Table of Contents

- The 5 Factors That Make Altcoins Explode

- Why Most Altcoins Fade Away

- How to Spot Red & Green Flags Before Buying

- What to Do When an Altcoin Starts Pumping

- When to Cut Your Losses or Exit Early

- How Obiex Helps You Trade Altcoins Smartly

- To Recap

- FAQs

In crypto, everyone knows “a guy” who bought a random coin at $0.002, only to see it skyrocket to $1 months later. That’s a 500x return.

But for every altcoin that explodes in value, there are dozens that crash to zero or simply fade away quietly.

The key question is: why do some altcoins explode in value while others fade away?

Is it pure luck? Insider info? Or can you actually learn to read the signs before buying?

Let’s break it down practically.

The 5 Factors That Make Altcoins Explode

1. Strong Tokenomics:

Good tokenomics are like a solid business plan. They control the number of tokens in existence, their distribution, and how people can utilise them.

For example, Bitcoin has a fixed supply of 21 million coins. That scarcity helps increase its value over time.

Some altcoins, like Binance Coin (BNB), use a deflationary model where coins are regularly “burned” (permanently destroyed), reducing supply and driving up demand.

Other altcoins build real demand by powering specific activities, like Ethereum (ETH) which is used to pay for smart contract transactions.

Without strong tokenomics, an altcoin may flood the market with too many coins, crashing the price.

Solid tokenomics create natural price pressure upwards, which is why they’re non-negotiable for coins that explode.

2. Real Utility:

Many coins die because they solve nothing. Altcoins that explode usually solve a real-world or digital problem.

For example, Uniswap (UNI) allows users to swap tokens directly without going through an exchange. That’s decentralised finance (DeFi) in action.

In the gaming world, Axie Infinity (AXS) created an entire play-to-earn economy, reaching billions in market cap during its peak.

Altcoins connected to AI (like Fetch.ai or SingularityNET), storage solutions (like Filecoin), or identity verification (like Civic) have also exploded due to real-life use cases.

If a coin has zero utility, it’s a sitting duck for altcoin pump and dump schemes. But real utility attracts real users, which supports long-term growth.

3. Active Community:

No matter how great the tech is, without a community pushing it forward, most projects stall. Coins like Dogecoin (DOGE) and PEPE are excellent examples of how a passionate, active community can send prices skyrocketing.

At its peak, Dogecoin reached a market cap of over $80 billion, driven almost entirely by memes, celebrity tweets, and an energetic online following.

Communities create buying pressure, defend the coin’s reputation, and spread awareness, often going viral.

Note: This social momentum can spark massive pump-and-dump cycles, but also fuels real growth when combined with good fundamentals.

4. Solid Partnerships & Roadmaps:

Big partnerships give altcoins instant credibility. When projects secure partnerships with established companies, governments, or blockchain networks, it signals long-term potential.

For example, Polygon (MATIC) has partnered with major brands like Adidas, Starbucks, and even governments in India for blockchain solutions. These partnerships validate the project and attract institutional investors.

In addition, clear and achievable roadmaps (public plans for development) show traders what’s coming next.

If you see a coin with no roadmap or unrealistic promises (like "5000% return in 2 weeks"), that’s your sign to run.

Solid partnerships and roadmaps help you pick the safest altcoins to trade, especially if you plan to buy trending altcoins.

5. Good Timing & Market Conditions:

Even great projects need good timing to explode. When Bitcoin enters a bull run, most altcoins ride the wave. This is called "altcoin season."

Exchange listings also matter. This occurs when an altcoin is listed on a major exchange, such as Binance or Coinbase. Their prices often surge due to sudden exposure and access.

Listings on trusted platforms like Obiex also help stabilise prices and improve liquidity for African traders.

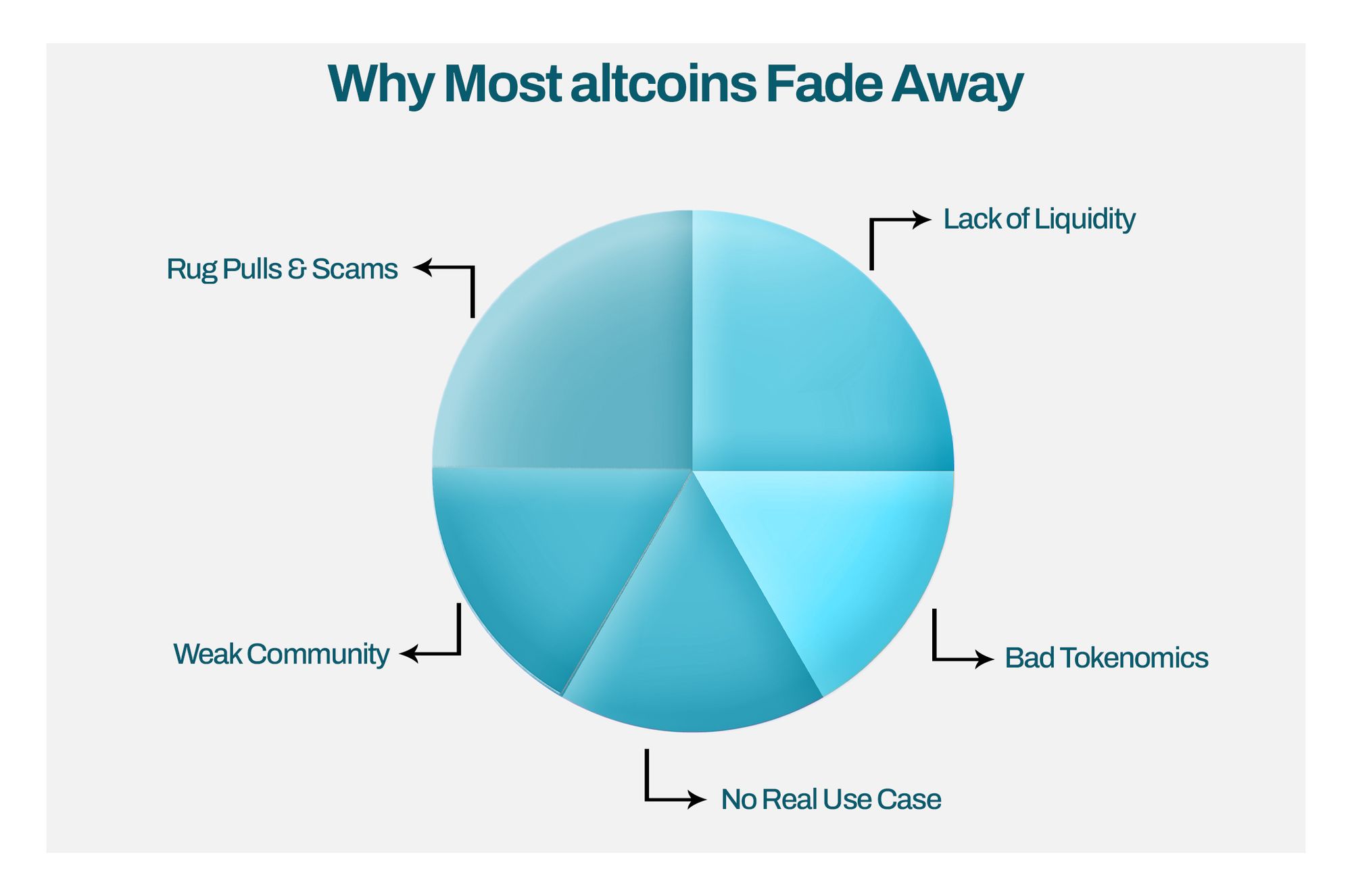

Why Most Altcoins Fade Away

Now let’s flip the coin: why do most altcoins crash?

1. Lack of Liquidity:

Many altcoins fade away because there simply aren’t enough people trading them.

For example, according to CoinMarketCap, over 50% of listed altcoins have a 24-hour trading volume of less than $50,000.

If you’re holding a coin with such low volume, you may not be able to sell it when you need cash, or worse, you’ll have to sell at a huge loss.

This is one of the primary reasons why some altcoins experience a temporary surge in value (when liquidity is high due to hype) but then crash later when the hype subsides and trading activity declines.

2. Bad Tokenomics:

Many altcoins crash because their tokenomics are simply bad. For instance, some coins have no cap on their supply, meaning millions of new tokens are printed regularly, which causes inflation and devaluation.

Worse, some developers secretly hold huge amounts of tokens (sometimes referred to as “whale wallets”). When these whales sell their holdings, it floods the market and instantly crashes the price.

This is why one of the key things to check when learning how to spot altcoin gems is the tokenomics.

3. No Real Use Case:

Sadly, many altcoins offer nothing but hype, memes, or vague promises. Without real-world adoption or a working product, interest fades and prices drop.

If you’re looking for the best altcoins for long-term holding, always ask: “What problem does this coin solve?”

If the answer is unclear, you may want to avoid it.

4. Weak Community:

Popular altcoins like Dogecoin or Shiba Inu exploded in value largely because they built strong, active online communities that kept interest and trading volume high.

However, many altcoins fail to build a real following. Without a loyal community sharing memes, creating discussions, and driving demand, most coins lose visibility and die.

Tip: Coins with low social engagement are 3x more likely to see price declines than active ones.

5. Rug Pulls & Scams:

A rug pull happens when developers suddenly abandon the project, taking investors' money with them. In 2023 alone, CertiK reported over $320 million lost to rug pulls.

Many of these coins had no transparency, anonymous teams, or no audits. Once confidence is lost, prices crash instantly.

How to Spot Red & Green Flags Before Buying

1. Check Market Cap vs Fully Diluted Valuation (FDV):

One of the first numbers you should always check is the market cap versus the fully diluted valuation (FDV).

- Market cap is the current price of the token multiplied by its circulating supply.

- FDV assumes all tokens that will ever exist are already in circulation.

For example, if a token has 10 million coins in circulation at $1 each, its market cap is $10 million. But if the total possible supply is 100 million coins, its FDV is $100 million.

If the FDV is much higher than the market cap, it means a lot of new tokens can still be released, which could dilute your holdings and potentially crash the price.

A healthy project usually has a reasonable gap between its market cap and FDV, as well as clear token release schedules (tokenomics).

Many launched tokens that later crashed had FDVs 10–20 times higher than their current market cap, indicating a significant risk of heavy dilution.

Tip: Always check both market cap and FDV before buying. You can easily see these numbers on sites like CoinGecko or CoinMarketCap.

2. Dev Team Transparency:

The development team behind the project is your first line of defence. Solid teams are public, experienced, and actively communicating. If you can’t find any information about the founders, or if the team hides behind fake names, that’s a massive red flag.

Look for:

- LinkedIn profiles.

- Public interviews.

- GitHub activity (actual coding work being done).

Tip: Never invest based on influencers alone. Verify who is actually building the project.

3. Twitter + Discord Activity:

A healthy crypto project has an active community, but not one driven only by hype. Check their Twitter, Discord, and Telegram:

- Are developers giving regular updates?

- Is the community asking real questions and getting clear answers?

- Are there constant "price predictions" and "moonshot" talks? (If yes, that’s a sign of potentially problematic hype).

If you see genuine conversations about the project’s utility and updates, that’s a green flag.

4. Is It Listed on a Legit Platform?:

Listings on credible exchanges indicate that the project has undergone some level of due diligence.

If an altcoin is only available on obscure platforms or only on decentralised exchanges (DEXs) with no KYC, you’re exposed to higher risks.

Tip: Trade altcoins on Obiex to avoid altcoin losses. Obiex supports verified projects and gives you access to the safest altcoins to trade.

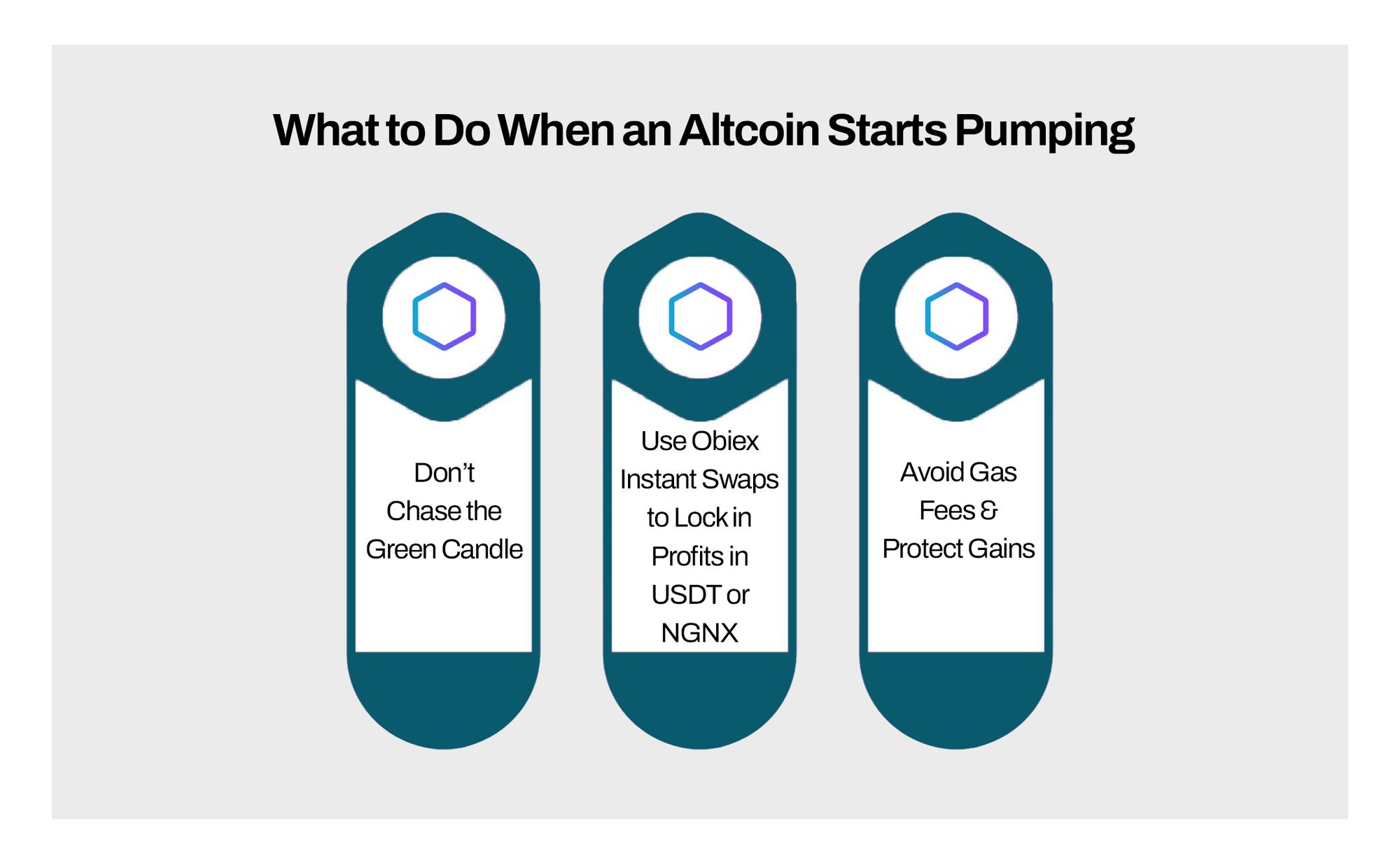

What to Do When an Altcoin Starts Pumping

1. Don’t Chase the Green Candle:

When an altcoin starts pumping, it's often already too late to buy. This is where many traders fall into the classic pump-and-dump trap.

It is likely that the whales may have bought in earlier and are now unloading on the latecomers.

If you buy at the top, you risk being stuck holding the bag when the price dumps.

Instead, zoom out on the chart: has the coin already pumped 50%, 100%, or 300% in a short time? If yes, avoid emotional buying. It’s usually better to watch patiently than to chase the hype.

2. Use Obiex Instant Swaps to Lock in Profits in USDT or NGNX:

If you already hold the altcoin before the pump, this is your window to trade them on Obiex and lock in profits.

The Obiex instant swap feature allows you to quickly swap your altcoin for stablecoins like USDT or NGNX.

Swapping during a pump secures your gains without needing complicated order books.

Remember: profits aren’t real until they’re locked.

3. Avoid Gas Fees & Protect Gains:

Gas fees, especially on blockchains like Ethereum, can eat into your profits during high-activity periods.

During altcoin pumps, gas fees often spike as many traders rush to make transactions.

This is where Obiex becomes extremely valuable: with Obiex’s off-chain swaps and liquidity routing, you avoid these unpredictable network fees while locking your gains.

When to Cut Your Losses or Exit Early

1. Price Has Dropped 70% or More, and Keeps Falling:

When an altcoin drops by 70% or more, especially outside of a market-wide crash, it’s often a sign of deeper problems.

Many altcoin projects (sometimes called "dead coins") have seen these kinds of sharp, sustained drops before eventually becoming worthless.

If your coin keeps bleeding and shows no recovery after major catalysts (like exchange listings, partnerships, or roadmap updates), it may be safer to exit and preserve what’s left of your investment.

2. Trading Volume Has Dried Up:

When daily trading volume drops below $500,000, especially for mid-cap or small-cap altcoins, it means there’s little market interest.

Low volume leads to poor liquidity, making it harder for you to sell without crashing the price further.

If volume stays flat or declines for weeks, consider cutting your losses.

3. The Project Stops Delivering on Promises:

If updates stop, developers disappear, or roadmaps go quiet for 3-6 months, that’s a huge red flag.

Many projects fade due to poor management, loss of funding, or simply being outcompeted. Many crypto projects have been abandoned due to team inactivity.

4. Market Sentiment Has Completely Shifted:

Sometimes, a narrative dies. Maybe that DeFi coin, metaverse token, or meme coin simply lost its hype. Social media engagement drops. Influencers stop talking about it. Search volumes on Google decline sharply.

When the story behind an altcoin no longer excites traders or institutions, its prices often continue to fall.

Coins that lose momentum after hype cycles rarely reclaim their old highs.

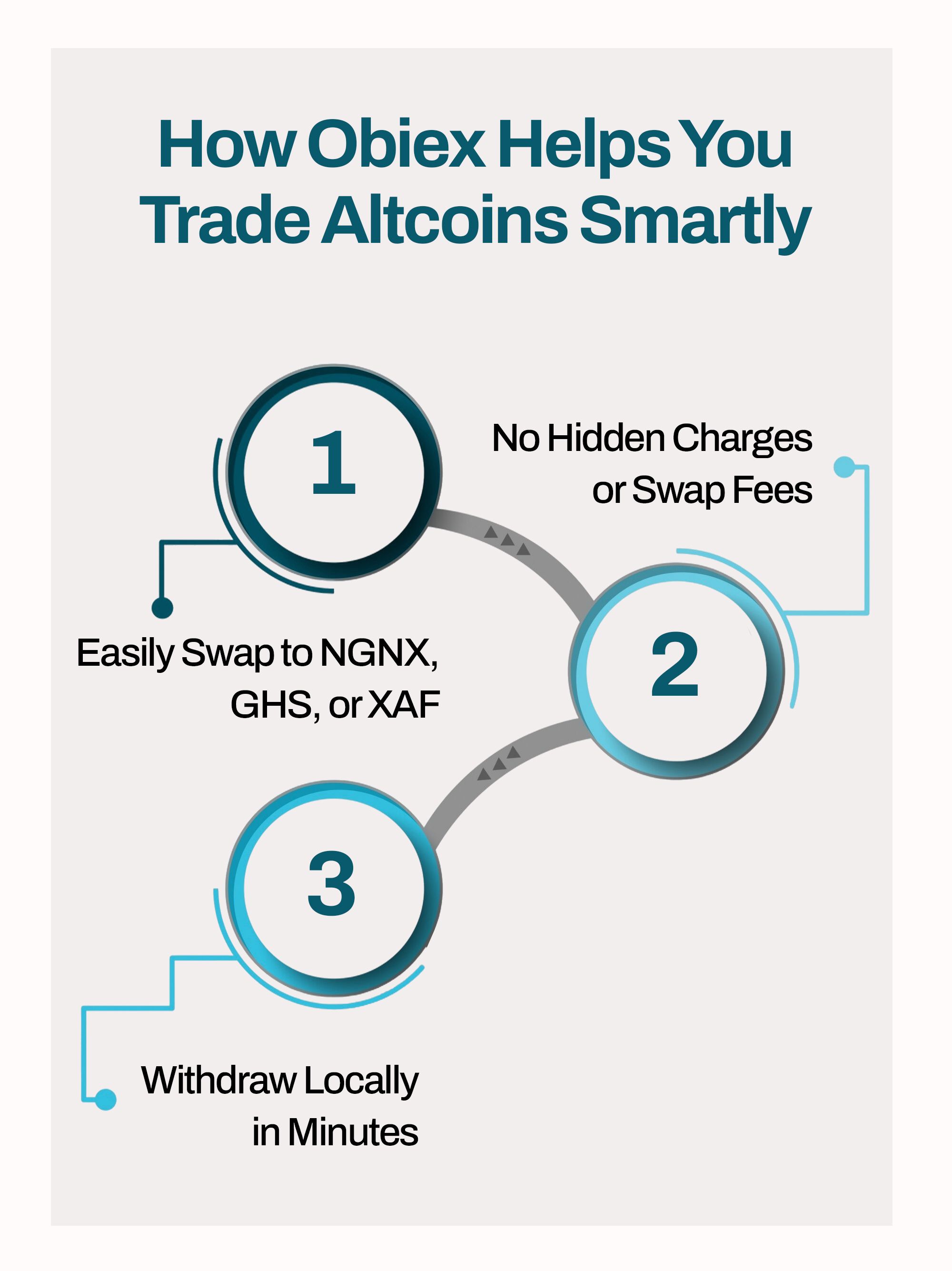

How Obiex Helps You Trade Altcoins Smartly

1. No Hidden Charges or Swap Fees:

Many platforms secretly charge high fees on every trade or swap, which, over time, destroys your profit margin.

Obiex eliminates these problems by allowing you to trade altcoins without hidden fees and with transparent pricing.

The Obiex crypto swap feature enables you to convert your coins instantly without incurring unexpected charges.

2. Easily Swap to NGNX, GHS, or XAF:

Obiex provides a fast way to lock in profits or cut losses by swapping your altcoins into local stablecoins, such as NGNX (Nigerian Naira token), GHS (Ghanaian Cedi token), or XAF (Central African Franc token).

This swap feature is extremely useful in high-risk markets, especially when dealing with pump-and-dump scenarios.

3. Withdraw Locally in Minutes:

After you buy trending altcoins on Obiex and exit profitably, you don’t want to be stuck waiting days for your money.

Obiex allows instant local withdrawals directly into your Nigerian, Ghanaian, or Cameroonian bank account.

This is extremely helpful when managing multiple trades and needing fast access to your cash.

In many cases, users complete withdrawals within minutes.

To Recap

With proper research, attention to tokenomics, real-world utility, and smart trading strategies, you can greatly improve your chances of selecting winning altcoins.

And when those winners pump, platforms like Obiex let you lock in profits instantly, without fees or delays.

Enjoy zero gas fees, fast swaps, and local currency access that puts you in control.

FAQs

Q1. Why do some altcoins explode in value while others fade away?

Altcoins explode when they have strong tokenomics, real utility, active communities, solid partnerships, and perfect market timing. Others fade due to poor liquidity, weak use cases, bad tokenomics, and scams.

Q2. What is an altcoin pump and dump explained simply?

A pump and dump occurs when a group artificially inflates a coin's price, attracts retail buyers, and then sells off, causing the price to crash.

Q3. What are the best altcoins for long-term holding?

Altcoins with strong fundamentals like Ethereum (ETH), BNB, Polygon (MATIC), and Chainlink (LINK) are often considered for long-term.

Q4. How to spot altcoin gems before they explode?

Look for real utility, transparent teams, healthy tokenomics, active communities, and listings on trusted exchanges like Obiex.

Q5. Why do altcoins crash so fast?

Altcoins crash when there’s no demand, poor project development, insider dumps, or loss of trust due to scams or failed roadmaps.

Q6. What are the safest altcoins to trade right now?

Blue-chip altcoins like ETH, BTC, and large-cap DeFi or AI tokens are generally safer. Always do your own research.

Q7. Where is the best platform to trade altcoins in Nigeria?

Obiex offers fast, reliable, and low-fee altcoin trading specifically tailored for Nigeria, Ghana, and Cameroon.

Q8. How can I trade altcoins without hidden fees?

Obiex allows you to swap altcoins instantly with zero swap fees and transparent pricing.

Q9. How do I swap altcoins for stablecoins quickly?

Use the Obiex crypto swap feature to convert your altcoins instantly into stablecoins like USDT, NGNX, GHS, or XAF.

Q10. How can I avoid altcoin losses?

Use proper risk management, set stop-loss levels, avoid chasing pumps, and lock profits early using platforms like Obiex.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.