Table of Contents

- Understanding Crypto Arbitrage in Nigeria

- What is Arbitrage?

- Why Do Price Differences Exist?

- How Much Can You Realistically Make?

- Types of Crypto Arbitrage Strategies and How to Execute Them

- Exchange-to-Exchange Arbitrage (Spatial Arbitrage)

- P2P Arbitrage

- Triangular Arbitrage

- Tools and Platforms for Succesful Arbitrage Trading in Nigeria

- Risk Management and Best Practices

- Step-by-Step Guide to Starting Crypto Arbitrage in Nigeria

- To Recap

- FAQs

Cryptocurrency arbitrage is a trading method where you profit from price differences of the same cryptocurrency across various markets or exchanges.

In Nigeria, this strategy has become popular due to the growing interest in cryptocurrencies and the profit potential.

In this article, we will guide you through the process of making money using crypto arbitrage in Nigeria.

This guide is designed for:

- Intermediate traders seeking additional profit strategies.

- Individuals already trading crypto aiming to boost earnings.

- Users familiar with exchanges and peer-to-peer (P2P) markets.

If you fall under this category, or are just interested in knowing what crypto arbitrage entails before testing the waters, keep reading.

Understanding Crypto Arbitrage in Nigeria

What is Arbitrage?

Crypto arbitrage is a trading strategy where traders take advantage of price differences for the same cryptocurrency on different exchanges.

Simply put, you buy crypto at a lower price on one platform and sell it at a higher price on another, making a profit from the difference.

This is possible because cryptocurrency prices are not the same across all exchanges at the same time.

By quickly moving funds between exchanges, traders can make money without taking on the risks of traditional crypto trading, like price volatility.

Why Do Price Differences Exist?

The price of a cryptocurrency can vary across exchanges for the following reasons:

- Liquidity Differences: Some exchanges have more buyers and sellers, leading to better prices, while others may have fewer participants, causing price imbalances.

- Trading Volume: High-volume exchanges tend to have more stable prices, while smaller exchanges can have higher fluctuations.

- Market Demand and Supply: The demand for a cryptocurrency on one exchange may be higher or lower than on another, affecting its price.

- Transaction Delays: The time it takes for deposits and withdrawals between exchanges can lead to price gaps.

- Regulatory and Payment Differences: In Nigeria, some platforms allow trading directly in Naira, while others only accept stablecoins like USDT, leading to variations in exchange rates and arbitrage opportunities.

How Much Can You Realistically Make?

The profit from crypto arbitrage in Nigeria depends on factors like price gaps, trading fees, and transaction speed.

On average, price differences between exchanges range from 1% to 5%.

For example, if Bitcoin is selling for $85,000 on one exchange and $85,500 on another, a trader who buys 1 BTC and sells it immediately could make $500. However, traders must consider:

- Trading Fees: Most exchanges charge fees for buying, selling, and withdrawing crypto. If fees add up to $100 in the above example, the net profit would be $400.

- Transaction Time: If transferring crypto between exchanges takes too long, prices may change before the trade is completed, reducing profits or causing losses.

- Capital Available: A trader with $1,000 can make smaller profits compared to someone trading with $10,000. Larger trades lead to higher profits but also come with greater risks.

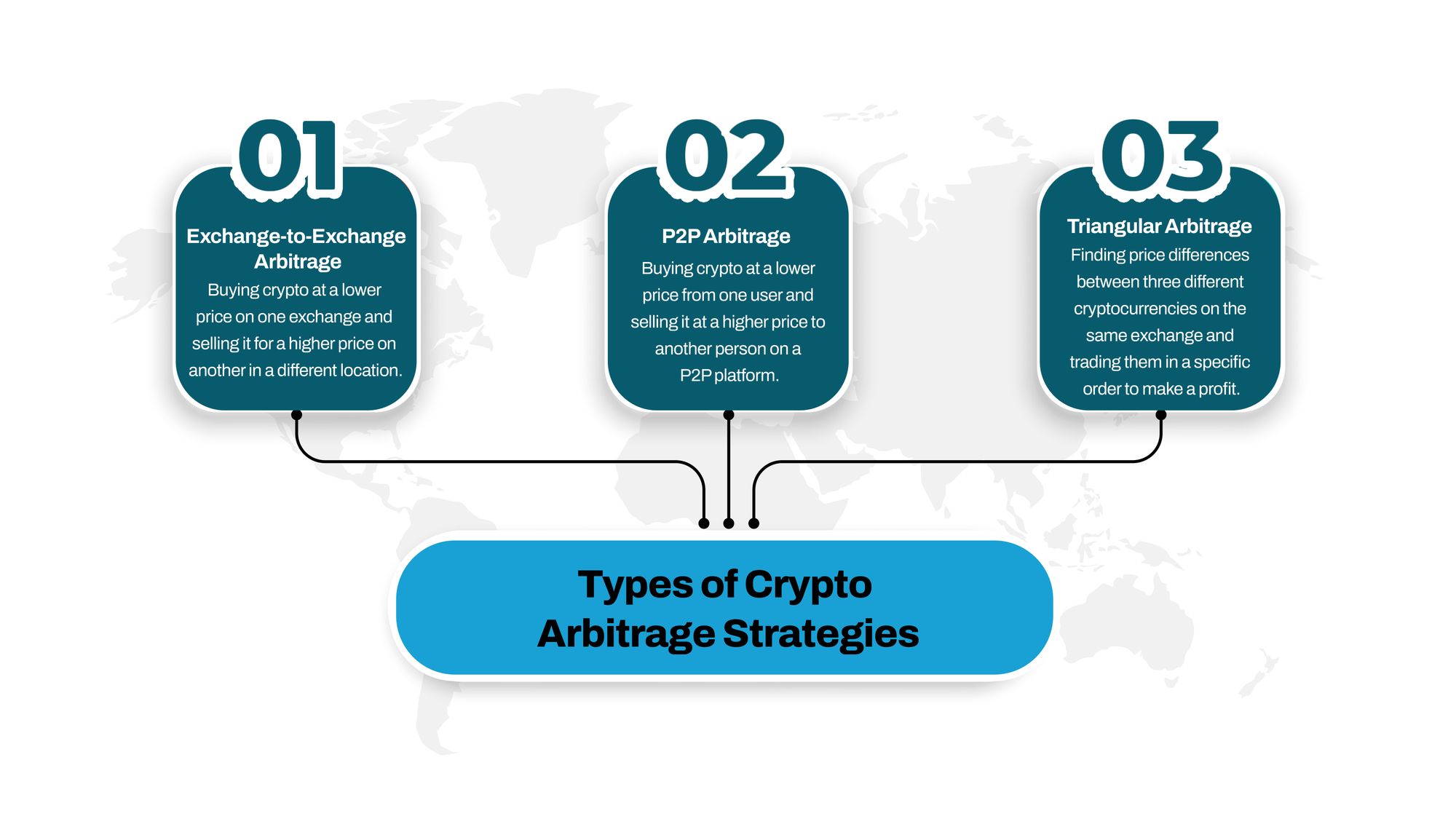

Types of Crypto Arbitrage Strategies and How to Execute Them

1. Exchange-to-Exchange Arbitrage (Spatial Arbitrage)

What It Is:

Exchange-to-exchange arbitrage, also known as spatial arbitrage, is the process of buying a cryptocurrency at a lower price on one exchange and selling it for a higher price on another in a different location.

This happens because different exchanges have slight price variations due to differences in trading volume, liquidity, and geographical factors.

How to Do It:

- Sign up on multiple cryptocurrency exchanges that support the same assets.

- Monitor price differences for a specific cryptocurrency across these exchanges.

- Use an arbitrage calculator to measure potential profits after factoring in fees.

- Buy the cryptocurrency on the exchange with the lower price.

- Transfer it to the exchange where the price is higher and sell it for a profit.

Example: If Bitcoin (BTC) is priced at $90,000 on Exchange A and $90,500 on Exchange B, you can buy 1 BTC on Exchange A, transfer it to Exchange B, and sell it for a $500 profit (minus fees).

Risks & Solutions:

- Transaction Fees: Fees for deposits, withdrawals, and trading can eat into profits. Always check these before executing a trade.

- Transfer Delays: Blockchain network congestion can cause delays, leading to price changes before the asset is sold. Using stablecoins like USDT for faster transactions can help.

- Withdrawal Limits: Some exchanges have withdrawal limits, which may restrict the amount you can transfer at once. Check exchange policies before trading.

2. Peer-to-Peer (P2P) Arbitrage

What It Is:

P2P arbitrage happens in the P2P marketplace and involves buying cryptocurrency at a lower price from one user and selling it at a higher price to another person on a P2P platform.

This strategy works well in Nigeria due to local price fluctuations and demand differences.

How to Do It:

- Identify a cryptocurrency with a lower price on a centralised exchange.

- Buy the asset and transfer it to a P2P marketplace where it sells at a higher price.

- List the asset for sale at the market rate and wait for a buyer.

- Sell and receive payment in any preferred method.

Risks & Solutions:

- Scams & Payment Risks: Always use escrow-protected platforms like Obiex to prevent fraud.

- Price Fluctuations: Prices on P2P platforms can change quickly. Sell as soon as you confirm a good price.

- Transaction Delays: Some buyers take time to release payments. Trade with verified buyers to reduce risk.

3. Triangular Arbitrage

What It Is:

Triangular arbitrage is a more advanced strategy that involves finding price differences between three different cryptocurrencies on the same exchange and trading them in a specific order to make a profit.

How to Do It:

- Identify three cryptocurrencies with mismatched prices (e.g., BTC, ETH, and USDT) on the same exchange.

- Convert the first currency into the second, then the second into the third, and finally back to the first.

- If done correctly, you end up with more of the original cryptocurrency than you started with.

Example:

- Start with 1 BTC.

- Convert 1 BTC into 20 ETH.

- Convert 20 ETH into 90,200 USDT.

- Convert 90,200 USDT back into 1.02 BTC, making a 0.02 BTC profit.

Risks & Solutions:

- Execution Speed: Prices can change rapidly, so use an automated trading bot for faster execution.

- Exchange Fees: Some exchanges charge fees for each conversion, so check before trading.

- Market Liquidity: Low liquidity can result in slippage, reducing potential profits. Use high-volume trading pairs to avoid this.

Tools & Platforms for Successful Arbitrage Trading in Nigeria

1. Crypto Exchanges:

Crypto arbitrage trading requires access to multiple exchanges where you can buy and sell cryptocurrencies. Obiex doesn’t only provide a great platform to arbitrage crypto, but also offers instant swaps, robust security measures, and much more.

2. Arbitrage Calculators:

Using an arbitrage calculator can help you determine whether a trade is profitable before executing it. These tools compare prices across multiple exchanges and calculate potential profits after deducting transaction fees. Popular arbitrage calculators include the Coingeko Arbitrage Tool, Cryptonator, and Pionex Arbitrage Bot.

3. Stablecoins for Arbitrage Trading:

To avoid losing money due to price fluctuations, most crypto arbitrage traders use stablecoins such as USDT, USDC, and BUSD. These digital currencies maintain a fixed value, making them ideal for quick transfers between exchanges.

4. Crypto Arbitrage Apps:

There are mobile apps designed to help traders monitor market prices, identify arbitrage opportunities, and automate transactions. Some of the best crypto arbitrage apps include Bitsgap, Cryptohopper, and Pionex. These apps provide real-time alerts, automated trading bots, and easy access to different exchanges.

5. Fiat On-Ramp and Off-Ramp Platforms:

Since arbitrage trading in Nigeria may involve converting crypto to naira, you need platforms that offer fast and affordable fiat transactions. Services like Obiex allow you to buy and sell crypto at competitive rates.

6. Trading Bots:

Automated trading bots can execute trades faster than manual trading, reducing the risk of price changes affecting your profit. Platforms like 3Commas, Pionex, and Bitsgap offer arbitrage trading bots that can analyse price differences and execute profitable trades automatically.

7. Secure Crypto Wallets:

To keep your funds safe while trading, you need a secure crypto wallet. Using a cold wallet (hardware wallet) for long-term storage and a hot wallet (mobile or web-based) for active trading can help you balance security and accessibility.

Risk Management & Best Practices

1. Use an Arbitrage Calculator to Estimate Profitability:

Before executing a trade, always use an arbitrage calculator to check if the price difference between exchanges is enough to cover transaction costs and still leave you with a profit. Some traders make the mistake of assuming that any price difference is profitable, but after deducting trading fees, withdrawal charges, and transfer delays, they may end up losing money.

2. Monitor Exchange Fees and Hidden Charges:

Each crypto exchange has different trading fees, withdrawal fees, and deposit charges. If you don’t factor these in, your expected profit may turn into a loss.

3. Choose the Best Crypto Arbitrage App for Speed:

Use a crypto arbitrage app that offers fast transactions, low fees, and reliable service. Some apps provide real-time alerts on price differences between exchanges, helping you act quickly before the market shifts.

4. Trade Only on Reliable Exchanges:

Not all cryptocurrency exchanges are trustworthy. Some have security issues, poor liquidity, or high withdrawal limits that can trap your funds. Before trading, research and choose exchanges with strong security, high trading volumes, and a good reputation.

5. Use Stablecoins to Protect Profits:

Due to crypto market volatility, prices can change rapidly between the time you buy and when you transfer funds to another exchange. Using stablecoins like USDT, USDC, or BUSD can help prevent losses from price fluctuations while you move funds between exchanges.

6. Keep Funds on Multiple Platforms:

To avoid delays in deposits and withdrawals, it is best to keep funds ready on at least two or three exchanges. This allows you to act fast when a crypto arbitrage opportunity arises instead of waiting for deposits to clear.

7. Be Cautious of Exchange Policies & Restrictions:

Some exchanges have withdrawal limits, KYC (Know Your Customer) requirements, or blocked transactions for certain countries. Before trading, confirm that you can withdraw or transfer funds easily to avoid getting stuck in an exchange.

8. Track Market Trends and News:

Sudden market changes, government regulations, or exchange updates can affect crypto arbitrage trading. Stay informed about policy changes and market trends to avoid unexpected losses.

9. Start Small and Scale Gradually:

If you are new to crypto arbitrage, start with small amounts to test strategies and understand how different exchanges work. Once you gain experience and confidence, you can scale up your trades gradually.

10. Use Secure Wallets and Protect Your Funds:

Use strong passwords, enable two-factor authentication (2FA) on your exchange accounts, and store funds in a secure crypto wallet instead of leaving them on an exchange.

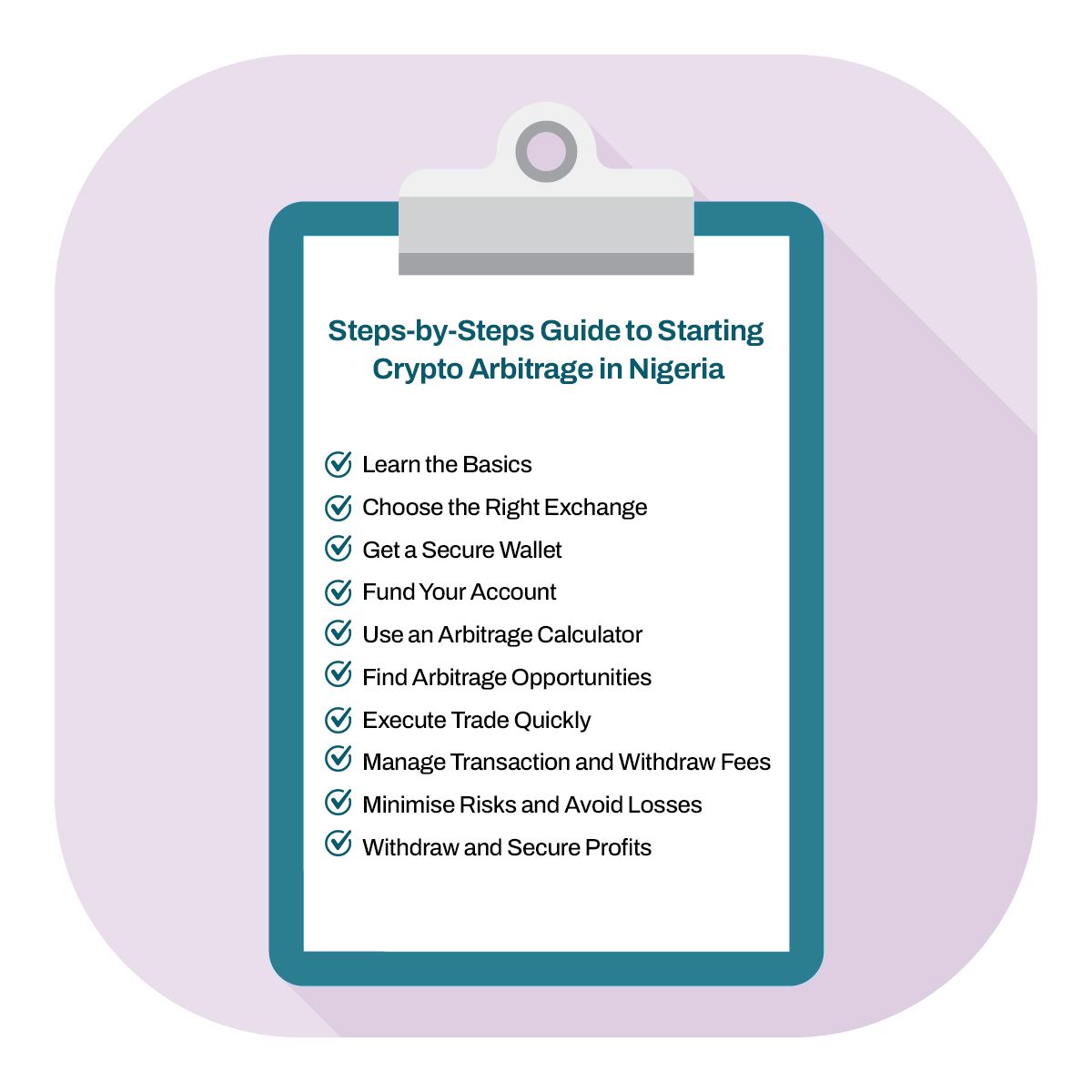

Step-by-Step Guide to Starting Crypto Arbitrage in Nigeria

1. Learn the Basics of Crypto Arbitrage: Before you start, you must understand how crypto arbitrage works.

2. Choose the Right Crypto Exchanges: Register on multiple cryptocurrency exchanges that allow deposits and withdrawals.

3. Get a Secure Crypto Wallet: Combining a hot and cold wallet is the best way to go. For arbitrage trading, a hot wallet is usually more practical because it allows faster transactions.

4. Fund Your Account with Capital: The amount depends on your risk level and goals. It’s also advisable to use stablecoins to avoid price fluctuations while moving funds between exchanges.

5. Use an Arbitrage Calculator: This helps you determine if a trade will be profitable after transaction fees. Many websites and trading platforms provide these calculators to estimate potential profits.

6. Find Arbitrage Opportunities: Constantly look for price differences across exchanges by manually checking prices, using arbitrage bots, and following market trends.

7. Execute the Arbitrage Trade Quickly: Once you spot an opportunity, buy the cryptocurrency, transfer, sell, and withdraw your profits.

8. Manage Transaction and Withdrawal Fees: Before executing a trade, check the total fees and ensure your profit is higher than the costs.

9. Minimise Risks and Avoid Losses: Minimise your risks by using reliable exchanges, checking liquidity, checking regulations, and avoiding scams.

10. Withdraw and Secure Your Profits: After completing a trade, you can reinvest the profits in another arbitrage trade or convert your crypto to stablecoins to maintain value.

To Recap

- Crypto arbitrage involves buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another exchange.

- Price differences across exchanges occur due to liquidity differences, trading volume, market demand and supply, transaction delays, and regulatory/payment variations.

- Average profit from crypto arbitrage ranges from 1% to 5%, depending on factors like price gaps, fees, and transaction speed.

- Types of crypto arbitrage strategies include exchange-to-exchange arbitrage, P2P arbitrage, and triangular arbitrage.

- Exchange-to-exchange arbitrage involves buying crypto on one exchange and selling it on another exchange at a higher price.

- P2P arbitrage involves buying crypto at a lower price on an exchange and selling it at a higher price on a P2P platform.

- Triangular arbitrage uses price differences between three different cryptocurrencies on the same exchange to make a profit.

- Tools for successful crypto arbitrage include exchanges, arbitrage calculators, stablecoins, crypto arbitrage apps, fiat on-ramp and off-ramp platforms, trading bots, and secure wallets.

- Risk management includes using arbitrage calculators, monitoring exchange fees, choosing reliable exchanges, using stablecoins, and protecting funds with secure wallets.

- To start crypto arbitrage, learn the basics, choose exchanges, get a secure wallet and fund your accounts, find arbitrage opportunities, execute trades quickly, manage fees, and minimise risks.

💡Sign up on Obiex to start trading and profiting from arbitrage!

FAQs

Q1. What is crypto arbitrage, and how does it work?

Crypto arbitrage is a trading strategy where traders buy a cryptocurrency at a lower price on one exchange and sell it at a higher price on another exchange to make a profit.

Q2. Is crypto arbitrage legal in Nigeria?

Yes, crypto arbitrage is legal in Nigeria. However, traders should use reputable exchanges and follow financial regulations to avoid potential restrictions.

Q3. How much money do I need to start crypto arbitrage trading in Nigeria?

You can start crypto arbitrage trading with as little as ₦50,000 ($48) or more, depending on the exchanges you use and the trading fees involved.

Q4. Which cryptocurrencies are best for arbitrage trading in Nigeria?

The most commonly used cryptocurrencies for arbitrage trading are Bitcoin (BTC), Ethereum (ETH), and stablecoins like USDT and USDC because they have high liquidity and are widely traded on multiple exchanges.

Q5. What are the risks involved in crypto arbitrage trading?

Transaction risks, exchange restrictions, high trading fees, and market volatility.

Q6. How do I find crypto arbitrage opportunities in Nigeria?

You can find arbitrage opportunities by using arbitrage calculators and crypto arbitrage apps.

Q7. Which are the best platforms for crypto arbitrage in Nigeria?

Obiex offers one of the best platforms for crypto arbitrage in Nigeria.

Q8. How can I calculate my potential profit in crypto arbitrage trading?

You can use an arbitrage calculator crypto tool to estimate your profit by considering the price difference, transaction fees, and withdrawal fees before executing a trade.

Q9. What is the best arbitrage strategy for beginners?

Beginners should start with simple spot arbitrage, which involves buying crypto at a lower price on one exchange and selling it on another at a higher price.

Q10. Can I automate crypto arbitrage trading?

Yes, some traders use crypto arbitrage bots to automate their trades and take advantage of small price differences quickly. However, bots require proper setup, and traders should monitor them to avoid unexpected losses.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.