Table of Contents

- What Determines Crypto Prices on Exchanges?

- Why Crypto Rates Vary Across Platforms

- Types of Price Differences You Might See

- The Risks of Not Understanding These Differences

- How Obiex Helps You Get the Best Rates

- Tips for Choosing a Crypto Platform with Fair Rates

- To Recap

- FAQs

Crypto prices are rarely the same across platforms for many reasons. For example, you might see Bitcoin priced at $116,326 on one exchange and $116,482 on another. These differences can be frustrating and costly if you don’t understand what causes them.

Here’s why these rates vary from one platform to another, how it affects your trades, and how you can avoid overpaying by using a transparent, real-time platform.

What Determines Crypto Prices on Exchanges?

1. Supply and Demand:

Just like in any regular market, the price of a cryptocurrency on an exchange depends heavily on how many people are buying (demand) versus how many are selling (supply). If more people are buying Bitcoin on Platform A than selling it, the price will go up. Meanwhile, on Platform B, where there are fewer buyers, the price may stay lower.

2. Liquidity Levels:

Liquidity refers to how easily and quickly you can buy or sell a crypto asset without affecting its price. Exchanges with high liquidity have more traders and larger volumes of crypto available, which usually leads to more stable prices. Lower-liquidity platforms often experience sharper price swings because there aren’t enough buyers or sellers to absorb large trades. For instance, a $5,000 Bitcoin order might barely move the price on Binance but could spike or drop the rate on a smaller exchange.

3. Trading Volume:

Higher trading volumes mean more frequent transactions, which helps maintain accurate and competitive prices. According to CoinGecko data, major exchanges like Binance and Coinbase can process billions of dollars in crypto trades daily. These high volumes make it easier for their pricing to reflect real-time global market demand. In contrast, platforms with low volume may lag behind the actual market or show distorted prices due to limited activity.

4. Exchange Pricing Models:

Every platform has its own internal pricing model. Some exchanges use price feeds from major liquidity providers or global aggregators. Others rely solely on their internal order book activity. Some platforms even include markups or use wider spreads to earn more on trades. This means what you see as the “rate” may already include a hidden cost.

For example, if you’re buying Ethereum on Platform C, and the price seems slightly higher than the average market rate, it might be due to an embedded markup rather than just supply and demand.

5. Regional Market Conditions:

Prices can also differ based on where an exchange operates. Regional demand, currency value, and local crypto policies can all affect how an exchange prices a coin. For example, during heavy inflation in some African or Latin American countries, users often rush to stablecoins like USDT, which pushes the local price above global average rates.

6. Exchange Fees and Hidden Charges:

Some exchanges make their rates look attractive upfront but add high swap or transaction fees at checkout. Others might offer low fees but slightly worse exchange rates. The real cost of a trade is the combination of both the listed rate and any fees taken from your trade behind the scenes.

Why Crypto Rates Vary Across Platforms

1. No Single Global Crypto Price:

Traditional stock markets like the NYSE or Nasdaq have centralised pricing. But crypto markets operate on decentralised exchanges, meaning there’s no universal source for Bitcoin or Ethereum prices. Each crypto platform sets its own prices based on what's happening within its own ecosystem, including the number of people buying, selling, and the prevailing price. This makes crypto pricing dynamic and slightly different from one exchange to another.

2. Differences in Order Book Depth:

Every exchange has something called an "order book"; a real-time list of buy and sell orders placed by users. The depth of this order book affects how prices shift. On larger exchanges with deep order books, prices are more stable because there’s a large volume of buy/sell activity. On smaller platforms with shallow order books, even a single large trade can significantly impact prices. That’s why you might see price jumps on less active exchanges.

3. Price Aggregation Methods:

Not all exchanges calculate prices the same way. Some display the last traded price, others show the mid-point between the highest buyer and lowest seller, and some use time-weighted averages over the past few minutes. These different methods of displaying prices can result in slight differences, even if the actual trading activity is similar.

4. Geographic Location and Market Conditions:

Location plays a major role in crypto pricing. For example, in countries facing inflation or currency devaluation, demand for stablecoins like USDT increases. This drives up prices locally, especially on peer-to-peer or region-focused platforms. Additionally, certain regulatory restrictions may limit access to liquidity providers in some regions, which can also widen the price gap compared to global averages.

5. Exchange Fees and Markups:

Some platforms build hidden fees into the crypto prices they display. This is known as a markup. You end up buying at a slightly higher price or selling at a slightly lower one than the real market rate. While it may seem small, these margins add up, especially for users who make frequent trades. Always compare both the listed rate and any additional fees to understand the actual cost of your transaction.

Types of Price Differences You Might See

Every exchange has two key numbers for each asset:

- Bid Price: This is the highest price someone is currently willing to pay for a cryptocurrency.

- Ask Price: This is the lowest price someone is willing to sell it for.

The difference between these two numbers is known as the spread. On large, liquid exchanges, this spread is usually small. But on smaller platforms or during times of low trading activity, the spread can be wider, meaning you’ll pay more to buy or receive less when selling.

2. Slippage:

Slippage happens when a trade is executed at a different price than what you initially saw or expected. This is common in fast-moving markets or when trading large amounts on platforms with low liquidity. For example, you might try to buy Bitcoin at $115,000, but the final execution occurs at $115,110 because the price moved before your order was processed.

3. Fiat vs Stablecoin Pricing:

You may see different prices depending on the currency you use for trading. If you’re trading crypto with fiat currencies like NGN or GHS, the price may be slightly higher compared to trading with stablecoins like USDT or USDC. That’s because stablecoin trades are often faster, more liquid, and involve fewer regulatory steps, especially on global platforms. This makes stablecoin swaps more efficient and sometimes cheaper.

4. Platform-Specific Markups:

Some exchanges add a hidden markup to the listed prices. You might see a nice, round number like $3,500 for ETH, but the real market price is $3,480. That $20 difference is a markup, an extra charge built into the price. This is especially common on platforms that don’t charge visible trading fees.

5. Real-Time Price Volatility:

Crypto prices change quickly, and if an exchange doesn't update its rates in real time, the price you see might lag behind the actual market. This can cause differences across platforms, especially during periods of high volatility like major news announcements or Bitcoin halving events.

6. Regional Liquidity Constraints:

In some regions, there might be fewer buyers and sellers on local platforms, which affects how easily you can trade. Lower liquidity means even small trades can push prices up or down, leading to unusual price differences compared to global exchanges.

7. Trading Pair Differences:

Prices can vary depending on which trading pair you're using. For example, buying Bitcoin with USDT might give you a different rate than buying it with Ethereum (ETH) or your local fiat currency. This is because each pair has its own demand, supply, and liquidity profile.

The Risks of Not Understanding These Differences

1. Paying More Than You Should:

If you don’t compare rates before buying, you could end up paying more than necessary. For instance, buying Bitcoin at $111,132 when another trusted platform is selling at $111,000 means you’ve just overpaid. That $132 difference on a $1,000 or $5,000 trade adds up quickly, especially if you’re trading regularly.

2. Missed Arbitrage Opportunities:

Arbitrage is a strategy that involves buying cryptocurrency where it’s cheaper and selling it where it’s more expensive. If you don’t understand rate differences across platforms, you may miss these chances entirely. For traders, this could mean leaving profit on the table. Even everyday users could benefit from spotting cheaper buy rates.

3. Unexpected Losses Due to Hidden Fees:

Many platforms hide fees within the crypto price instead of charging separate transaction fees. This means you may think you’re getting a reasonable rate, but the platform is actually taking a cut without showing it. Over time, these small hidden costs eat into your portfolio, especially if you're trading frequently.

4. Confusion in Portfolio Valuation:

If you're tracking your crypto portfolio using global average prices but bought your assets at a premium on a specific platform, your profit/loss may appear off. This can cause confusion when assessing your actual holdings, especially if you plan to sell on a different exchange or convert back to fiat.

5. Reduced Profits for Traders:

If you’re a trader, not accounting for price spreads, slippage, or fee markups can reduce your expected profits. For example, thinking you're buying low and selling high, only to realise that both trades have built-in hidden costs, can turn a winning trade into a breakeven or even a losing one.

6. Overestimating Market Opportunities:

Seeing a cheap price on one platform might tempt you to act fast, but if you don’t understand how that rate is calculated (e.g., it’s stale or based on limited liquidity), you could be misled into thinking it’s a better deal than it actually is. This leads to poor timing and worse trade execution.

7. Poor Choice of Trading Platform:

Many users stick to one platform out of convenience, unaware they’re regularly getting worse rates. Not knowing how prices work means you might remain loyal to a platform that’s quietly costing you more over time through wide spreads, slow updates, or uncompetitive pricing models.

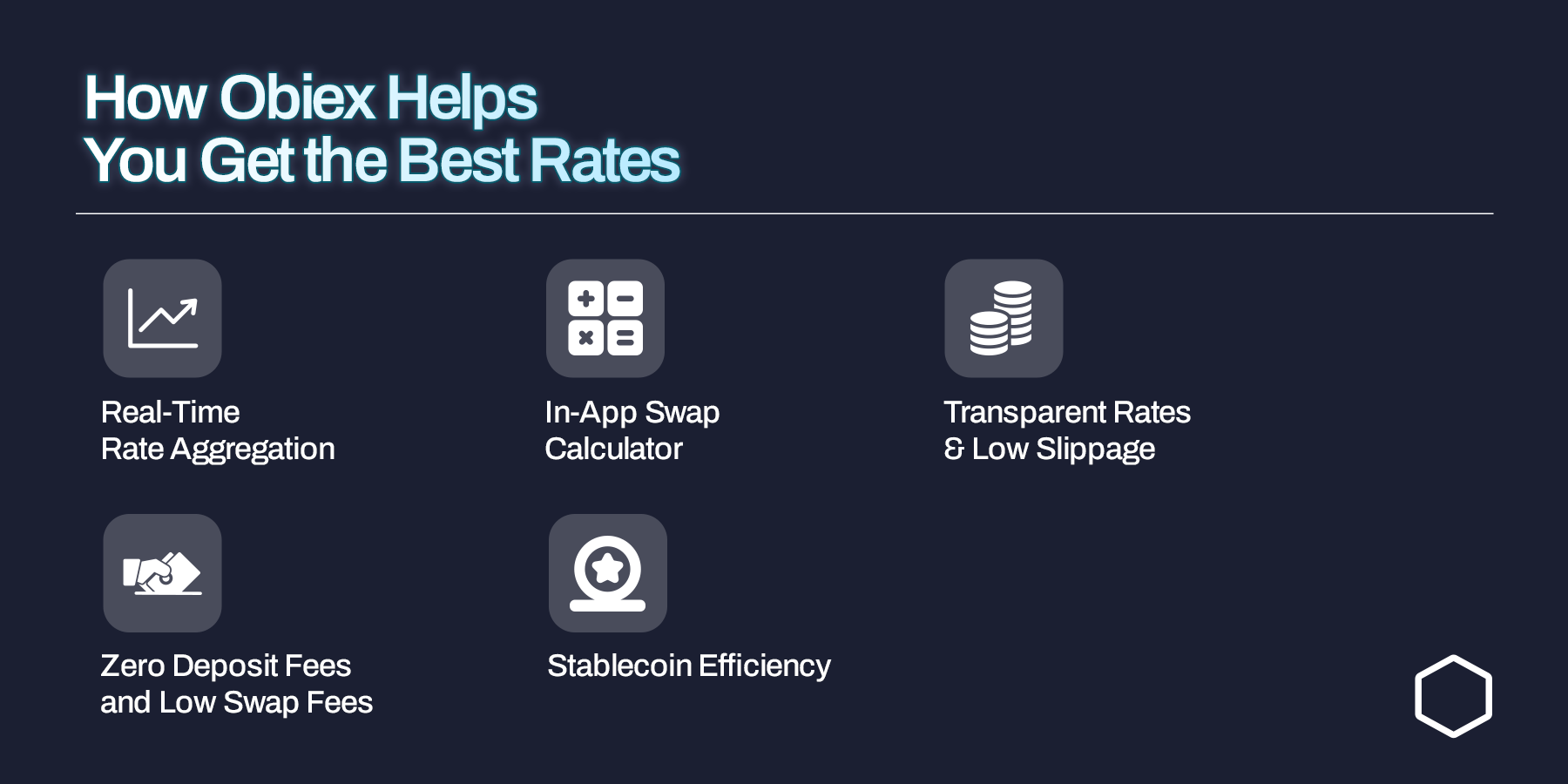

How Obiex Helps You Get the Best Rates

1. Real-Time Rate Aggregation:

Obiex pulls live prices from multiple liquidity sources and shows you the best available rate. This means you’re not relying on a single exchange’s pricing. You’re getting an optimised rate based on what’s currently available on the broader market. You don’t have to compare prices across different platforms. Obiex does the heavy lifting for you.

2. In-App Swap Calculator:

Before you make any trade, Obiex shows you precisely what you’ll receive through the app’s built-in swap calculator. It clearly displays the amount you’ll get after the swap, including any small, transparent swap fee.

3. Transparent Rates and Low Slippage:

Obiex is built for fairness and clarity. We don’t hide fees in the exchange rate or inflate prices with markups. Our system is also designed to minimise slippage. So, the rate you see before clicking “swap” is usually the rate you will receive. The Obiex “swap without confirmation” feature also helps with this efficiency. Even during high market activity, our system ensures stability and fairness.

4. Zero Deposit Fees and Low Swap Fees:

We don’t charge deposit fees, so you can fund your account without worrying about extra costs. Our swap fees are among the lowest you’ll find, making Obiex one of the most affordable platforms for everyday users and active traders alike.

Bonus: Stablecoin Efficiency

Obiex offers seamless support for stablecoin trading, which helps reduce volatility and speeds up transactions. You can easily swap between stablecoins like USDT and USDC, or between stablecoins and fiat, all at competitive rates with quick execution.

Tips for Choosing a Crypto Platform with Fair Rates

1. Look for Rate Transparency:

Always choose platforms that clearly display the exchange rate and any associated fees before completing a transaction. If you can’t see exactly what you’re paying or receiving, that’s a red flag. Transparent platforms help you make informed decisions, not blind bets.

2. Compare Exchange Spreads:

Check the bid-ask spread. Platforms with wide spreads often lead to higher costs for you. Look for exchanges that offer tight spreads or that actively optimise them through innovative aggregation tools.

3. Evaluate Fee Structures:

Don’t be fooled by the phrase “zero fees.” Some platforms claim this but sneak charges into the exchange rate itself. Always read the fine print or test small transactions to see if the actual outcome matches what was promised. A good platform is upfront about all fees, whether flat or percentage-based.

4. Monitor Real-Time Pricing:

Use platforms that offer real-time pricing based on multiple sources, not outdated or delayed prices. This ensures you’re getting the most current market value, especially during high-volatility moments.

5. Check for Slippage Controls:

If a platform frequently executes trades at different rates than what was shown, it may not be managing slippage effectively. Look for exchanges that use slippage protection tools to ensure your trades don’t end up costing more than expected.

6. Consider Stablecoin and Fiat Pairing Options:

Some platforms offer better rates for stablecoin swaps compared to fiat trades due to faster settlement and lower regulatory costs. Choose a platform that allows flexibility in pairing options, so you can take advantage of whichever gives the better rate.

To Recap

- Crypto prices vary across exchanges due to supply, demand, trading volume, and liquidity.

- Bid and ask prices create spreads. The wider the spread, the higher the cost.

- Slippage and hidden fees can lead to unexpected losses if you’re not paying attention.

- Fiat vs stablecoin trades may have different rates due to speed and regulatory factors.

- Obiex helps users get better rates with real-time aggregation, transparent pricing, and low fees.

- To choose the right platform, look for clear rates, fair spreads, and transparent fee structures.

Tired of guessing the best rates?

👉Trade smarter with Obiex. Swap crypto instantly at transparent rates with zero deposit fees.

FAQs

Q1. Why are crypto prices different on every platform?

There is no global crypto price. Each platform sets its price based on its users, liquidity, fees, and trading volume.

Q2. What is bid and ask in crypto trading?

Bid is what buyers are willing to pay; ask is what sellers want. The difference is the spread.

Q3. Is it better to buy crypto with fiat or stablecoins?

Stablecoins often give better rates due to lower friction and faster settlement.

Q4. What is slippage?

Slippage occurs when you receive a different price than expected due to market movement or low liquidity.

Q5. How can I get the best crypto rate?

Use platforms like Obiex that show real-time rates and aggregate liquidity sources.

Q6. Do some platforms hide fees in the crypto price?

Yes, some platforms add hidden fees in their rate. Always compare final amounts.

Q7. Can I save money by comparing crypto rates?

Yes. Even small differences can save you a lot, especially with large trades.

Q8. What is crypto arbitrage?

Buying low on one platform and selling high on another.

Q9. How does Obiex offer better rates?

By aggregating rates from multiple sources and removing deposit fees or hidden charges.

Q10. How can I start swapping crypto on Obiex?

Sign up, deposit your crypto or fiat, and use the swap tool to trade instantly.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.