Table Of Contents

- What are Flash Coins?

- How Do Flash Coins Scams Work?

- What Are the Risks of Flash Coin Scams?

- The Relationship Between Cryptocurrency Confirmation and Flash Coin Scams

- How is a Bitcoin transaction confirmed?

- How to Avoid Flash Coins Scams

- Red Flags to Watch for in Cryptocurrency Transactions

- FAQs

Flash coin scams are popular scams that traders and cryptocurrency users fall victim to.

In this article, we explain flash coins, how scams work, and how to avoid them.

What are Flash Coins?

A flash coin is a cryptocurrency that is sent to your wallet but doesn't stay there for long. It can be any cryptocurrency, such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), or Solana (SOL).

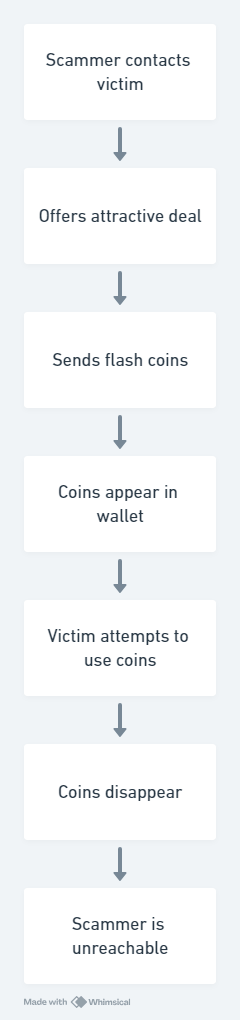

How Do Flash Coins Scams Work?

Flash coins are often sent by scammers or fraudsters. They use Peer-to-Peer (P2P) trading, a way of buying and selling cryptocurrencies in which traders buy and sell directly with each other on a cryptocurrency exchange app or website.

P2P trading can also happen off the app or website.

How? Traders can directly interact with each other on a messaging platform like Telegram, negotiate terms, and trade cryptocurrency with each other as they would on an official platform or exchange.

What Are the Risks of Flash Coin Scams?

Flash coin scams can result in financial losses and damaged trust in cryptocurrency trading. The risk comes from:

- Double-spending attempts: Scammers try to use the same coins for multiple transactions.

- Insecure P2P trades: Dealing with unverified traders outside of secure platforms increases the risk of scams.

- Fake confirmations: Scammers can deceive you into thinking a transaction is complete before the network has validated it.

Examples of Flash Coin Scams

- The Telegram Trade Gone Wrong: A trader received 0.5 BTC in their wallet after agreeing to a deal on Telegram. However, the coins disappeared before the network confirmed the transaction, and the trader lost $15,000.

- Invalid Ethereum Transaction: A buyer sent ETH for a purchase, but the transaction was rejected by the network’s nodes after 15 minutes. The seller vanished, leaving the buyer without their ETH or the product.

The Relationship Between Cryptocurrency Confirmation and Flash Coin Scams

Every cryptocurrency has a confirmation time, which is the time it takes for a transaction to be validated and added to the blockchain.

For example, Bitcoin transactions are typically confirmed in about ten minutes. However, flash coins don't follow this regular confirmation period.

Flash coins appear in your wallet, making you think the transaction was successful. However, the coin disappears from your wallet after some time, leaving you confused about what happened.

It may appear like your wallet was hacked, but in reality, it could be a flash coin sent to you.

However, please note that not all flash coins are scams or scam coins. Sometimes, transactions are rebroadcasted (resent on the blockchain after some hours), and it makes the initially sent coin become invalid. It's only a flash coin scam if the coin never appears in your wallet again.

These coins often vanish because they are invalid and rejected by the nodes in the blockchain network.

Double-spending is when you use the same cryptocurrency for multiple transactions. Sometimes, the person initiating the transaction may modify the blockchain to reclaim the spent coins.

However, these modified transactions are eventually rejected and considered invalid by the network's nodes.

Nodes are like the committee overseeing and recording all transactions on the blockchain.

It's important to be cautious and wait for proper blockchain network confirmation before considering a transaction as fully complete.

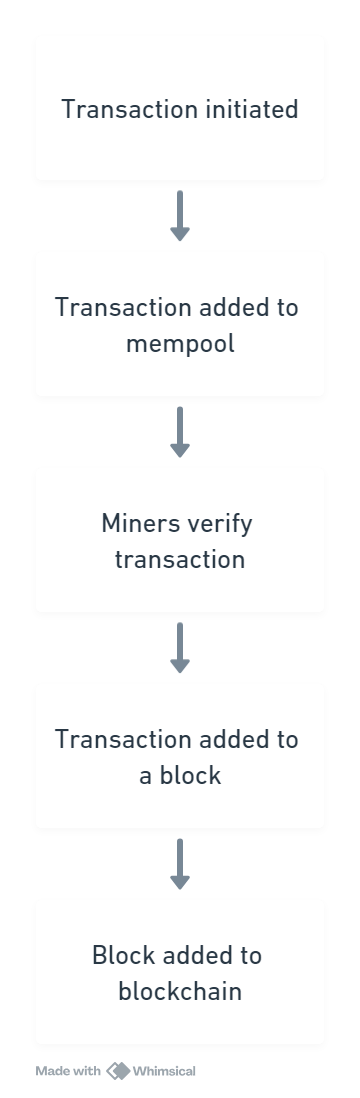

How Is a Bitcoin Transaction Confirmed?

Once you send a Bitcoin transaction, it must be confirmed before it's considered final. Confirmation happens when the transaction is added to a "block" of transactions.

Miners compete to solve a math problem, and the first one to solve it gets to add the block to the blockchain, which is like a public ledger.

Each block takes about 10 minutes to be added, and once it is, the transaction becomes more secure and harder to change.

The more blocks added after it, the more confident you can be in the transaction's validity.

To be safe, it's recommended to wait for a certain number of confirmations before considering a transaction as truly confirmed.

- For transactions under $1,000, one or two confirmations may be enough.

- For transactions between $1,000 and $10,000, wait for at least three confirmations.

- For larger transactions over $10,000 or more, wait for three or more confirmations before considering it fully confirmed.

By waiting for these confirmations, you can have more confidence that your Bitcoin transaction is secure and irreversible.

How to Avoid Flash Coins Scams

Here are three ways to avoid or at least lower your chances of falling for a flash coin scam:

- Trade with people you trust. Carrying out your P2P trades with a trustworthy person will save you a lot of headaches. The risk of them scamming you cannot be ruled out, but it's a better chance to take than doing business with a stranger or someone you barely know.

- Use a crypto exchange that offers P2P. The traders here are vetted, and resolutions will likely be handled better.

- If you're buying crypto from an unfamiliar trader, always ask for a priority fee. Priority fees help confirm transactions quickly.

- You can ask for their sellers' hash IDs or copy and paste their addresses on the blockchain explorer. It will show the transaction process and tell you whether it is invalid or valid.

Red Flags to Watch for in Cryptocurrency Transactions

Identifying early warning signs can help you avoid flash coin scams. Look for:

- Too-good-to-be-true offers: Deals that seem unrealistically favourable are often scams.

- Unverified traders: Avoid transacting with unknown or unverified users, especially in P2P trading.

- Transactions that vanish quickly: If coins disappear from your wallet shortly after appearing, it could be a flash coin scam.

- Requests for off-platform trades: Traders asking to complete transactions outside official platforms is a major red flag.

FAQs

Q: Can Flash Coins be reversed or cancelled after disappearing from my wallet?

A: Flash coins typically cannot be reversed or cancelled once they disappear from your wallet because the blockchain network often rejects invalid transactions

Q: Are flash coin scams specific to a particular cryptocurrency, or can they happen with any coin or token?

A: Flash coin scams can potentially happen with any cryptocurrency, not just a specific one. Scammers use this tactic to target coins and tokens, including BTC, ETH, SOL, XRP and others.

Q: Are flash coin scams more common in Peer-to-Peer (P2P) trading or on regular cryptocurrency exchanges?

A: Flash coin scams can occur in both P2P trading and regular exchanges. However, they are more commonly associated with P2P trading due to the direct interaction between traders.

Q: Are there any warning signs or red flags to watch for when dealing with flash coin transactions?

A: Some warning signs include transactions that seem too good to be true, unverified or unfamiliar traders and transactions that disappear from your wallet shortly after appearing.

Q: What should I do if I suspect a flash coin scam or have fallen victim to one?

A: If you suspect a scam, stop further transactions, report the issue to the platform or exchange you used, and consider reporting it to relevant authorities. If you've fallen victim, it's important to act quickly to minimise potential losses.

Q: Can I trust cryptocurrency exchanges to protect me from flash coin scams?

A: While reputable exchanges like Obiex offer security features and dispute resolution services, they cannot guarantee protection against flash coin scams. Users must be cautious when conducting cryptocurrency transactions.

Q: How Many Confirmations Should I Wait for Before Considering a Transaction Secure?

A: For transactions under $1,000, one or two confirmations may be enough.

For transactions between $1,000 and $10,000, wait for at least three confirmations.

For larger transactions over $10,000 or more, wait for three or more confirmations for full security.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.