Table of Contents

- What Is a Bear Raid in Crypto?

- How Bear Raids Work

- Who Is Behind Bear Raids?

- How Bear Raids Affect the Crypto Market

- Bear Raid vs. Bear Trap: What’s the Difference?

- How to Spot a Bear Raid Early

- How to Protect Yourself from a Bear Raid

- To Recap

- FAQs

A bear raid is like a group of giant whales teaming up to shake the crypto tree so that panicked retail traders (smaller investors) drop their coins.

Once the price drops, these whales swoop in and buy the assets at a discount.

Let’s go into more detail about what a bear raid is, how whales execute them, and how you can spot and protect yourself from being trapped in one.

What Is a Bear Raid in Crypto?

A bear raid is when a group of powerful traders, known as whales, work together to push down the price of a cryptocurrency on purpose.

They do this by creating fear in the market, making smaller traders panic and sell their coins at a low price.

The Main Goal of a Bear Raid:

- Force the price of a coin down quickly

- Buy back the same coin at a much cheaper price

- Make profits when the price eventually recovers

How Is a Bear Raid Different from Normal Bearish Sentiment?

It’s easy to confuse a bear raid with a regular market downturn or bearish sentiment.

But here’s the key difference:

Let me give you an example:

Let’s say a whale wants to buy more Ethereum (ETH), but they feel the price is too high at $3,500.

Instead of waiting for a natural dip, they and a few partners start shorting ETH heavily and spread rumours on Twitter (X) that “Ethereum is being banned in XYZ country.”

Retail traders panic, start selling, and the price crashes to $3,000. The whales then buy up a large amount of ETH at this discounted price and close their shorts for profit.

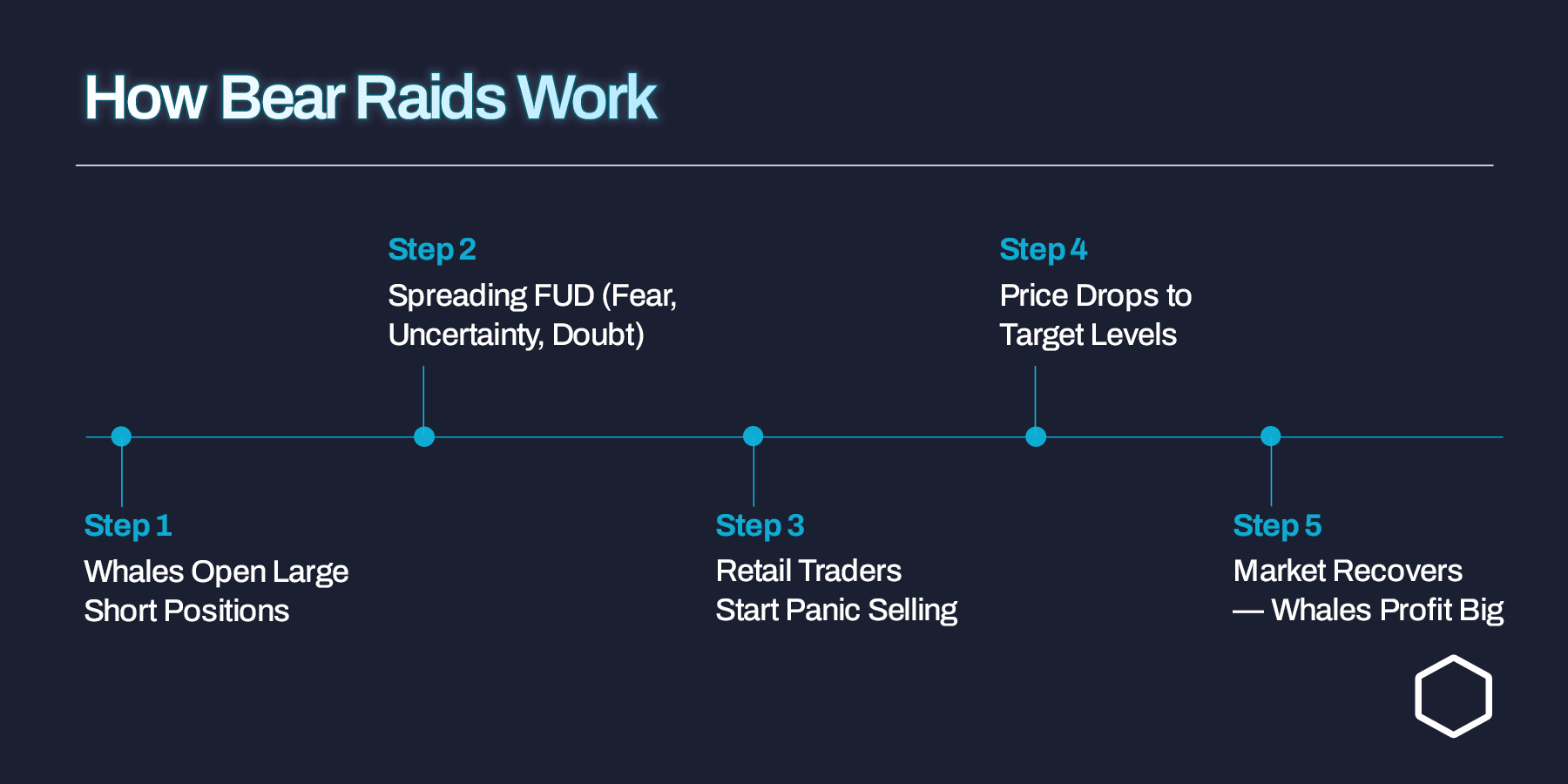

How Bear Raids Work

Step 1: Whales Open Large Short Positions

First, whales or coordinated trading groups bet that the price of a coin will go down by opening big short positions. Shorting means they borrow the coin and sell it immediately, hoping to buy it back later at a lower price to return it, keeping the difference as profit.

The bigger their short positions, the more selling pressure it creates on the coin.

Step 2: Spreading FUD (Fear, Uncertainty, Doubt)

Next, they spread negative news and rumours to scare retail traders into selling their coins. This FUD can be:

- Fake news about a government ban or lawsuit.

- Rumours of a project being hacked.

- Claims that a major exchange is insolvent.

- Influencers or anonymous accounts posting bearish tweets.

These messages are spread across Twitter/X, Reddit, Discord, and even some crypto news outlets. The goal is to create panic.

Step 3: Retail Traders Start Panic Selling

As the FUD spreads, many retail traders (small investors) see the falling prices and negative news. They fear bigger losses and start selling their coins in a hurry, which adds more selling pressure.

This panic selling amplifies the price drop, making it look like a real market crash, but it’s actually artificially triggered by the whales’ actions.

Step 4: Price Drops to Target Levels

Once the price has fallen to a level the whales want (usually much lower than the original price), they:

- Buy back large amounts of the coin at a discount.

- Close their short positions, locking in profits from the price difference.

- Sometimes, they even flip bullish and start pushing positive news to drive prices back up.

Step 5: Market Recovers — Whales Profit Big

After the raid, once the selling pressure eases, prices often stabilise or recover. Whales now hold a large amount of coins purchased cheaply. They profit in two ways:

- From the shorting profits when prices dropped.

- From the future price increase after they’ve scooped up the cheap coins.

Who Is Behind Bear Raids?

They are usually planned and executed by powerful players in the crypto market who have the resources to move prices. As stated earlier, these players are commonly known as whales.

Who Are These Whales?

In crypto trading, whales are individuals, institutions, or groups that hold large amounts of a cryptocurrency. Because of their massive holdings, whales can influence the price of a coin by buying or selling in large volumes.

Whales involved in bear raids can be:

- Crypto Hedge Funds: Firms that manage large capital and execute complex trading strategies.

- Private Trading Syndicates: Groups of wealthy investors who coordinate large trades together.

- Influential Individuals: High-net-worth traders or influencers with enough followers to sway market sentiment.

- Market Makers on Exchanges: Some trading firms that provide liquidity on exchanges may also engage in manipulation tactics (though this is harder to prove).

Why Do Whales Conduct Bear Raids?

The main reasons are to:

- Profit from Short Positions: Whales can earn huge profits by betting on price drops and forcing the market in that direction.

- Accumulate Coins Cheaply: After prices crash, whales can buy up large amounts of coins at discounted prices.

- Control Market Sentiment: By manipulating price action, whales can control the mood of the market, making retail traders act in ways that benefit them.

Is Bear Raid Manipulation Easy to Prove?

No, and that’s part of the problem.

In traditional financial markets, bear raids are illegal and closely monitored by regulators like the SEC (Securities and Exchange Commission). But in crypto, it’s a different story:

- Crypto markets are largely unregulated.

- Many trades happen anonymously across different exchanges.

- Whales often use multiple wallets, exchanges, and tactics to hide their tracks.

- Coordinated FUD campaigns are often disguised as “opinion posts” or “warnings.”

Because of these factors, proving a bear raid is happening in real-time is very difficult.

How Bear Raids Affect the Crypto Market

1. Sudden Price Crashes:

A bear raid can cause a sharp and unnatural drop in price. This isn’t the usual slow dip that happens after bad news. It’s a fast, aggressive sell-off that can knock a coin down by 10%, 20%, or even more within hours.

2. Liquidations of Leveraged Traders:

In crypto trading, many traders use leverage (borrowing money to trade larger positions). When prices fall quickly:

- Traders who are over-leveraged get liquidated (their positions are forcefully closed by exchanges).

- This creates a chain reaction where more liquidations lead to further price drops, even if there’s no real reason for the sell-off.

Bear raids are designed to trigger these liquidations because they add more selling pressure, making the price drop even harder.

3. Panic Selling by Retail Investors:

The real victims of bear raids are often retail traders, everyday investors who don’t have access to inside information or advanced tools.

- As they see the price falling and negative news spreading, they panic and sell their coins at a loss.

- Many traders exit the market emotionally, thinking the crash is due to serious problems, not realising it’s been artificially triggered.

4. Market-Wide Volatility:

Even if a bear raid targets just one coin, the panic can spill over to other assets.

- Crypto markets are highly interconnected; when Bitcoin crashes, altcoins usually follow.

- The overall market becomes unstable, leading to high volatility, fake breakdowns, and unpredictable price swings.

5. Damage to Investor Confidence:

Frequent bear raids can make retail investors feel that the market is “rigged” against them.

- New investors may lose trust in crypto trading.

- Projects that get targeted may suffer from long-term reputation damage, even if the FUD was fake.

Bear Raid vs. Bear Trap: What’s the Difference?

Bear Raid:

- A planned attack where whales or large traders force the price of a coin down by shorting and spreading FUD (Fear, Uncertainty, Doubt).

- The goal is to create mass panic so retail traders sell their coins cheaply.

- Whales then buy back those coins at lower prices and profit when prices recover.

Bear Trap:

- A fake bearish signal designed to trick traders into thinking the price will fall, only for it to reverse and go up.

- Whales or smart traders might push the price below key support levels to trigger stop-losses.

- Once enough traders have sold, the price suddenly bounces back up, trapping the sellers who now miss out on the recovery.

Key Differences:

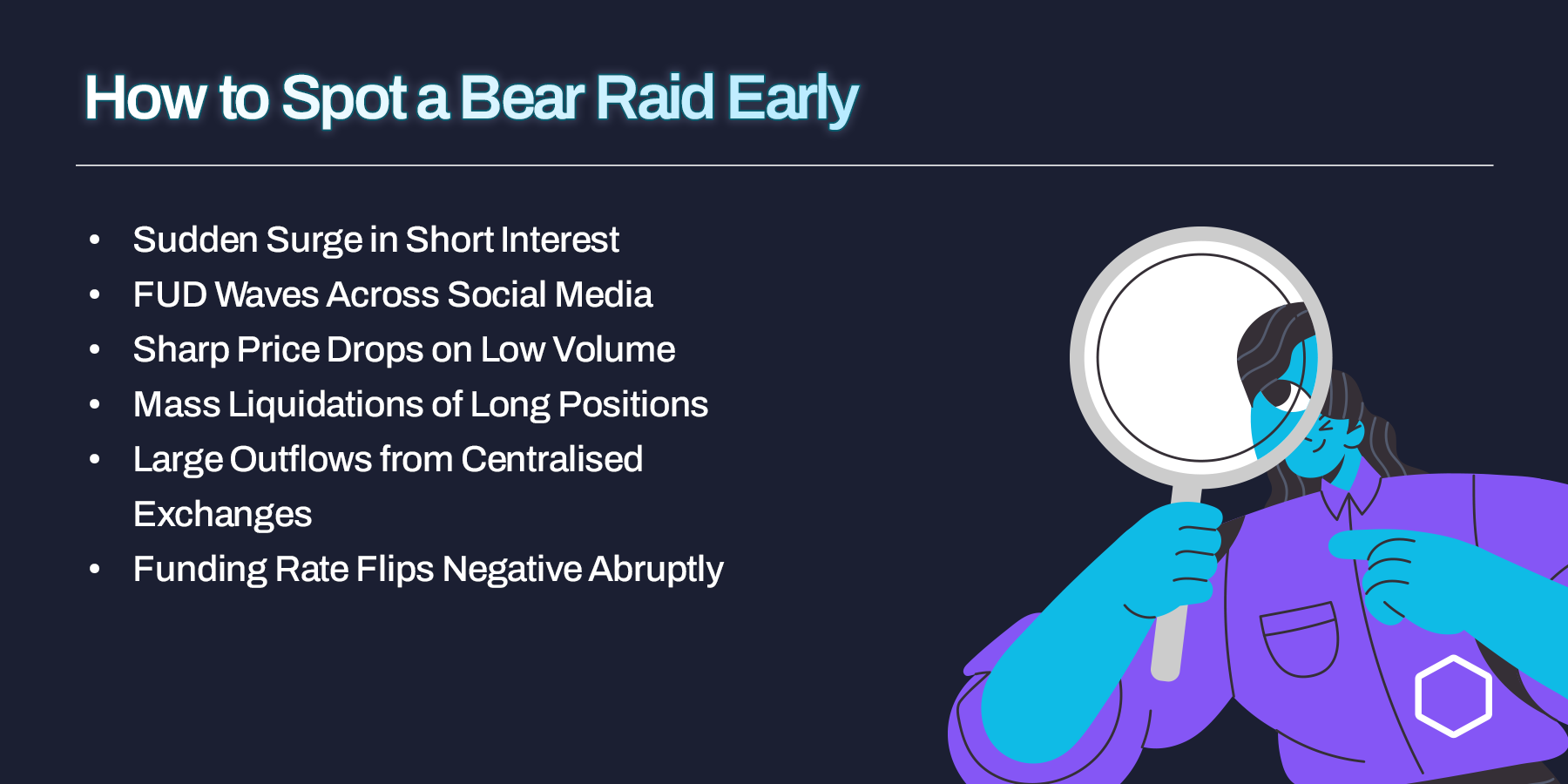

How to Spot a Bear Raid Early

1. Sudden Surge in Short Interest:

One of the biggest red flags is when there’s a sharp increase in short positions on a specific coin within a short time.

- Check platforms like CoinGlass or Hyblock Capital to monitor open interest (OI) and short vs. long ratios.

- If short positions are rising unusually fast, especially on large-cap coins, it could indicate whales preparing for a bear raid.

2. FUD Waves Across Social Media:

Bear raids often involve spreading fear through coordinated FUD campaigns.

- You might notice sudden negative posts on Twitter/X, Reddit, Discord, or crypto news blogs.

- The posts may sound like “insider warnings” or “breaking news” but often lack credible sources.

- If you see the same bearish message being repeated across multiple accounts quickly, it could be an organised effort to create panic.

3. Sharp Price Drops on Low Volume:

In a normal market correction, price drops usually come with high trading volumes as people rush to sell.

- But during a bear raid, you might see sharp price declines even when volume is low.

- This means the price is being pushed down intentionally by a few large players, not by general market sentiment.

4. Mass Liquidations of Long Positions:

Bear raids often target over-leveraged long positions.

- When whales force prices below key support levels, they trigger liquidations of long positions.

- If you see a sudden wave of liquidations (forced sell-offs) happening, it’s a sign that a bear raid may be underway.

5. Large Outflows from Centralised Exchanges:

Before or during a bear raid, whales may move large amounts of assets out of exchanges to private wallets or OTC desks.

- This reduces available liquidity and makes it easier to manipulate prices.

- You can track this activity using on-chain analytics platforms like CryptoQuant or Whale Alert.

6. Funding Rate Flips Negative Abruptly:

The funding rate on perpetual futures shows the balance between longs and shorts.

- If funding rates suddenly flip negative (indicating more people are shorting), it could be a sign of an incoming bear raid.

- A sharp funding rate drop, especially when paired with social media FUD, is a strong warning signal.

How to Protect Yourself from a Bear Raid

- Ignore Social Media Hype: Don’t react to sudden FUD on Twitter/X. Always verify from credible sources before acting.

- Place Smart Stop-Loss Orders: Avoid obvious stop-loss zones. Whales often target these to force liquidations.

- Watch On-Chain Data & Funding Rates: Monitor whale movements and sudden funding rate flips to spot signs of manipulation.

- Focus on Fundamentals, Not Noise: If the project’s fundamentals are strong, short-term bear raids shouldn't scare you out.

- Limit Leverage Usage: High leverage makes you an easy target in whale-driven price crashes.

- Stay Calm and Avoid Emotional Trading: Often, the best move during a bear raid is to pause, reassess, and wait for clarity.

To Recap

- Bear Raids are coordinated attacks by whales to push crypto prices down artificially through shorting and spreading FUD.

- Whales profit by shorting first, creating panic, then buying back assets at lower prices.

- Bear Raids are different from natural market downturns; they are planned manipulation, not reactions to real news.

- Retail traders often suffer the most, losing money through panic selling and liquidations.

- Early warning signs include: sudden short interest spikes, FUD waves on social media, low-volume price drops, and whale wallet movements.

- Protect yourself by staying calm, verifying information, watching on-chain data, and avoiding emotional trades.

- Don’t over-leverage and place smart stop-losses to reduce your risk of being trapped in a bear raid.

Follow Obiex for more practical trading insights that protect your crypto portfolio from hidden risks.

👉 Visit our blog for more guides that make you a smarter trader.

FAQs

Q1. Are bear raids illegal in crypto?

In traditional markets, they are illegal. However, crypto's decentralised nature makes regulation and enforcement challenging.

Q2. Can retail traders benefit from bear raids?

Rarely. Most retail traders get trapped. Only experienced traders who spot the raid early and buy the dip can benefit.

Q3. How can I monitor for signs of a potential raid?

Watch for sharp spikes in short interest, unusual negative sentiment waves, and whale wallet movements on-chain.

Q4. What’s the difference between a bear raid and normal bearish sentiment?

Bearish sentiment happens due to real bad news. A bear raid is a planned manipulation using fake or exaggerated news to create fear.

Q5. Do bear raids only happen in low-cap coins?

No. While low-cap coins are easier targets, bear raids can happen in major assets like Bitcoin and Ethereum, especially during volatile periods.

Q6. Can exchanges prevent bear raids?

Exchanges can monitor unusual short activity and price manipulation patterns, but most operate with minimal intervention due to decentralisation.

Q7. How do whales profit from bear raids?

They profit from short positions and buying back assets at lower prices after panic-induced sell-offs.

Q8. How often do bear raids happen in crypto?

They’re more common in high-volatility periods, such as during regulatory announcements or bear markets.

Q9. Is it possible to create a legal bear raid?

Technically, unless it involves fake news or insider manipulation, aggressively shorting an asset isn’t illegal in crypto. But coordinated FUD campaigns cross ethical lines.

Q10. What should I do if I suspect a bear raid is happening?

Stay calm, double-check fundamentals, watch on-chain data, and avoid making hasty decisions based on social media rumours.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.