Table of Contents

- What is a Custodial Wallet?

- What is a Non-Custodial Wallet?

- Key Differences Between Custodial and Non-Custodial Wallets

- How to Decide: Questions Fintech Platforms Should Ask

- Use Case Scenarios: When Each Wallet Type Works Best

- Compliance and Security Considerations

- Scaling and Maintenance: Which Wallet Type is Easier to Operate at Scale?

- Why Use Obiex for Wallet Infrastructure?

- To Recap

- FAQs

Crypto is no longer just for exchanges. Fintech platforms across Africa and globally are incorporating crypto features to stay competitive, enhance cross-border payments, and cater to a growing digital-native user base.

But how you integrate crypto matters just as much as why. Your wallet infrastructure affects:

- User Control: Who owns the crypto, and who controls the private keys?

- Security: Who is liable if funds are compromised?

- Compliance: Who handles KYC, AML, and reporting?

- UX: How simple or complex is the wallet experience for end users?

Choosing between a custodial and non-custodial wallet is not just a technical decision. It’s a product, legal, and operational one too.

In this article, we will help you understand when to use a custodial and non-custodial wallet for your fintech products.

What Is a Custodial Wallet?

A custodial wallet is a type of crypto wallet where a third party, usually the platform or service provider, holds and manages the crypto assets on behalf of the user.

In simple terms, your fintech platform (or a provider) is in charge of storing and securing the users’ crypto, just like how banks hold money for customers.

When a user creates a wallet on your app, they don’t get access to the private keys (which are the cryptographic codes needed to move or control the assets).

Instead, your platform manages those keys in the background, making the experience easier for users, especially those who aren’t familiar with how crypto works.

Examples of custodial wallets include Binance wallets, Coinbase, and Obiex Custodial API.

Why Custodial Wallets Make Sense for Fintech Platforms:

- User-Friendly Onboarding: Your users don’t have to understand blockchain or key management. Signing up and using the wallet feels like opening a regular digital account.

- Account Recovery: If a user loses their password or device, your platform can help them recover access. Something that’s not possible in non-custodial setups.

- Compliance Integration: With custodial wallets, it’s easier to manage KYC, AML, and transaction monitoring from a central point, which is critical if your platform needs to meet regulatory requirements.

- Full Control Over User Flow: You can automate internal controls, transaction limits, and anti-fraud checks, all within your app, because you manage the wallet infrastructure directly.

What Is a Non-Custodial Wallet?

A non-custodial wallet is a crypto wallet where the end-user controls their own private keys, not the platform or a third party.

In simple terms, your fintech platform provides users with the tools to hold and manage their own crypto, without storing or accessing the assets directly.

Here’s how it works: when a user signs up, they generate a wallet (usually via your app), and the private keys are stored on their device, not on your servers.

That means they alone can access, move, or recover their funds. If the keys are lost, the assets are lost too. There’s no recovery mechanism unless the user backed up their keys.

Examples of non-custodial wallets include MetaMask, Trust Wallet, and WalletConnect.

Why Non-Custodial Wallets Matter for Fintech Platforms:

- Users Keep Full Control: Your platform doesn’t touch the crypto. That’s a major plus for users who care about privacy, autonomy, and decentralisation.

- Regulatory Detachment: Since you’re not “holding” the funds, your legal and compliance exposure is reduced. Though you still need to watch for transaction risks and fraud patterns.

- Best Fit for DeFi & Web3 Users: If your product involves smart contracts, staking, token swaps, or decentralised finance, non-custodial wallets are the standard.

- No Recovery Support: Unlike custodial wallets, users are 100% responsible for keeping their keys safe. If they lose access, there’s nothing your support team can do.

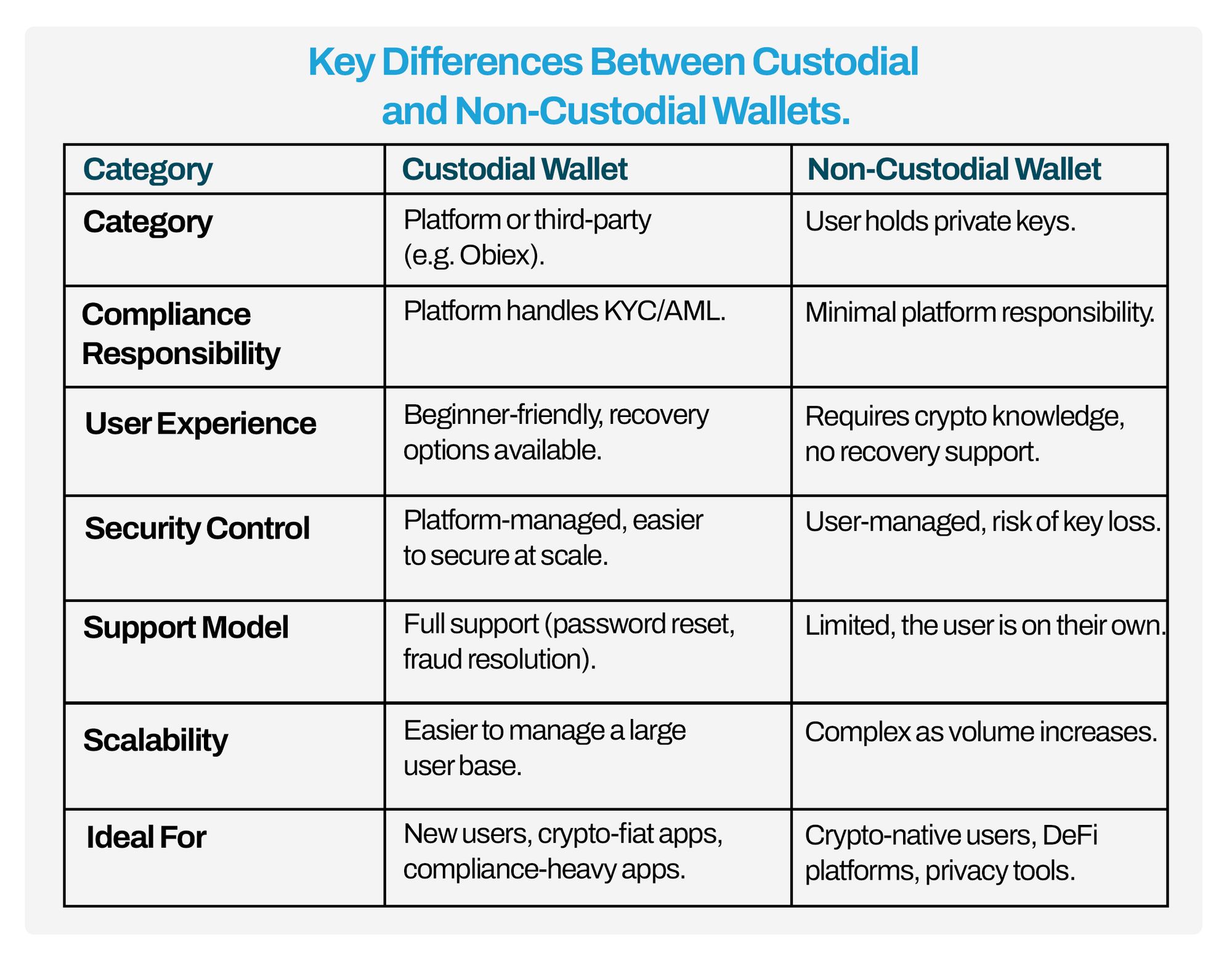

Key Differences Between Custodial and Non-Custodial Wallets

1. Private Key Ownership:

- Custodial Wallet:Your platform (or provider) holds and manages the private keys for users.Easier for beginners.Higher platform responsibility.

- Non-Custodial Wallet:The user holds their own private keys.True ownership and decentralisation.No recovery if keys are lost.

2. Compliance and KYC/AML Responsibilities:

- Custodial Wallet:Your platform is legally responsible for compliance, including KYC, AML, and transaction monitoring.More control over risk.May require licenses and ongoing audits.

- Non-Custodial Wallet:Compliance obligations are lighter since users hold the assets, but you may still need to monitor on-chain behaviour.Less regulatory burden.Still requires anti-fraud measures.

3. User Experience (UX):

- Custodial Wallet:Feels like a regular fintech app. Users can recover their account using their email address or phone number.Low-friction onboarding.Less control for users.

- Non-Custodial Wallet:Users need to back up their seed phrases or private keys.Ideal for crypto-savvy users.Can be confusing for beginners.

4. Support and Recovery Options:

- Custodial Wallet:You can offer full support, password resets, two-factor authentication, etc.Standard fintech support model.

- Non-Custodial Wallet:If the user loses access, there’s no way to recover the funds.No recovery support from your team.

5. Scalability and Technical Overhead:

- Custodial Wallet:Easier to scale. You control wallet creation, fee management, and transaction batching.Streamlined backend.You handle the full infrastructure.

- Non-Custodial Wallet:More complex to build and maintain. You’ll need secure key generation, encrypted storage, and smart contract interactions.Flexible for DeFi.Higher dev complexity.

How to Decide: Questions Fintech Platforms Should Ask

1. Who Owns the Risk? (Liability Mapping)

If something goes wrong, like a breach or a lost wallet, who takes responsibility?

- Choose custodial if you’re ready to own the operational and legal risks tied to holding funds.

- Choose non-custodial if you prefer to limit your custody-related exposure.

2. What Jurisdictions Are You Operating In? (Regulatory Exposure)

Different countries and regions have different rules around crypto custody. In places like Nigeria, South Africa, Kenya, and Canada, custodial wallet providers may need to register as VASP (Virtual Asset Service Providers) or MSBs (Money Services Businesses).

Non-custodial platforms often don’t need custody licenses, but still need to address AML, fraud, and transaction monitoring expectations.

- Choose custodial if you're ready to build in markets with licensing requirements and operate under strict regulatory frameworks.

- Choose non-custodial if you’re targeting less-regulated regions or privacy-first users.

3. What Is Our User Demographic?

Your users’ crypto experience will determine what kind of wallet flow works best.

- Choose custodial if your users expect a traditional fintech experience.

- Choose non-custodial if you’re building for developers, DeFi traders, or privacy-conscious users.

4. What Volumes and Flows Do We Expect?

- High transaction volumes (e.g. payroll, remittances, savings apps) are easier to batch and manage with a custodial wallet.

- Decentralised interactions (e.g. staking, token swaps, DeFi) typically require non-custodial wallet infrastructure.

5. Do We Want Crypto as a Feature or a Core Product?

- If crypto is just a feature (e.g. topping up airtime, paying bills, or sending money across borders), a custodial wallet is often faster to launch and easier to manage.

- If crypto is the core of your product (e.g. launching a DEX, NFT platform, or savings product on-chain), a non-custodial wallet gives users more autonomy and aligns with Web3 principles.

Use Case Scenarios: When Each Wallet Type Works Best

Custodial Wallets Are Ideal For:

1. Payment and Remittance Apps (Fiat-Crypto Conversion):

If your platform offers crypto payments, money transfers, or cross-border remittance with fiat on- and off-ramps, custodial wallets are easier to manage.

- Users don’t need to understand private keys.

- Transactions can be batched to reduce network fees.

- You can automate compliance and handle conversions internally.

Examples:

- A savings app that allows users to buy USDT and withdraw naira.

- A remittance product converting BTC to mobile money or bank transfers.

2. Platforms Targeting First-Time or Non-Crypto Users:

If your customers are new to crypto or using it purely for convenience, they don’t want to deal with seed phrases, key backups, or smart contracts. They need:

- Familiar UX (like traditional fintech apps)

- Full support and recovery options

- Faster onboarding flow

Examples:

- A mobile wallet for day-to-day spending

- A fintech app offering dollar savings in USDC or BTC

3. Enterprise and Institutional Clients:

Institutions and regulated entities prefer a setup where compliance, monitoring, and fund security are managed centrally. Custodial wallets make this easier to implement and scale using:

- Granular user permissions

- Role-based access and audit logs

- Integration with KYC and AML workflows

Examples:

- A platform offering B2B crypto settlements

- Corporate crypto treasury solutions

Non-Custodial Wallets Are Ideal For:

1. DeFi Platforms, DEX Aggregators, and Web3 Tools:

If your product interacts with smart contracts or allows users to trade on decentralised exchanges (DEXs), non-custodial wallets are necessary.

- Users can sign transactions directly from their wallet

- No need for centralised custody

- Compatible with on-chain protocols

Examples:

- A DeFi investment dashboard

- A platform for token swaps and yield farming

2. Products Focused on Privacy and User Autonomy:

For platforms targeting privacy-conscious users or operating in markets with high levels of censorship, a non-custodial setup provides users with more control.

- Users remain anonymous (no KYC required)

- Wallets are stored locally on user devices

- No single point of failure

Examples:

- A crypto wallet for journalists, NGOs, or communities in unstable markets

- A browser extension wallet for interacting with dApps

3. Self-Custody First Platforms (Crypto-Native Users):

Advanced users prefer wallets that allow them to control their assets directly. If your platform serves a crypto-native audience, self-custody builds trust.

- Users expect seed phrase recovery and MetaMask-style UX

- Gives power and control to the user

- Aligns with Web3 values and decentralization

Examples:

- A DAO management platform

- An NFT marketplace with user-owned assets

Compliance and Security Considerations

1. KYC/AML Responsibilities:

- Custodial Wallets:You (the platform) are legally responsible for KYC and AML checks. This includes collecting user data, verifying identities, and reporting suspicious transactions.

- Non-Custodial Wallets:The user manages their assets independently, which reduces your KYC/AML burden. However, you may still need to monitor usage patterns, especially if offering fiat rails or access to third-party services.

2. Licensing Requirements:

- If you’re offering custodial wallets, many jurisdictions require licensing as a Virtual Asset Service Provider (VASP) or Money Services Business (MSB).

- In Nigeria, platforms offering wallet custody may need to comply with NDPR (Nigeria Data Protection Regulation) and CBN-related guidelines.

3. Data Security & Privacy:

- Custodial wallets involve collecting and storing sensitive user data, email addresses, KYC documents, transaction history, etc. That means you must implement data encryption, access controls, and secure storage.

- Non-custodial wallets store keys locally on the user’s device, so your platform holds little or no sensitive user data, reducing compliance risk, but you still need to secure your app against exploits and phishing attempts.

Threat Models:

Handling Risks:

For Custodial Wallets:

- Use hot/cold wallet separation

- Apply role-based access control for internal teams

- Enable 2FA and IP whitelisting for sensitive operations

- Regularly audit transaction flows and admin activity

For Non-Custodial Wallets:

- Ensure key generation happens securely on the user’s device

- Use encrypted key storage (e.g., device Secure Enclave or keystore)

- Add seed phrase education and optional backup solutions

- Monitor the app for phishing attempts or malicious modifications

Scaling and Maintenance: Which Wallet Type Is Easier to Operate at Scale?

Let’s look at what scaling and maintaining each wallet type really involves:

1. Custodial Wallets: Easier to Centralise, Easier to Control

Custodial wallets are typically easier to manage at scale because your platform controls everything, from wallet generation to transaction flow and user support.

Advantages:

- Centralised hosting allows for optimised transaction processing (e.g. batching withdrawals, managing internal transfers without touching the blockchain).

- Fee Efficiency: You can reduce blockchain network fees by aggregating or delaying transactions.

- Streamlined Support: Users contact your team directly for account issues, password resets, or blocked funds.

- Built-in Monitoring: Track wallet usage, suspicious activity, or wallet limits in real-time.

- DevOps Friendly: Easier to integrate with internal admin tools and analytics dashboards.

Maintenance Tasks You Control:

- Wallet creation and database management

- Hot/cold wallet separation and liquidity routing

- Transaction queue management

- Internal fraud prevention and access control

- Real-time logging and alerting

Challenges:

- You carry more operational load, especially around uptime, security patching, and compliance.

- Infrastructure must be reliable under high volumes. Downtime can mean blocked funds.

2. Non-Custodial Wallets: More User Control, More Technical Complexity

Non-custodial wallets shift responsibility to the user, but they also increase the engineering overhead on your side, especially when building a reliable, secure, and intuitive interface for key management.

Advantages:

- No custody burden: You don’t manage or store user funds.

- Users are self-sufficient: No need for recovery support or manual intervention.

- Lighter backend ops: No wallet hosting, no cold storage policies.

What You Still Need to Build or Maintain:

- Secure client-side key generation

- Encrypted local storage or integration with secure enclaves (e.g., iOS Secure Enclave, Android Keystore)

- UX for seed phrase backup, recovery flows, and warnings

- Blockchain interaction logic, transaction signing, gas estimation, and broadcast

Challenges:

- More front-end engineering complexity (mobile and web).

- Higher user error rates, especially at scale.

- Difficult to offer support when something goes wrong (e.g. lost private keys, incorrect transaction signing).

- You may need to support multiple blockchain networks and wallet formats as your product expands.

Why Use Obiex for Wallet Infrastructure

- Fast integration: Your dev team can go live quickly with Obiex’s clean, well-documented API. No need to manage blockchain nodes or wallet keys manually.

- Built-in compliance: With Obiex, you can deploy custodial wallets in minutes, fully managed by Obiex and backed by enterprise-grade security and compliance features.

- Designed for African and Global Fintech Realities: Obiex is not just a generic wallet provider. We understand the challenges fintech platforms face across Africa’s fragmented markets.

- Scalable infrastructure: Obiex is built to handle thousands of wallet operations reliably and securely.

- Hybrid-ready: Need to serve both new users and crypto-native customers? Obiex supports hybrid wallet infrastructure.

To Recap

There’s no one-size-fits-all wallet type. The decision between custodial vs non-custodial wallets should depend on:

- Your compliance responsibilities

- Your users’ crypto experience

- Your long-term product strategy

- Your ability to manage custody risks

Obiex helps you reduce that complexity, so your team can focus on building value, not infrastructure.

👉Explore Obiex’s Wallet API for Fintech Platforms to get started with a secure, scalable, and compliance-ready wallet solution tailored for your crypto infrastructure needs.

FAQs

Q1. What is the main difference between custodial and non-custodial wallets?

Custodial wallets hold the user’s crypto for them; non-custodial wallets let users control their own private keys.

Q2. Which wallet type is better for new users?

Custodial wallets are easier for beginners since they don’t need to manage keys.

Q3. Are non-custodial wallets more secure?

They offer more privacy but shift the security burden to users. If users lose their keys, funds are lost.

Q4. Do I need licenses to offer custodial wallets?

Yes, depending on your region. Obiex’s API helps fintechs meet compliance standards.

Q5. Can I integrate both wallet types into one platform?

Yes. Many fintechs use a hybrid model to support both.

Q6. How long does Obiex’s wallet integration take?

Most fintechs integrate Obiex’s wallet API within 7–14 days.

Q7. Can I offer fiat-to-crypto services with Obiex?

Yes. Obiex supports crypto-fiat flows through its wallet APIs.

Q8. What if a user forgets their password in a custodial setup?

You can offer email or phone-based recovery options.

Q9. How does Obiex keep custodial wallets safe?

With encryption, multi-signature access, cold wallet separation, and 24/7 monitoring.

Q10. What support does Obiex offer for wallet API integration?

Technical support, API documentation, and a dedicated integration team.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.