What is Money Dysmorphia? And how it affects your finances

Money dysmorphia is an emotional and psychological condition where your perception of your financial situation doesn’t align with reality.

We all tend to have very complicated relationships with money because it is a part of our existence that we cannot escape.

For a lot of us, money management can feel like skating on thin ice because of the fragile balance between income and expenses—income volatility, unpredictable costs, debt pressure—the whole nine yards.

But what happens when your perception of money starts to affect your mental, emotional and even physical well-being?

This phenomenon has a name: Money Dysmorphia.

I know, I know. It sounds serious, right? It is.

In this article, I will break down everything you need to know about money dysmorphia:

- what it means,

- how it manifests,

- the root causes,

- and how to overcome it

💸So keep reading!

What is Money Dysmorphia?

While this term is relatively new, there’s a chance you or someone you know has experienced it.

Money dysmorphia is an emotional and psychological condition where your perception of your financial situation doesn’t align with reality.

Picture this: You have N50k in your bank account right now, which is enough to cover all your needs for the week, but instead of feeling good about it, you are worried about it not being enough.

Or you saved N200k for a new gadget, and after buying it, you start to feel guilty about spending the money at all, even though you budgeted for it.

“What if I run out?”

That’s what money dysmorphia is. It makes you worry about things that aren’t true.

People who experience money dysmorphia tend to obsessively check their bank accounts, avoid spending money even on necessities and constantly worry about not having enough—even when they are financially stable.

This condition is often rooted in anxiety and a distorted perception of one's financial situation, leading to stress and feelings of inadequacy.

Money dysmorphia doesn’t discriminate- it can affect any and everyone regardless of their socioeconomic status.

From the minimum wage earner who is in constant fear that they don’t have enough to the highly paid tech professional who hoards wealth out of fear of future scarcity.

This condition can undermine a person's sense of security, and even those with stable or growing incomes may grapple with irrational fears of impending financial disaster, causing them to restrict their spending or over-saving to the point where they miss out on opportunities to enjoy their earnings.

What Are The Root Causes of Money Dysmorphia?

Money dysmorphia doesn’t just happen It’s often the result of several factors, many of which are intensified in African societies.

1. Working Multiple Jobs: The reality for most of us is that one job isn’t enough to make ends meet.

You might need to work two, three or even four jobs at the same time with side hustles to make ends meet.

Despite the hustle, the fear of not having enough or losing what little financial security you have can make you feel like you’re always behind, even when you're doing okay.

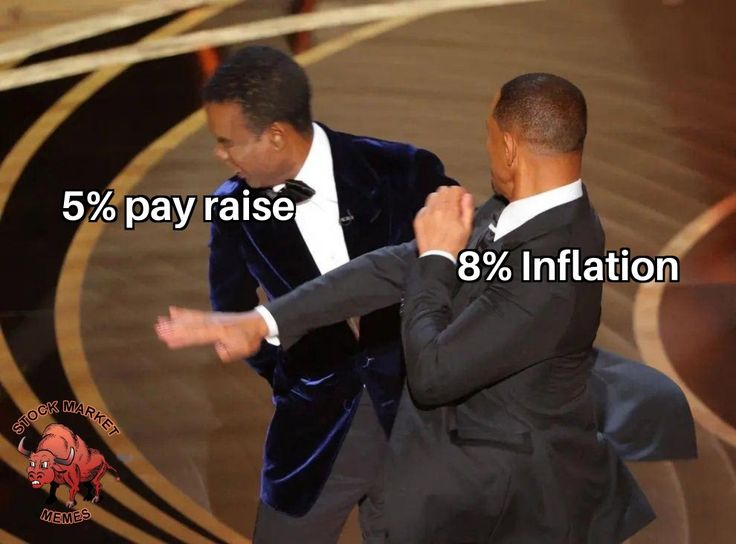

2. Economic Instability: When it comes to financial security, most of us face an uphill battle because we live in countries with volatile economies, high inflation, and frequent currency devaluation.

We often remember the financial crises our parents went through and that history plays a role in how we view money today.

Even those in relatively stable financial positions carry an underlying fear that everything could fall apart at any moment.

3. Cultural Pressure: For instance, in Africa, where societal expectations are high, there is undeniable pressure to “make it” early in life, especially because success is often measured by material wealth.

Whether it's to take care of family members, pay school fees, build a house, or live up to societal standards, this can lead to an obsession with accumulating and holding onto money.

How does Money Dysmorphia Manifest?

Understanding the telltale signs of money dysmorphia is the first step to identifying if you or someone you know is dealing with it.

A few signs are:

1. Underspending: Have you ever refused to buy something you needed, not because you couldn’t afford it, but because you believed you shouldn’t spend the money?

For example, you need a new laptop bag because the one you have is worn out.

You have enough money saved to buy the bag, but instead, you convince yourself not to spend it, even though you can easily afford it. You think, “I shouldn’t spend this X Naira, just in case,” or “I don’t deserve to spend on myself right now.”

This is underspending—not buying something you actually need not because you can’t afford it, but because you feel like spending the money is a waste. This form of self-deprivation is a subtle sign of money dysmorphia.

2. Fear of Checking Your Account: I know we joke about the fear of checking our account balances after buying groceries or “splurging on” skincare, but did you know that it can be a sign of money dysmorphia?

When you avoid checking your account, it’s often because you are worried that there, somehow, won’t be enough even when you know you’re covered. This stress can stop you from feeling in control of your money, making it more difficult to plan and manage your finances calmly.

3. Guilt: Feeling guilty about spending money is something many people struggling with money dysmorphia experience.

You need to buy groceries, which is an essential because man must chop, but as soon as you do, a guilty feeling washes over you. You start to think that spending any money is wasteful, even when it’s on a basic necessity.

This guilt also manifests more when you (temporarily) beat the Aka Gum allegations and decide to treat yourself.

Maybe you want to buy a new dress or go out for a nice meal, but instead of enjoying the moment, your mood is ruined because you feel like you shouldn’t be spending money on yourself at all.

This mindset can lead to avoiding even essential purchases, convincing yourself that they’re extravagant.

4. Devaluing Your Worth: I know this sounds very extreme, but if you’ve ever thought, “I don’t deserve this much money” or “I’m not worth being paid this much,” that’s money dysmorphia talking.

You sabotage your financial success.

You may get a job offer with a salary that you feel is too high for you and instead of celebrating, you start to think, “I don’t deserve it. I shouldn’t accept it.” This feeling can cause you to turn down opportunities that’ll benefit you financially, all because you don’t believe in your value.

Similarly, if you’re a freelancer or an entrepreneur you may undercharge for your services and this doesn’t just limit your income but also sends a message to others that you don’t value your skills.

How to Overcome Money Dysmorphia

Now that you know what money dysmorphia is and how it can rear its ugly head, how can you overcome it?

Here are five simple steps to beating money dysmorphia.

1. Have an Attitude adjustment: The first step, as with all things, is to change your mindset about finances. What are some negative thoughts you have about and towards money? Let me help you list some of them out;

- "If I spend this money now, I’ll regret it later."

- "I’ll never have enough money."

- "What if an emergency happens and I’m not prepared?"

- "I’m going to run out of money.

Instead of those, try these:

- "I have enough money to meet my needs right now."

- "I can handle unexpected expenses if they arise."

- "I deserve to earn money for my skills and hard work."

- "I am doing the best I can with my finances, and that’s enough." - Yes, you are!

2. Have a Realistic Budget: Budgeting is another great way to take control of your finances and build a healthier relationship with money.

Track your income, expenditures and savings, and ensure your budget reflects your reality, not your fears. Start by allocating money for essentials, savings and a bit of self-care. This will help balance your spending guilt with your need to save responsibly.

3. Set Realistic and Specific Financial Goals: Instead of setting goals like "I want to make more money," set goals that are SMART - specific, measurable, attainable, relevant and time-based.

For example, you may plan to save 20% of your income each month or pay off a debt by a certain date. Break down your bigger goals into smaller, manageable steps.

4. Talk About It! Yes, we all hate talking about money, especially in African cultures.

The subject of money is taboo, which makes it harder to open up about financial struggles, but talking to a financial advisor, a friend, or even a therapist can help you gain perspective.

5. Set Boundaries Around Work and Money: If you’re always working to make more money and never taking a break, you will be burnt out.

While having multiple jobs is glorified these days, it’s important to find (or create!) balance. Set boundaries with your time and remind yourself that making money should not come at the expense of your mental or physical health.

Bonus Tip: Practice Gratitude!

Money dysmorphia thrives on the fear of scarcity. Combat this by practising gratitude.

Take time to reflect on what you already have, whether it’s a steady income, a supportive network or good health.

Gratitude can shift your mindset from lack to abundance.

To Recap

- Navigating your financial journey is more than just managing money; it requires understanding your emotional relationship with it.

- While money dysmorphia is not a term you hear every day, it’s a very real issue that many people experience in silence.

- Although it can be overwhelming, it is important to remember that it is a mindset, not a reality. With awareness, you can start taking control of your financial outlook and build a healthier relationship with money.

So, take a deep breath, give yourself a break and trust that you're doing better than you think!

Good luck in your financial journey!

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.