Table of Contents

- 7 Signs You Need to Switch Crypto Partners

- You’re Paying Too Many Hidden Fees

- The Swap Rates Are Always Against You

- Withdrawals Are Slow or Unreliable

- Poor Customer Support or No Local Help

- Limited Local Currency Options

- You Can’t Track or Plan Your Costs

- You're Forced to Use P2P for Everything

- How to Choose a Better Crypto Partner

- Why Obiex Might Be Your Best Switch Yet

- To Recap

- FAQs

If you use crypto for trading, payments, or sending money across borders, your platform should help you save, not drain your wallet.

But the truth is, many crypto users in Nigeria, as well as in other African countries, are silently losing money to high fees, bad swap rates, slow withdrawals, and poor customer support.

It might not look like much at first: ₦100 here, 1.5% there, maybe a ₦500 withdrawal fee. But over time, it adds up, especially if you’re doing regular transactions.

However, you don’t have to stay stuck.

Many traders and small business owners have switched platforms and saved thousands of naira by simply choosing a better option.

In this guide, we’ll show you 7 clear red flags that it’s time to switch crypto partners, and how Obiex helps you trade smarter without overpaying.

7 Signs You Need to Switch Crypto Partners

1. You’re Paying Too Many Hidden Fees:

If you notice small amounts being deducted during swaps, transfers, or even wallet inactivity, those are hidden fees, and they pile up fast.

Most African crypto users pay 1–2% in hidden charges per transaction without even realising it. These can come from inflated swap markups, flat transfer fees, inactivity penalties, or minimum withdrawal thresholds.

For example, if you swap $1,000 worth of USDT every week and your platform adds just a 1.5% markup, that’s $15 lost weekly, reaching over $750 a year. Add on $1–$3 for each crypto transfer, and you’re looking at serious operational costs, especially if you're a small business making regular cross-border payments.

The worst part is that these costs are often not listed up front. If you can’t easily calculate how much you’re losing in fees, that’s already a problem. A good crypto platform should be clear, upfront, and cost-effective.

If you constantly feel like your balances are shrinking faster than they should, your platform is likely taking more than it’s giving.

2. The Swap Rates Are Always Against You:

Poor swap rates are one of the most underreported ways crypto platforms overcharge users.

Let’s say you’re swapping USDT to NGN. If the market rate is ₦1,500 per USDT, but your platform only offers ₦1,470, that’s a ₦30 loss per dollar. For a $1,000 swap, you’re giving up ₦30,000, almost $20, for no reason.

Some platforms quietly build this margin into their rates instead of charging direct fees, making it harder to notice. This is especially damaging in countries where local currency volatility can already shrink your margins.

If you're a business receiving client payments in stablecoins and converting to GHS or XAF, poor swap rates can significantly affect your cash flow.

It’s not just about how much crypto you hold. It’s about how much value you actually receive when you convert. If your swap rates are always below market, your crypto partner is silently draining your profit.

3. Withdrawals Are Slow or Unreliable:

Crypto markets move fast. If your platform can’t match that speed, you’re at a serious disadvantage.

Many African users report waiting hours, or even days, for fiat withdrawals to hit their bank accounts. In countries like Nigeria, where naira rates can shift by the hour, a delayed withdrawal could mean getting ₦1,450 per USDT instead of ₦1,500 (a 3.3% loss) just because your platform dragged its feet.

For traders, this delay can mean missing buying opportunities. For businesses, it could stall payments to suppliers or staff. Worse still, some platforms process withdrawals only during “business hours,” which makes no sense in a 24/7 crypto economy.

If you’re constantly left wondering when your money will arrive, or if you need to raise a support ticket every time you cash out, that’s not a partner, that’s a liability.

4. Poor Customer Support or No Local Help:

When something goes wrong with your crypto transaction, being able to reach real support is critical. Yet many platforms, especially international ones, don’t offer local customer service for African users.

You're left dealing with slow email responses, unhelpful chatbots, or support reps who don’t understand regional issues, like the CBN's latest policy or MTN mobile money rules in Ghana.

Worse, some platforms only offer support in English, ignoring users in French-speaking countries like Cameroon.

If your business depends on crypto for payments or trading, delays in resolving issues could affect your operations.

If you're always stuck with copy-paste responses or told to "wait 48 hours," it's time to rethink your platform.

A crypto partner should provide timely, human support, especially when real money is involved.

5. Limited Local Currency Options:

Some popular platforms still don’t support local currencies like GHS, NGN, or XAF directly. This forces users to rely on unstable third-party methods, like P2P trading, just to get money in or out.

Not only is this inconvenient, but it also exposes users to risks, scams, bad rates, and delays. For example, if you’re in Ghana and want to withdraw in GHS but your platform doesn’t support it, you might have to sell your crypto to someone on Telegram or WhatsApp. That’s not just risky. It’s unscalable.

Businesses need reliable, direct support for local currencies to plan cash flow, pricing, and operations. If your platform doesn’t offer that, it’s not built with your market in mind.

6. You Can’t Track or Plan Your Costs:

Budgeting is impossible when your crypto platform doesn’t show you exactly what you’re being charged.

Many users don’t know if they’re paying 1% or 5% in swap markups because the rates aren’t transparent. Others get hit with unexpected withdrawal or inactivity fees.

For small businesses, this makes it hard to plan around crypto payments or set accurate prices. For traders, it means you can’t calculate your profit margins clearly.

A serious red flag is when a platform doesn’t display the full cost of a transaction before you hit "Confirm."

If you always feel like you need a calculator to understand your final costs, your current platform is doing a poor job. Clear, upfront pricing is not a luxury. It’s a necessity.

7. You're Forced to Use P2P for Everything:

If your platform relies heavily on peer-to-peer (P2P) trading for deposits or withdrawals, that’s a red flag.

P2P methods are often the fallback for platforms that can’t build proper local banking partnerships. While P2P can work in some cases, it introduces serious risks: scams, wrong payments, delays, and lack of accountability.

You’re basically trusting a stranger with your money, and if something goes wrong, your platform won’t take responsibility.

For example, many Nigerian users have reported being banned or restricted on platforms after a failed P2P transaction, even when they followed the rules. Businesses can’t afford that kind of instability.

If your only option for funding or withdrawing your wallet is through a random Telegram seller or an in-app P2P buyer, your crypto partner isn’t actually doing the hard work of serving your market properly.

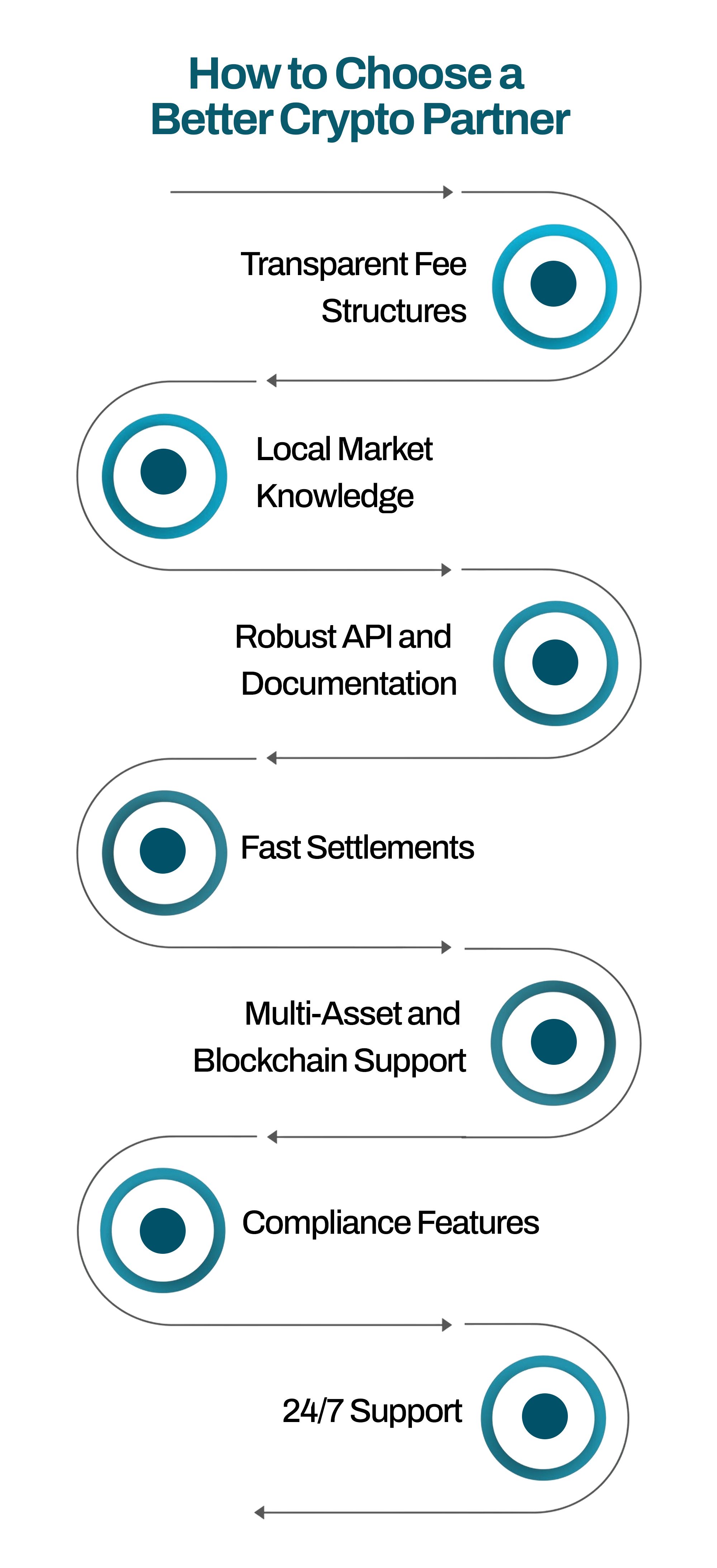

How to Choose a Better Crypto Partner

1. Transparent Fee Structures:

Always check if the platform clearly states their fees upfront, including swap fees, wallet charges, withdrawal costs, and network fees. Avoid platforms that hide costs inside bad exchange rates or only reveal final charges after the transaction.

2. Local Market Knowledge:

A good crypto partner should understand how your local market works, from currency fluctuations to payment trends. For example, platforms operating in Nigeria should offer NGN-related support, easy Naira conversions, and local P2P alternatives.

3. Robust API and Documentation:

If you run a fintech app or trading service, your partner’s API matters. Look for detailed developer docs, consistent uptime, and the ability to automate wallet creation, swaps, and transfers with little technical downtime.

4. Fast Settlements:

Slow transactions can ruin business operations. Choose platforms with fast crypto confirmations (under 10 minutes for major assets) and fiat settlements that happen same-day or within 24 hours, not in batches over multiple days.

5. Multi-Asset and Blockchain Support:

You should be able to access multiple stablecoins, tokens, and chains without needing multiple wallets. A good platform supports swaps across major chains like Ethereum, Tron, BSC, and Layer 2s, plus tokens like USDT, USDC, BTC, and local stablecoins.

6. Compliance Features:

In regulated regions, your crypto partner must meet compliance requirements to keep your business safe. Look for KYC/AML procedures, transaction monitoring tools, and the ability to generate audit trails or reports for accounting purposes.

7. 24/7 Support:

Your money doesn’t sleep, and neither should your support. Make sure the platform offers real human help, not just bots, across live chat, WhatsApp, or email, with average response times under 15 minutes, especially during high-volume periods.

Why Obiex Might Be Your Best Switch Yet

1. Transparent, Low-Cost Pricing:

Obiex offers some of the lowest swap fees in Africa, with zero withdrawal charges on most transactions. No hidden network fees. What you see is what you pay, and it’s clearly shown before each trade.

2. Deep Local Market Knowledge:

Obiex is tailored for African users. You can swap USDT, BTC, and other crypto directly into NGN or GHS, with fast settlement and support for local payment methods. Whether you’re sending money abroad or converting crypto to naira, the platform is optimised for your region.

3. Robust APIs for Fintech Builders:

Obiex offers stable, well-documented APIs for wallet creation, swap automation, and transaction monitoring, perfect for fintechs, payment apps, or cross-border platforms looking to scale securely.

4. Fast, Reliable Settlements:

With real-time swaps, the Obiex swap without confirmation feature, and same-day fiat payouts, you won’t be waiting around. Most transactions settle in minutes, not hours, even during peak periods.

5. Multi-Asset + Multi-Chain Support:

Swap across Ethereum, Tron, BSC, and more, with support for key assets like USDT, BTC, ETH, and NGN tokens. No need to move funds across multiple platforms to get the job done. You can access several trading pairs on Obiex.

6. Built-In Compliance Tools:

Whether you’re a business or a high-volume user, Obiex helps you stay compliant with KYC, transaction logs, and account-level reporting. Perfect for audits, bookkeeping, and internal risk checks.

7. 24/7 Human Support:

Need help on a Sunday at midnight? Obiex provides fast, human support via live chat and WhatsApp, with an average response time of under 10 minutes. You’re never left waiting when your money’s on the line.

To Recap

- You may be losing value in every swap if your platform’s rates are consistently below the market average.

- Platforms without real, local customer support leave users stuck with slow, unhelpful responses.

- When fees and rates aren’t transparent, it becomes impossible to track or plan business costs accurately.

- Platforms that rely heavily on P2P trading expose users to scams, payment errors, and poor accountability.

- A better crypto partner should have clear fee structures, support for local currencies, and fast, reliable settlements.

- Ideal platforms also offer robust APIs, compliance tools, and 24/7 human customer support.

- Obiex provides low, transparent fees, fast transactions, multi-chain support, and strong local market focus.

- It also offers fintech-friendly APIs, built-in compliance features, and responsive human support around the clock.

You don’t need to stick with a platform that eats into your profits.

Obiex gives you fast swaps, zero-fee wallets, and real-time rates.

👉Trade smarter. Join Obiex today.

FAQs

Q1. How do I know if I’m paying too much on my crypto platform?

Look out for hidden fees, bad swap rates, and slow withdrawals. If you're constantly losing money without knowing why, you’re probably overpaying.

Q2. What fees does Obiex charge?

Obiex has zero wallet fees, transparent swap costs, and no hidden charges for local withdrawals.

Q3. Is Obiex available in Nigeria and Ghana?

Yes. Obiex fully supports NGN and GHS, and is optimised for users in Nigeria, Ghana, and Cameroon.

Q4. How fast are withdrawals on Obiex?

Withdrawals to local bank accounts are instant for supported currencies.

Q5. Can I swap USDT to Naira directly on Obiex?

Yes. You can swap USDT to NGN at real-time rates without using P2P.

Q6. What makes Obiex better than other platforms?

Obiex focuses on low fees, fast service, and local support for African users.

Q7. Is Obiex safer than P2P trading?

Yes. Obiex lets you trade directly on the platform without relying on third parties.

Q8. How does Obiex compare to Binance in Nigeria?

Obiex offers faster local withdrawals and is built with local currencies in mind, unlike many global platforms.

Q9. Can I use Obiex for my small business?

Absolutely. Many small business owners use Obiex for cross-border payments, swaps, and instant withdrawals.

Q10. Where can I learn more about Obiex’s features?

Visit the Obiex blog for articles on features.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.