What is cNGN?

cNGN is a Naira-backed stablecoin regulated by the Nigerian Securities and Exchange Commission (SEC).

It is supported by major Nigerian banks and payment service providers, including Access Bank, Sterling Bank, Providus, Korapay, First Bank, Interstellar, Interswitch, Budpay, and Convexity.

What is a stablecoin?

A stablecoin is a type of cryptocurrency designed to maintain a steady value by being tied to a stable asset like a fiat currency (e.g., the U.S. Dollar, Naira) or a commodity (e.g., gold). Unlike volatile cryptocurrencies such as BTC, ETH, PEPE, DOGE, and XRP, stablecoins offer price stability, making them more practical for everyday transactions and cross-border payments.

Stablecoins have been around for nearly a decade, providing a reliable alternative in the crypto space. They help reduce volatility and offer a seamless way to send money across borders—especially within Africa—without the hassle of traditional payment systems.

When was cNGN launched?

The Naira-backed stablecoin was officially launched on February 3, 2025, making it Africa’s first regulated stablecoin.

As of February 4, 2025, there are 4,400 cNGN in circulation, held by seven users, with 14 on-chain transactions recorded and one supporting country.

cNGN is authorized under the Nigerian SEC’s regulations, following a provisional license granted in 2024 to its founding entity, Wrapped CBDC.

The stablecoin is governed by the Africa Stablecoin Consortium (ASC), a partnership led by Convexity, alongside Interstellar, Digital Currency Coalition, and Alpha Geek.

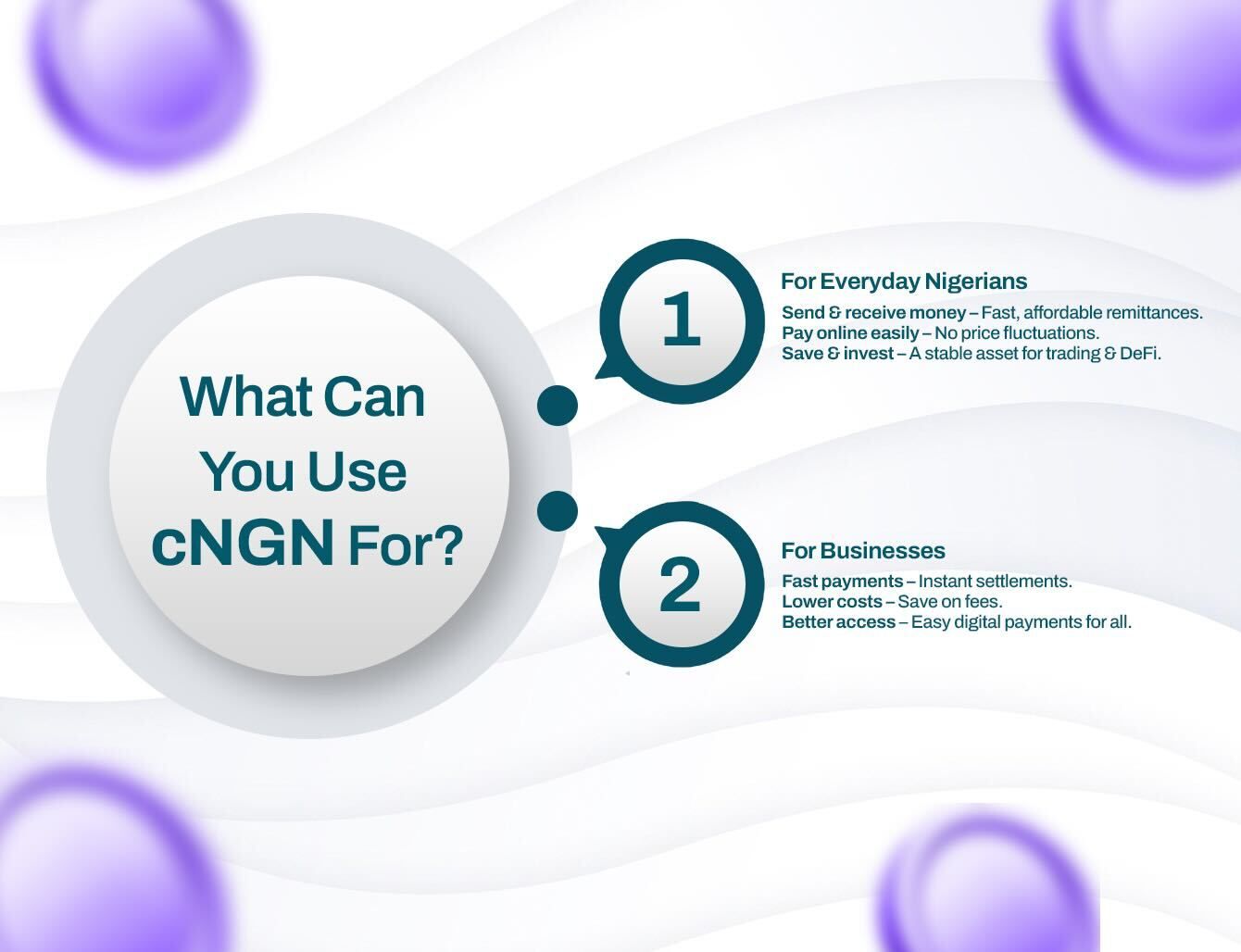

What can you use cNGN for?

For everyday Nigerians, cNGN offers an easy way to access digital finance.

Its stable value makes it a reliable alternative to typically volatile cryptocurrencies, providing benefits like:

- Seamless remittances – Send and receive money across borders quickly and affordably.

- Easy online transactions – Make secure online payments for goods and services without worrying about price fluctuations.

- Investment opportunities – Use cNGN as a stable asset for saving, trading, or exploring decentralized finance (DeFi) options.

For businesses, cNGN enables:

- Faster payment settlements – Process transactions instantly, reducing the time it takes for funds to clear.

- Lower transaction costs – Save on payment processing fees.

- Greater financial inclusion – Provide easier access to digital payments for individuals and businesses that are underserved by the traditional banking system.

Chimezie Chuta, founder of the Blockchain Nigeria User Group, in an interview with Business Day highlighted that cNGN’s launch integrates Nigeria’s currency into decentralized finance (DeFi).

“cNGN will help onboard the unbanked population, achieving greater financial inclusion. It will also allow businesses to integrate with crypto firms that support cNGN rather than relying solely on traditional payment channels.”

He added:

“With cNGN regulated by the SEC and authorized by the CBN, the burden of regulatory compliance is lifted from end users, integrators, and developers.”

How is cNGN different from the eNaira?

While both cNGN and the eNaira are pegged to the Nigerian Naira at a 1:1 ratio, their underlying technology sets them apart.

- The eNaira operates on a private blockchain built on Hyperledger Fabric, a permissioned distributed ledger technology.

- The cNGN, on the other hand, runs on public blockchains, including Bantu, Polygon, Ethereum, BNB Smart Chain, and Tron.

Unlike the eNaira, which is a Central Bank Digital Currency (CBDC) issued directly by the Central Bank of Nigeria (CBN), cNGN follows the stablecoin model, similar to USDT.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.