Table of Contents

- Why P2P is Not Built for Business

- How P2P Causes Compliance Problems

- Signs Your Business Has Outgrown P2P

- What You Need Instead

- Why Obiex is the Best Option for Volume Flows

- How to Move Volume on Obiex

- To Recap

- FAQs

Peer-to-peer (P2P) crypto trading became popular in Africa because it was easy to start with. No need for a license, just a wallet and a willing buyer or seller. Many B2B crypto operators, fintechs, and OTC desks started here to move stablecoins like USDT or USDC across borders.

But here’s the problem:P2P may work for individuals and small volumes. But it breaks when you try to handle $1M+ monthly flows, settle large client payouts, or automate treasury operations.

In this article, we will discuss some of the reasons why you should not rely on P2P for volume flows and introduce effective alternatives for moving large orders on Obiex.

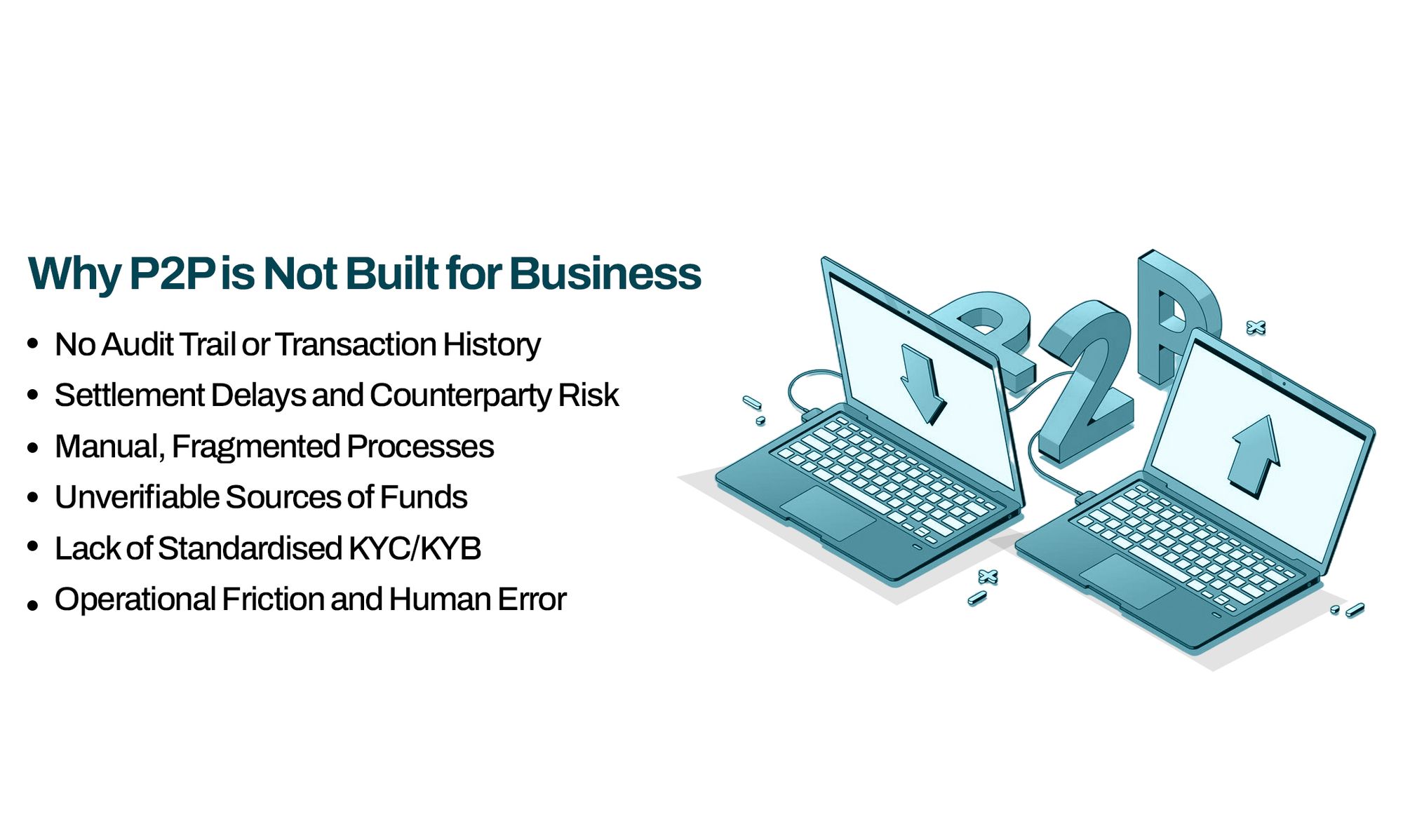

Why P2P is Not Built for Business

1. No Audit Trail or Transaction History:

Businesses require a comprehensive and verifiable audit trail for every transaction, ensuring compliance, effective internal controls, and accurate external reporting. P2P platforms often provide incomplete or no official transaction logs.

There is usually no standard invoice, settlement report, or unified ledger showing counterparties, timestamps, or wallet origins. This makes reconciliation difficult, and more importantly, non-compliant for audits or due diligence.

For companies managing large monthly flows, this lack of documentation exposes them to significant legal, financial, and reputational risks.

2. Settlement Delays and Counterparty Risk:

Unlike institutional-grade platforms, where settlement is fast and automated, P2P trades often require waiting for a human counterparty to confirm receipt manually, which can sometimes take hours or even days.

Worse, if a counterparty fails to send funds or disappears, there’s no real protection, leaving businesses exposed to failed trades, blocked working capital, and lost revenue opportunities.

3. Manual, Fragmented Processes:

P2P workflows are not designed for automation. Each transaction often requires chatting with a seller, confirming rates, checking wallet addresses, and uploading screenshots, all of which are done manually.

For teams handling 100+ settlements daily, this is unsustainable. A typical high-volume OTC desk might take hours on P2P processes that should be fully automated.

This introduces obstacles, slows down growth, and diverts teams from higher-impact activities like liquidity planning and treasury optimisation.

4. Unverifiable Sources of Funds:

In a P2P model, you often don’t know where the crypto you’re receiving is coming from, and neither does your counterparty. This exposes individuals to significant risks, including money laundering, sanctioned wallets, and regulatory violations.

Without knowing the source of funds, your business could unknowingly aid illicit activity, risking blacklisting by partners or global exchanges.

5. Lack of Standardised KYC/KYB:

Most P2P platforms do not enforce consistent Know Your Customer (KYC) or Know Your Business (KYB) checks.

Counterparties could be using fake IDs, stolen wallets, or unregistered businesses. If your company trades with entities that are unverified or on a watchlist, you’re exposed to fines or regulatory shutdowns.

Several African fintechs have lost banking partners in the past two years due to P2P exposure, where counterparties could not be traced or verified during audit reviews.

6. Operational Friction and Human Error:

P2P depends heavily on human coordination. That means typos in wallet addresses, missed confirmations, payment mismatches, and failed screenshots are common.

One wrong digit in a wallet address can send $100,000 to the wrong person, with no way to reverse it.

For enterprise teams processing millions in stablecoins, this creates significant risk. It also adds unnecessary stress to operations teams and causes friction across treasury, compliance, and finance functions.

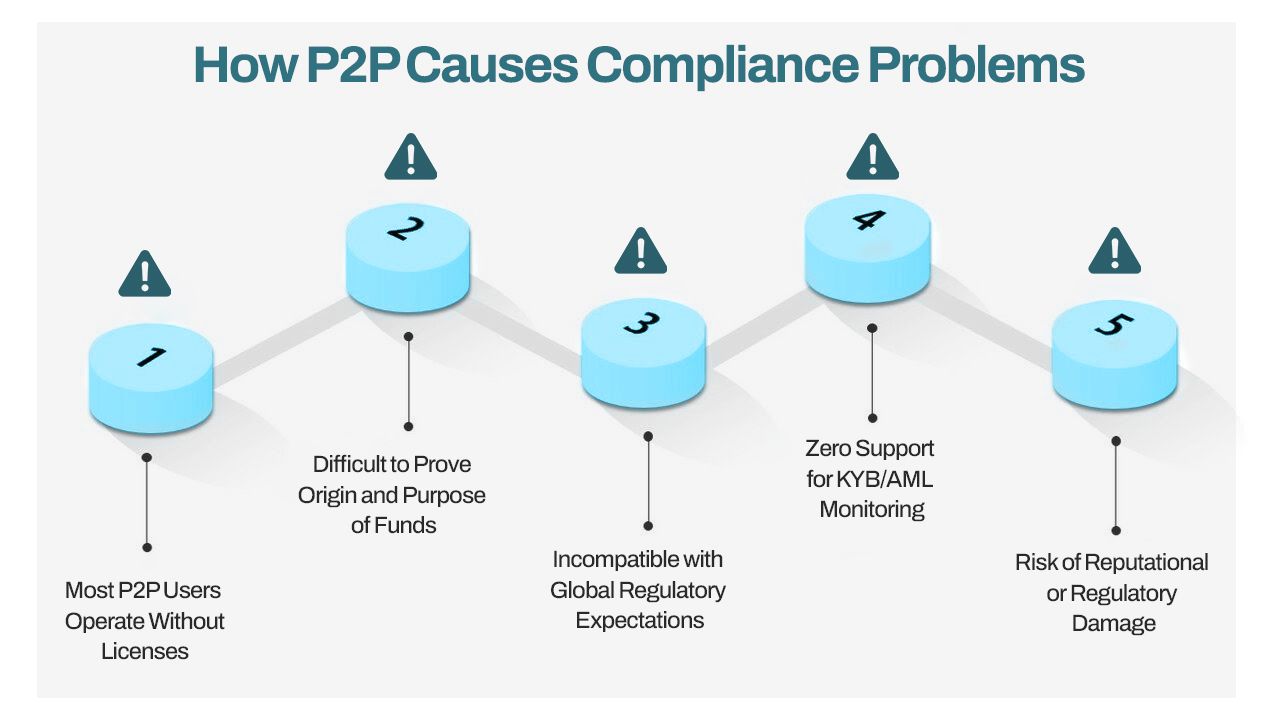

How P2P Causes Compliance Problems

1. Most P2P Users Operate Without Licenses:

The majority of traders on P2P platforms are individuals or small entities that do not hold any regulatory licenses. This means you could be trading large volumes with unverified or unauthorised actors.

For a B2B operation, this creates instant legal exposure, especially if your jurisdiction requires counterparties to be licensed or registered virtual asset service providers (VASPs).

Without knowing who you're trading with, you risk violating local and international laws.

2. Difficult to Prove Origin and Purpose of Funds:

In P2P trades, it’s nearly impossible to confirm the source or destination of funds at scale. This is especially problematic for treasury teams handling large monthly stablecoin flows.

If a regulator, auditor, or banking partner requests a transaction breakdown, P2P platforms provide no audit trail.

Most P2P trades are settled via informal channels like bank transfers, mobile money, or WhatsApp conversations.

This lack of documentation increases your exposure to money laundering and fraud accusations, even if your intentions are clean.

3. Incompatible with Global Regulatory Expectations:

Global financial standards, such as the FATF Travel Rule, MiCA in Europe, and FinCEN guidelines in the U.S., require transparent transaction data, counterparty verification, and traceable settlement records.

P2P platforms offer none of these. If your business is expanding across borders or working with global partners, using P2P puts you out of alignment with these expectations.

This can lead to frozen accounts, rejected transactions, or blacklisting from banking and payment partners.

4. Zero Support for KYB/AML Monitoring:

Know Your Business (KYB) and Anti-Money Laundering (AML) checks are essential when managing institutional-level crypto flows.

P2P platforms do not support automated KYB or real-time AML alerts. You are responsible for manually checking who your counterparty is, and whether they are flagged by any sanctions list or regulatory body.

This is operationally impossible to manage when you're dealing with dozens of transactions per day, each worth tens or hundreds of thousands of dollars.

5. Risk of Reputational or Regulatory Damage:

Using P2P for high-volume trades can damage your company's reputation. If even one trade is linked to a flagged wallet, scam operation, or sanctioned jurisdiction, your business could face inquiries, account shutdowns, or media scrutiny.

Even if no laws are broken, the reputational cost is high. For institutional teams, the downside of being associated with untraceable crypto activity far outweighs any temporary cost savings P2P might offer.

Signs Your Business Has Outgrown P2P

If any of these apply, it’s time to upgrade:

1. You're Trading $1M+ Monthly:

Once your business is moving over $1 million in crypto volume per month, the operational strain of P2P becomes unsustainable.

P2P platforms don’t offer guaranteed liquidity at this scale. You’ll spend hours hunting down counterparties with enough balance, negotiating rates manually, and constantly worrying about whether a deal will close on time.

More importantly, the lack of automation means your team is burning unnecessary time on every transaction.

Institutional desks and treasury teams trading this volume require liquidity pools that are deep, instant, and dependable, rather than inconsistent peer deals.

2. You Need Audit Trails or Tax Reporting:

If your finance team is preparing monthly reports, doing tax filings, or conducting audits, then P2P simply doesn’t cut it.

P2P transactions often lack formal documentation, transaction histories, or verifiable receipts. You might receive a wallet screenshot, but that won’t satisfy auditors or regulators.

For any business working with external investors, banks, or regulators, traceability is a non-negotiable requirement. Without audit trails, your back-office compliance becomes a nightmare.

3. You're Working Across Multiple Jurisdictions:

P2P was not built for international operations. Once your business starts settling payments in countries other than the one from which you operate, you quickly encounter regulatory blind spots, counterparty risks, and foreign exchange inconsistencies.

You’ll be juggling multiple regional P2P platforms with little to no unified compliance framework. Worse still, cross-border settlements can break down due to inconsistent wallet formats, delays, or blocked transactions.

4. You’ve Missed Deals Due to Slow Settlements:

This is one of the most expensive symptoms. In fast-moving markets, settlement speed is everything. If you’ve ever lost a deal because your P2P counterparty delayed for hours, or disappeared entirely, you’re already paying the price.

Business-grade crypto requires real-time settlement engines, not flaky one-on-one deals. That’s what Obiex provides: fast, programmatic execution for high-value flows.

5. You Need Automated Settlement and Treasury Flows:

Manual processes don’t scale. If you’re moving funds between wallets, counting confirmations, or updating spreadsheets every day, you’re at risk. Treasury managers handling $5M+ per month in stablecoins can’t afford to rely on manual P2P chats.

You need webhooks, APIs, and programmable settlement workflows that connect with your internal tools. Obiex enables this with enterprise-level automation, allowing you to focus on strategy rather than operations.

What You Need Instead

What does real crypto infrastructure look like for high-volume businesses?

1. Built-in KYC/KYB and Compliance Support:

Relying on P2P for volume flows often exposes your business to regulatory and reputational risks due to the lack of built-in compliance. Obiex’s infrastructure includes Know Your Customer (KYC), Know Your Business (KYB), and Anti-Money Laundering (AML) checks by default, helping you meet both internal risk standards and external regulatory obligations.

2. On-Demand Liquidity with Full Visibility:

P2P trades rely on the availability of fragmented individual sellers, leading to delays and unpredictable pricing. In contrast, Obiex provides deep liquidity pools across major stablecoins like USDT, USDC, and BUSD. You get transparent quotes, clear spreads, and immediate execution, so you never have to “wait for a match.” This ensures stablecoin transactions can settle within minutes, even at scale, across borders.

3. Fast, Traceable, Secure Settlements:

Delays, reversals, or unconfirmed transfers can lock up business funds for hours or days. With Obiex, you get traceable settlement logs, secure custody integrations, and time-bound SLAs that guarantee faster transaction finality. Every USDT sent through Obiex’s infrastructure can be tracked and confirmed.

4. API Access and Automation:

Scaling crypto operations means reducing manual workflows. P2P is impossible to automate reliably because it depends on human intervention for negotiation, confirmations, and counterparty risk checks. Obiex solves this by offering robust API access that enables your engineering and operations teams to integrate crypto trading, settlement, and treasury functions directly into your business backend. You can set up recurring payments, fetch exchange rates, monitor balances, and automate bulk settlements in seconds, saving hours of manual work and eliminating costly human errors.

5. Compatibility with Business Operations and Scale:

P2P was never built for enterprise-scale operations. It simply doesn’t integrate with accounting tools, treasury dashboards, or compliance systems. Obiex is built specifically for B2B teams, offering platform features like user roles and permissions, transaction audits, multi-wallet access, and bulk trade execution.

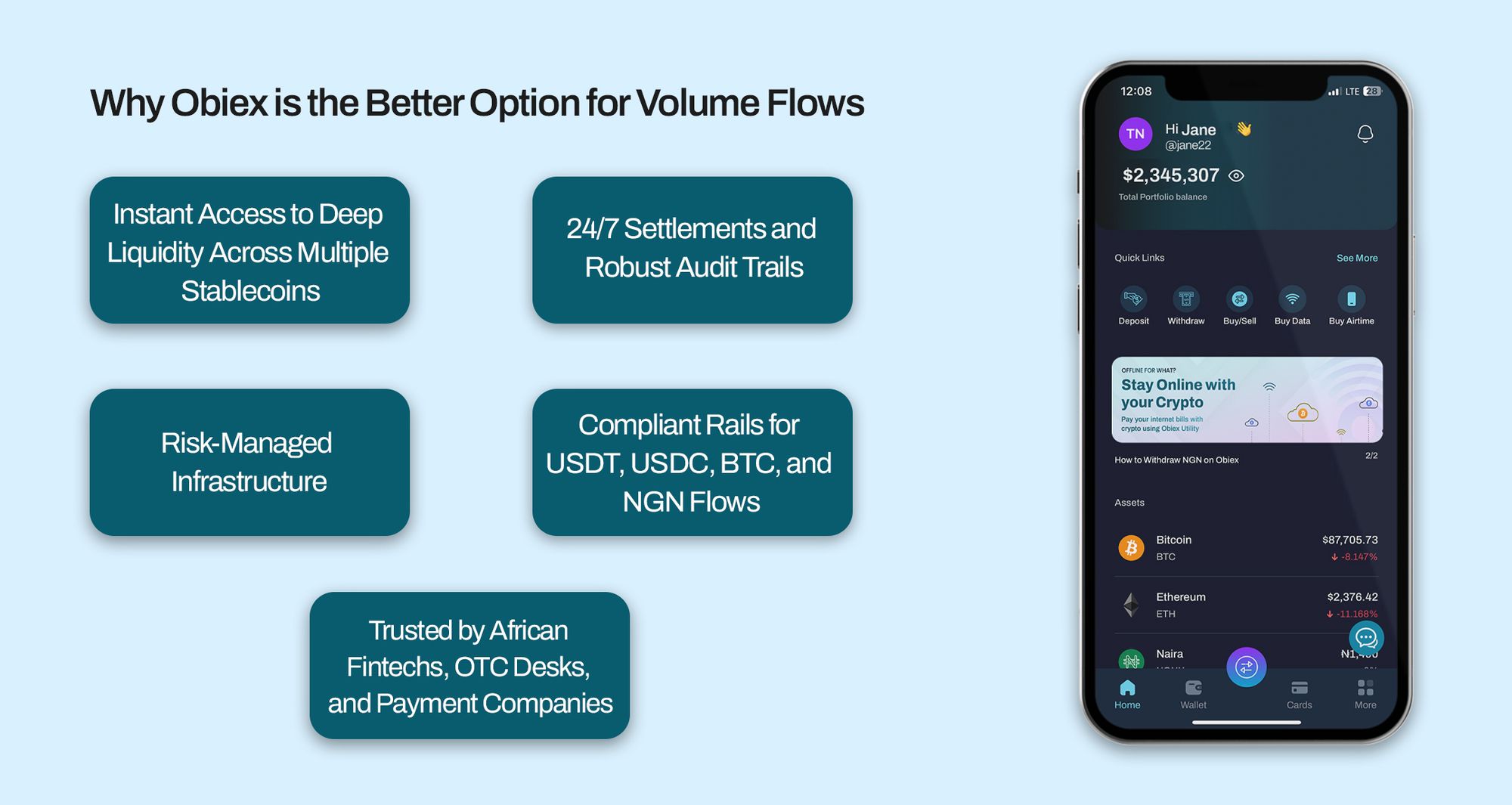

Why Obiex is the Better Option for Volume Flows

1. Instant Access to Deep Liquidity Across Multiple Stablecoins:

Obiex connects you to deep liquidity pools for high-volume trading in USDT, USDC, and NGN—available instantly. This means businesses don’t have to wait for a counterparty to show up, as is often the case with P2P.

2. 24/7 Settlements and Robust Audit Trails:

Unlike P2P, where manual negotiation and confirmation delays can waste hours, Obiex offers 24/7 automated settlements with real-time reporting. You get complete audit logs of every transaction, including wallet addresses, timestamps, and volumes; something P2P setups simply cannot offer.

3. Risk-Managed Infrastructure:

Obiex eliminates the counterparty risk that’s common in P2P deals. Every transaction is settled on-chain or within the Obiex escrowed ledger system, removing the chance of default.

4. Compliant Rails for USDT, USDC, BTC, and NGN Flows:

Obiex operates on fully compliant rails, supporting KYB (Know Your Business), AML (Anti-Money Laundering), and transaction screening. For B2B operators, especially those interfacing with banks, regulators, or external investors, using a compliant platform is non-negotiable. Obiex supports regulated flows in and out of major assets, including USDT, USDC, BTC, and the Nigerian Naira (NGN), making it easy to stay compliant while expanding your reach across borders.

5. Trusted by African Fintechs, OTC Desks, and Payment Companies:

Leading fintechs, OTC desks, and cross-border payment companies across Nigeria, Ghana, and Cameroon already rely on Obiex to power their backend crypto flows. Obiex is battle-tested in African markets and built for scale. It provides real infrastructure used in live operations every day.

How Moving Volume Works on Obiex

1. Connect via Platform or API:

You can move volume on Obiex in two ways: through a clean, user-friendly dashboard or via direct API integration.

Most enterprise users prefer the API option for automating large flows, especially when managing bulk stablecoin transactions like USDT or USDC.

The Obiex API is built for speed and scale, capable of handling thousands of requests per minute.

For teams that need to integrate directly with payment rails, treasury operations, or internal crypto wallets, the API provides seamless control and real-time settlement access.

2. Choose Currencies and Settle Instantly:

Once connected, you simply select the currencies you want to move, whether it’s sending 1M USDT from Nigeria to Ghana or swapping USDC to NGNX. Obiex offers instant settlements on major stablecoins like USDT, USDC, BUSD, as well as local currencies like NGN, XAF, and GHS.

All settlements are completed in seconds, not hours or days, like with P2P. No need to wait for a counterparty or manually verify deals.

The liquidity is always ready, and slippage is minimal, even at high volume, because Obiex maintains institutional-grade liquidity pools across key corridors.

To Recap

Let’s recap:

- P2P is risky, slow, and unscalable for large business operations.

- You can’t afford settlement delays, missing audit trails, or non-compliant flows.

- Your business needs institutional infrastructure, not a WhatsApp group.

- Stop trading like a retail user. Use Obiex crypto infrastructure for enterprises.

🚀 Ready to upgrade from P2P to business-grade crypto trading?Join the high-volume traders using Obiex!

FAQs

Q1. Why isn’t P2P good for businesses handling large volumes?

Because it lacks compliance, speed, and traceability. It’s risky and not scalable.

Q2. Is it legal to use P2P for business payouts?

In most countries, yes, but it’s a grey area. Without proper licenses and documentation, you could face penalties.

Q3. What’s the difference between P2P and Obiex liquidity?

P2P relies on informal trades. Obiex offers verified, institutional-grade liquidity with real-time settlements.

Q4. How does Obiex ensure secure and compliant settlements?

By integrating KYB/KYC, AML screening, and providing full transaction audit trails.

Q5. Can I automate my crypto treasury with Obiex?

Yes. Obiex offers APIs that plug directly into your treasury systems for real-time, automated flows.

Q6. Can Obiex support multi-currency settlements?

Yes; USDT, USDC, NGN, BTC, and more. All with instant swaps and traceability.

Q7. How do I onboard my team to Obiex?

We offer full onboarding support. Just book a session with our enterprise team.

Q8. What is the minimum volume Obiex supports?

Our infrastructure is designed for businesses moving $100K+ monthly, with best value at $1M+.

Q9. Is Obiex regulated?

Yes. Obiex operates in accordance with global best practices for compliance and financial integrity.

Q10. How quickly can I settle trades with Obiex?

Most trades settle within 5 minutes, 24/7.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.