Table of contents

- The Hidden Truth Behind “Instant” Swaps

- “Instant” vs. Truly Instant: How Obiex Does it Differently

- How to Swap Instantly on Obiex

- What Makes Obiex’s Instant Swaps Reliable

- FAQs

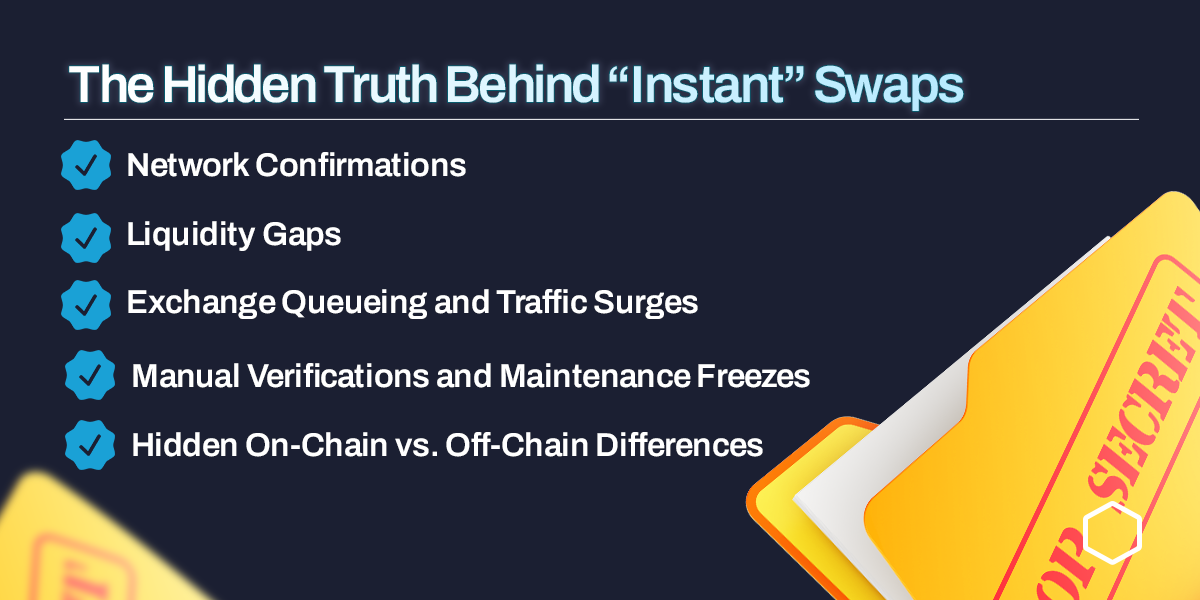

The Hidden Truth Behind “Instant” Swaps

When most exchanges say “instant”, what they really mean is “pretty fast… if everything goes right.”

The truth is that many “instant crypto swaps” still rely on several behind-the-scenes processes that cause hidden delays. Processes that traders aren’t usually told about.

Understanding these delays helps you see why swaps on some platforms can take minutes or even longer.

Here’s what’s really happening when your swap isn’t as instant as promised:

1. Network Confirmations:

Every blockchain network has its own confirmation process. When you initiate a swap involving a coin like Bitcoin or Ethereum, the transaction must be verified by miners or validators before it’s finalised.

Take Bitcoin, for example. It produces a new block roughly every 10 minutes, and most exchanges wait for at least one or two confirmations before marking a swap as complete. That means your “instant” swap can easily sit for 10–20 minutes while the network does its work.

Ethereum is faster, averaging about 12 seconds per block, but during periods of high congestion, those confirmations can also slow down or cost more in gas fees.

Even stablecoins can be delayed depending on the blockchain you’re using. USDT on Tron might take seconds, but USDT on Ethereum or Omni can take much longer.

These network waits are invisible to most users, yet they’re the main reason many “instant swaps” aren’t truly instant.

2. Liquidity Gaps:

Another hidden issue is liquidity. Liquidity simply means having enough assets available for you to swap when you want.

Many exchanges don’t actually hold all the tokens they let you trade. They connect to third-party providers or external markets.

When demand spikes (for example, during a BTC price rally or crash), those liquidity sources can run low. This forces the platform to queue your transaction until they find a matching buyer or seller.

What looks like a “processing” message on your screen is actually your swap waiting for someone else’s assets to become available.

3. Exchange Queueing and Traffic Surges:

When everyone is trading at the same time, such as after major crypto news or during a market crash, network congestion and exchange traffic can skyrocket. Platforms prioritise transactions in order, meaning some swaps get processed instantly, while others wait in line.

Even if the blockchain is fast, your exchange’s internal servers might be overloaded with pending requests. This queuing adds more delay, and users often mistake it for “slow internet” when it’s really a backend overload.

4. Manual Verifications and Maintenance Freezes:

Behind many “instant” platforms are risk checks, wallet audits, and manual verifications. Some exchanges freeze withdrawals or swaps temporarily to perform maintenance or security reviews, but they don’t always announce it immediately.

When that happens, swaps that should have cleared in seconds can suddenly take several minutes or even hours. These delays often have nothing to do with blockchain performance. They’re caused by internal processes meant to protect the platform, not necessarily to improve your experience.

5. Hidden On-Chain vs. Off-Chain Differences:

Most users don’t realise that how a swap is executed makes all the difference. There are two major methods:

- On-Chain Swaps: These require direct blockchain transactions and confirmations (common with decentralised exchanges).

- Off-Chain Swaps: These happen inside the platform’s internal system, with settlement handled later in bulk (common with exchanges like Obiex).

The first depends entirely on blockchain speed, while the second eliminates the blockchain waiting time completely. When you’re using a platform that only supports on-chain swaps, “instant” is physically impossible. You’ll always wait for the network to confirm.

6. The Marketing Illusion of “Instant”:

Finally, there’s the marketing problem. Many exchanges use the word “instant” loosely to attract users. What they mean is that the swap request is received instantly, not that the transaction actually settles right away.

Even though you click “swap” and see a progress bar move quickly, the funds may still be pending until confirmations arrive or liquidity becomes available. It’s fast-looking, but not truly fast.

“Instant” vs. Truly Instant: How Obiex Does it Differently

1. On-Chain Dependency vs. Off-Chain Execution:

Most exchanges depend on the blockchain to process every swap. That means when you trade BTC for USDT, your swap sits in line waiting for miners or validators to confirm the transaction on-chain. This is why you often see the “processing” message that lingers for minutes.

Obiex removes that dependency completely. Swaps on Obiex are executed off-chain, inside the platform’s internal system. Instead of waiting for the blockchain to approve your transaction, Obiex matches and settles it instantly using its internal ledger. The on-chain reconciliation occurs in the background, so your funds are available immediately.

This off-chain execution model eliminates network confirmation delays and makes Obiex’s swaps genuinely instant.

2. Traditional Liquidity Matching vs. Internal Liquidity Pools:

On most platforms, your swap depends on external liquidity, meaning they have to find a matching buyer or seller before your transaction is complete. When markets are busy or liquidity is low, your swap can get delayed or executed at a worse price.

Obiex takes a different approach. It maintains internal liquidity pools across major trading pairs like BTC/USDT and USDT/ETH. That means when you hit “swap,” Obiex already has the liquidity ready to complete your trade internally, without depending on external order books.

3. Hidden Spreads vs. Transparent Rates

Many exchanges that promise “instant swaps” quietly hide small spreads in their pricing. These are extra mark-ups added to the swap rate that most users never notice. They only see that the final amount is lower than expected.

Obiex is fully transparent. Before confirming your trade, you see the exact rate and amount you’ll receive. In many cases, Obiex rates are even better than P2P markets, especially for popular pairs like BTC/USDT, because there’s no human negotiation or intermediary delay.

4. Blockchain Confirmation Wait vs. Instant Wallet Credit:

On other exchanges, your swap isn’t truly finished until the blockchain confirms it. Even if you see “successful,” the funds might still be unconfirmed or unavailable for use.

With Obiex, once you confirm your swap, your new asset appears in your wallet immediately. You can send, trade, or withdraw it right away.

5. Variable Speed vs. Consistent Instant Execution:

A key frustration for many traders is inconsistency. Some swaps go through fast, while others lag depending on the time of day, network load, or asset type.

Obiex’s internal system provides consistent execution speed across pairs and time zones. Whether you’re trading at 2 p.m. or 2 a.m., your swap completes in seconds on average.

Here is a tabular comparison for better understanding:

How to Swap Instantly on Obiex

Step 1. Log in to Your Obiex Account

- Open the Obiex mobile app or visit your browser.

- Sign in using your email and password.

- If you’re new, create an account. It takes only a couple of minutes.

Step 2. Tap the “Swap” Button

- On mobile: you’ll find a Swap button (often centered at the bottom).

- On web: look for Swap (often near the top-right or navigation menu).

- Tap or click it to open the swap interface.

Step 3. Choose the Cryptos You Want to Swap

- Select which coin you will send (for example, BTC).

- Select which coin you want to receive (for example, USDT).

- The interface will prompt you to pick both sides of the pair.

Step 4. Tap “Get Quote” to View Your Rate

- After selecting the assets, tap Get Quote.

- Obiex will fetch and display the exact rate you’ll receive.

- That rate is locked in for a short time — even if market prices move seconds later, your swap still executes at that rate.

Step 5. Confirm and Complete the Swap

- Review the quoted rate and amount.

- If everything looks good, tap Confirm.

- Immediately, Obiex executes the swap using its internal liquidity.

- Your wallet balance updates right away, showing your new crypto.

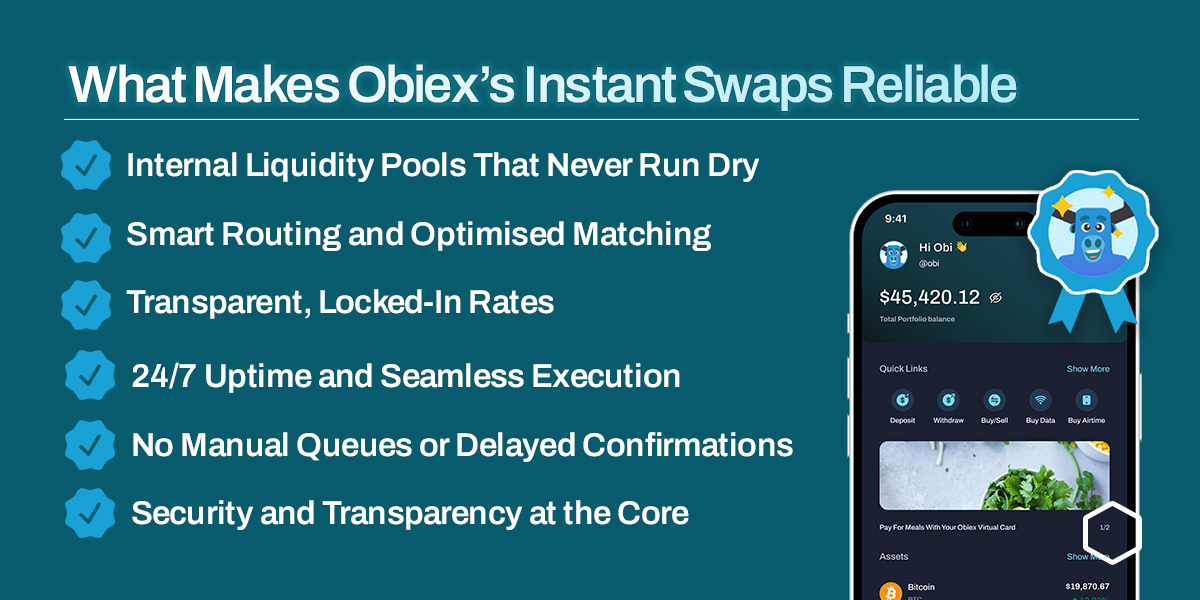

What Makes Obiex’s Instant Swaps Reliable

1. Internal Liquidity Pools That Never Run Dry:

Most platforms rely on external order books or third-party liquidity providers. When those partners are low on supply, your swap gets delayed or cancelled.

Obiex avoids that problem entirely by maintaining deep internal liquidity pools across popular trading pairs like BTC/USDT, ETH/USDT, and more.

These pools ensure that when you swap, the system already has enough assets on both sides to complete your trade instantly.

This is the core of what makes the platform’s swaps both instant and reliable. Liquidity is always available internally, not borrowed or routed elsewhere.

2. Smart Routing and Optimised Matching:

Obiex’s internal engine uses smart routing algorithms that automatically match trades at the best available price in milliseconds.

Instead of queuing your swap behind others, the system distributes trades efficiently across available pools to prevent bottlenecks.

This means that even during high-volume periods, like when Bitcoin’s price is surging or markets are volatile, your swap still executes at the quoted rate without slowdown.

3. Transparent, Locked-In Rates:

With Obiex, what you see is what you get. The platform locks your swap rate before you confirm the transaction.

That means once you accept the quoted price, your swap executes at that exact rate, even if market prices move a few seconds later.

4. 24/7 Uptime and Seamless Execution:

Crypto markets never sleep, and neither does Obiex. The system is built with round-the-clock uptime and load-balanced servers designed to handle high traffic without freezing or slowing down.

So whenever you’re swapping, Obiex executes with the same reliability and speed. The backend infrastructure is designed for high availability, meaning even during maintenance or sudden spikes in user activity, you’ll still get uninterrupted service.

5. No Manual Queues or Delayed Confirmations:

On some exchanges, swaps can get stuck waiting for manual checks, risk reviews, or approval queues. These extra layers are often invisible to users and can stretch an “instant” swap into a multi-minute delay.

Obiex’s swap system is fully automated and risk-assessed in real time. Transactions don’t need human approval to move forward, so there’s no backlog.

Every swap is processed instantly using Obiex’s internal verification and ledger reconciliation systems, all of which run continuously in the background.

6. Security and Transparency at the Core:

Speed doesn’t come at the expense of safety. Obiex uses multi-layered security architecture to protect your assets and swaps:

- Advanced encryption and real-time monitoring for all transactions.

- Segregated wallets for operational and liquidity funds.

- Background blockchain reconciliation for accuracy and traceability.

In short, your swaps happen instantly on the front end, but are still fully tracked, audited, and verified on the backend.

👉 Stop waiting for confirmations. Experience true instant swaps on Obiex today.

FAQs

Q1. What does “instant crypto swap” really mean?

A swap that settles immediately in your exchange wallet without you waiting for on-chain confirmations.

Q2. Why do my swaps take so long on other exchanges?

Often because they wait for blockchain confirmations, have low liquidity, or are batching withdrawals.

Q3. Are instant swaps safe?

Yes, when done by a regulated, transparent platform. Obiex executes swaps internally and settles on-chain later while keeping security controls.

Q4. How does Obiex make swaps truly instant?

By using internal liquidity pools and off-chain ledger execution, with on-chain settlement handled in the background.

Q5. Do I pay extra fees for faster swaps?

Obiex shows transparent rates. There are no secret “speed” surcharges; fees are visible before you confirm.

Q6. What crypto pairs can I swap instantly on Obiex?

Common pairs like BTC/USDT are supported instantly; check the platform for the full list.

Q7. What happens if a swap fails midway?

Obiex keeps clear logs and will automatically reverse or reconcile failed swaps; funds are protected by platform controls.

Q8. How do I know a platform’s swap is truly instant?

Look for transparent execution times, instant ledger updates, and no required user wait for confirmations.

Q9. Is Obiex faster than P2P exchanges?

Yes, P2P depends on humans and can be slower or inconsistent; Obiex provides automated instant execution.

Q10. Are Obiex’s instant swaps available globally?

Availability varies by jurisdiction and asset. See the Obiex platform for current coverage.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.