Table of Contents

- Why It is Hard to Find Hidden Crypto Gems Before Everyone Else

- Using GitHub to Spot Promising Crypto Projects

- Using Discord to Join Private Alpha Communities

- Using X (Formerly Twitter) to Track Trends and Influencers

- Red Flags to watch Out for in Early projects

- Putting It All Together

- How to Trade New Gems on Obiex Safely and Quickly

- To Recap

- FAQs

Finding hidden crypto gems before the crowd can turn a small investment into a life-changing opportunity. But to get in early, you need tools that go beyond basic news or influencer hype.

Platforms like GitHub, Discord, and X (formerly Twitter) can help you discover promising crypto projects before they hit the mainstream.

In this article, we’ll show you, step by step, how to use each of these platforms, what to look for, and how to avoid scams.

Why It is Hard to Find Hidden Crypto Gems Before Everyone Else

Finding the next big crypto project before it explodes sounds exciting, but in reality, it’s a lot harder than it looks.

Most people miss out on early gains not because they’re lazy, but because the crypto space is noisy, fast-paced, and full of distractions.

If you don’t know where to look, or what to ignore, it’s easy to get lost.

Here are four main reasons it’s hard to find hidden crypto gems early:

1. There’s Too Much Information Everywhere:

Every day, new tokens launch, new influencers tweet, and new videos drop claiming to know “the next 100x coin.” The problem is, most of this information is either copied, exaggerated, or outdated.

With this much noise, finding useful insights becomes like looking for a needle in a haystack. You need to filter through the noise to find real signals, and that takes practice and the right tools.

2. Hype Is Not the Same as Value:

Just because a token is trending doesn’t mean it has long-term value. Many early investors fall into the trap of buying a coin because it’s getting attention online, only to realise later that the project has no product, no users, and no real roadmap.

Real hidden gems often look “boring” at first. They don’t spend on marketing. They focus on building. That’s why they’re easy to overlook if you’re only paying attention to hype.

3. Scams and Rug Pulls Are Still Everywhere:

Crypto is full of opportunity, but it’s also full of scams. In 2023 alone, over $2 billion was lost to rug pulls and exit scams, according to Chainalysis. Some of these projects looked professional. They had websites, social media pages, and even influencers promoting them.

What they didn’t have was real code, real users, or real intentions. That’s why relying only on Twitter or YouTube isn’t enough. You need to dig deeper into developer activity and community signals.

4. Most People Don’t Know Where to Start Their Research:

Let’s face it, most retail investors don’t know how to properly research a new token. They rely on influencers, friend recommendations, or random Telegram groups. But real research requires checking:

- GitHub for developer activity

- Discord for real community discussions

- Twitter/X for trends and builder updates

It sounds technical, but it doesn’t have to be. With a simple routine and the right focus, you can build an edge and start spotting real opportunities early.

Using GitHub to Spot Promising Crypto Projects

If you're serious about finding hidden crypto gems, GitHub is one of the most underrated tools you should be using.

While most people are busy scrolling Twitter or watching YouTube reviews, smart investors are checking GitHub to see what’s actually being built.

GitHub is where developers store and update their project code. If a crypto project claims it’s building something innovative, GitHub is the easiest way to see if that’s true. It provides a behind-the-scenes view of whether the team is actually working or just marketing.

What to Look for on GitHub

You don’t need to be a programmer to spot early signs of a legit project. Here are the main things to check:

- Commits: These are updates to the code. A project with consistent commits shows active development. If the last update was six months ago, that’s a red flag.

- Contributors: The number of people contributing to the code matters. A good project usually has multiple developers, not just one person pushing all the updates.

- Stars: These are similar to "likes" on GitHub. If other developers find the code interesting or valuable, they star it. A high number of stars typically indicates that the project is gaining attention from the developer community.

- Forks: A fork is when someone copies the code to build on it. This shows interest and adoption. More forks often mean more people are testing or building on the project.

Red Flags to Avoid

- No Activity: If the GitHub page looks abandoned with no updates for weeks or months, that’s a bad sign.

- Only One Contributor: If only one person is writing all the code, the project may be risky or too early.

- Copy-Paste Code: Some scam projects clone the GitHub code from popular projects and pretend it’s theirs. If everything looks copied, be cautious.

- Private Repos: If a project claims to be open-source but you can’t view their code, that’s suspicious.

Helpful Shortcut

If checking GitHub feels overwhelming, tools like CoinGecko and Token Terminal make it easier. On CoinGecko, search for any token and go to the “Developer” tab. You’ll see a score based on GitHub activity, commit history, and contributors.

Using Discord to Join Private Alpha Communities

Discord is where most of the real-time action in crypto takes place. While GitHub shows you what’s being built, Discord shows you who’s building it, how active the community is, and what’s coming next.

If you want to stay ahead of the crowd, joining the right Discord servers is one of the smartest moves you can make.

Discord is like a giant group chat where crypto teams, developers, early supporters, and community managers discuss, share updates, and drop early information, including announcements such as testnet launches, token drops, and partnerships.

What Are Alpha Communities?

An alpha community is a private or semi-private group where people share early insights, leaked updates, and valuable research.

These groups are often invite-only, and they’re filled with experienced traders, builders, and researchers.

Inside these groups, people don’t just repeat what’s trending. They’re the ones spotting trends before they happen.

Where to Find Discord Links

To join a project’s official or alpha Discord server:

- Check the project’s website (usually in the footer).

- Look at their X (Twitter) profile bio or pinned posts.

- Ask in existing Telegram groups or subreddits.

- Follow trusted accounts that often share invite links.

Always double-check that the link is legit. Fake servers are common in crypto.

What to Watch For Inside Discord

Once you’re in, don’t just scroll around aimlessly. Focus on specific channels and signs of real activity:

- #announcements: Key updates from the project team, partnerships, funding rounds, or token launch dates.

- #dev-updates: Technical progress, feature rollouts, bug fixes, or testnet status.

- #airdrops or #events: Where you’ll often find early access opportunities, giveaways, or whitelists.

- Community chats: Active, healthy discussion is a good sign. If it feels dead or full of spam, be careful.

What Makes a Good Community?

- Developers and team members are present and reply to questions.

- Clear roadmap and regular updates.

- Helpful community mods, not just hype bots.

- Discussions about actual development, not just price.

Red Flags to Avoid

- Empty servers with just welcome messages and bots

- No roadmap or update history

- Constant hype and “moon” talk, but no product

- Bots pretending to be users (usually with generic messages or emojis only)

Why Discord Gives You the Edge

A lot of valuable information is shared on Discord before it reaches Twitter, Telegram, or crypto news websites.

For example, testnet airdrop campaigns are often first announced in Discord. If you’re active, you can participate early and position yourself before the token goes live.

And if you’re in the right alpha community, you’ll get access to early-stage projects that aren’t even listed on CoinGecko yet.

Using X (Formerly Twitter) to Track Trends and Influencers

In crypto, X (formerly Twitter) is where trends originate, and where they can suddenly gain momentum overnight. If GitHub shows what’s being built, and Discord shows what’s being tested, X shows what people are talking about, backing, and watching closely.

But here’s the thing: most people use X the wrong way. They follow hype accounts, chase viral tweets, and end up buying tokens that are already too late.

The smart way to use X is to follow the builders, not just the influencers, and learn how to filter noise from real insight.

Why X Matters for Early Crypto Research

- Instant updates: Many founders, devs, and crypto researchers share project progress, launches, and key info first on X.

- Public conversations: You can see how a project is being received by the wider crypto community.

- Access to threads, AMAs, and leaks: Often, upcoming airdrops, private rounds, or token launches are hinted at in replies or retweets before they’re official.

Who to Follow for Real Insights

To find hidden crypto gems early, your feed should include:

- Builders and Founders: These are the individuals who are actively working on new projects. Example: @0xPolygon, @haydenzadams (Uniswap), @StaniKulechov (Aave).

- Crypto Analysts and Researchers: Accounts that break down projects before they launch. Look for those who post in-depth threads or token breakdowns, such as @Route2FI, @DeFiIgnas, or @DegenSpartan.

- Project Accounts: Follow the official X accounts of projects you’re watching. Turn on notifications so you don’t miss updates.

- Alpha Communities: Some private groups or DAOs share public threads or teaser tweets. Don’t ignore them.

Smart Ways to Use X for Crypto Research

Here’s how to make X work for you, not distract you:

- Use Hashtags: Search for terms like #airdrop, #cryptogems, #testnetlive, and #DefiAlpha to discover new projects or opportunities.

- Create Twitter Lists: Group your top sources into a private list for faster browsing. You can make one for devs, one for projects, and one for traders.

- Use Advanced Search: Combine keywords like “launching soon” + “IDO” or “testnet” + “live now” to spot upcoming activity.

Avoiding the FOMO Trap

X moves fast, and it’s easy to feel like you’re missing out. However, FOMO (Fear of Missing Out) often leads to poor decisions. Don’t jump into a coin just because it’s trending.

Here’s what to do instead:

- Pause and cross-check: Is the project active on GitHub? Are there real people talking on Discord?

- Check the source: Is this info coming from a founder or someone credible, or just a hype account?

- Wait for confirmations: Look for official threads, timelines, and tokenomics before investing.

Red Flags to Watch Out For in Early Projects

Here’s a breakdown of the most common warning signs to watch for when researching early crypto projects on GitHub, Discord, and X:

1. Fake or Inactive GitHub Repositories:

If a project claims to be building something technical but has no GitHub activity, that’s a major red flag.

What to look out for:

- No recent commits or updates in weeks/months

- One contributor is handling all the code

- Code copied from other projects (check for identical file structures or names)

- A GitHub page that exists but is completely empty

What to do instead:

Use tools like CoinGecko’s Developer Score to check if a project is actually active. If it scores low or has no GitHub link at all, think twice.

2. Empty or Low-Quality Discord Servers:

A Discord server with no real conversation or only bot messages is usually a sign that the project doesn’t have a real community, or it’s pretending to have one.

Red flags:

- No real discussion, just spam, emojis, or hype messages

- No #dev-updates or #announcements

- Admins who don’t respond or disappear after launch

- Fake member counts (10,000 members but only 3 people online)

What to do instead:

Spend a few minutes reading the recent chat. Look for real questions, team updates, and roadmap discussions. If the community feels active and helpful, that’s a good sign.

3. Twitter Bots and Manufactured Hype:

Many low-quality projects purchase fake followers and utilise bots to inflate their token's popularity beyond its actual value.

How to spot it:

- Thousands of likes but no real replies or conversations

- Comments full of generic responses like “To the moon!” or “This is huge!”

- Influencers promoting the project without giving any real analysis or disclosures

What to do instead:

Focus on real engagement. Check who’s retweeting and replying. Are they respected builders or just spam accounts? Cross-check the info with GitHub and Discord.

4. No Clear Roadmap or Use Case:

A token that exists just to “go up in price” won’t last. If the project can’t explain what problem it solves, who it’s for, or what comes next, it’s probably not worth your time.

Red flags include:

- No whitepaper or product details

- Vague promises like “changing DeFi forever” with no actual plan

- Token launches before the platform is ready

- No team or anonymous team with no track record

What to do instead:

Look for a clear mission, product vision, and timeline. Even if the product isn’t ready yet, a solid plan is a good sign.

5. Pump-and-Dump Patterns:

Some tokens get hyped quickly, jump in price, and then crash just as fast. This is common with low-cap tokens that haven’t launched fully or are only listed on small exchanges.

Signs include:

- Sudden price spikes after influencer posts

- No token vesting or lockups for the team

- No liquidity lock (meaning they can pull out funds anytime)

What to do instead:

Use platforms like DEXTools or DEX Screener to check if liquidity is locked, and research the tokenomics thoroughly before making a purchase.

Putting It All Together: Your Daily 30-Minute Research Routine

By now, you know how to use GitHub to check developer activity, Discord to monitor community health, and X (Twitter) to track trends and conversations.

The next step is building a simple, repeatable system to help you find hidden crypto gems before they blow up.

You don’t need to spend hours researching every day. In fact, 30 focused minutes a day is enough to build an edge over most retail investors.

All you need is a routine and the discipline to follow it consistently.

Here’s a practical daily research system you can use:

10 Minutes on GitHub – Check Who is Building:

Start your session by reviewing projects with recent GitHub activity.

What to do:

- Visit CoinGecko and go to the “Developer” tab for trending projects

- Look for consistent commits and active contributors.

- Scan GitHub pages of new projects you’ve seen on X or Discord.

- Make note of:

- Last update date

- Number of contributors

- Number of stars and forks

- Comments in the commit history (are they fixing bugs or shipping features?)

Goal: Spot projects that are actively being built, not just hyped.

10 Minutes on Discord – Monitor Real Community Signals:

Next, jump into a few Discord servers of projects you’re watching or recently discovered.

What to look for:

- #announcements: Are there recent updates?

- #dev-updates: Are they releasing features or testnets?

- #general-chat: Is the community active, asking smart questions, and getting replies?

- #airdrop/#early-access: Are there any upcoming opportunities?

Bonus Tip: Join 2–3 alpha communities or early-stage Discord groups that discuss promising projects before launch.

Goal: Find tokens with strong, active communities and real updates, not ghost towns.

10 Minutes on X (Twitter) – Track What is Gaining Attention:

Finish by scanning your curated Twitter/X feed.

What to do:

- Check your Twitter Lists (separate builders, analysts, and project accounts).

- Look at trending crypto hashtags like #DefiAlpha. #CryptoGems, or #airdrop.

- Search for specific tokens or terms like “testnet live”, “pre-sale”, “whitelist open”.

- Bookmark or save high-quality threads and founder tweets.

- Watch for repeated mentions of a project across different accounts.

Goal: Identify early trends or updates that haven’t gone mainstream yet.

Recommended Tools to Make This Easier:

To speed things up and get more accurate data, use these free tools during your routine:

Final Tip: Keep a Tracker or Watchlist

Create a simple spreadsheet or Notion page to track:

- Project name

- GitHub link

- Discord invite

- X/Twitter handle

- Last update

- Notes from your research

Over time, you’ll build a personal watchlist of high-potential, early-stage projects, and be ready to act when one of them takes off.

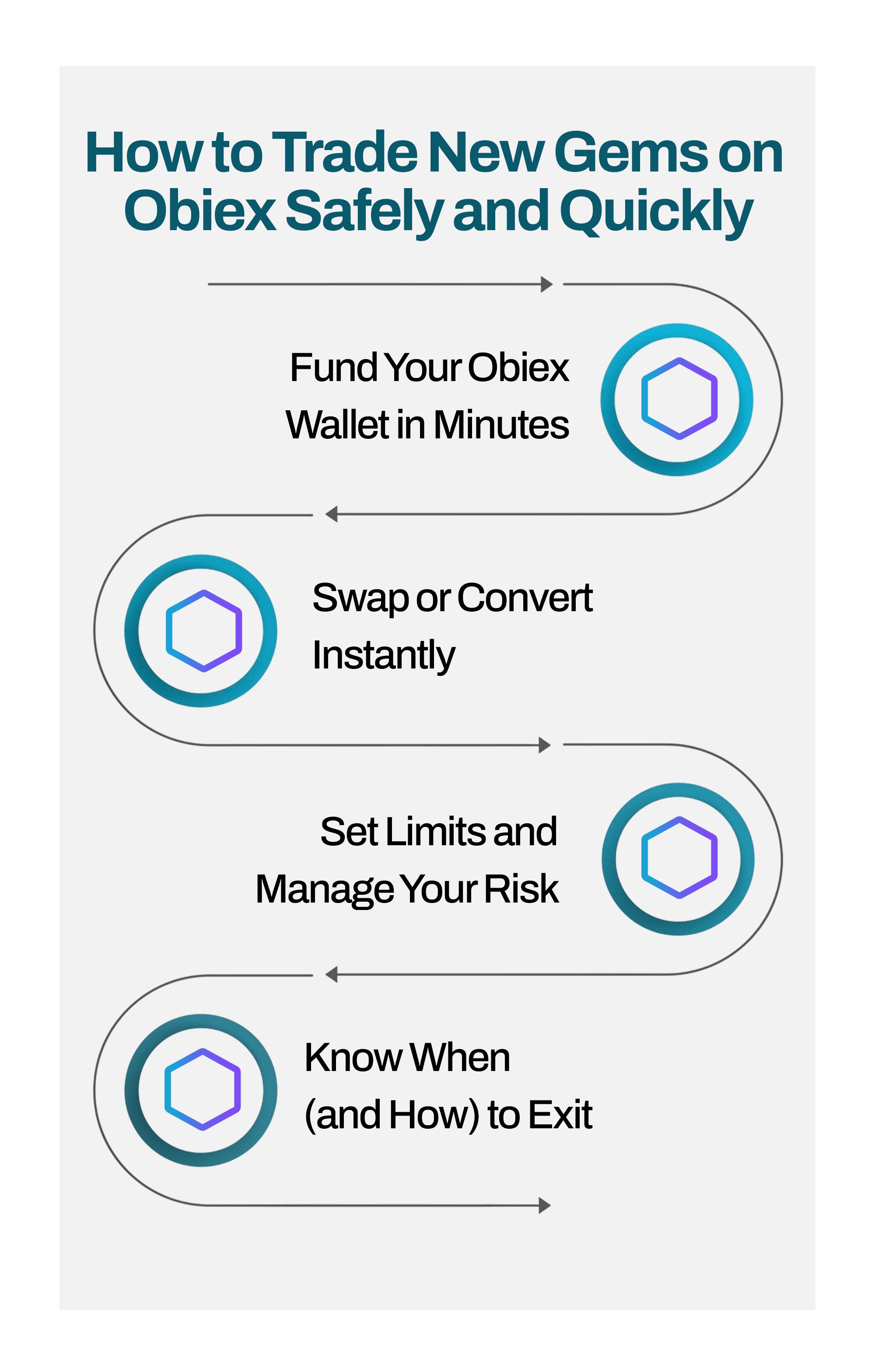

How to Trade New Gems on Obiex Safely and Quickly

So, you’ve done the research. You’ve found a promising project early using GitHub, Discord, and X. Now comes the most important part: getting in before everyone else, safely and quickly.

Obiex is built exactly for moments like this. Whether you want to buy, swap, or convert small-cap tokens, Obiex gives you the tools to act fast without the stress of clunky interfaces or hidden fees.

Here's how to trade early crypto gems the smart way using Obiex:

1. Fund Your Obiex Wallet in Minutes:

Before you can make any trades, you need to top up your Obiex wallet.

You can fund your wallet using:

- Crypto deposits: Send BTC, USDT, or other supported coins directly to your Obiex wallet.

- Bank transfer: Use your local currency (like NGN) to buy USDT or other stablecoins via bank transfer or other payment methods.

- Crypto swaps: Instantly convert one coin to another right inside the Obiex platform.

Tip: If you're researching a new gem that isn’t listed yet, keep a portion of your wallet in stablecoins (like USDT) so you can buy fast once it goes live.

2. Swap or Convert Instantly—No Waiting, No Spreads:

Obiex offers instant swaps, meaning you don’t have to go through complex order books or wait hours for a trade to execute.

How it works:

- Choose the crypto you want to convert (e.g. USDT to a trending altcoin)

- Enter the amount

- Swap instantly with no hidden fees or delays

It’s that simple.

Why this matters: When you discover a low-cap token early, speed is crucial. If you're too slow, the price might double before you even finish signing up on an exchange. Obiex helps you avoid that.

3. Set Limits and Manage Your Risk:

Even the most promising projects can be volatile, especially in their early stages. That’s why it’s important to protect your capital.

Risk management tips:

- Start small. Don’t go all in

- Set profit targets (e.g. sell 30% if the token does 3x)

- Use stop-loss orders or alerts to limit losses.

- Don’t chase green candles. Buy based on your research, not emotions.

Pro Tip: Keep a fixed percentage of your Obiex portfolio in stablecoins. This gives you flexibility to react to new gems while still staying safe.

4. Know When (and How) to Exit:

Getting in early is great, but knowing when to take profit is just as important. Many early investors lose money because they hold too long or panic sell too early.

How to approach exits:

- Set clear profit-taking rules (e.g. take 50% off the table after 2x).

- Watch for token unlocks or vesting periods (you can check these on CryptoRank).

- Monitor liquidity. If it dries up, it might be time to exit.

- Don’t wait for a “perfect” top. Take profit gradually as the price climbs.

To Recap

- Without a system, it’s easy to fall for bad projects or miss out on real ones.

- On GitHub, look at code updates (commits), contributor activity, and developer interest (stars and forks).

- Avoid projects with inactive or fake GitHub pages.

- On Discord, join official or alpha servers to watch roadmap updates, team engagement, and airdrop opportunities.

- On X, follow builders, researchers, and projects directly.

- Use hashtags, search terms, and curated lists to spot upcoming launches or low-key alpha before they go viral.

- Avoid fake GitHub repos, empty Discords, bot-filled Twitter hype, and projects with no clear use case or roadmap.

- Spend 10 minutes each on GitHub, Discord, and X.

- Use tools like CoinGecko, Token Terminal, and DappRadar to validate what you find.

- Use Obiex to fund your wallet, swap tokens instantly, and manage your risk with clear exit strategies.

Ready to apply what you’ve learned?

👉Get started on Obiex to trade those gems today.

FAQs

Q1. What are hidden crypto gems?

These are undervalued or lesser-known crypto projects with strong potential that have yet to gain mainstream recognition.

Q2. How do I find new crypto projects early?

Use platforms like GitHub, Discord, and Twitter to spot early activity, community growth, and developer updates.

Q3. Is GitHub reliable for crypto research?

Yes. It shows real-time developer activity, which is a good signal of whether a project is active or abandoned.

Q4. What is an alpha group in crypto?

A private community that shares early information, project analysis, and investment tips before the public hears about them.

Q5. How do I avoid crypto scams?

Avoid projects with inactive GitHub pages, fake Discord members, paid hype on Twitter, or no real use case.

Q6. What is Obiex used for?

Obiex is a crypto trading platform that lets you swap tokens instantly, manage your wallet securely, and discover new investment opportunities.

Q7. Can I trade low-cap tokens on Obiex?

Yes, Obiex supports a wide range of tokens, including small-cap and trending assets.

Q8. Is Twitter still useful for crypto research?

Yes. Twitter (now X) remains the best platform for live crypto news, project announcements, and trend spotting.

Q9. How much time should I allocate for daily research?

Just 30 minutes a day using GitHub, Discord, and X is enough to stay ahead.

Q10. How do I start using Obiex?

Visit obiex.finance, create a free account, fund your wallet, and start trading within minutes.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.