Table of Contents

- The Problem: Slippage and Margin Loss in Large Trades

- What Causes Price Loss During Large BTC Trades?

- How Obiex Helps You Execute Large BTC Orders Smoothly

- Execution Strategies to Avoid Margin Loss

- Localisation: Why This Matters in Nigeria

- To Recap

- FAQs

The Problem: Slippage and Margin Loss in Large Trades

When you're trying to execute large BTC orders in Nigeria, one of the biggest problems you face is slippage.

Slippage happens when the price you expect to buy or sell Bitcoin changes by the time your order is fully completed.

For example, let’s say you want to buy 50 BTC at ₦85 million per BTC. If the exchange you’re using has low liquidity (meaning there aren’t enough sellers at that price), your order will be filled at different prices as it moves down the order book.

This means instead of paying ₦85 million consistently, some of your BTC might get filled at ₦86 million or even higher, eating into your profit.

This issue gets worse with large trades because most crypto platforms in Nigeria are built for small retail transactions, not high-volume BTC trading.

The problem often comes down to shallow order book depth. Simply put, there aren’t enough buy or sell orders at each price level to support your large order without moving the market.

Let’s look at a case study here:

A Nigerian OTC trader attempting to sell 10 BTC on a regular exchange at ₦104.5 million per coin ended up settling for an average price of ₦102.7 million due to poor liquidity.

That’s a slippage of ₦1.8 million per BTC; a total margin loss of ₦18 million.

This is why trying to trade Bitcoin in Nigeria without price slippage using standard exchanges can be risky for high-volume traders.

The more volume you try to push through a weak order book, the worse your average price becomes.

Slippage isn’t just annoying. It directly affects your bottom line.

To avoid this, active traders now turn to BTC OTC trading in Nigeria or specialised platforms like Obiex Prime for high-volume traders, where deep liquidity and direct counterparty execution allow you to trade Bitcoin in bulk with minimal price movement and maximum margin protection.

What Causes Price Loss During Large BTC Trades?

1. Lack of Liquidity in the Local Market:

In a high-liquidity environment, a large order can be filled quickly at or near the expected price. However, when liquidity is limited, large orders get broken into smaller parts and filled progressively at different price levels.

For example, if a trader wants to buy ₦100 million worth of BTC, but there’s only ₦20 million available at the target price, the system will continue filling the rest of the order at incrementally worse prices. This leads to slippage.

This issue is especially pronounced in local order books that aren’t connected to deeper global liquidity pools. As a result, traders handling large volumes often experience significant price loss unless they use platforms or methods designed for bulk execution.

2. Inadequate Trade Execution Infrastructure:

Not all trading platforms are equipped with the necessary infrastructure to manage high-volume orders efficiently. Platforms with outdated or basic execution engines tend to process large trades in fragmented, delayed pieces, resulting in poor price fills. This problem is compounded during periods of high volatility, when speed and precision are essential.

Without advanced order matching algorithms, dynamic routing, or real-time risk controls, such platforms expose traders to wider spreads and execution delays. This can be the difference between a profitable arbitrage opportunity and a loss.

Institutional-grade execution, such as smart order routing or access to aggregated liquidity, helps reduce this risk but is often absent in retail-focused or underdeveloped platforms.

3. Ineffective Order Strategies: Market vs. Limit vs. OTC

Another major contributor to price loss is the improper use of order types. Many traders default to market orders, which are executed immediately at the best available price. In a low-liquidity environment, this means the trade may quickly sweep through the order book, leading to significant slippage.

Instead, limit orders allow traders to set a maximum buy price or minimum sell price, ensuring that trades only execute under favourable conditions. While this may delay execution, it prevents unexpected losses from thin order books.

Also, Over-the-Counter (OTC) trading is a preferred method for handling large transactions discreetly and efficiently. OTC allows two parties to agree on a price off the public exchange, avoiding the market impact of large orders.

Experienced traders and institutions often combine limit orders with OTC execution to maintain control over pricing while accessing the necessary trade size.

4. Emotional and Reactive Trading Decisions:

High-volume trading is as much about discipline as it is about strategy. Emotional trading, especially during periods of volatility, can lead to impulsive decisions such as placing large market orders without proper risk assessment. This often results in unnecessary slippage and avoidable losses.

To handle emotions better during high-stakes trading:

- Set a clear trading plan with entry and exit points.

- Use pre-set limit orders instead of reacting in real time.

- Avoid trading large volumes during peak volatility unless absolutely necessary.

- Take breaks when emotions are high to avoid making rash decisions. Staying calm and thinking strategically can make the difference between protecting your margin and losing it.

How Obiex Helps You Execute Large BTC Orders Smoothly

1. Swap Without Confirmation: Lock in Prices Instantly

Obiex eliminates the risk of slippage with its Swap Without Confirmation feature.

This tool allows you to exchange large amounts of Bitcoin instantly at the listed price, without waiting for a second confirmation screen.

For traders moving ₦10 million or more in BTC, this simple step can protect against sudden price swings that typically happen within seconds. It’s especially helpful during high market volatility, allowing you to execute large BTC orders in Nigeria with confidence.

2. OTC Desk: Private Quotes, Better Pricing, and Liquidity

For traders handling ₦100 million or more, Obiex offers a professional-grade OTC (Over-The-Counter) Desk.

This service is tailored for high-value trades and offers better liquidity, private quotes, and direct execution without impacting public order books.

With Obiex’s OTC desk, you can negotiate better pricing for large Bitcoin trades without slippage, reducing your exposure to market fluctuations.

3. Zero Fees on Swaps: Maximise Your Margins

High fees can eat into profits when trading large volumes. Obiex removes that worry by charging zero fees on all crypto swaps, including BTC trades.

This means you keep 100% of your trading value, whether you're moving ₦5 million or ₦500 million in Bitcoin. For high-volume BTC trading, every fraction of a percent counts.

Compared to platforms that charge 0.5% or more per trade, Obiex helps you save millions of naira over time, making it the go-to choice for Bitcoin trading with low margin loss.

4. Obiex Prime: Better Execution for High-Volume Traders

For businesses and institutional traders who need even more control and efficiency, Obiex offers Obiex Prime.

This upcoming service is tailored to users executing consistent, high-volume BTC trades in Nigeria.

Obiex Prime will provide better execution speeds, priority access to liquidity, and custom APIs for automating trades.

If you're running a crypto business or managing client funds, this solution gives you the precision and support needed to scale.

It’s a premium tool for active traders looking to trade BTC in bulk on Obiex without compromising on pricing or speed.

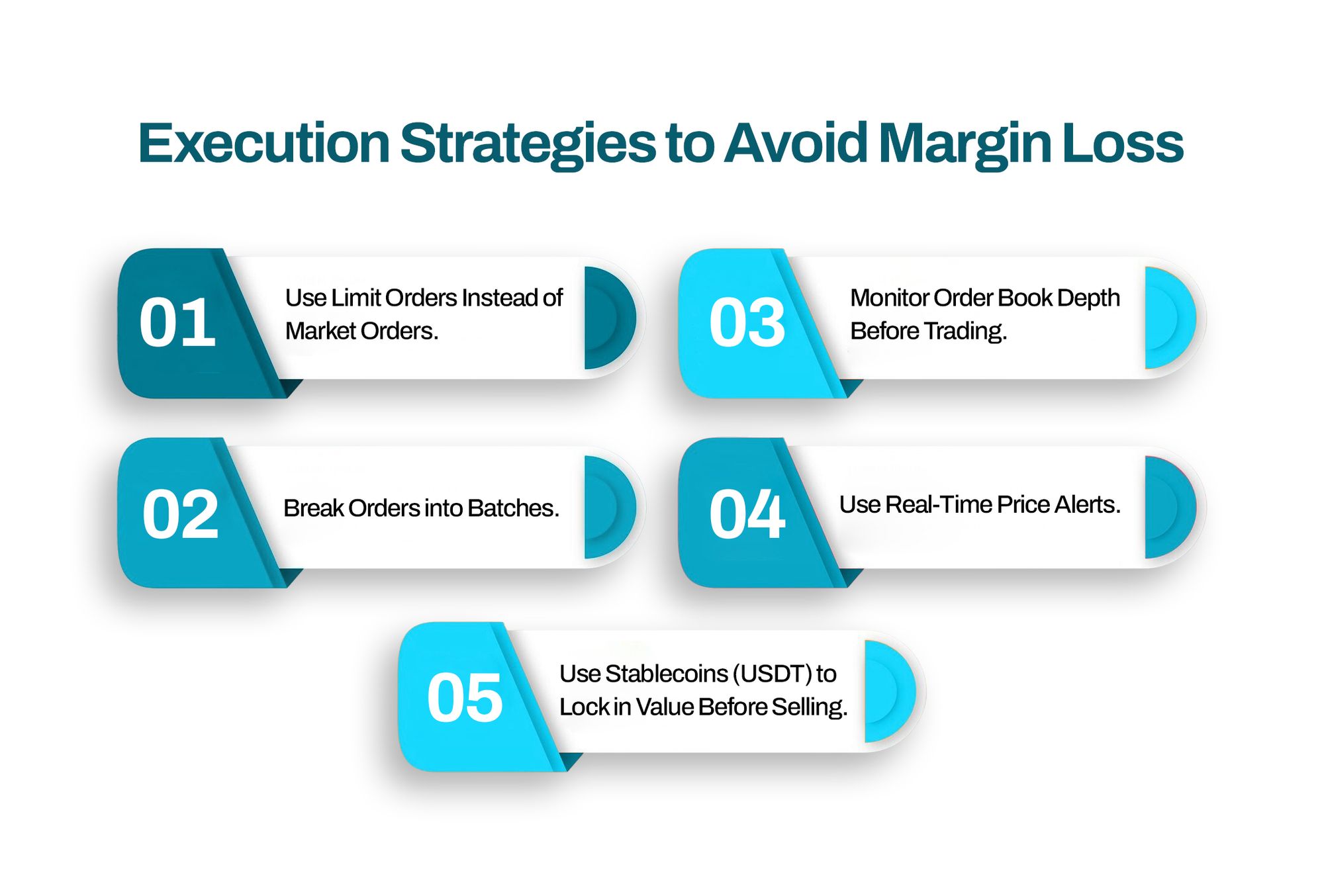

Execution Strategies to Avoid Margin Loss

1. Use Limit Orders Instead of Market Orders:

A market order buys or sells Bitcoin instantly at the best available price.

This might sound convenient, but when placing a large BTC order, it can lead to slippage.

A limit order allows you to set the exact price at which you're willing to buy or sell. This helps you avoid overpaying or underselling, especially when the order size is large.

For example, if you want to buy ₦100 million worth of BTC, using a limit order ensures you don’t sweep through the order book and get stuck with unfavourable rates.

2. Break Orders into Batches:

Instead of placing a single, large order, break it into smaller, manageable batches.

This reduces your exposure to price swings and gives you better control over each entry or exit.

If you plan to buy ₦50 million worth of BTC, split it into five ₦10 million orders across different time intervals or market conditions.

This approach helps smooth out the average entry price and lowers slippage.

Many high-volume traders on Obiex use this batch strategy to spread out their risk and reduce the effect of shallow liquidity in the BTC/NGN market.

3. Monitor Order Book Depth Before Trading:

Before you execute large BTC orders in Nigeria, always check the order book depth of the BTC/NGN trading pair. The order book shows available buy and sell orders at different price levels.

If the liquidity is low, your large order could cause the price to move significantly, leading to higher costs or lower profits.

4. Use Real-Time Price Alerts:

Bitcoin prices can change rapidly, and executing at the wrong time, even by a few minutes, can cost you a lot.

Setting up real-time price alerts lets you know when the BTC/NGN price hits your target range.

This way, you only act when market conditions are right.

Traders can set custom alerts and receive notifications via email or app so they don’t miss key price windows.

For high-volume BTC trading in Nigeria, timing is everything, and real-time alerts help you trade smarter, not just faster.

5. Use Stablecoins (USDT) to Lock in Value Before Selling:

If you’re receiving BTC and don’t plan to sell immediately, consider converting it to a stablecoin like USDT to lock in value.

Bitcoin’s price can swing 5–10% in a single day. By converting BTC to USDT, you protect your gains and avoid margin loss due to market dips.

Then, when you're ready to convert to naira, you can sell USDT directly into NGNX without worrying about BTC’s volatility.

This is especially useful for crypto merchants or OTC desks that receive Bitcoin in bulk and need to protect revenue.

To Recap

- Slippage happens when large BTC orders can't be filled at a single price due to low liquidity, leading to margin loss.

- Most Nigerian crypto platforms aren't built for high-volume BTC trading, causing major price inefficiencies.

- A weak order book causes traders to receive worse prices as their large orders get filled in parts.

- Poor liquidity, outdated infrastructure, and reactive trading all contribute to price loss in large BTC trades.

- Market orders are risky in low-liquidity environments; limit orders and OTC trading offer more control.

- Emotional decisions during volatility can worsen outcomes; planning and calm execution are essential.

- Obiex offers Swap Without Confirmation to lock in prices instantly and prevent sudden slippage.

- Obiex charges zero fees on swaps, helping traders maximise profits on large BTC transactions.

Ready to trade like a pro?

👉 Start executing large BTC orders on Obiex without losing margin.

FAQs

Q1. What is the best platform to execute large BTC orders in Nigeria?

Obiex is one of the best platforms due to its OTC desk, zero-fee swaps, and high-liquidity support.

Q2. What is slippage in crypto trading?

Slippage is the difference between the expected price and actual price during a trade. It’s common in large trades on low-liquidity platforms.

Q3. How can I avoid slippage when trading Bitcoin?

Use limit orders, OTC desks, and platforms like Obiex that support high-volume trading.

Q4. Can I trade ₦100 million worth of BTC on Obiex?

Yes, Obiex OTC Desk supports high-volume BTC trading with private quotes and deep liquidity.

Q5. What is Obiex Prime?

Obiex Prime is a service for high-volume traders that offers better pricing, faster execution, and premium support.

Q6. How fast are large BTC orders executed on Obiex?

Most OTC trades are executed within minutes, depending on liquidity and market conditions.

Q7. Are there any hidden fees on Obiex for large BTC trades?

No. Obiex charges zero fees on swaps, and OTC quotes are transparent.

Q8. Can I get Naira directly after selling BTC on Obiex?

Yes, with NGNX withdrawals, you can settle in Naira easily.

Q9. Does Obiex support stablecoin trading for large volumes?

Yes, you can swap BTC to USDT or other stablecoins instantly and securely.

Q10. How can I contact the Obiex OTC Desk?

You can access the OTC desk by signing in to your Obiex account and reaching out via the OTC request form or live support.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.