Table of Contents

- What Determines Bitcoin's All-Time Highs?

- A Look at Bitcoin’s Price Journey (2009 – 2023)

- 6 Biggest Bitcoin All-Time Highs in History

- April 14, 2021 - $64,895

- November 10, 2021 - $69,000

- March 6, 2024 - $73,835

- November 7, 2024 - $76,999

- November 10, 2024 - $80,152

- November 13, 2024 - $91,203

- How Bitcoin's All-Time Highs Impact the Market

- Factors That Could Lead to Future Highs

- To Recap

- FAQs

Bitcoin, the world's first cryptocurrency, has seen a remarkable journey since its creation in 2009.

Starting with a value of almost zero, Bitcoin has broken several all-time highs, becoming one of the most talked-about assets in financial history.

But what exactly are the key moments when Bitcoin reached unprecedented prices, and what influenced these spikes?

In this article, we'll explore the six biggest all-time highs in Bitcoin history.

These records reflect Bitcoin's growth from a niche digital asset to a mainstream investment, heavily influenced by economic events, market sentiment, and regulatory news.

Before looking at these all-time highs, let’s explore more of the factors that contribute to these price spikes.

What Determines Bitcoin’s All-Time Highs?

Bitcoin’s all-time highs are influenced by a mix of factors that shape demand and supply in the market, affecting how much people are willing to pay for it. One of the most significant factors is market demand—simply put, if more people want to buy Bitcoin, its price goes up.

Big events like the introduction of new financial products, such as Bitcoin ETFs (Exchange-Traded Funds), can trigger these increases by making it easier for institutions and individual investors to buy Bitcoin.

In 2024, Bitcoin saw record highs after the approval of Bitcoin spot ETFs, which allowed more investors to hold Bitcoin in regulated, accessible ways.

Another key factor is Bitcoin halving. Halving happens every four years, and it cuts the reward miners earn by half, making new Bitcoins scarcer.

This decreased supply, paired with steady or rising demand, often pushes prices up over time.

The April 2024 halving reduced the mining reward from 6.25 BTC to 3.125 BTC, adding to Bitcoin’s limited supply and likely contributing to a new price surge.

Macroeconomic factors—like inflation, interest rates, and government policies—are also important determinants. When central banks lower interest rates or inflation rises, investors often look for alternative assets like Bitcoin, hoping to protect their wealth.

The recent Federal Reserve rate cut led to increased buying, as lower rates made Bitcoin a more attractive investment compared to traditional financial products.

Similarly, political events, such as the U.S. presidential election, can influence market optimism or caution; Bitcoin’s recent high of $76,999 came shortly after Donald Trump won the US presidential election.

Lastly, technological and industry developments are another factor impacting Bitcoin’s price. Advances in blockchain technology, legal recognitions, or new use cases for Bitcoin can make it more appealing.

When a major exchange or financial platform integrates Bitcoin or when large companies invest, it signals trust and stability, often encouraging new buyers and boosting prices.

A Look at Bitcoin’s Price Journey (2009 – 2023)

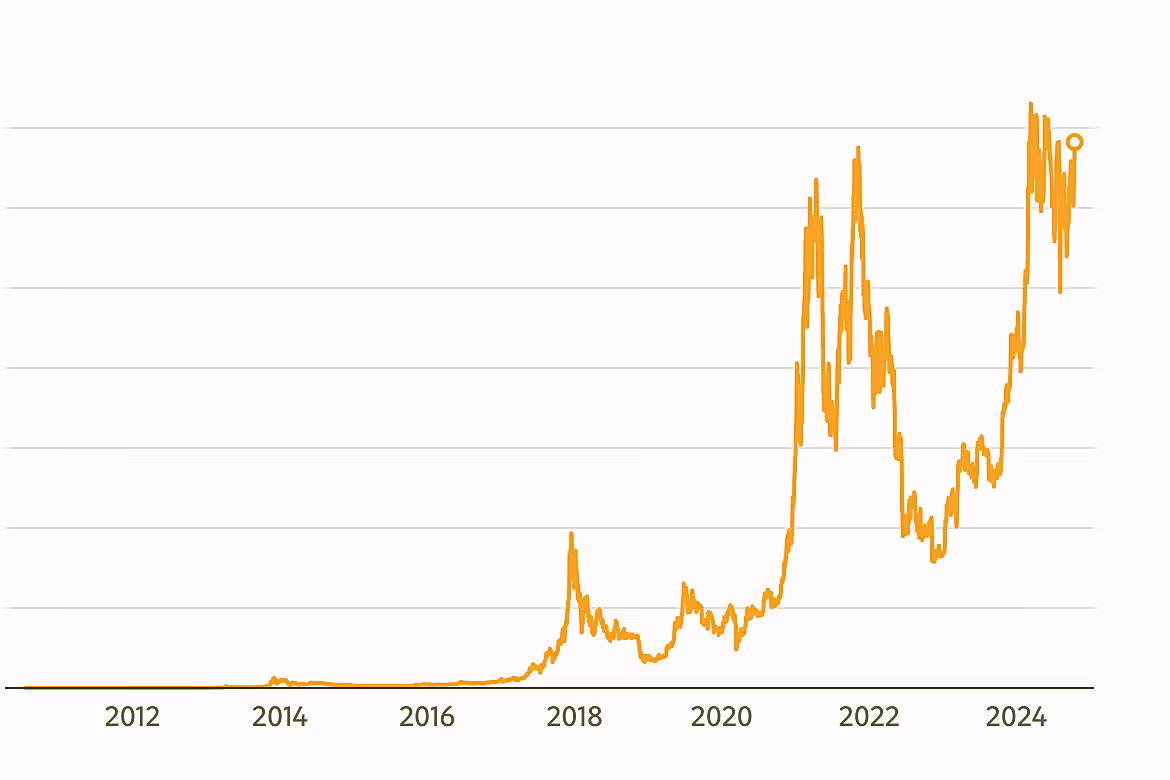

Bitcoin’s journey from 2009 to 2023 has been nothing short of remarkable, marked by major price milestones that tell a story of growth, hype, and volatility.

Bitcoin was launched in 2009 with no real monetary value; it was mostly an experiment among early adopters.

However, by 2010, Bitcoin’s value climbed to about $0.30, and by June 2011, it had reached $29.60— a huge leap from its initial worth of nearly nothing.

In 2013, Bitcoin’s value really took off, hitting $1,000 in November, which was a groundbreaking milestone for a digital currency that had initially been viewed with scepticism.

Fast forward to 2017, and Bitcoin hit another record high of around $19,188 in December, a price surge driven by increased interest from investors and mainstream media.

Then came 2020 and 2021, when Bitcoin’s price skyrocketed once more amid the COVID-19 pandemic as people turned to digital assets.

In April 2021, Bitcoin reached an all-time high of $64,895, backed by growing institutional interest and the launch of major cryptocurrency trading platforms.

In the summer of 2021, Bitcoin's value took a significant hit, dropping by 50% to close at $30,829 on July 19.

By September, however, BTC experienced another surge, peaking at $52,956 before sliding down again, closing at $40,597 just two weeks later.

On November 10, 2021, Bitcoin reached a new all-time high of $69,000 but closed the day at $64,921.

By mid-December, it had dropped to $46,211, as concerns around inflation and the rise of the Omicron COVID-19 variant led to increased market volatility.

Between January and May 2022, Bitcoin’s price continued to decline, reaching a closing price of $47,459 at the end of March before sliding further to $29,000 on May 11. This marked the first time since July 2021 that Bitcoin had closed below $30,000.

On June 13, crypto prices fell sharply, with Bitcoin dipping below $23,000 for the first time since December 2020. By the end of 2022, Bitcoin had fallen below $20,000.

The landscape shifted in 2023, with Bitcoin starting the year at $16,530. It steadily climbed throughout the year, reaching $42,258 by the close of 2023.

6 Biggest Bitcoin All-Time Highs in History

1. April 14, 2021 - $64,895:

The first major peak happened on April 14, 2021, when Bitcoin hit $64,895. This surge was fueled by Coinbase, a major U.S.-based cryptocurrency exchange, going public on the Nasdaq.

The initial public offering (IPO) made waves globally, as investors saw it as a sign of legitimacy for the cryptocurrency industry.

Combined with Tesla’s announcement that it had invested $1.5 billion in Bitcoin and would accept it as payment, these factors helped push Bitcoin to new heights.

2. November 10, 2021 - $69,000:

Only months later, on November 10, 2021, Bitcoin reached another record, climbing to $69,000.

This was partly driven by inflation concerns in the U.S., leading investors to look for assets like Bitcoin that could potentially hedge against inflation.

The launch of the first U.S. Bitcoin futures ETF (Exchange-Traded Fund) around the same time also made it easier for traditional investors to get exposure to Bitcoin, adding to the demand.

3. March 6, 2024 - $73,835:

In 2024, Bitcoin saw another historic high, reaching $73,835 in early March.

This increase followed the long-awaited approval of Bitcoin Spot ETFs by the U.S. Securities and Exchange Commission (SEC).

With more ETFs available, investors had new and simpler ways to invest in Bitcoin, driving up demand.

The approval was seen as a sign that the U.S. was finally embracing cryptocurrency, attracting fresh interest and investments.

4. November 7, 2024 - $76,999:

On November 7, 2024, Bitcoin surged once more, hitting $76,999. This jump was influenced by the U.S. presidential election results.

With Donald Trump re-elected and a new administration promising to support Bitcoin and blockchain technology, many investors became optimistic about future regulatory support.

This election-driven optimism led to a spike in Bitcoin’s value.

5. November 10, 2024 - $80,152:

Just a few days after the previous peak, Bitcoin broke past the $80,000 mark on November 10, 2024, reaching $80,152.

This milestone continued the momentum from the election and was reinforced by announcements suggesting a friendlier stance toward cryptocurrencies in U.S. policy.

The excitement kept prices high as more people anticipated positive changes for Bitcoin in the financial system.

6. November 13, 2024 - $91,203:

Finally, on November 13, 2024, Bitcoin reached its highest price ever at $91,203.

This increase was driven by even more spill-overs from the ongoing enthusiasm following the U.S. election, as well as the possibility of new crypto-friendly regulations and the creation of a Strategic Bitcoin Reserve.

Investors anticipated Bitcoin would play an even bigger role in the global economy, making this peak one of the most remarkable in Bitcoin’s history.

How Bitcoin's All-Time Highs Impact the Market

When Bitcoin hits an all-time high, it doesn’t just make headlines—it has a ripple effect across the entire cryptocurrency market.

Each surge often attracts new investors, sparks media attention, and can trigger a wider interest in digital assets, sometimes boosting the prices of other cryptocurrencies like Ethereum and Litecoin.

For example, when Bitcoin first reached $20,000 in December 2017, this high brought an influx of mainstream attention and even institutional investors, which helped Bitcoin to be seen as a serious asset.

By reaching new highs, Bitcoin frequently influences investor sentiment.

When prices soar, some see it as an opportunity to invest, hoping for further gains, while others may worry about a bubble, leading them to sell to lock in profits.

This combination of buying and selling can create high volatility in the crypto market.

Major Bitcoin highs also impact related assets like Bitcoin futures and ETFs, which provide traditional investors with indirect ways to gain exposure to crypto.

In 2021, when Bitcoin climbed above $64,000, it helped the market reach a then-record capitalisation of over $2 trillion.

Factors That Could Lead to Future Highs

1. Bitcoin Halving Events:

Every four years, Bitcoin undergoes a "halving" process, where the reward miners receive for adding a new block to the blockchain is cut in half.

This decrease in supply is built into Bitcoin’s code to help limit its total supply to 21 million coins.

Halving events have historically triggered price increases as reduced supply typically leads to higher demand.

2. Institutional Investment and Spot Bitcoin ETFs:

In 2024, the approval of Spot Bitcoin ETFs (exchange-traded funds) by the U.S. Securities and Exchange Commission (SEC) made it easier for institutions and large investors to buy Bitcoin directly.

This access has driven up demand, significantly pushing Bitcoin’s price higher.

Institutional investments tend to bring price stability and large capital inflows, and each new approval in the ETF space has the potential to boost Bitcoin’s value.

3. Macroeconomic Factors and Interest Rates:

Bitcoin’s price often reacts to changes in the broader economy, especially interest rate shifts from central banks.

Lower rates often encourage investors to seek assets like Bitcoin as an alternative to traditional investments.

Future economic conditions, including rate cuts or inflation concerns, could further influence Bitcoin’s appeal and price.

4. Geopolitical Events and Regulatory Changes:

Geopolitical shifts, such as election outcomes or policy changes, also play a significant role.

As stated earlier, after Donald Trump’s re-election in November 2024, Bitcoin’s price surged due to speculation on potential crypto-friendly policies and promises of a U.S. “Strategic Bitcoin Reserve.”

Regulatory developments like these create optimism among investors, as governments globally are increasingly recognising cryptocurrency’s role in the financial ecosystem.

Clear and supportive regulation could encourage future price spikes.

5. Global Adoption and Technological Advancements:

As more businesses, countries, and individuals adopt Bitcoin for everyday use, demand continues to rise.

Major companies adopting Bitcoin as a payment method, or nations recognising it as legal tender, would significantly impact its value.

Also, ongoing technological advancements in the blockchain space, like the development of Bitcoin’s Lightning Network for faster transactions, could drive up interest and make Bitcoin more attractive to new users, contributing to potential price highs.

6. Scarcity and Demand:

Bitcoin’s limited supply of 21 million coins is fundamental to its scarcity, and this factor will continue influencing its price as demand rises.

As more investors acquire Bitcoin, and with millions already lost or held long-term, available supply diminishes, which can lead to a scarcity-driven price increase.

Bitcoin’s role as “digital gold” and a hedge against traditional financial instability makes its scarcity a central factor that could push it to new all-time highs in the future.

To Recap

- Key factors influencing Bitcoin’s all-time highs include market demand, Bitcoin halving events, macroeconomic conditions, and regulatory changes.

- Major events like the approval of Bitcoin ETFs and Bitcoin halving have spurred notable price surges by increasing accessibility and reducing supply.

- The top five most significant Bitcoin all-time highs mainly occurred in 2024. Bitcoin reached $73,835 in early March, hit $76,999 on November 7, and peaked most recently at $91,203 on November 13, 2024.

- Each all-time high had a broad market impact, often drawing new investors, increasing media attention, and spurring interest in related assets like Ethereum and Bitcoin ETFs.

- Future price highs could be driven by ongoing factors such as Bitcoin halving, institutional investment, regulatory shifts, global adoption, and its fixed supply limit.

FAQs

Q1. What is the highest Bitcoin rate in history?

The highest recorded Bitcoin rate is $91,203 on November 13, 2024.

Q2. How much was 1 Bitcoin in 2009?

In 2009, Bitcoin was virtually worthless, trading for a fraction of a penny.

Q3. What was Bitcoin’s price in 2015?

In 2015, Bitcoin's price ranged between $200 and $400.

Q4. How much will 1 Bitcoin be worth in 2030?

It’s hard to predict, but some analysts speculate it could exceed $100,000 if adoption continues to grow.

Q5. How much is $100 Bitcoin worth right now?

This value changes frequently based on the market rate. You can check a live exchange for the current value.

Q6. How does Bitcoin's halving affect its price?

Bitcoin’s halving events reduce the supply of new Bitcoin, often leading to increased prices as demand continues to grow.

Q7. What is the best way to track Bitcoin prices?

You can track Bitcoin prices on cryptocurrency exchanges or financial apps that provide real-time price updates.

Q8. What influences Bitcoin’s price the most?

Bitcoin’s price is influenced by demand, scarcity, economic conditions, and regulatory news.

Q9. How does Bitcoin compare to other cryptocurrencies in terms of price?

Bitcoin is generally the highest-priced cryptocurrency due to its popularity, supply limit, and historical market dominance.

Q10. Is Bitcoin a good investment?

Bitcoin is highly volatile and can offer significant returns, but it’s also risky. Always research thoroughly and consider your financial goals before investing.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.