secure a blockchain network and validate its transactions.

Blockchain utilises a consensus algorithm for validating network transactions. The two popular consensus algorithms are Proof of Work and Proof of Stake.

The Proof-of-Work model makes users or member computers need to solve complex math problems before they can create a new block. This method of mining is heavily energy-intensive.

The Proof-of-Stake model uses an algorithm to select validators to verify new information before it's added to a block or to create a block. Validators are users who invest their cryptocurrency for use as blockchain verification; this process is called staking.

The blockchain selects stakers randomly or by the number of tokens they’ve staked.

Selected stakers receive cryptocurrency in exchange for participating in the blockchain validation process as long as they confirm the correct information.

The earned crypto combines the crypto within the validated block, and the fees users paid for validated transactions.

How to Stake Crypto

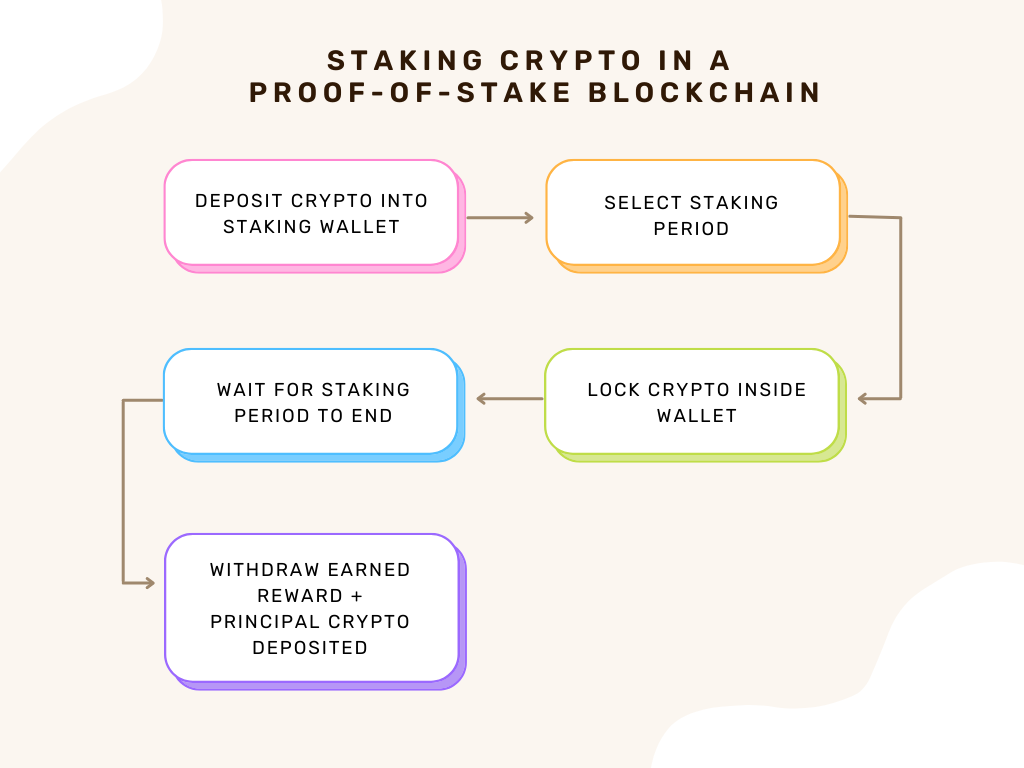

There are several ways to stake crypto to earn rewards/money. Here's how staking works in a Proof of Stake blockchain.

Let's call our first potential crypto staker Sally.

Sally wants to stake some ETH on the Ethereum blockchain. This is how she does it:

- Sally deposits ETH into a wallet on an exchange that supports staking. She selects the period to stake - 3 months and locks the coins in her wallet. She can choose flexible staking, which allows her to withdraw her crypto before the stipulated lock-up period is over. Or fixed staking that only unlocks her coins when the lock-up period has ended.

- After the staking period is over, the staking provider makes the coins available for withdrawal. In addition, Sally receives her earnings from staking after the service provider has deducted their service charge.

- Sally can either spend, withdraw, or re-stake her crypto (plus earnings) to gain more rewards.

It is advisable to thoroughly research the cryptocurrency and the staking platform you intend to use before investing your money. The more knowledge you have, the higher your chances of selecting a profitable cryptocurrency and platform to stake.

Let's call our second potential crypto staker Peter. Peter wants to stake some crypto, but he wants to use DeFi staking. Defi staking provides liquidity on decentralised exchanges that offer non-custodial atomic swaps between coins and tokens.

Atomic swaps are smart exchange contracts that allow two tokens to be traded between two different blockchains like Bitcoin and Ethereum, Cardano and Solana, etc.

Because automated market makers (AMMs) decentralised crypto exchanges utilise liquidity pools and algorithms to set cryptocurrency pair liquidity and market prices, they need liquidity from users such as Peter to continue effective trading.

Hence, the exchanges encourage users to provide tokens of a trading pair at a 1:1 ratio in a liquidity pool. For instance, users can provide both ETH AND USDT for an ETH/USDT trading pair.

The rewards gained from DeFi staking are typically provided in the exchange's native coin. Users get their rewards after staking a unique crypto called LP (liquidity provider) token.

The LP token represents the staker's share in the decentralised crypto exchange's liquidity pool. The staker can redeem this token whenever they want for the token they provided (alongside their staking rewards).

This means if a user staked both ETH and USDT to get an LP token, they receive ETH and USDT and their earned profit when they redeem the LP token.

Let's go back to our second potential staker Peter. To set up his DeFi Stake, this is what he does:

- Peter connects his wallet to a DeFi AMM platform and deposits ETH and USDT (because he's staking for an ETH/USDT pair) at a 1:1 ratio in the liquidity pool. This would be 1 ETH and 1323.30USDT (based on October 5, 2022 prices).

- The DeFi exchange provides the amount of ETH-USDT LP tokens representing Peter's share in the pool and distributes them to his wallet.

- Peter chooses to lock the ETH-USDT LP tokens for 60 days.

- At the end of the 60 days, he redeems the ETH-USDT LP tokens for his original tokens and any staking and liquidity provider rewards, such as a share of trading fees from the pool).

Both types of staking stated above are similar in their goal but differ in their process and requirements.

Are you a Peter or a Sally? The answer depends on how much profit you want, how much crypto capital you have, and how high your risk appetite/tolerance is.

How Much Can I Earn From Crypto Staking?

Cryptocurrency staking is ideal for people who want to make passive income. Staking rewards differ from coin to coin. You can get as low as 1-2% profit from staking or as high as 150% per annum.

The longer you stake, the higher your profit tends to be.

Typically, coins and tokens with high market caps offer lower annual percentage yields (APYs) than cryptocurrencies with lower market caps. For instance, Ethereum (ETH) offers 5-6% staking profit APY (Annual Percentage Yield), while assets like DefiChain (DFI) offer up to 70–75% profit annually.

Rewards also vary by crypto exchange platform. Some offer up to 6% profit APY while others offer 3-4%. The variance in profit percentages is due to 2 reasons:

- These exchange platforms run staking pools where locked coins from users are combined to increase their chances of being selected as validators. Most proof-of-stake blockchains select validators based on the amount of staked crypto; therefore, the bigger the pool, the higher the chance for validating blocks and earning rewards for users.

- The exchange platforms deduct their service charges before giving users their earned profit. Although some pools don't have fees, others charge 3–12%. Some even charge as high as 30–50%.

Is Staking Crypto Safe?

Despite its advantage as a simple way to earn passive income, there are certain risks involved in cryptocurrency staking:

- Volatility: Staking typically involves non-stablecoin cryptos. These coins, such as ADA, BTC, XRP, ETH, and LTC, are prone to volatile price changes. There's a considerable risk of losing your money to a sudden price decrease or a market crash.

This can be particularly exacerbated if you stake your coins in a fixed staking plan that won't allow you to liquidate your investments until the due date. If the market crashes or you find another crypto to invest in, you can't take out your staked coins or tokens. However, selecting a flexible staking plan without mandatory lock-up stipulations can avert these risks.

- Hacking risks: This can happen when you stake your coins on a centralised exchange that holds your cryptocurrency and private keys to access your coins. There's always the risk of losing your crypto to a hack or internal company fraud.

- Smart contract bugs: Decentralized crypto exchanges use smart contracts to run transactions, and a tiny code error can be devastating for users. Always use DeFi exchanges and platforms that have audited smart contracts to be safe.

- Slashing: Cryptocurrency staking platforms manage the technical aspect of staking, such as liquidating blocks and running blockchain nodes. Suppose they attempt to validate a fraudulent transaction or fail to sustain a 100% uptime. In that case, a blockchain network may penalise the platform by withholding the block validation rewards or slashing all the staked coins or tokens. Every user who staked a coin or token loses their investment when slashing happens.

To Wrap Up

Crypto staking is a way to earn extra income from your cryptocurrency by contributing your coins or tokens to a liquidity pool or blockchain financial validation pool.

It is advisable to thoroughly research the cryptocurrency and the staking platform you intend to use before investing your money. The more knowledge you have, the higher your chances of selecting a profitable cryptocurrency and platform to stake.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.