Table of Contents

- What Is a Crypto Portfolio?

- Types of Crypto Portfolio

- Why Is Building a Crypto Portfolio Important?

- How to Build Your Crypto Portfolio

- Best Practices for Crypto Portfolio Allocation

- Tools to Manage Your Crypto Portfolio

- Recap

- FAQs

Whether you're just beginning your crypto journey or have been in the game long enough, having a well-thought-out crypto portfolio can help you navigate the unpredictable crypto space effectively.

This is our guide to help you build a standard crypto portfolio in 2025. This article will explain how to create, allocate, and manage your crypto portfolio while making wise investment choices.

What Is a Crypto Portfolio?

A crypto portfolio is a collection of cryptocurrencies and digital assets you own, similar to a traditional investment portfolio. It may include major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), altcoins, DeFi tokens, and stablecoins.

The purpose of a crypto portfolio is to diversify your investments across different types of assets to reduce risks and potentially increase returns.

Types of Crypto Portfolio

1. The Balanced Crypto Portfolio:

This portfolio is like a mix of a safe savings account and a high-reward investment.

It includes a combination of established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), alongside smaller allocations in emerging altcoins with growth potential.

For example, you might allocate 50% to Bitcoin and Ethereum (for stability), 30% to mid-sized cryptocurrencies like Solana (SOL) or Polkadot (DOT), and 20% to new or smaller projects.

This setup reduces risk while offering opportunities for growth.

2. The High-Risk, High-Reward Portfolio:

If you’re ready to take bigger risks for potentially higher rewards, this portfolio focuses heavily on altcoins and newer projects.

For instance, 70% of your investments could go into promising but volatile tokens like meme coins (e.g., Dogecoin or Shiba Inu) or DeFi projects, while 30% is reserved for Bitcoin or Ethereum as a safety net.

Remember, this approach can deliver large gains, but it’s not for everyone due to the higher risk of losses.

3. The Long-Term Crypto Portfolio:

This portfolio focuses on cryptocurrencies that have proven their value over time.

You might allocate 80% to long-term assets like Bitcoin and Ethereum, 10% to mid-sized coins like Chainlink (LINK), and 10% to promising projects with solid use cases.

The idea is to hold these assets for 3–5 years or more, taking advantage of their stability and potential to increase in value.

4. The Diversified Crypto Portfolio:

Just as you wouldn’t eat only one type of food, a diversified crypto portfolio spreads your investments across different sectors of the crypto market.

For example, you could allocate 30% to Bitcoin, 30% to Ethereum, 20% to DeFi tokens like Aave (AAVE), and 20% to blockchain infrastructure tokens like Polygon (MATIC).

This strategy helps balance risks across various types of cryptocurrencies.

5. The Beginner’s Crypto Portfolio:

For those just starting out, simplicity is the way to go. Hypothetically, a good beginner portfolio might include 60% Bitcoin, 30% Ethereum, and 10% stablecoins like USDT (Tether) or USDC (USD Coin).

This setup provides exposure to the most trusted cryptocurrencies while limiting risk with stablecoins that don’t fluctuate much in value.

Why Is Building a Crypto Portfolio Important?

A crypto portfolio helps you manage risk, diversify your investments, and align your financial goals with your risk tolerance.

For example, instead of putting all your money into one cryptocurrency like Bitcoin, a diversified crypto portfolio might include Ethereum, Solana, and a few stablecoins.

This way, if one coin drops in value, others in the portfolio might cushion the loss.

How to Build Your Crypto Portfolio

The following are steps with which you can build your portfolio. First things first:

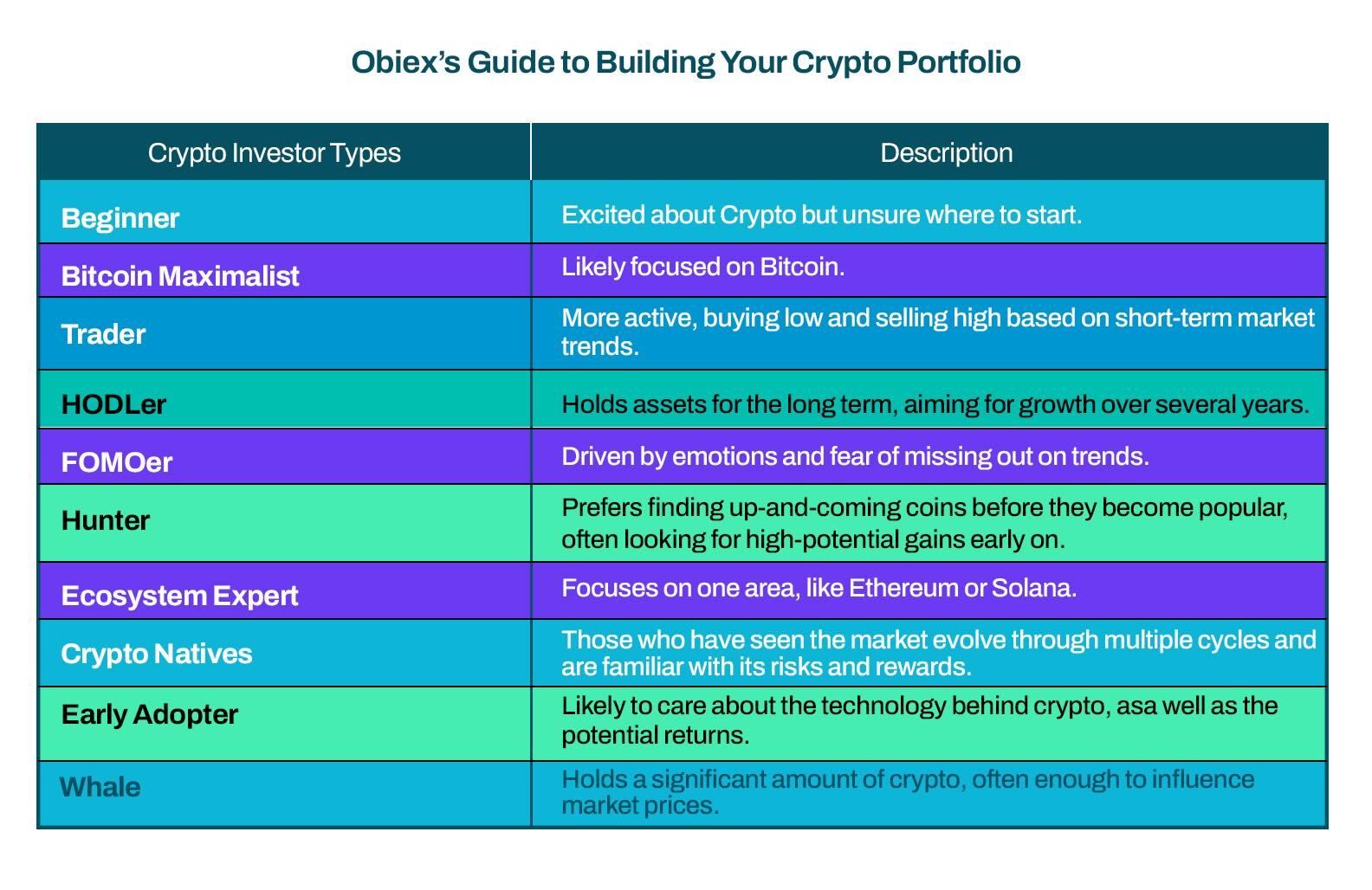

1. Determine Your Crypto Investor Type:

Before anything else, you must understand what type of investor you are.

This helps you tailor your approach to cryptocurrency investing in a way that aligns with your goals and risk tolerance.

There are many types of crypto investors, each with a different strategy.

For example, if you’re a Beginner, you might be excited about crypto but unsure where to start. You may want to focus on building a diversified crypto portfolio that spreads risk across different types of assets.

If you're a Bitcoin Maximalist, your focus will likely be on Bitcoin, and you'll probably prefer a long-term crypto portfolio strategy, holding onto your Bitcoin through market ups and downs.

On the other hand, if you're a Trader, you might be more active, buying low and selling high based on short-term market trends.

For those who don't like to rush, the HODLer mentality might appeal to you, where you plan to hold your assets for the long term, aiming for growth over several years.

If you tend to act on impulse, you might relate to the FOMOer, driven by emotions and fear of missing out on trends.

The Hunter type is for those who prefer finding up-and-coming coins before they become popular, often looking for high-potential gains early on.

If you prefer treating crypto as a long-term investment similar to traditional stocks, the Traditional Investor approach may suit you.

For those who have deep knowledge of specific crypto ecosystems, the Ecosystem Expert is ideal, allowing you to focus on one area, like Ethereum or Solana.

Crypto Natives are those who have seen the market evolve through multiple cycles and are familiar with its risks and rewards.

If you’re an Early Adopter, you likely care about the technology behind crypto, as well as the potential returns.

And lastly, the Whale is someone who holds a significant amount of crypto, often enough to influence market prices.

By identifying your crypto investor type, you can make informed decisions when building your crypto portfolio, whether it’s for short-term gains or long-term crypto portfolio growth, and ensure your best crypto portfolio allocation is tailored to your unique strategy.

2. Choose a Strategy Aligned with Your Type:

A well-aligned strategy can mean the difference between long-term success and costly mistakes.

For example, if you're new to crypto, strategies like dollar-cost averaging (DCA) or micro-investing are great starting points. These methods involve making small, consistent investments over time, which can help you build a diversified crypto portfolio without the stress of market timing.

If you're a seasoned investor or have a knack for identifying undervalued projects, value investing might be your best bet. This approach requires thorough research to find cryptocurrencies priced lower than their potential worth, creating opportunities for substantial returns.

On the other hand, risk-tolerant investors might prefer growth investing, which focuses on projects with high future potential, even if they are underdeveloped today. This strategy often attracts traders and early adopters who can spot trends before they go mainstream.

For those who enjoy data-driven decision-making, technical analysis is a powerful tool. By studying market charts and patterns, you can make informed trades based on market conditions.

However, if you prefer simplicity and have a long-term vision, the HODL strategy could be ideal. This involves buying and holding coins regardless of short-term price fluctuations. For instance, early Bitcoin holders who stayed the course have seen its price rise from a few dollars in 2010 to over $100,000 in 2025.

The key creating an effective portfolio is aligning your strategy with your goals, resources, and comfort level. Whether you're creating a balanced crypto portfolio for the long haul or experimenting with short-term trades, choosing the right strategy ensures your journey in building your crypto portfolio is both effective and manageable.

3. Pick Coins that Match Your Strategy:

Cryptocurrencies come in various “types,” each serving a different purpose in your portfolio. For instance, if you prefer stability, Bitcoin and Ethereum might be your go-to options. Bitcoin is often called "digital gold" due to its ability to store value over time, while Ethereum's smart contract capabilities make it the backbone of decentralised applications. Both are suitable for long-term investors using strategies like dollar-cost averaging (DCA) or “HODLing” (holding for the long haul).

On the other hand, if you’re chasing growth, smart contract platforms like Solana and Avalanche, or decentralised finance (DeFi) projects like Aave and Uniswap, might fit your plan. These coins are ideal for growth investing because they operate in sectors with immense potential, though they come with higher risks.

Meanwhile, stablecoins like USDC or Tether can serve as safe havens, offering minimal volatility while you wait for better investment opportunities.

Diversification is key to a balanced crypto portfolio, so consider spreading your investments across categories.

For example, allocate a portion to metaverse tokens such as Decentraland or gaming projects like Axie Infinity, which are promising for long-term growth but can be highly volatile.

If you believe in the future of a decentralised internet, web3 coins like Filecoin or Polkadot might appeal to your strategy.

4. Set Up a Crypto Portfolio Tracker:

Once you’ve chosen the cryptocurrencies for your portfolio, the next step is setting up a crypto portfolio tracker.

A portfolio tracker is like a personal finance app but specifically designed for cryptocurrency. It helps you monitor the value of your investments, track market changes, and assess each asset's performance in real-time.

Without a tracker, building your crypto portfolio and keeping it balanced can become overwhelming, especially when you hold multiple coins.

For instance, if your portfolio includes Bitcoin, Ethereum, and smaller altcoins, their values can fluctuate rapidly. A portfolio tracker provides a clear snapshot of how much each cryptocurrency contributes to your overall holdings, which is key to maintaining a diversified crypto portfolio.

Many trackers even allow you to set alerts for price changes, helping you make quick decisions when needed. For example, if your long-term crypto portfolio includes a smaller token, the tracker can notify you if its price suddenly spikes or drops.

Best Practices for Crypto Portfolio Allocation

Balanced Crypto Portfolio Example

When building your crypto portfolio, a balanced crypto portfolio is important to manage risk and maximise potential returns.

Let’s break it down with a simple example. Let’s say you are dividing your portfolio into four categories, each with a specific role to play. You can do it in the following way:

- 50% Bitcoin: Half of your portfolio is allocated to Bitcoin. Why? It’s the oldest and most reliable cryptocurrency, known for being a strong store of value. If you do not own Bitcoin, try another stable coin.

- 30% Ethereum: A third of your portfolio goes to Ethereum, which dominates the smart contract space. Ethereum is like the crypto operating system, and it also supports decentralised apps and NFTs.

- 10% Altcoins: This portion focuses on smaller, more volatile coins like Solana, Avalanche, or Polkadot. These coins are riskier but have higher growth potential, much like investing in tech startups. If one of these coins succeeds, it could significantly boost your returns.

- 10% Stablecoins: The final 10% is in stablecoins such as USDT or USDC. These coins are tied to fiat currencies like the US dollar, providing a safety net during market crashes. Think of them as the emergency fund of your diversified crypto portfolio, allowing you to hedge against sudden volatility.

Long-Term Crypto Portfolio Strategies

When it comes to long-term crypto portfolio strategies, the goal is to build a stable, growing foundation over time.

It’s similar to planting a garden: you carefully choose reliable seeds (cryptocurrencies), nurture them regularly, and remove weeds (unproductive assets) to keep the garden healthy.

To start, focus on well-established cryptocurrencies such as Bitcoin and Ethereum, which have a track record of stability and growth over the years.

These are often called "blue-chip" cryptos and can act as the backbone of a balanced crypto portfolio.

Another important practice is reinvesting profits. Instead of cashing out every time the market rises, consider reinvesting those gains into your portfolio. This strategy is known as compounding, and it can significantly increase your holdings over time, similar to how reinvested dividends grow traditional stock investments.

For example, if you earn $500 from a Bitcoin price surge, reinvesting it into other solid cryptos like Solana or Cardano could further diversify and strengthen your crypto portfolio.

Lastly, it’s important to rebalance your portfolio regularly. Cryptocurrency values can fluctuate widely, meaning some assets may grow faster than others.

Rebalancing ensures your investments stay aligned with your original plan. For example, if Bitcoin grows to make up 60% of your portfolio when your target was 40%, sell a portion and reinvest in other cryptos to maintain a diversified crypto portfolio.

Experts recommend reviewing your allocation every three to six months to stay on track.

Tools to Manage Your Crypto Portfolio

1. Portfolio Trackers: CoinTracker, Delta, and Blockfolio

Portfolio trackers are apps designed to help you monitor the performance of your crypto investments in real time.

Tools like CoinTracker, Delta, and Blockfolio allow you to see all your crypto assets in one place, even if they’re spread across multiple wallets and exchanges.

2. Secure Wallets:

A secure wallet is like a personal safe for your cryptocurrency.

Hardware wallets are known for their top-notch security features, as they keep your private keys offline, away from potential hackers.

These wallets are crucial for maintaining a long-term crypto portfolio because they safeguard your assets even if your computer or phone is compromised.

While exchanges can hold your crypto, having a wallet ensures you’re the sole owner of your funds.

3. Reliable Exchanges: Obiex

Exchanges play a vital role in building your crypto portfolio, as they allow you to buy, sell, and trade different cryptocurrencies. Platforms like Obiex are reliable for managing and diversifying your portfolio.

Obiex offers an easy-to-use interface, competitive fees, and tools to help you maintain a diversified crypto portfolio.

To Recap

- A crypto portfolio is a collection of digital assets like Bitcoin, Ethereum, altcoins, DeFi tokens, and stablecoins. Its goal is to diversify investments, manage risks, and enhance returns.

- The types of crypto portfolios include the Balanced Portfolio, High-Risk, High-Reward Portfolio, Long-Term Portfolio, Diversified Portfolio, and Beginner’s Portfolio.

- Building a crypto portfolio is important because it manages risks and aligns investments with financial goals.

- To build a Crypto Portfolio, start by determining your investor type, choosing an investment strategy, selecting preferred coins, and setting up a portfolio tracker.

- Portfolio trackers help monitor asset performance, set alerts for price changes, and maintain diversification.

FAQs

Q1. What is a cryptocurrency portfolio?

A cryptocurrency portfolio is a collection of digital assets owned by an investor, including cryptocurrencies, DeFi tokens, and stablecoins.

Q2. How do you build a crypto portfolio?

Start by setting investment goals, choosing a strategy (e.g., DCA or HODL), and diversifying across major cryptocurrencies, altcoins, and stablecoins.

Q3. What should my crypto portfolio look like?

A balanced crypto portfolio could include 50% Bitcoin, 30% Ethereum, 10% altcoins, and 10% stablecoins.

Q4. What is the best portfolio for crypto?

The best portfolio depends on your goals, but a mix of stable, growth, and speculative assets is ideal.

Q5. How many cryptos should you have in your portfolio?

It depends on your strategy, but 5-10 different assets often provide sufficient diversification.

Q6. What is a crypto portfolio allocation example?

Example: 40% Bitcoin, 30% Ethereum, 20% altcoins, and 10% stablecoins.

Q7. How to build your crypto portfolio for beginners?

Beginners should start small, focus on major cryptocurrencies, and use tools like DCA for consistent investments.

Q8. What is the best crypto portfolio allocation?

A balanced allocation includes 50% in Bitcoin/Ethereum, 30% in altcoins, and 20% in stablecoins.

Q9. What is a diversified crypto portfolio?

It includes a mix of cryptocurrencies, ensuring no single asset dominates, reducing overall risk.

Q10. What is a long-term crypto portfolio?

A long-term crypto portfolio focuses on stable and reliable assets like Bitcoin and Ethereum, with a smaller portion in promising altcoins for growth potential.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.