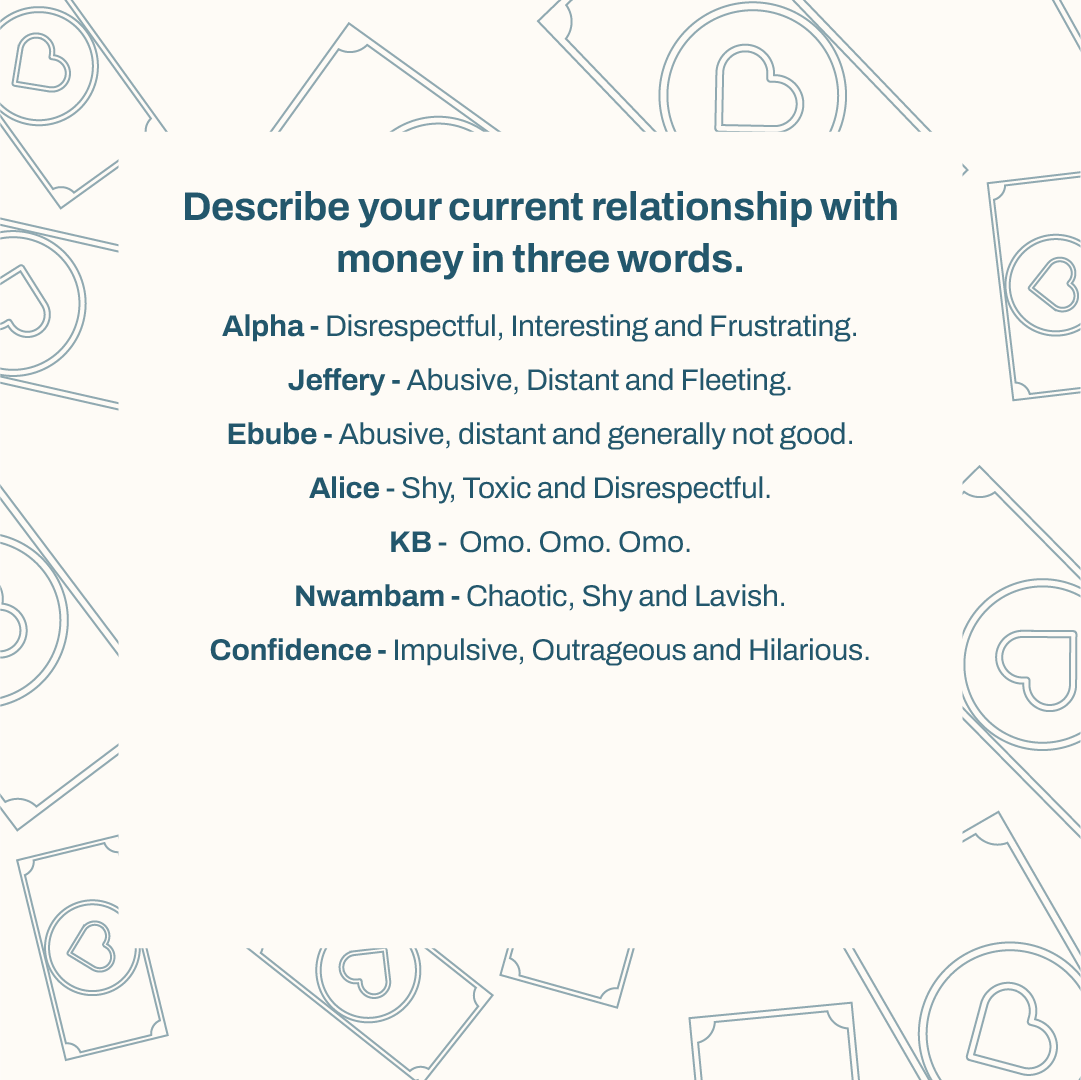

Describe your current relationship with money in three words.

Alpha: Disrespectful, Interesting and Frustrating.

Jeffrey: Abusive, Distant and Fleeting. Basically, I am in a situationship with money.

Ebube: We have a distant relationship. Abusive, distant and generally not good.

Alice: Shy, Toxic and Disrespectful.

KB: Omo. Omo. Omo.

Nwambam: Chaotic, Shy and Lavish.

Confidence: Impulsive, Outrageous and Hilarious.

What do you do that brings you money?

Alice: I am a social media manager and my mother’s daughter. I get money from those two places and sometimes from my father.

KB: I am a fashion designer, stylist, and my parent’s baby. That’s where I get money from.

Jeffrey: I am a writer. That’s my source of income - content writing and my mother.

Alpha: I manage people’s money and lend money out for interest. I am also my parents' first son. Enough said.

Ebube: I am a graphic designer and video editor. That’s where my money comes from.

Nwambam: I am a part-time forex trader. I am my mother’s favourite child, and I have friends who play professional football that sponsor my life.

Confidence: I am fully unemployed, but I have my daddy, who pays for everything, and my uncles and older cousins, who always randomly send me money.

On average, how much do you make in a month? And how much do you spend?

Jeffrey: On average, it can be as high as ₦350K or as low as ₦200K. In a month, I typically spend as much as ₦150K a month.

Alice: ₦150K to ₦250. I spend everything I earn most months.

Ebube: I usually make ₦50K to ₦90K, and I can spend as much as ₦90K monthly.

KB: I make about ₦200K to ₦250K and spend about ₦150K to ₦ 200K.

Alpha: In a good month, I can see like ₦300K. I spend according to needs (actually, wants); If it requires I spend it all, then so be it.

What do you spend the most money on monthly?

Alice: Birthday gifts, because I know at least one person every month with a birthday and food.

KB: Food, my younger brother and gifts for my friends.

Jeffrey: Food and transportation.

Ebube: Food and buying random useless things I may never use again.

Nwambam: Omo food oh. Lifestyle, women…

Alpha: Lifestyle, I love to go out. I also celebrate birthdays for my friends, but food takes the biggest chunk of the cake. It’s so expensive right now.

Confidence: I’m always expecting a package, so yeah, that.

What’s your individual approach to saving money?

Ebube: I basically saved based on what I get. Let’s say I make ₦50k; I can save ₦30K from that. Some days, I make ₦15K and use the whole thing. I try to save monthly, but it is not easy.

Jeffrey: I usually save all the money I earn from freelancing, which makes my savings quite irregular. In some months, I save a lot. Other months, I save nothing. I used to save 40% of my salary, but since this new government came into power, it has become harder to save.

KB: I try my best to save at least ₦50K monthly. I put everything from my salary into my savings.

Nwambam: I don’t save. I live a very lavish life. I can have ₦500K today, and in the next 2-3 weeks, it will be finished. There was a time when I was saving at least ₦100k monthly, but before the end of the month, I opened my savings and used the money. My mother is always telling me to save, but I don’t because I believe money is always going to come. However, saving is something I still want to learn as a person.

Alpha: I save as money comes. Some months, I can save ₦150K or ₦200K. The month's money does not come like that; I save zero naira because I have to save myself first. But I am disciplined and have good saving habits. I can commit to not touching the money I have put aside for something.

Alice: I save sometimes because I have more expenses in some months. Most of the time, I just save the salary from one of my jobs. Some months, I will spend all the salary from both my jobs, plus the money my parents give me, because life is tough and what if I die? But I try as much as possible to save at least ₦50k in a good month.

Confidence: I only save when I don’t see what to spend my money on. I really don’t save. I’m always spending money.

What's the biggest financial goal you're working towards right now?

Alice: An apartment and an iPad.

KB: Rent, Gadgets for my illustration. Everything is about a nice ₦1 Million

Jeffrey: I am working towards getting back my emergency funds. It was between ₦600 to ₦1M. It depleted because early this year, I moved to a new place, and I spent about ₦800K on moving.

Alpha: I’m getting a new place, so I need that and a lot of expensive stuff. Also, I need to get my emergency funds back up to what I can see and smile.

Confidence: I want a new car. Am I saving up for that? No. So, I guess nothing at the moment.

Ebube: I am working towards getting my own space and also getting better gadgets because those would really help my business

In the next ten years, what does financial success look like for you?

Jeffrey: First, I want to be able to spend money without overthinking it and have a fund that provides monthly returns that can sustain my lifestyle.

KB: One, not practising medicine. Two, being able to swipe my card and buy anything I want. Finally, being able to afford a trip to anywhere on random days to get anything I want

Alice: I would say, being able to make random purchases without having palpitations. Let me just pay without calculating what’s left in my account because I know I still have enough. Then, taking random trips without much planning - just take my passport and go.

Ebube: Financial freedom means being able to indulge my whims. For instance, two weeks ago, I felt like going phone shopping. If I had money then, I would have been able to.

Nwambam: I want to have five or more multiple streams of income, including Real Estate, Agriculture, and Transportation. I also want to be able to travel without overthinking it because I love to travel.

Alpha: Financial success to me is freedom. I want to be able to say No to things. Travelling is also a big thing for me, so I want to be able to afford business or first class even if I am just going somewhere like Lagos or anywhere in the world really. I want to be able to not think before doing whatever I want. I want to have investments I am not actively involved in but are bringing in consistent money. It also looks like smashing my career goals.

Confidence: Honestly, it’s being able to buy whatever I want and book a flight to whatever country I want whenever I want without thinking twice.

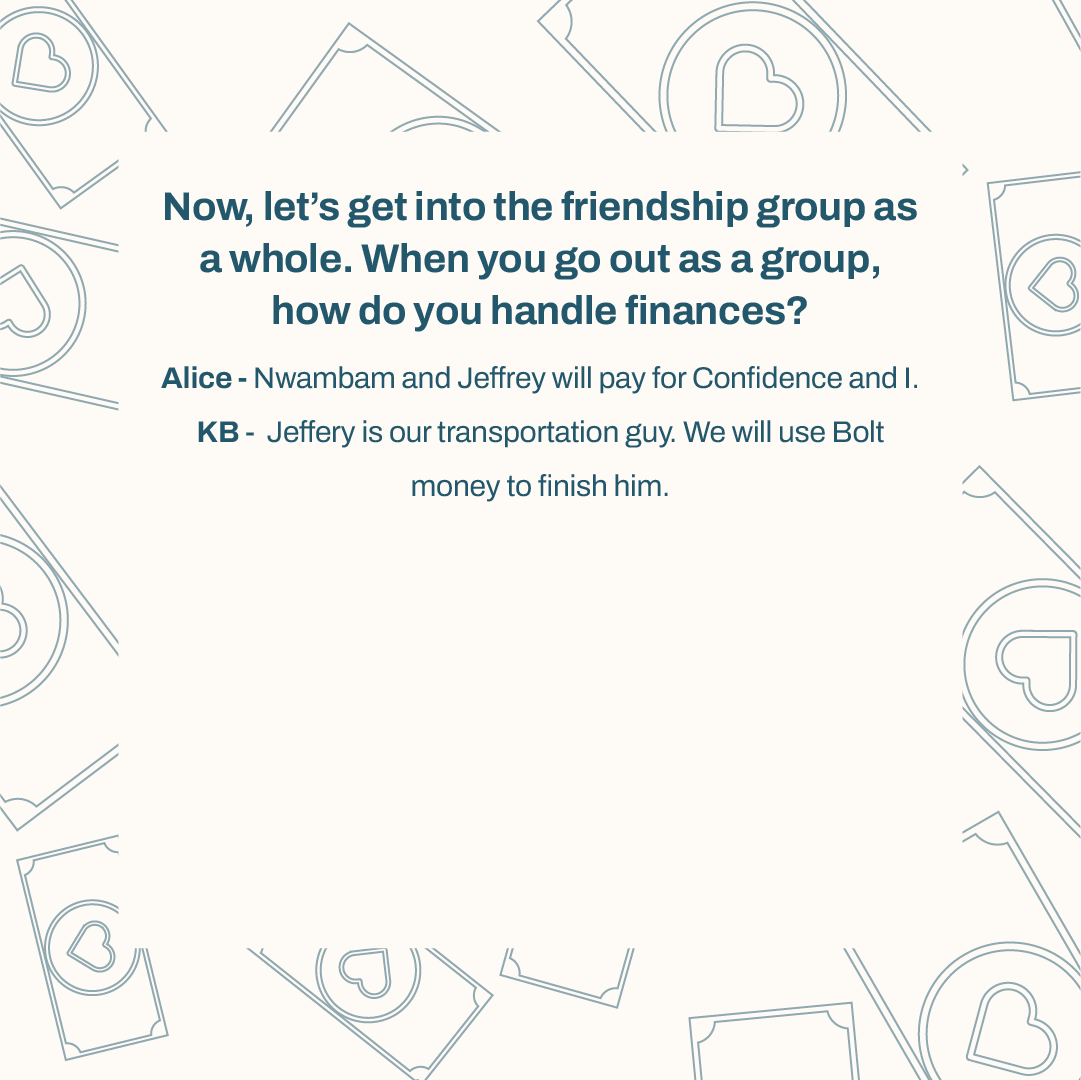

Now, let’s get into the friendship group as a whole. When you go out as a group, how do you handle finances?

Alice: Nwambam and Jeffrey will pay for Confidence and I.

KB: Jeffery is our transportation guy. We will use Bolt money to finish him.

So, If I get this right, Nwambam and Jeffrey are bankrolling the group?

Jeffrey: Please, oh! That’s not it. Most times, if we are going anywhere, we plan for it so we know how much we will spend on the outing.

Sometimes, one person pays for whatever we spend when we get to the venue and at the end of the day, we send the money back to the person. If we are contributing for birthdays, we all pay to one person’s account; then we account for each naira spent.

Alpha: Yeah, Jeffrey is pretty spot on. One person pays, and then everyone sends it to that person.

Wow. Accountability. Have there been any instances where money has caused tension or disagreements within your friend group?

Alpha: Well, within the core friend group, no, but there are some elements I rather not go into. Honestly, the worst that happens is that we will just shout and express our annoyance and move on.

There was something we did last year: a cookout. Ah, that was a crazy time for money and everything. But last last, if money wants to cause tension, we will just take a deep breath and call them out respectfully or just allow the person involved to do what they want.

Jeffrey: I don’t think money has ever caused tension. It might cause a slight issue, but we tend to be very vocal about situations, so it just tends to resolve after having the conversation.

How do you people feel about borrowing and lending money within the group?

Jeffrey: Ah, It’s pretty normal.

KB: Very very normal. We are each other’s financial lifesavers.

Nwambam: Too normal.

Alpha: It’s very easy within us because you don’t have to chase anyone to pay you back.

Is there any goal you are all jointly saving towards at the moment?

Nwambam: Yes! We want to attend the Bole Festival in Port Harcourt. We have been planning it for three months.

What’s the total amount of money you need for the trip?

Nwambam: ₦600K, which covers transportation, feeding, and accommodation. We are contributing ₦60K each, and we are also going with some friends outside this core group.

How is the savings going?

Nwambam: We opened a joint account, but as we speak to you now, not even ₦10 is in that account.

Alpha: We just give God the glory.

When is this festival?

Alice: August.

So you have about a month plus to raise the money? On a scale of 1 to 10, how confident are each of you that you will hit your savings target and make it to the festival?

Alice: 9.5! I believe my friends die!

KB: Omo, 5 oh.

Jeffrey: Ehmm, 2,

Ebube: I will say a 4. I am not really confident.

Alpha: 4 please.

Confidence: 9

Nwambam: Honestly, it's a 6 or 7 for me because I don’t mind paying for some of my guys so we can go.

Alice: ODOGWU SILENCER!!!

Alpha: President General Among the Nation!

Jeffrey: I have changed my mind please. It is now 9!

People, please.

Nwambam: Anyway, as I was saying, I have no problems paying for my friends, but I can’t pay for everyone. If I can pay for one or two people, I don’t mind.

Confidence: You people should tell Nwambam to send my ₦500K.

Final question! - You get a chance to go back in time and invest $100 in any company or asset. What do you invest in?

Nwambam: I will invest in Bitcoin.

Alpha: Apple! I am definitely buying Apple stock.

Ebube: I would invest in Bitcoin and myself by taking a couple of courses.

Jeffery: I would buy Nvidia stock.

KB: I would invest in Bitcoin for real.

Alice: I can’t think of anything other than BTC.

Confidence: Definitely Bitcoin.