Table of Contents

- What Are the Day-to-Day Issues?

- How Stablecoins Solve These Problems

- Practical Use Cases

- Why Obiex Is the Go-To for Stablecoin Business Payments

- How to Get Started: Using Obiex for Your Business

- To Recap

- FAQs

This article explains how African businesses are using Obiex to manage their stablecoin transactions.

It’s written for business owners, importers/exporters, freelancers, and entrepreneurs who want a simple and secure way to transfer money, without the headaches of foreign exchange (FX) issues or hidden bank charges.

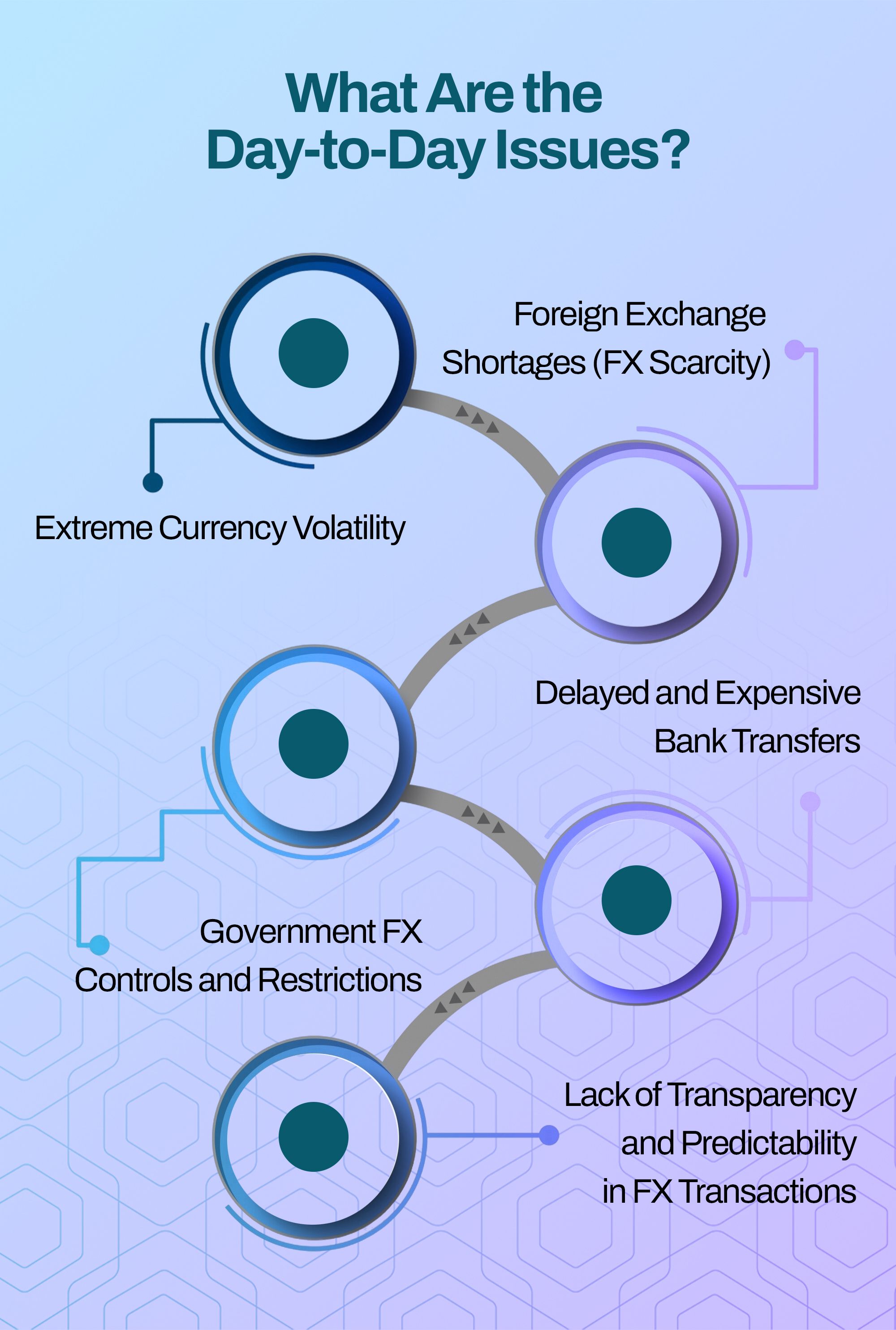

What Are the Day-to-Day Issues?

1. Foreign Exchange Shortages (FX Scarcity):

Many African central banks struggle to supply enough U.S. dollars to meet the demand from importers and businesses.

This shortage forces business owners to turn to black market sources at extremely high exchange rates.

For businesses that import machinery, electronics, or raw materials, this FX shortage directly affects their ability to restock, meet client deadlines, or grow sustainably.

It also leads to pricing instability, since many businesses must frequently adjust prices to reflect the unpredictable cost of foreign exchange.

2. Extreme Currency Volatility:

Currency instability is one of the most serious problems African businesses face when dealing with cross-border trade.

In Nigeria, the naira has seen more devaluations between 2021 and 2025 than it did in the previous decades.

Although not as wide-ranging as Nigeria, these devaluations have also spread to Ghana, with the cedi facing significant instabilities from time to time. These shifts drastically affect everyday operations.

For instance, a business that owes $5,000 to a supplier may suddenly need twice the local currency to settle the same bill just a few weeks later. This kind of volatility makes it almost impossible to plan or budget properly.

Even after negotiating a good deal with a supplier, businesses often face losses when the exchange rate changes before they can make the payment.

As a result, entrepreneurs are forced to increase their prices frequently, absorb losses, or delay operations, all of which reduce their competitiveness and profitability.

3. Delayed and Expensive Bank Transfers:

African businesses trying to make international payments through traditional banks often face long delays and high fees. A single international wire transfer can take between 3 to 7 business days, depending on the bank and destination. Sometimes, banks put additional holds on funds due to compliance checks or regulatory red tape.

This causes serious timing issues, especially when dealing with global suppliers who expect fast and reliable payments. On top of that, bank charges for international transfers can range from $25 to $50 per transaction, excluding hidden currency conversion costs.

For small and medium-sized businesses, these fees add up quickly, and yet the service remains inefficient. Delayed payments can lead to lost supplier relationships, cancelled orders, late shipments, and strained operations.

These inefficiencies make international trade more risky and less attractive for African SMEs.

4. Government FX Controls and Restrictions:

In many African countries, governments have introduced strict policies on how foreign currency can be accessed or used. These FX controls are meant to protect national reserves, but they end up making things harder for legitimate businesses.

In Nigeria, for instance, the central bank has a long list of “banned” items that businesses are not allowed to pay for using official FX channels. This includes important goods like rice, vegetable oils, spaghetti/noodles, cement, and even some types of machinery.

As a result, even when businesses can show proper documentation, they’re denied access to the FX they need.

In Ghana and Cameroon, restrictions often take the form of long approval processes or low FX allocation limits per business.

These rules delay operations and increase reliance on unofficial markets, where prices are unstable and trust is limited. Ultimately, these policies create a system where businesses can’t plan ahead or operate freely in the global market.

5. Lack of Transparency and Predictability in FX Transactions:

A common frustration for business owners is the lack of transparency when dealing with banks and currency exchanges. Rates can change without notice, hidden charges are common, and businesses often don’t know the final cost of a transaction until it’s completed.

This unpredictability makes it extremely difficult to budget or forecast cash flow. For example, a business might expect to pay a supplier $10,000, only to realise after fees and unfavourable rates that they’ve spent significantly more than expected.

Some banks and transfer services also operate on batch schedules, meaning payments are grouped and processed at the end of the day or later. This adds delays and leaves businesses uncertain about when their money will actually reach its destination.

For SMEs with tight profit margins and fast-moving inventory, these kinds of delays and uncertainties can disrupt entire supply chains.

How Stablecoins Solve These Problems

1. Protecting Business Funds from Currency Devaluation:

African currencies are often unstable due to inflation, political shifts, and central bank policies. When businesses keep their earnings in local currencies, they risk losing value almost overnight.

Stablecoins give businesses the ability to store value in digital dollars instead. For example, converting ₦1 million to USDT in May 2023 would have preserved more than twice its local purchasing power by mid-2024, compared to holding that amount in naira.

2. Sending Cross-Border Payments Without FX Delays:

Bank-based cross-border payments can take days and often require documentation that delays transactions. FX shortages make it worse, especially in Nigeria, where businesses must queue for access to official FX rates or buy at inflated black-market prices.

Stablecoins make it possible to send value across borders in minutes. A business in Nigeria can pay a manufacturer in China instantly, without going through paperwork or FX approval. This speeds up production cycles, inventory turnover, and overall efficiency.

3. Providing Access to the Dollar Without the Black Market:

In many African countries, access to US dollars is tightly restricted or overpriced through informal markets.

Stablecoins offer a legal and efficient alternative for holding and transacting in dollars.

Businesses can move in and out of stablecoins as needed, avoiding the risks of black-market rates or fluctuating parallel market prices.

4. Lowering Costs of Transactions:

Traditional international transfers can be expensive, with banks and remittance services charging high fees and offering poor exchange rates.

Stablecoin transfers, on the other hand, have significantly lower costs, often just a fraction of what banks charge. This allows businesses to save money on every transaction, especially when dealing with multiple international partners or regular cross-border flows.

5. Improving Transaction Speed and Reliability:

Stablecoin transactions are processed on blockchain networks that operate 24/7. This means businesses don’t have to wait for banking hours, weekends to pass, or payment clearance delays.

Whether it's Saturday evening or Monday morning, transactions go through quickly, reducing operational friction and helping businesses move faster.

6. Enhancing Transparency and Record-Keeping:

Stablecoin payments create digital records that are secure, tamper-proof, and easily traceable. This is useful for bookkeeping, audits, and verifying transactions.

Unlike some informal payment channels that leave no trail, stablecoin transfers give businesses clear, time-stamped proof of every payment sent or received.

7. Removing Barriers to Global Trade:

Many African businesses are limited by a lack of access to global financial infrastructure, such as USD accounts or international credit cards.

Stablecoins remove these barriers by giving businesses a dollar-equivalent tool they can use to transact globally.

This expands the reach of African SMEs, enabling them to work with suppliers, freelancers, and customers anywhere in the world, without traditional financial limitations.

Practical Uses

Let’s look at a few practical use cases of how traders from Nigeria, Ghana, and Cameroon can use stablecoins on Obiex.

Use Case 1: A Nigerian Trader Paying a Supplier in China

Chuka runs a clothing business in Lagos, Nigeria. He buys his goods from a supplier in Guangzhou, China. Normally, he had to go through black market agents to get dollars, often losing money in the process.

Now, Chuka uses USDT for his business payment through Obiex. He:

- Buys USDT on Obiex with Naira

- Sends USDT to his supplier in China

- The supplier receives the funds in minutes

- No delay, no overcharging, no paperwork

What changed for Chuka?

He no longer worries about Naira losing value while waiting for the bank to process his transaction.

Use Case 2: A Ghanaian E-commerce Brand Hedging with USDT

Ama owns an online skincare brand in Accra. During the 2022 economic crisis, the Cedi lost a significant percentage of its value in a few months. Her business suffered heavy losses.

To protect her money, Ama now stores profits in USDT on her Obiex crypto wallet. This way:

- Her profits don’t lose value due to local inflation

- She can easily pay international suppliers in stablecoins

- She converts only what she needs into Cedis to run local operations

How does this make Ama a better business person?

This gives her full control and helps her plan better for the future.

Use Case 3: A Cameroonian Freelancer Paid in Stablecoins

Jean, a web developer in Douala, works with clients in Europe and the U.S. Before, he relied on PayPal or bank transfers, which took a long time and cost him extra fees.

Now, clients pay him in stablecoins (USDT), and he withdraws in XAF using Obiex. The benefits:

- No international banking delays

- No hidden charges

- He can hold his earnings in stablecoins and withdraw whenever he wants

- He avoids losses from currency depreciation

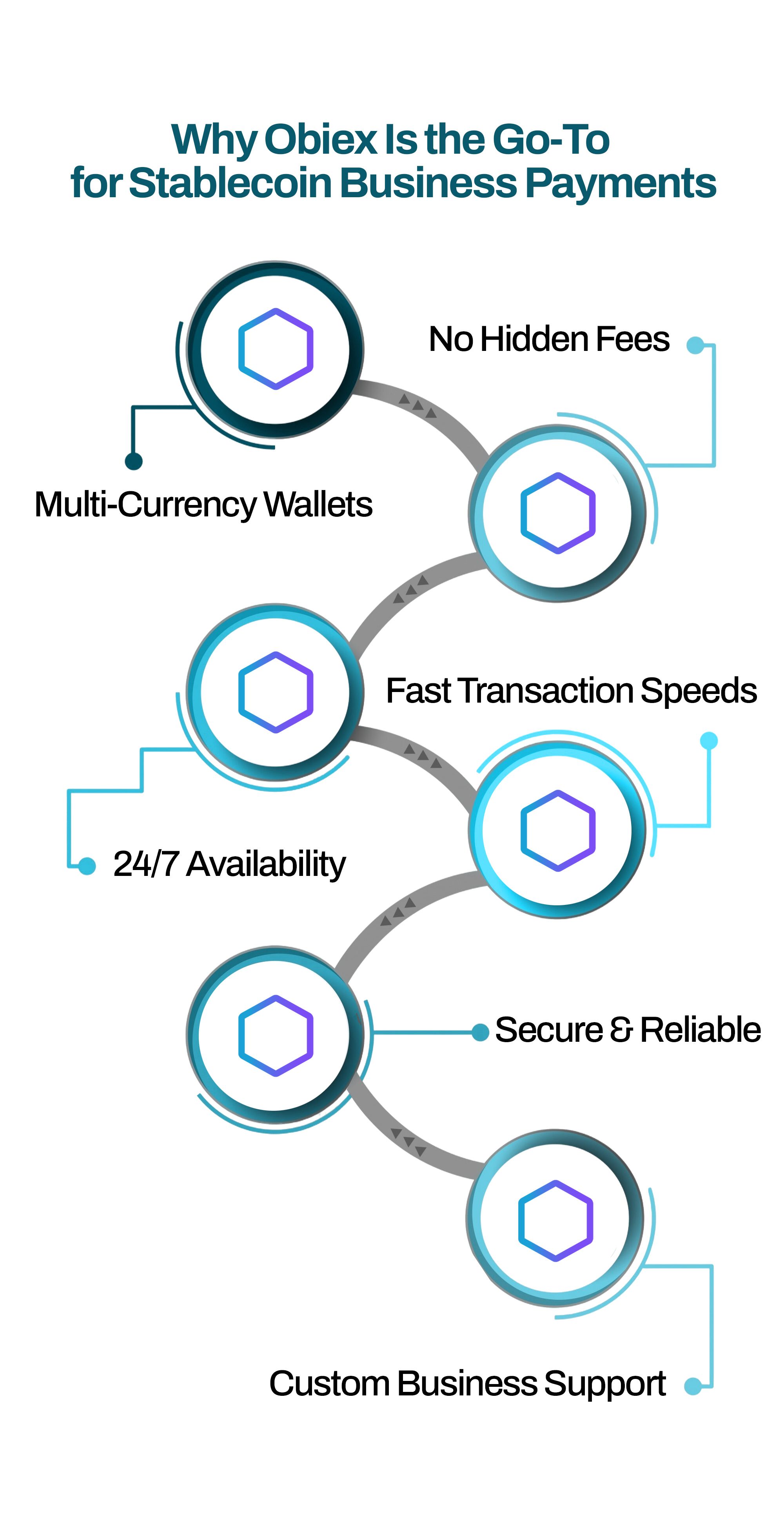

Why Obiex Is the Go-To for Stablecoin Business Payments

There are many crypto platforms out there, but Obiex stands out for African businesses. Here's why:

- No Hidden Fees: You can use USDT for business on Obiex without hidden charges.

- Multi-Currency Wallets: You can receive and convert stablecoins to NGN, GHS, or XAF instantly.

- Fast Transaction Speeds: Payments are completed within minutes, not days.

- 24/7 Availability: Obiex works around the clock (including the customer service representatives). There are no “banking hours.”

- Secure & Reliable: Obiex follows strict crypto security standards and compliance practices to keep your funds safe.

- Custom Business Support: You can get support tailored for your type of business and country.

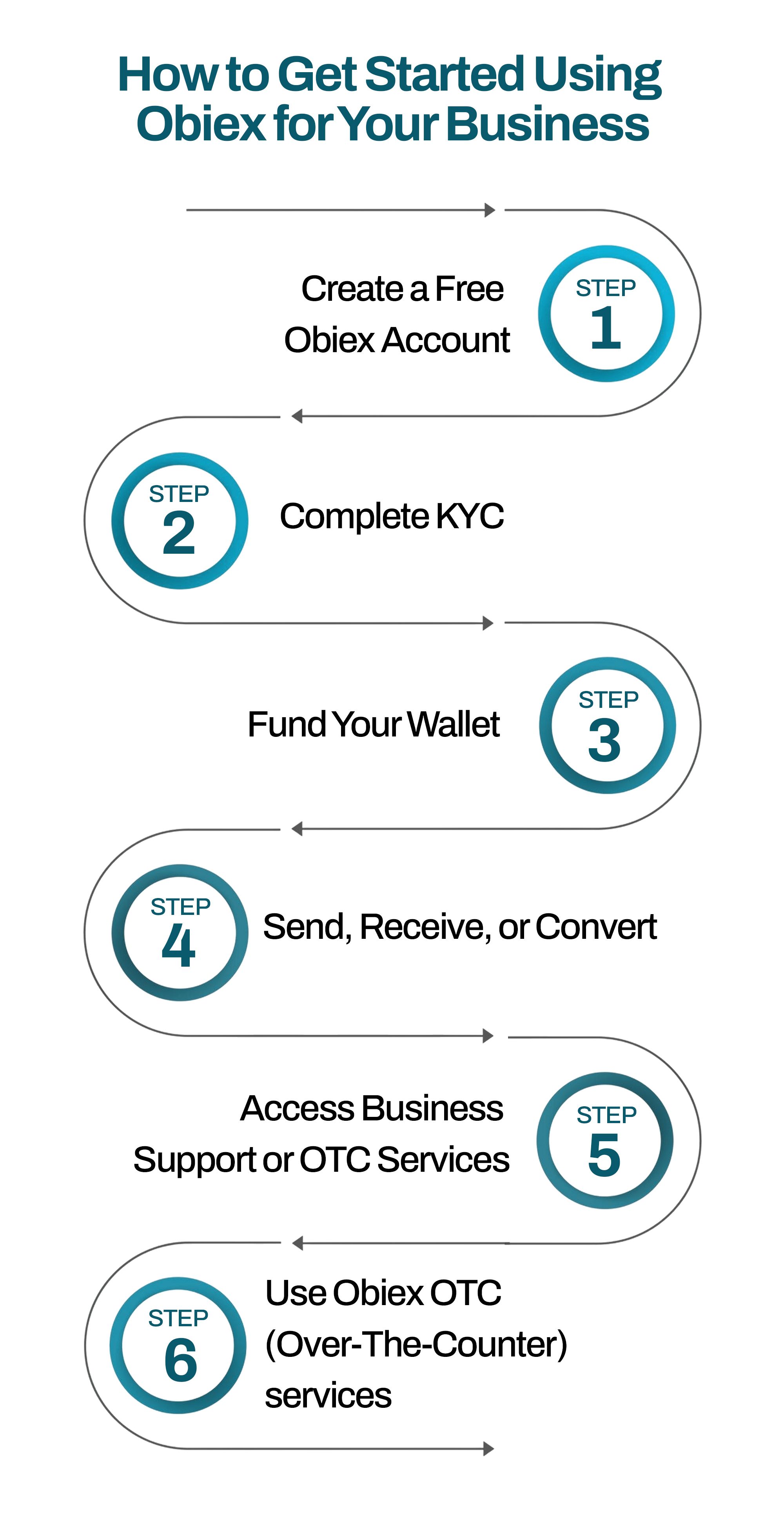

How to Get Started Using Obiex for Your Business

Step 1: Create a Free Obiex Account

Go to obiex.finance, or download the Obiex app on your mobile device, and sign up with your business or personal email.

Step 2: Complete KYC

Upload a valid ID and basic documents. This takes just a few minutes.

Step 3: Fund Your Wallet

You can fund your wallet with NGN, GHS, or crypto like USDT.

Step 4: Send, Receive, or Convert

Use your Obiex business crypto wallet to:

- Pay international suppliers with stablecoins

- Send USDT from Nigeria to China, or any other country

- Convert stablecoins to local currency instantly

Step 5: Access Business Support or OTC Services

Obiex also provides official B2B support for African businesses that want customised crypto solutions.

We offer:

- Business onboarding and walkthroughs

- Bulk or recurring payment solutions

- Regulatory guidance for crypto payments

- Settlement in multiple currencies (NGN, GHS, XAF)

📩 Email us at [email protected] to set up a call with our team.

Step 6: Use Obiex OTC (Over-The-Counter) services:

👉Do you want to buy or sell large amounts of USDT or BTC (₦5M and above)?

Here’s how it works:

- Email [email protected] with your request. Or click “OTC desk” on the Obiex website to fill out a request form.

- Our OTC desk will confirm the current rate and transaction details.

- Once agreed, you send funds or crypto.

- We settle directly into your wallet or bank account, fast and secure.

To Recap

- Stablecoins protect business funds from local currency devaluation by storing value in a digital dollar equivalent.

- Businesses can make cross-border payments instantly with stablecoins, avoiding FX delays and paperwork.

- Obiex offers zero hidden fees and transparent stablecoin transactions.

- Users can withdraw stablecoins instantly to local currencies like NGN, GHS, or XAF through Obiex.

- Obiex provides detailed transaction history, improving record-keeping and professional accountability.

- The Obiex wallet supports multiple currencies, making it easy to manage payments across regions.

- Obiex offers 24/7 stablecoin liquidity, allowing businesses to act quickly at any time.

- Obiex is preferred for business payments due to no hidden fees, fast transfers, 24/7 service, and secure infrastructure.

👉Are you ready to move your business forward?

Use Obiex to pay, receive, and convert stablecoins across Africa. It is fast, secure, and with zero hidden fees.

FAQs

Q1. What are stablecoins in Africa used for?

They are used by businesses to store value, pay suppliers, and receive payments in USD-equivalent crypto like USDT.

Q2. How do I pay international suppliers with stablecoins?

Just buy USDT on Obiex, send it to your supplier’s crypto wallet, and you’re done, usually in minutes.

Q3. Can I convert stablecoins to local currency on Obiex?

Yes. You can convert USDT to NGN, GHS, or XAF instantly on Obiex.

Q4. Is Obiex safe for business payments?

Yes. Obiex follows top industry security standards to protect your transactions.

Q5. How do I avoid currency devaluation in Africa?

By holding your business funds in USDT or another stablecoin instead of local currency.

Q6. Can I use Obiex even if I’m new to crypto?

Absolutely. Obiex is built to be simple, even for beginners.

Q7. What are the fees on Obiex?

Obiex charges zero hidden fees for stablecoin transactions and conversions.

Q8. Which stablecoins can I use on Obiex?

The main one is USDT, but Obiex also supports other popular stablecoins.

Q9. How do I withdraw local currency from Obiex?

Convert your stablecoin to NGN, GHS, or XAF and withdraw directly to your local bank or mobile wallet.

Q10. Can freelancers and SMEs use Obiex?

Yes. Whether you’re a freelancer or a large SME, Obiex works for all business sizes.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.