Table of Contents

- What is JOMO in Crypto?

- Trader Pain Points with FOMO

- How Smart Traders Turn FOMO into JOMO

- Case Study Walkthrough: FOMO vs JOMO

- Mistakes to Avoid While Practising JOMO

- To Recap

- FAQs

What Is JOMO in Crypto?

JOMO stands for Joy of Missing Out, and in crypto trading it’s the exact opposite of FOMO, the Fear of Missing Out.

Where FOMO makes traders chase a coin after it’s already pumped, JOMO is about calmly sticking to a plan. A JOMO trader is happy to skip a trade that doesn’t meet their rules, even if the price keeps running for a while. Their goal is always simple: protect your capital and lock in profits instead of gambling on hype.

Think of it this way:

- FOMO = panic-buying near the top, holding losers, and hoping for a miracle.

- JOMO = waiting for solid entry and exit levels, taking profits early, and preserving cash for the next real opportunity.

JOMO doesn’t mean sitting out of the market forever. It means you trade on your terms, using clear entry and exit zones and fast execution tools, so every move is intentional and every profit is secured.

Trader Pain Points with FOMO

FOMO pushes traders to act on emotion instead of strategy. Below are the key problems it creates:

1. Buying Near Market Tops:

When prices rise quickly, FOMO can trigger impulsive buying without checking real value or timing. Traders often enter late, leaving little room for profit and a high risk of loss.

2. Holding Losing Positions:

Instead of accepting a small loss, traders gripped by FOMO may hold a trade hoping it will rebound. This can turn a manageable dip into a large drawdown and lock up capital that could be used elsewhere.

3. Missing Planned Exits:

FOMO can create greed, causing traders to ignore pre-set targets. Waiting for “just a bit more” often leads to missed exits and erased gains when the market reverses.

4. Slow or Hesitant Execution:

Fear of missing out can cause both rushing and freezing. Traders might hesitate at key moments or struggle to act quickly, and even short delays during high volatility can mean worse prices.

How Smart Traders Turn FOMO into JOMO

Rule 1: Pre-define Entry & Exit Zones (Stop the guessing)

Why It Works: Emotional trades happen because you decide in the moment. Pre-defining zones removes the moment.

What to do:

- Draw obvious support and resistance levels on your chart.

- Mark one conservative entry (dip), one aggressive entry, a primary take-profit (TP1) and a final take-profit (TP2/TPX).

- Decide stop-loss (SL) distance before entry (in price or %).

- Set price alerts on your charting tool, and have Obiex ready to execute when the price hits your zone.

Quick checklist:

- Support/resistance drawn

- Entry(s) and SL set on paper

- TP1/TP2 defined with % targets

- Obiex funded and ready for instant swap

Why Obiex helps: Fast swaps reduce slippage and execution delay. Your exit or scale-out happens when your plan says it should.

Rule 2: Take Partial Profits Early (Protect the trade’s upside)

Why It Works: Locking a portion of gains reduces emotional stress and removes the “must hold for the moon” pressure.

Practical scaling plan (example):

- Sell 25% at the first target (e.g., +10–15%).

- Sell another 25% at the second target (e.g., +25–30%).

- Move SL to break-even after TP1.

- Let the remaining position run with a trailing stop or final TP.

Why it matters: A few early profit-taking points can turn a 50% drawdown into a manageable pullback. You walked away with gains instead of watching them evaporate.

Rule 3: Skip Overheated Trades (The actual “Joy”)

Why it works: Missing a blown top keeps capital available for better setups. JOMO is actively preserving buying power.

How to judge “overheated” trades:

- Price moves parabolic with little pullback.

- RSI is above 70 on multiple timeframes.

- Social volume spikes much faster than volume on the orderbook.

- The move lacks structure (no clear support on recent pullbacks).

What to do instead:

- Stay in cash or move to stablecoins on Obiex.

- Monitor for a healthy correction or re-test of support before entering.

- Use saved capital to catch the next true low-probability, high-reward setup.

Tip: Holding stablecoins on Obiex lets you deploy capital quickly once a real entry appears.

Rule 4: Use Volatility Indicators for Timing (Don’t enter randomly)

Why it works: Indicators give objective cues so you enter when odds favour you, not when your chest tightens.

Tools to use simply:

- Bollinger Bands: If price rides the upper band with expanding width, the trade may be overheated.

- RSI: Readings above 70 suggest overbought; below 30 suggest oversold.

- ATR (Average True Range): Use ATR to size stops: set SL = 1–1.5 × ATR for volatility-aware stops.

- Support/resistance confluence: Indicators + structure = stronger signal.

Practical rule: Don’t buy an asset that is within a one standard deviation above the moving average on your chosen timeframe unless you have a clear re-entry plan.

Execution & Risk Management — exact steps to follow every trade

Pre-trade checklist

- Trade idea fits your rules (trend, structure, confluence).

- Entry, SL, TP1, TP2 written down.

- Risk per trade decided (commonly 0.5–2% of account).

- Obiex is funded, and the quick-swap path is checked.

During-trade checklist

- Execute entry when zone hit. Use a limit order if you want precision; use an instant swap if you need speed.

- Immediately place SL and TP alerts where possible.

- Scale out according to your plan (automate if possible).

Post-trade checklist

- Journal entry, reason, SL, TP, and emotional state.

- Review outcome vs plan every week.

- If you broke rules, note why and how to prevent next time.

Case Study Walkthrough: FOMO vs JOMO

Let’s break down a scenario to see how two traders, one driven by FOMO and the other practising JOMO, handle the same market move.

Market Setup

- Coin: Bitcoin (BTC/USDT)

- Price Action: BTC rallies from $110,000 to $114,000 in 24 hours after a sudden news headline.

- Volatility: Average 1–3% swings every 15 minutes.

1. The FOMO Trader:

Mindset: “If I don’t buy now, I’ll miss the breakout!”

Actions:

- Buys at $114,000 when Twitter and Telegram chats are buzzing.

- No pre-set stop loss or take-profit target.

- Hopes for $120,000 “by tomorrow.”

Outcome:

- Within hours, BTC corrects to $111,000 (a 2.6% loss).

- Panic sets in; sells at $111,000.

- Total loss on a $50,000 position: about $1,300.

Key Mistakes:

- Entered at peak hype with zero plan.

- No stop loss or exit strategy.

- Relied on social media instead of chart levels.

2. The JOMO Trader:

Mindset: “If the rally is real, there will be a safer entry. My capital is more important than chasing a spike.”

Actions:

- Waits for a pullback toward strong support around $111,000.

- Pre-defines plan:

- Entry: $111,200

- Stop Loss: $110,000 (risk ≈ 1%)

- Take-Profit 1: $114,500 (+3%)

- Take-Profit 2: $118,000 (+6%)

- Uses Obiex price alerts and keeps funds in USDT ready for an instant swap.

Outcome:

- Entry triggered at $111,200 after the correction.

- Sells 50% of position at $114,500 for a 3% gain.

- Sells the rest at $118,000 for a 6% gain.

- Average profit on a $50,000 position: around $1,600, with controlled risk.

Key Advantages:

- Planned entry and exits before trading.

- Locked partial profits early.

- Used fast execution on Obiex to exit at targets.

Side-by-Side Results

Takeaway:

The JOMO trader didn’t “miss out” by waiting. They avoided a 2.6% loss and secured roughly a 4.5% average profit simply by following a pre-planned system and using Obiex for fast, zero-fee execution.

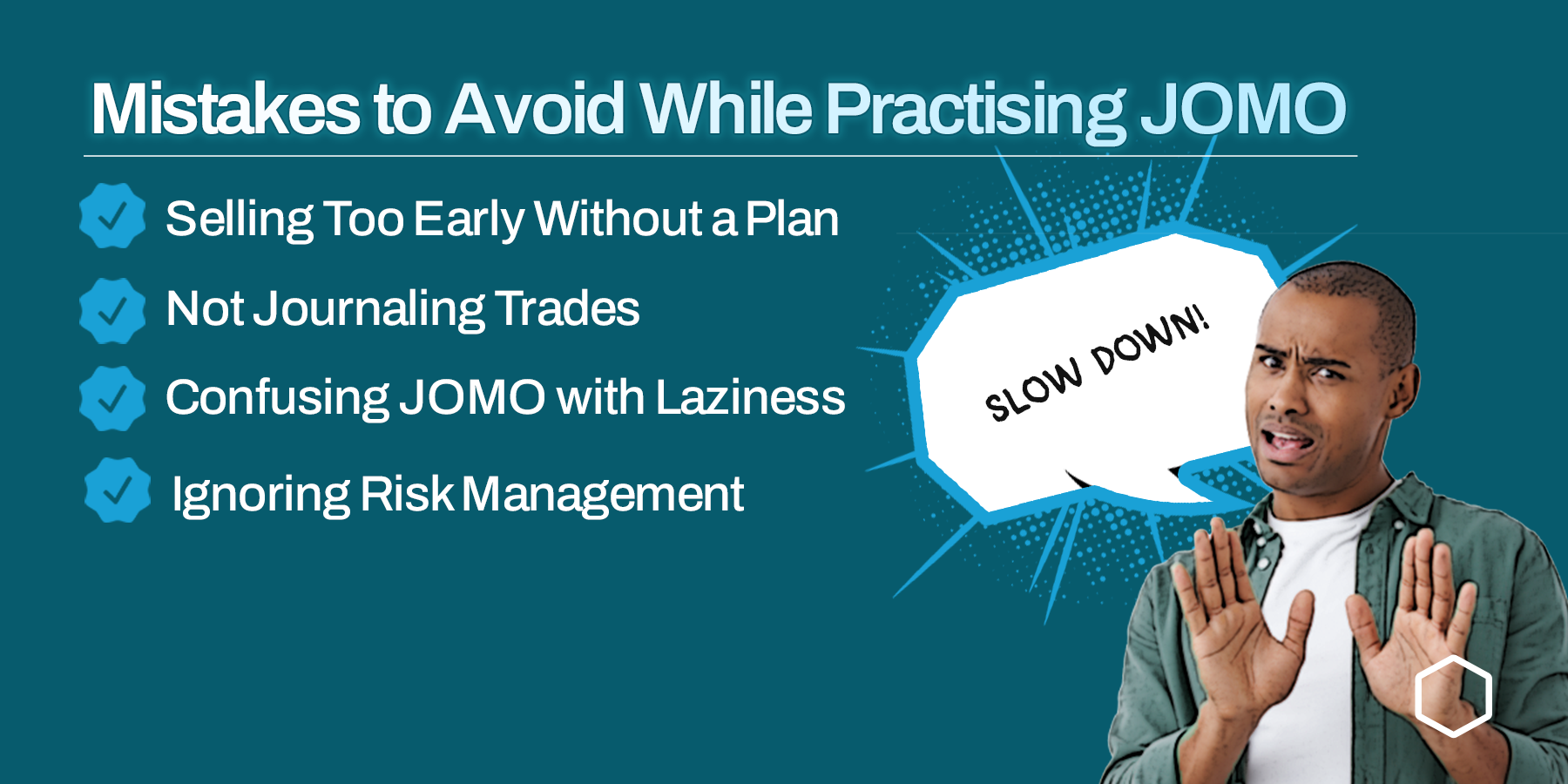

Mistakes to Avoid While Practicing JOMO

1. Selling Too Early Without a Plan:

Problem: Some traders sell at the first sign of profit out of fear the market will reverse. This often leads to small gains and missed larger moves.

Fix:

- Set clear take-profit (TP) targets before entering the trade.

- Use partial exits (e.g., 25% at TP1, 25% at TP2) to secure profits while letting the rest ride.

- Keep stop-loss (SL) orders in place so you don’t have to guess when to exit.

2. Not Journaling Trades:

Problem: Without a trading journal, you can’t track what’s working or spot recurring mistakes. Many traders repeat bad habits because they have no record to review.

Fix:

- After each trade, record entry price, exit price, reasons for the trade, and emotional state.

- Review the journal weekly to see patterns (good or bad) and adjust rules.

3. Confusing JOMO with Laziness:

Problem: Some think JOMO means never trading or avoiding research. That’s not discipline. It’s inactivity.

Fix:

- Continue scanning the market and setting alerts even when you skip a trade.

- Treat “no trade” as an active decision backed by analysis, not an excuse to avoid work.

4. Ignoring Risk Management:

Problem: Skipping hype trades is useless if you over-leverage the trades you do take. One bad position can wipe out weeks of careful planning.

Fix:

- Risk only a small, consistent percentage of your account on each trade (commonly 1–2%).

- Use stop-losses sized with volatility indicators like ATR (Average True Range).

5. Relying on Slow Execution:

Problem: You can plan perfectly but still miss targets if your platform is slow or has high fees.

Fix:

- Use a platform like Obiex for instant, zero-fee swaps so your exits match your plan.

- Set price alerts and be ready to act immediately.

To Recap

- JOMO in crypto means trading with discipline and skipping hype-driven moves.

- FOMO leads to losses by pushing traders to buy late or hold losers too long.

- Always set clear entry, exit, and stop-loss levels before opening a trade.

- Take profits early by scaling out at set targets to secure gains and lower stress.

- Avoid overheated trades and wait for healthy pullbacks to protect capital.

- Use objective tools like RSI and Bollinger Bands instead of social media signals.

- Keep a trading journal to track decisions, results, and emotional triggers.

- Limit risk to about 1–2% of your account on each trade and size stops using volatility.

- Execute quickly with platforms like Obiex for instant, zero-fee swaps that match your plan.

- FOMO equals losses; JOMO delivers planned entries, locked profits, and steady growth.

👉Turn JOMO into profit. Start trading instantly on Obiex.

FAQs

Q1. What does JOMO mean in crypto trading?

JOMO is the Joy of Missing Out, staying disciplined and skipping risky trades.

Q2. How can I avoid FOMO when trading crypto?

Set entry/exit zones, use alerts, and execute instantly with platforms like Obiex.

Q3. What strategies help lock in profits early?

Scale out profits at 25% or 50% gains instead of waiting for a huge move.

Q4. Is JOMO better for day trading or long-term trading?

Both. The key is following pre-defined rules.

Q5. How do I apply JOMO with tools like Bollinger Bands or support/resistance?

Use them to time entries and exits and avoid overheated prices.

Q6. Why is FOMO dangerous in crypto?

Prices can move 1–3% in seconds. Buying late means instant losses.

Q7. Can JOMO increase my win rate?

Yes. Skipping bad trades improves overall profitability.

Q8. What role does Obiex play in a JOMO strategy?

Fast execution, zero-fee swaps, and reliable service help you follow your plan.

Q9. How do I know if a trade is overheated?

Check RSI (>70), parabolic price action, or sudden social media spikes.

Q10. Does JOMO mean never taking risks?

No. It means only taking calculated risks with a plan.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.