Table of Contents

- What is a B2B Crypto Audit (and Who Needs One)?

- The B2B Crypto API Audit Checklist

- What Happens When These Boxes Aren’t Checked

- How Obiex’s B2B Crypto API Stacks Up

- API Integration Tips

- To Recap

- FAQs

In high-volume crypto trading, your API isn’t just a piece of code. It’s the heartbeat of your entire infrastructure.

If it fails, your operations stall, your users lose confidence, and your business loses money.

A slow, buggy, or insecure API can create downtime during peak trading, lead to compliance breaches, or worse, expose sensitive financial data.

This is especially risky for African fintechs, OTC desks, and B2B payment platforms handling cross-border transactions, where speed, security, and uptime are non-negotiable. The fact is that API performance directly affects your bottom line. That’s why auditing your crypto API is not optional. It’s mission-critical.

Whether you're a CTO, backend engineer, or operations lead, you need a practical, rigorous API audit checklist that ensures your trading systems are fast, secure, and compliant.

This article breaks down exactly what that checklist should include, why it matters, and how Obiex’s B2B crypto API sets a new standard for performance, reliability, and transparency in enterprise crypto infrastructure.

What Is a B2B Crypto API Audit (and Who Needs One)?

A B2B crypto API audit is a deep technical and compliance check that helps businesses ensure their crypto trading infrastructure is fast, secure, and built to scale.

It extends far beyond simply verifying that an API works. It evaluates five core areas: performance, security, compliance, documentation, and scalability.

A proper audit will test if the API can handle large trade volumes without lag, whether all transactions are logged and traceable, and if the provider meets regulatory and data security standards (like ISO 27001 or GDPR). It also examines the quality of API documentation and the availability of support when issues arise.

This type of audit is crucial for crypto exchanges, OTC desks, remittance platforms, stablecoin payment providers, and fintechs that process over $5 million in crypto transactions each month.

Many teams assume that “if it connects and sends trades, it’s fine”. But that’s a myth. An untested or undocumented API can crash during a high-volume event, introduce compliance risks, or incur significant costs due to downtime.

Auditing your crypto API means checking if it's battle-tested, properly monitored, and backed by real support, not just functional.

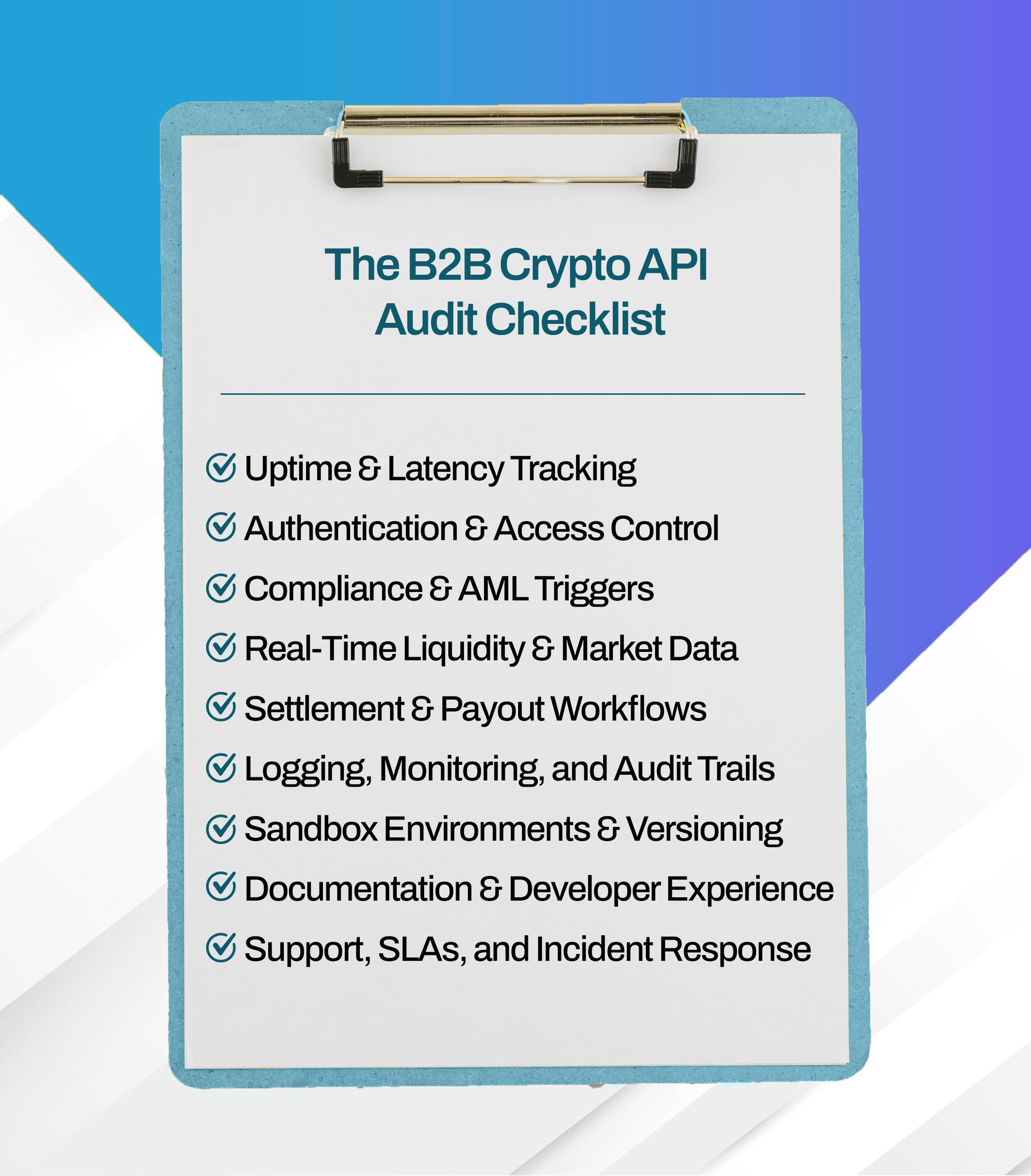

The B2B Crypto API Audit Checklist

1. Uptime & Latency Tracking:

What to Check: Measure the API's uptime (how often it is online) and latency (how quickly it responds to requests).

Tools to Use: Postman monitors, Pingdom, synthetic traffic via Cron jobs, or built-in observability tools like New Relic.

Why It Matters: In crypto, even a 1-second delay can affect trade execution or cause slippage. For high-volume B2B platforms, 99.9% uptime translates to a maximum of 43 minutes of downtime per month. Anything less impacts your business.

Example: A remittance platform experiencing 10-minute API outages during Nigeria-EU trade hours can lose thousands in delayed settlements.

2. Authentication & Access Control:

What to Check: How API keys are issued and revoked, whether endpoints have role-based restrictions, and if rate limits are enforced per user or key.

Security Features: Look for IP whitelisting, 2FA for sensitive dashboard access, and HMAC or JWT token-based auth for API calls.

Why It Matters: If an API key is compromised and rate limits aren’t in place, a single key can flood your systems or trigger unauthorised trades.

Example: An OTC desk accidentally exposes a test key, without IP whitelisting, bots begin hammering the live endpoint.

3. Compliance & AML Triggers:

What to Check: Are there KYB/KYC hooks built in? Can the API block trades or withdrawals above a certain threshold?

Why It Matters: Regulators in markets like South Africa or Kenya are tightening crypto compliance rules. You need APIs that support real-time AML alerts, enforce per-customer transaction caps, and trigger escalations.

Example: If a user tries to move 100 BTC out of a Kenyan crypto app, the API should block the transaction pending compliance review.

Obiex API: Comes with built-in KYB/KYC checks, supports travel rule compliance, and lets you configure AML flags at the API level.

4. Real-Time Liquidity & Market Data:

What to Check: Does the API return live bid/ask prices, order book snapshots, and slippage data in milliseconds?

Why It Matters: Businesses need live pricing to execute market-making or arbitrage strategies. Delayed or stale prices can lead to losses.

Example: A crypto payments processor gets USDT/NGN quotes with a 5s delay. By the time the transaction clears, the price has moved.

Obiex Advantage: Connect directly to liquidity pools, get executable quotes, and access aggregated price feeds across 10+ markets.

5. Settlement & Payout Workflows:

What to Check: Does the API support batch payouts, real-time settlements, and multi-chain transfers?

Why It Matters: In some African markets, stablecoin payouts are often the fastest settlement option. But not all APIs offer cross-border coverage or support bulk operations.

Example: A fintech doing 500 daily USDT payouts needs to automate transactions to save on gas fees and reduce ops overhead.

Obiex API: Supports bulk payouts, programmable delays, fee previews, and seamless on/off-ramps in Africa.

6. Logging, Monitoring, and Audit Trails:

What to Check: Are API logs immutable (fixed), timestamped, and accessible via dashboard or API?

Retention Policy: Ask how long logs are stored, ideally, 6 to 12 months, and whether they can be filtered by endpoint, IP address, or key.

Why It Matters: In case of a bug or security breach, you need full audit trails. Regulators may also request logs during audits.

Example: An internal system bug triggers unauthorised withdrawals. Without detailed logs, it's impossible to trace the source.

7. Sandbox Environments & Versioning:

What to Check: Does the provider offer a dedicated testnet, with no risk to live funds? Is versioning documented and backwards-compatible?

Why It Matters: Breaking changes in API versions can crash your production system. You need a safe way to test before deploying.

Example: A fintech updates to v2 of an API, and trade execution fails because the payload schema changed.

Best Practice: Only integrate APIs with versioned endpoints, and test in the sandbox first.

8. Documentation & Developer Experience:

What to Check: Is the documentation clear, complete, and updated regularly? Are there sample requests, error code references, and SDKs?

Why It Matters: Poor documentation slows down integration and leads to production errors. Your dev team shouldn’t need to “guess” how an endpoint works.

Example: If a backend engineer at a remittance startup can’t find error code mappings, they can spend 4 hours debugging a rate limit issue.

9. Support, SLAs, and Incident Response:

What to Check: What’s the response time commitment? Is there a 24/7 support channel and an escalation path for outages?

Why It Matters: In crypto, issues don’t wait for business hours. You need guaranteed Service Level Agreements (SLAs) and a designated point of contact during API failures.

Example: If your platform goes down during a Friday night bull run, support may not respond until Monday morning.

Obiex SLA: Guarantees efficient incident response, has an escalation ladder, and provides engineering-level support via several channels for B2B clients.

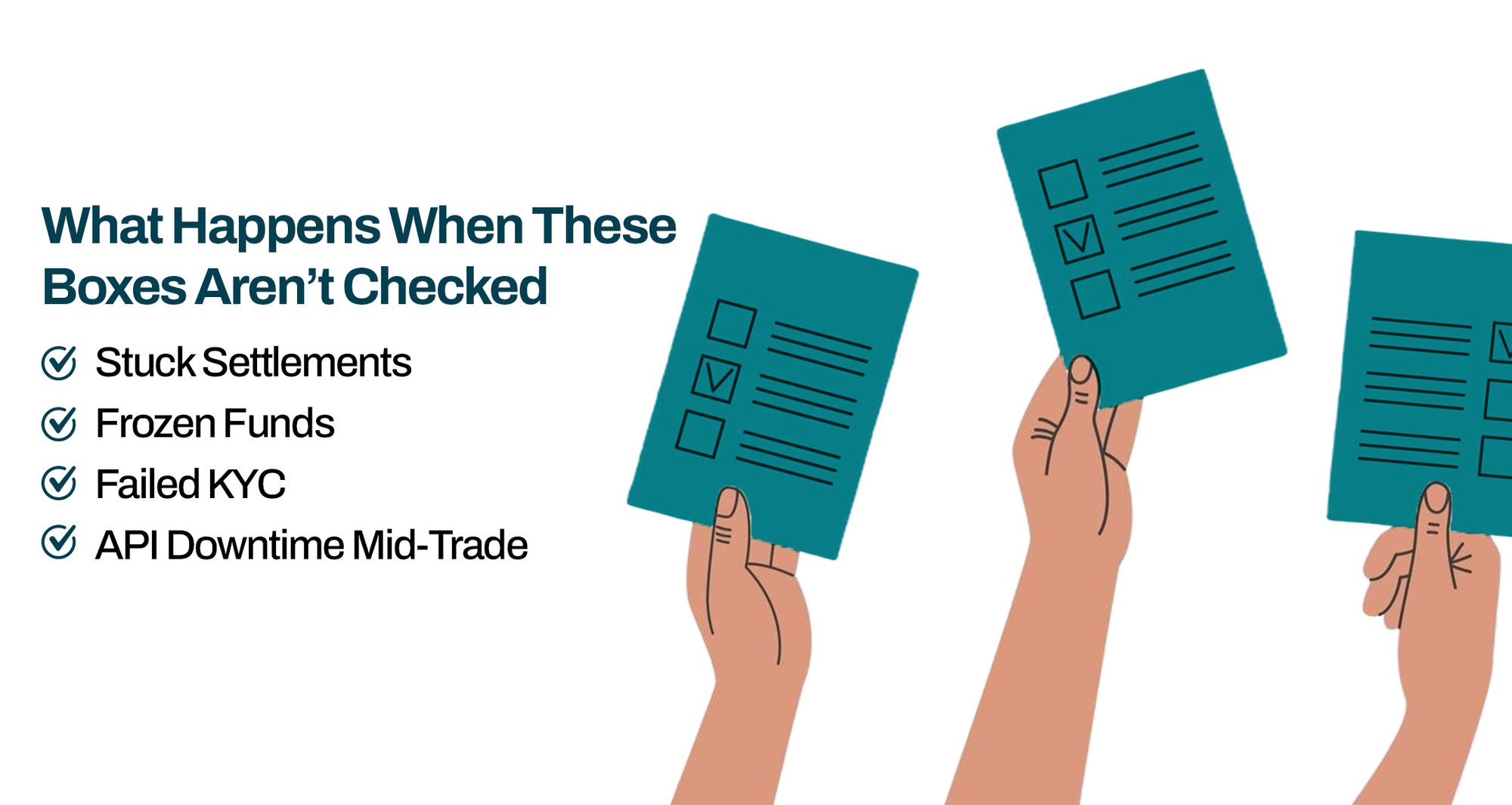

What Happens When These Boxes Aren’t Checked

Let’s be blunt… when your crypto API infrastructure isn’t properly audited, things can break fast. And in B2B trading, breakages don’t just mean technical errors. They mean revenue loss, compliance exposure, user churn, and reputational damage.

The stakes are high because businesses rely on API stability and security to move real funds at real speed.

When checklist items are skipped, you’re opening the door to operational chaos. Here’s what that actually looks like:

1. Stuck Settlements:

If your system can’t confirm, process, and reflect completed settlements instantly, user trust collapses.

Imagine a treasury team expecting a USDT payout across borders, only to have it delayed due to an API not syncing with the settlement layer.

Now you’re not just facing a technical bug. You’re risking client churn, SLA violations, and legal disputes.

2. Frozen Funds:

When APIs don’t handle wallet permissions, transaction flags, or withdrawal approvals properly, funds can get locked in limbo.

This often happens due to incomplete webhook handling or a lack of fallback procedures.

For regulated fintechs and cross-border remittance providers, frozen funds can trigger internal audits or even be flagged by financial watchdogs, especially if they involve regulated assets like stablecoins.

3. Failed KYC:

Skipping proper audit checks on your KYC flow integrations means users can slip through the cracks, or worse, get blocked for no reason.

Poor API callback handling, invalid document parsing, or timeout errors often result in failed verifications. Regulators interpret this as non-compliance or negligence.

4. API Downtime Mid-Trade:

API uptime is not just a “nice-to-have” for B2B platforms. It is a mission-critical factor in trade execution.

During volatile markets or high-volume trading windows, even a 2-minute outage can result in slippage, arbitrage loss, or failed customer orders.

How Obiex’s B2B Crypto API Stacks Up

1. Modular and Scalable Infrastructure:

Obiex offers a full-stack API infrastructure that allows businesses to integrate just what they need: wallets, swaps, deposits, withdrawals, and NGN on/off-ramps, without unnecessary bloat.

This modularity allows startups to launch with just wallet creation and grow into deeper features, such as liquidity and compliance monitoring, over time.

Obiex currently supports over 20 tokens and 7 blockchain networks, including Ethereum, Tron, BSC, and Arbitrum. This provides partners with the flexibility to meet diverse user needs without constantly switching providers or overhauling backend systems.

2. Enterprise-Grade Liquidity and Execution:

Obiex delivers enterprise-grade liquidity depth for popular pairs like BTC/USDT, BTC/NGN, and USDT/NGN. Unlike many providers that offer indicative quotes and fail to execute at displayed rates, Obiex’s RFQ engine offers fixed, real-time quotes, meaning what you see is what you get.

There is zero slippage, even during market spikes, and execution is instant.

3. High Uptime and Speed You Can Trust:

Obiex delivers 99.95% API uptime, even during periods of high volatility. Our infrastructure is optimised for scale, with thousands of swap and withdrawal operations executed daily without delay.

The average swap execution time is under 200 milliseconds, making it fast enough for real-time user interactions on consumer apps.

The entire platform is hosted on reliable cloud infrastructure with auto-scaling to meet peak demand, ensuring smooth performance under load.

4. KYC-Ready and Audit-Ready Compliance Features:

Obiex’s API is designed for full compliance readiness. Wallet models can be customised for KYC enforcement, and all wallet activities, deposits, withdrawals, swaps are fully auditable via webhook logs and transaction history.

Withdrawals can be screened in real time against OFAC or custom blacklists. Fiat ramps include transaction thresholds and origin-of-funds checks, making it easier to pass regulatory reviews.

For partners preparing for licensing or audits, this reduces manual overhead and ensures technical accountability.

5. Fast and Flexible Developer Experience:

Speed to market is everything, and Obiex’s developer tools are designed to get teams live in under 10 business days. You get sandbox credentials instantly, complete Postman docs, webhook support, and a dashboard for testing, monitoring, and configuration.

Authentication is simple (bearer tokens), and webhook alerts notify you of every deposit, status change, or execution event. Our dedicated engineering support team works directly with your developers during onboarding to make the integration smooth.

6. Seamless Wallet and Transaction Management:

The Obiex API allows partners to instantly create wallets for users across Ethereum, Tron, BSC, Polygon, and more, with internal transfers that are completely free.

Obiex also manages private keys and wallet security, so you don’t have to. Deposits are automated with chain-specific minimums to protect against dust spam, and withdrawals come with transparent gas fees (typically 5–10 bits, depending on the chain).

For African fintechs, this means you can offer wallet services without needing deep crypto infrastructure expertise in-house.

7. Built-in Fiat Ramps and Settlement Capabilities:

Obiex includes a native NGN on/off-ramp that integrates directly with Nigerian banking infrastructure for fast deposits and withdrawals. This supports KYC-enabled wallet models and applies daily cashout limits and velocity checks to minimise fraud.

For partners processing local settlements or user payouts, Obiex’s fiat rails offer one of the fastest and most compliant NGN ramps available, without the integration nightmare of dealing with multiple third-party providers.

API Integration Tips

- Run parallel environments: Before going fully live, mirror your production environment in staging. Sync key metrics, trade volumes, latency stats, and failover responses to observe how the API behaves under live-like loads.

- Monitor early activity with manual overrides: In the first 24–72 hours of go-live, keep ops teams on standby with override access. Implement temporary throttling rules, rollback buttons, and hot-patch fallbacks. Even well-documented APIs can behave differently when exposed to edge-case inputs in real trading.

- Build feedback loops with engineers and ops teams: Set up real-time logs and structured feedback loops between your backend engineers, product leads, and compliance ops. Track API errors, response times, and data mismatches with timestamps and tags. Use automated alerting (like Slack or PagerDuty integrations) to flag anomalies instantly.

To Recap

- A full audit checks five areas: performance, security, compliance, documentation, and scalability.

- APIs must support KYC/KYB and AML features to meet tightening regulatory standards.

- APIs should allow efficient settlements, including batch payouts and multi-chain transfers.

- Factors to consider in your crypto API audit checklist include uptime and latency tracking; authentication and access control; compliance and AML triggers; real-time liquidity and market data; settlement and payout workflows; logging, monitoring, and and audit trails; sandbox environments and versioning; documentation and developer experience; and support, SLAs, and incident response.

- Obiex offers a modular API that supports wallets, swaps, and settlements with scalable infrastructure.

Want an infrastructure partner that scales with your volume?Join top African fintechs using Obiex’s API to settle $5M+ monthly.

👉 Explore Obiex’s B2B crypto API.

FAQs

Q1. What’s the difference between a crypto API audit and a security audit?

Crypto API audits check for speed, uptime, and usability. Security audits focus on code vulnerabilities and penetration tests.

Q2. How often should we review our trading API setup?

At least once per quarter or after major updates or scaling events.

Q3. Can I use Obiex’s API in sandbox mode?

Yes, Obiex provides full sandbox environments to test trades, settlements, and withdrawals.

Q4. What data security standards does Obiex follow?

Obiex follows ISO 27001, GDPR, and PCI DSS guidelines for enterprise-grade security.

Q5. How quickly can I go live with Obiex?

Typical go-live time is under 48 hours, with onboarding support.

Q6. What’s Obiex’s API uptime guarantee?

Obiex maintains a 99.95% uptime SLA with 24/7 status monitoring.

Q7. Can we integrate Obiex’s API with our existing wallet infrastructure?

Yes, Obiex supports flexible integration with wallets, custodians, and KYC tools.

Q8. Does Obiex support cross-chain payouts?

Yes, Obiex allows cross-chain payouts in multiple stablecoins and tokens.

Q9. What if my volume spikes suddenly?

Obiex’s API is auto-scalable and load-tested for high-volume scenarios.

10. How do I access Obiex’s API documentation?

Visit obiex.finance or contact support for access.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.