Table of Contents

- Why is It Important to Learn Money Management in Your 20s and 30s?

- What Money Management Mistakes are you making in Your 20s and 30s?

- What are the Best Methods to Manage Money in Your 20s?

- How Do You Manage Money in Your 30s?

- Investment Options for 20-Somethings and 30-Somethings

- Major Differences in Managing Money in Your 20s vs. Your 30s

- 5 Unconventional Money Management Tips & Rules

- 5 Must-Read Money Management Books

- 5 Money Management Quotes You Should Live By

- To Recap

- FAQs

Managing money can look very different depending on which stage of life you're in.

One moment, you are in your 20s, saving money to hang out with friends, buy that beautiful outfit you found online, or that device of your dreams.

Next thing you know, you are in your 30s, probably married with kids, with so many responsibilities and bills to pay that it seems impossible to save up for your financial goals.

For many, the financial goals and challenges of their 20s are extremely different from those in their 30s.

In your 20s, your goal might be to visit a fancy country for a vacation and retire by the time you are 40, but when you get to your 30s, you begin to realise that you might just push that retirement goal forward by a decade.

At this point, the goal might be reduced to getting just enough money to survive and take care of responsibilities. This is when you start developing a strong belief that, indeed, “Adulthood is a scam.”

Although the approaches to managing your finances in your 20s and 30s are different, the best time to build a long-standing and productive finance management habit is in your 20s. You build on this habit in your 20s and modify it in your 30s.

In this article, you will learn money management tips tailored to people in their 20s and 30s. So, if you are still figuring out how to handle your finances, get in here!

Why is It Important to Learn Money Management in Your 20s and 30s?

Learning money management early on is important because the financial decisions you make in your 20s and 30s can have a long-term impact on your future.

In your 20s, you might be fresh out of school, starting your career, and probably earning an income for the first time. This is the perfect time to learn how to manage your money because you have fewer responsibilities, giving you more room to experiment with saving and investing.

Good money habits developed early can help you avoid debt, build a solid emergency fund, and grow wealth over time.

For instance, even saving just ₦20,000 a month in your 20s can add up to over ₦2.4 million in ten years—this doesn’t even include potential investment returns!

On the other hand, managing money in your 30s becomes more challenging as life’s responsibilities increase. By then, you might be thinking about buying a house or renting a better apartment, raising kids, or planning for retirement. Here is an article where 17 young Nigerians share how much they would need to retire.

If you didn’t develop solid money management habits in your 20s, it becomes harder to play catch-up in your 30s.

For example, not investing early might mean missing out on years of compound interest, making it more difficult to reach long-term goals.

Knowing how to invest in your 20s and how to save and invest in your 30s can be your key to financial security.

What Money Management Mistakes Are You Making in Your 20s and 30s?

In Your 20s:

1. Not Living Within Your Means:

In your 20s, you might feel the urge to upgrade your lifestyle because you’re now earning a steady income. Whether it’s buying a new phone every year or upgrading to the latest fashion trends, these small expenses add up quickly.

Many people in their 20s fall into the trap of "lifestyle inflation," where their spending habits increase as their income grows. Instead of saving for the future, they spend excessively on things like eating out, nightlife, and gadgets.

For example, if you spend ₦5,000 on lunch every day at a restaurant instead of packing meals, you could end up spending over ₦100,000 a month. This money could be better spent investing in mutual funds or saving in an emergency fund.

2. Neglecting to Start an Emergency Fund:

Many people in their 20s think they’re too young to worry about emergencies, so they don’t bother saving for one. Life is unpredictable, and unexpected costs, like a medical bill or car repair, can easily throw your finances off track.

If you don’t have an emergency fund, you might be forced to borrow money at high interest rates, which can lead to debt. A good and conventional rule is to save at least 3-6 months of living expenses.

So, if your monthly expenses are ₦200,000, aim to have at least ₦600,000 in an emergency fund. It might seem like a big task, but even setting aside a small amount each month can add up over time.

3. Ignoring Investment Opportunities:

In your 20s, it’s easy to focus on immediate wants instead of future growth. You might think investing is only for the wealthy or that it’s something to start later in life.

However, the earlier you start investing, the more your money grows due to compound interest.

For example, if you invest ₦50,000 a month in a stock portfolio that earns 10% annually, by the time you're 30, you could have over ₦8 million.

Investing in your 20s also allows you to take more risks since you have more time to recover from market downturns.

In Your 30s:

1. Failing to Adjust Your Budget for Growing Responsibilities:

By the time you’re in your 30s, you’re likely facing more financial responsibilities such as rent, heavier black tax, car loans, or children’s school fees.

One major mistake people make is not adjusting their budget to reflect these growing expenses.

For example, you might still be budgeting the same amount for leisure/enjoyment as you did in your 20s, even though your responsibilities have increased.

It’s important to regularly review your budget and cut down on unnecessary expenses to prioritise your financial obligations.

A helpful tip is to follow the 50/30/20 rule: 50% of your income goes to necessities, 30% to flexible expenses, and 20% to savings or investments.

2. Underestimating Retirement Savings:

Many people in their 30s focus on their immediate financial needs and postpone saving for retirement. However, this delay can cost you in the long run.

For example, if you wait until your mid-30s to start saving for retirement, you’ll need to set aside a much larger portion of your income compared to if you started in your 20s.

The earlier you start contributing to a pension fund or retirement savings account, the more interest and returns you’ll earn over time.

For instance, contributing ₦50,000 monthly to a retirement fund from age 30 could grow into millions by the time you retire, depending on the interest rate.

3. Taking on Too Much Debt:

It’s common to take on more debt in your 30s for things like a car, home, or education. However, many make the mistake of taking on too much debt without a solid repayment plan.

This often happens because of a desire to "keep up with the Joneses" or live beyond your means.

For example, if you take out a car loan with high monthly payments that leave little room for saving or investing, you might struggle to meet other financial goals.

It’s important to carefully evaluate your debt and prioritise paying it off before taking on new loans.

What are the Best Methods to Manage Money in Your 20s?

1. Create a Budget and Stick to It:

This means tracking your income and expenses to see where your money is going.

If you earn ₦100,000 a month, you might allocate ₦40,000 for rent (building it up monthly if your rent is annual), ₦20,000 for food, ₦10,000 for transportation, and ₦10,000 for savings.

This is just a practical example, so these figures are used randomly. Adjust them to your income and expenses. Use budgeting apps or spreadsheets to help you stay on track.

2. Build an Emergency Fund:

As mentioned earlier, aim to save at least three to six months' worth of expenses. If your monthly expenses are ₦50,000, having ₦150,000 to ₦300,000 saved can provide a financial cushion in case of unexpected events like job loss or medical emergencies.

This fund should be kept in a separate savings account to avoid spending it on regular expenses.

3. Start Investing Early:

Even small amounts can grow over time with compound interest. For example, if you start investing ₦5,000 monthly at an average return rate of 10%, you could have over ₦1 million saved by the time you’re 30.

Look into options like mutual funds, stocks, or government savings bonds. Starting early means you have more time for your money to grow.

4. Pay Off High-Interest Debt:

Managing money in your 20s also means handling any existing debt. Focus on paying off high-interest debt as quickly as possible. Paying it off promptly will save you from accumulating more interest.

5. Save for Retirement:

It might seem early, but starting to save for retirement in your 20s can have huge benefits.

You can contribute to retirement accounts such as the Nigerian Pension Scheme or a personal retirement savings account (RSA). Even small contributions now can lead to a substantial retirement fund eventually with compound growth.

If you save ₦10,000 monthly in a retirement account with a 7% annual return, you could end up with a significant amount by the time you retire.

6. Live Below Your Means:

Instead of upgrading your lifestyle each time you get a raise, continue living modestly.

If you receive a ₦20,000 salary increase, consider saving most of it rather than spending it immediately.

This approach helps build savings and investments without altering your lifestyle much.

7. Educate Yourself About Personal Finance:

Read books, attend seminars, and follow credible financial blogs or advisors. Understanding concepts like budgeting, investing, and debt management equips you with the knowledge to make informed financial decisions.

How Do You Manage Money in Your 30s?

1. Budgeting and Tracking Expenses:

Track all your expenses, from groceries to utility bills, and ensure you stick to your budget.

If you’re spending a significant amount on dining out or entertainment, consider cutting back and redirecting those funds towards savings or debt repayment. Tools like budgeting apps can help keep track of your spending.

2. Build an Emergency Fund:

Again, save towards an emergency fund. Having this always makes a huge difference.

3. Debt Management:

By your 30s, you might have accumulated various types of debt, such as business loans and bank loans. Prioritise paying off these high-interest debts first.

4. Retirement Savings:

Start focusing on retirement savings if you haven't already. The earlier you begin, the more you benefit.

Contribute to retirement accounts such as a pension plan or a personal retirement savings account.

5. Investing Wisely:

With a more stable income, consider investing in a diversified portfolio to grow your wealth.

Investing in real estate is often a smart choice, as property values can appreciate over time. Ensure you research or consult a financial advisor to make informed decisions that align with your long-term goals.

6. Insurance:

Ensure you have adequate health insurance, life insurance, and, if you own a home, property insurance. This protects you and your family from unexpected financial burdens.

If you have dependents, life insurance can provide financial support in case of unforeseen circumstances.

7. Saving for Children’s Education:

If you have children, start saving for their education. Open a dedicated education savings account and contribute regularly.

This preparation can ease the financial burden when it’s time for school fees or higher education expenses.

8. Financial Goals:

Reevaluate your financial goals and adjust them according to your current situation. If buying a new car or planning a family vacation is on your list, make sure to save for these goals systematically.

For example, if you plan to buy a new car in the next few years, set aside a portion of your monthly income into a savings account specifically for this purpose.

Investment Options for 20-Somethings and 30-Somethings

For 20-Somethings:

1. High-Yield Savings Accounts: One of the safest ways to grow your money in your 20s is by using a high-yield savings account.

This type of account offers a higher interest rate compared to traditional savings accounts.

If you open a high-yield savings account in Nigeria, you might earn interest rates of around 4% to 6% annually.

This is a great option for emergency funds or short-term savings goals. It helps you manage money with minimal risk.

2. Stock Market Investments: Many young people start by investing in individual stocks or exchange-traded funds (ETFs).

For example, you might invest in Nigerian companies like Dangote Cement or MTN Nigeria, or even international companies via global stock exchanges.

With stock investments, it’s important to do your research and consider using apps that allow you to buy and track stocks easily.

3. Cryptocurrency: You don’t need to invest in the expensive cryptocurrencies, like Bitcoin or Ethereum. There are many altcoins that are popular among younger investors due to their potential for high returns.

While they come with higher risk, they can be part of a diversified investment strategy. Sign up with Obiex to start your crypto investment journey now.

For 30-Somethings:

1. Retirement Accounts: A retirement account is a great investment. It allows you to save a portion of your income for retirement with tax benefits.

It’s a long-term investment that helps ensure you’re financially secure in your later years.

2. Real Estate: Real estate can be a lucrative investment as you move into your 30s, especially if you’re starting a family or looking for a stable asset.

Investing in property, whether it’s a rental apartment or commercial real estate, can provide steady income and appreciate in value.

Cities like Lagos and Abuja offer growing real estate markets where you might consider investing in property to secure long-term returns. Other Nigerian cities are also opening into the real estate market.

3. Mutual Funds: Mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities.

This can be a good way to reduce risk compared to investing in individual stocks.

Nigerian mutual funds managed by companies like Stanbic IBTC or UBA offer various options that cater to different risk tolerances and investment goals.

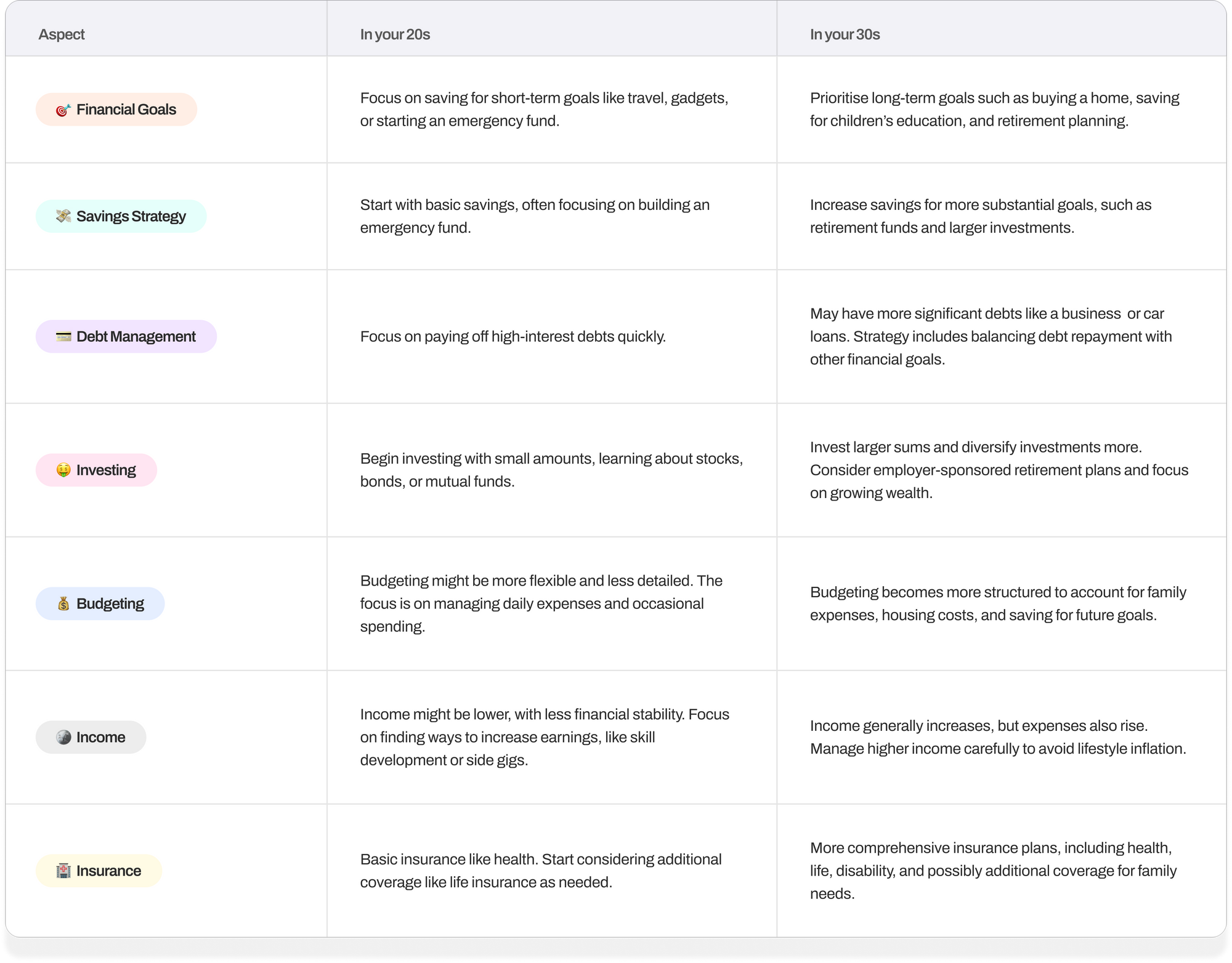

Major Differences in Managing Money in Your 20s vs. Your 30s

5 Unconventional Money Management Tips & Rules

1. Instead of just setting up a regular transfer to your savings account, try rounding up your everyday purchases to the nearest naira/dollar or currency you spend and saving the spare change.

2. While investing in the stock market is essential, investing in yourself can be even more rewarding. Consider spending on courses or certifications that could advance your career. This might mean spending money upfront, but the long-term benefits can greatly outweigh the initial costs, especially if it boosts your earning potential in your 30s.

3. Traditionally, the 50/30/20 rule divides your budget into 50% needs, 30% wants, and 20% savings. Add a twist by allocating a portion of the 'wants' category to a ‘dream fund’ for long-term goals like starting a business or early retirement.

4. Instead of just tracking expenses, try a zero-based budget where every Naira or dollar you earn is assigned a specific job, including savings, investments, and even fun money. This way, you will be intentional about every penny spent and saved, reducing waste and increasing efficiency.

5. Occasionally, give yourself a “no-spend” challenge for a week or a month. This means avoiding all non-essential purchases. It's a practical way to reset your spending habits and get a clear picture of where your money goes.

5 Must-Read Money Management Books

When it comes to managing money effectively, reading the right books can make a big difference.

For those looking to improve their financial skills, here are five must-read money management books that offer practical advice for both your 20s and 30s.

1. "The Total Money Makeover" by Dave Ramsey:

This book provides a straightforward approach to money management, focusing on budgeting, saving, and eliminating debt.

Ramsey’s method includes a step-by-step plan that can be particularly useful for those in their 20s who are starting to build a financial foundation.

2. "Your Money or Your Life" by Vicki Robin and Joe Dominguez:

This classic offers a comprehensive look at how to manage your money and make it work for you.

It includes strategies for tracking expenses and transforming your relationship with money, which can help those in their 30s who are managing more complex financial responsibilities.

3. "Rich Dad Poor Dad" by Robert Kiyosaki:

Kiyosaki’s book is a must-read for understanding the basics of investing and wealth building.

It contrasts different financial philosophies and provides practical advice on how to build wealth through smart money management.

4. "The Millionaire Next Door" by Thomas J. Stanley and William D. Danko:

This book studies the habits of wealthy individuals and reveals that many millionaires live frugally.

It’s a great resource for learning how to manage money wisely and save for long-term goals, whether you’re in your 20s or 30s.

5. "I Will Teach You to Be Rich" by Ramit Sethi:

Sethi’s book is tailored for young adults and covers essential money management tips, including how to save, invest, and automate finances.

His practical advice is ideal for those looking to establish solid financial habits in their 20s and adapt them as they progress into their 30s.

5 Money Management Quotes You Should Live By

1. “The best way to predict your future is to create it.” – Peter Drucker.

2. “Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett.

3. “The goal isn’t more money. The goal is living life on your terms.” – Chris Brogan.

4. “A penny saved is a penny earned.” – Benjamin Franklin.

5. “The only thing money can’t buy is poverty.” – John Steinbeck.

To Recap

- Cultivating a great finance management habit in your 20s will pave the way for financial security in your 30s.

- You do not need to overspend to live comfortably. Live within your means.

- Although investment opportunities are the way to go, do not just grab anyone you see. Conduct diligent research before making a decision.

- With every growing responsibility you get, adjust your budget accordingly.

- Always have a budget. It helps you stay in your financially safe area. Track your expenditures and match them to your income.

- Set up financial goals. They help you stay intentional about your money.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.