Table of Contents

- What Is a Trading Pair?

- Fiat vs Stablecoin vs Altcoin Pairs

- Quote vs Base Asset: Why It Matters

- Key Factors When Choosing a Trading Pair

- Matching Pairs to Strategy Types

- Top Stablecoin Pairs for African Traders

- What to Avoid When Picking a Pair

- To Recap

- FAQs

If you’ve ever opened a crypto trading app and seen dozens of trading pairs like BTC/USDT or USDT/NGNX, you’ve probably asked yourself, “Which one should I use?”

The truth is, the trading pair you choose can make or break your strategy.

Whether you’re scalping for quick wins, holding for long-term gains, or trading daily with high volume, picking the right pair affects your profits, risk level, and even how fast you can enter or exit a trade.

Not all pairs are created equal.

Some are more liquid, some are more volatile, and some barely move at all.

In this article, we’ll break down how to choose trading pairs that actually fit your style, capital size, and goals, especially if you’re trading from Nigeria, Ghana, or Cameroon.

What Is a Trading Pair?

A trading pair is simply two different assets that you can trade against each other on a crypto exchange.

It shows what you're using to buy or sell a specific cryptocurrency.

If you are trading BTC/USDT, which is one of the most popular trading pairs, it means you're either buying Bitcoin (BTC) with Tether (USDT) or selling Bitcoin to get Tether.

If you buy BTC/USDT, you're spending USDT to get BTC. If you sell BTC/USDT, you are trading BTC and receiving USDT in return.

On platforms like Obiex, you’ll also see fiat-based pairs like USDT/NGNX. That means you’re trading Tether (a stablecoin) against Nigerian Naira (NGNX).

Fiat vs Stablecoin vs Altcoin Pairs

When trading crypto, understanding the type of trading pair you are dealing with is just as important as selecting the asset itself.

Each type of pair—fiat, stablecoin, or altcoin—behaves differently in the market and fits different strategies.

Let’s break them down one by one so you can choose the right pair for your trading plan.

1. Fiat Pairs (e.g. BTC/NGNX, USDT/GHS):

Fiat pairs are crypto assets traded directly against a local currency, such as the Nigerian Naira (NGN), Ghanaian Cedi (GHS), or Central African Franc (XAF).

These pairs are perfect when you’re looking to either onboard with cash or withdraw your profits into local currency.

This is particularly useful for African traders who require quick access to local funds without undergoing multiple conversions.

On Obiex, you can trade fiat pairs like USDT/NGNX, USDT/GHS, or USDT/XAF instantly, with good rates and zero fees.

Fiat pairs are primarily used for entering or exiting the crypto market, rather than engaging in deep market speculation.

However, they can also be volatile when your local currency is unstable, so it's essential to watch exchange rates closely.

2. Stablecoin Pairs (e.g. BTC/USDT, ETH/USDC):

Stablecoin pairs are crypto assets traded against a stable digital currency like USDT (Tether) or USDC (USD Coin).

These stablecoins are designed to match the value of the US dollar, which makes them much easier to track profits and losses.

For example, if you’re trading BTC/USDT, you know 1 USDT is roughly equal to $1, so your profit calculation becomes straightforward.

This type of pair is perfect for scalpers and high-volume traders who need stable pricing, tight spreads, and high liquidity.

In fact, BTC/USDT remains one of the most actively traded pairs globally, with a daily volume of over $20 billion as of early 2024.

For African traders, stablecoin pairs are ideal because they help protect against fluctuations in local currencies.

You can also use them to hold value safely when sitting out of the market.

On Obiex, stablecoin trading pairs are fast, reliable, and have zero slippage in most trades.

3. Altcoin Pairs (e.g. ETH/BTC, DOGE/USDT):

Altcoin pairs involve trading one crypto against another.

These pairs are known for their high volatility, fast price swings, and bigger risk, but also offer larger rewards.

A popular altcoin pair, such as ETH/BTC, allows you to bet on whether Ethereum will outperform Bitcoin.

This is great for more experienced traders who understand how different coins move.

Altcoin pairs are often utilised in swing trading or automated strategies where you aim to capitalise on significant market movements over hours or days.

However, not all altcoins have good liquidity. Some meme coins or low-cap tokens may have limited trading volume, resulting in poor fills and wide spreads.

Always check the order book before entering an altcoin trade.

On Obiex, major altcoin pairs like ETH/USDT or SOL/USDT offer solid liquidity and a smoother trading experience.

Pro Tip: When choosing between fiat, stablecoin, and altcoin pairs, ask yourself:

- Am I cashing out or just trading? — Use fiat pairs.

- Do I want to lower risk and clearly monitor my profit? — Go with stablecoin pairs.

- Am I ready to take on more risk for a possible higher return? — Explore altcoin pairs.

Top Stablecoin Pairs for African Traders

For traders in Nigeria, Ghana, and Cameroon, stablecoin trading pairs offer a practical way to manage market risks, protect their capital, and simplify trading.

Unlike volatile altcoins, stablecoins like USDT and USDC are tied to the US Dollar, so their value doesn’t fluctuate wildly.

That stability is very useful in countries where local currencies, like the Nigerian Naira (NGN) or Ghanaian Cedi (GHS), can quickly lose value due to inflation.

Here are the top stablecoin pairs African traders should focus on, especially when trading on platforms like Obiex:

1. BTC/USDT – Trade Bitcoin Against a Stable Asset:

This pair lets you buy or sell Bitcoin using Tether (USDT).

Because USDT holds a steady value, you can track your profits or losses more clearly without worrying about two volatile assets moving at the same time.

BTC/USDT is also one of the most liquid pairs in the global market.

On Obiex, this pair offers tight spreads and fast execution, making it ideal for both scalping and swing trading strategies.

2. USDT/NGNX – Easily Swap Between Tether and Naira:

USDT/NGNX is perfect for Nigerian traders who want to quickly move between crypto and local currency.

NGNX is Obiex’s tokenised version of the Naira, and it allows you to convert between USDT and Naira in seconds.

This pair is useful if you earn in Naira but want to hold your savings in USDT to protect against inflation.

There are no hidden fees, and the conversion is instant, saving you time and money compared to using traditional banks or black-market FX vendors.

3. USDC/NGNX – Great for Diversifying Stablecoins:

USDC is another popular stablecoin like USDT, backed by fully audited reserves.

Some traders prefer USDC for its transparency and regulatory backing in the US.

Pairing it with NGNX or other fiat currencies lets you diversify your stablecoin holdings while still staying connected to your local currency.

USDC/NGNX is a smart option if you're looking to reduce reliance on just one stablecoin and want flexibility when markets shift.

4. Why These Stablecoin Pairs Matter for African Traders:

- Protect Against Currency Volatility: In Nigeria and Ghana, local currencies often lose value due to inflation or economic instability. Stablecoin pairs help protect your crypto capital by allowing you to trade and save in USDT or USDC rather than losing value in Naira or Cedi.

- Faster Onboarding/Offboarding with Obiex: Obiex allows you to swap in and out of these stablecoins instantly. Whether you’re depositing Naira or withdrawing USDT, the process is smooth, fast, and reliable.

- No Hidden Fees and Best Market Rates: Unlike other platforms that charge surprise fees, Obiex gives you transparent pricing, tight spreads, and competitive rates. That means you keep more of your profits.

- Save Time on Conversions: Forget the back-and-forth stress of using P2P or bank apps. With stablecoin pairs like USDT/NGNX or USDC/NGNX, Obiex handles conversions for you in a few taps, with no delays.

Quote vs Base Asset: Why It Matters

1. What Is the Base Asset?

The base asset is the first asset listed in a trading pair. It’s the coin or token you are buying or selling.

For example, in ETH/USDT, the base asset is ETH (Ethereum). This means that when you place a buy order, you are buying Ethereum (ETH). When you sell, you are selling ETH.

It is the primary asset being traded.

Think of it this way: You are always trading the base asset in exchange for the quote asset.

2. What Is the Quote Asset?

The quote asset is the second asset in a trading pair.

It’s what you use to measure the value of the base asset and also what you receive after the trade.

In ETH/USDT, the quote asset is USDT (Tether). So if you buy 1 ETH at $3,500, you are paying 3,500 USDT.

All your profits and losses are calculated in the quote asset.

Not understanding this can lead to errors in your math, especially when trying to track gains.

3. Why Does This Matter When Trading?

This matters because it directly affects how you calculate returns, set price alerts, or even decide which trades make the most sense based on your local currency or financial goals.

Let’s say you’re trading BTC/USDT. You bought 0.1 BTC at 60,000 USDT. If BTC rises to 65,000 USDT, you’ve gained 5,000 USDT per BTC. Your profit is in USDT, not in BTC.

If your strategy is to stack more BTC, that’s a different goal than making profits in USDT.

Now compare that to USDT/NGNX.

Here, you are using USDT as the base asset, and you are either buying or selling it in exchange for NGNX.

So, if you’re trying to exit crypto into local currency quickly, knowing this structure helps you avoid slippage and execute trades more efficiently.

4. Real-Life Example: ETH/USDT vs USDT/NGNX

- Trading ETH/USDT means you’re making profit/loss in USDT. This is great if you want to lock in gains in a stablecoin that holds value.

- Trading USDT/NGNX means your returns are in NGNX, which may fluctuate with market conditions in Nigeria. This matters for traders converting crypto to fiat or vice versa.

Understanding the quote and base helps you make smarter decisions, like:

- “Should I hold my profit in USDT or convert to NGNX now?”

- “Am I trying to grow my BTC or just earn stablecoins?”

Key Factors When Choosing a Trading Pair

1. Volatility:

Volatility refers to the degree to which the price of a pair fluctuates within a short period.

Some traders love it; others hate it.

If you're a scalper (quick, small trades), high volatility can be your friend. It creates more chances to profit.

Pairs like DOGE/USDT or SHIB/USDT move rapidly, which means quick wins (and equally quick losses).

If you’re holding long-term or prefer peace of mind, too much volatility can be stressful. In that case, stick to more stable pairs.

BTC/USDT and ETH/USDT have moderate volatility. Enough movement for trading opportunities, but not too wild to manage.

2. Liquidity & Volume:

Liquidity refers to the ease with which you can buy or sell an asset without significantly affecting its price. High liquidity = faster, smoother trades.

Volume indicates the amount of that pair being traded. The higher the volume, the better the liquidity.

Globally, BTC/USDT sees over $20 billion traded daily, which means you can enter or exit trades fast without major price drops.

On Obiex, BTC/USDT, USDT/NGNX, USDT/GHS, and USDT/XAF are among the most liquid pairs, making them ideal for large orders and minimising slippage.

3. Spread:

The spread is the difference between the buy price and the sell price of a pair.

A tight spread means you lose less money in the gap, which is great for scalpers and anyone who trades actively.

On Obiex, BTC/USDT and USDT/NGNX have some of the tightest spreads, so you can enter and exit without losing profit to wide gaps.

Wider spreads, common in lesser-known altcoins, can eat into your profits fast.

4. Trading Hours & Market Activity:

The crypto market is open 24/7, but not all times are equal. Some pairs are more active during certain hours.

For example, BTC/USDT typically becomes busier during US and European business hours, as this is when most global traders are online.

For fiat pairs such as USDT/NGNX, USDT/GHS, and USDT/XAF, trading activity increases during local business hours in Nigeria, Ghana, and Cameroon.

Knowing when a market is busiest helps you time your trades better for tighter spreads and faster execution.

5. Correlations:

Some trading pairs move in the same direction because they are closely linked.

For example, ETH/BTC often mirrors BTC/USDT. If Bitcoin drops significantly, Ethereum typically follows suit.

If all your trades are in correlated pairs, your risk is doubled.

Diversifying into uncorrelated assets or fiat-backed pairs like USDT/NGNX can reduce your risk and give you more control.

6. Your Risk Appetite:

If you like to play it safe, stablecoin trading pairs are your best bet.

Pairs like USDT/NGNX or BTC/USDT offer less price drama and more predictable movements.

However, if you have a higher risk appetite and seek larger profit opportunities, then volatile altcoin pairs like SHIB/USDT or DOGE/USDT may be your preferred choice. Just be prepared for fast swings.

Always match the pair to your comfort level.

7. Capital Size:

Your capital size plays a big role in pair selection.

If you’re trading with a large amount, you need high liquidity to prevent your trades from causing slippage. That’s where pairs like BTC/USDT and USDT/NGNX shine.

If you’re working with smaller capital, you can explore altcoins for higher percentage returns.

But be careful; low-volume altcoins can be harder to sell quickly and may come with higher spreads.

8. Platform Availability:

Not every crypto pair is listed everywhere. Always check what your platform offers.

On Obiex, some of the most reliable pairs include BTC/USDT, ETH/USDT, USDT/NGNX (with GHS and XAF also available), and USDC/NGNX.

Using available, well-supported pairs ensures faster trades, better support, and fewer errors.

Don’t waste time looking for obscure pairs that aren’t even on your platform.

Matching Pairs to Strategy Types

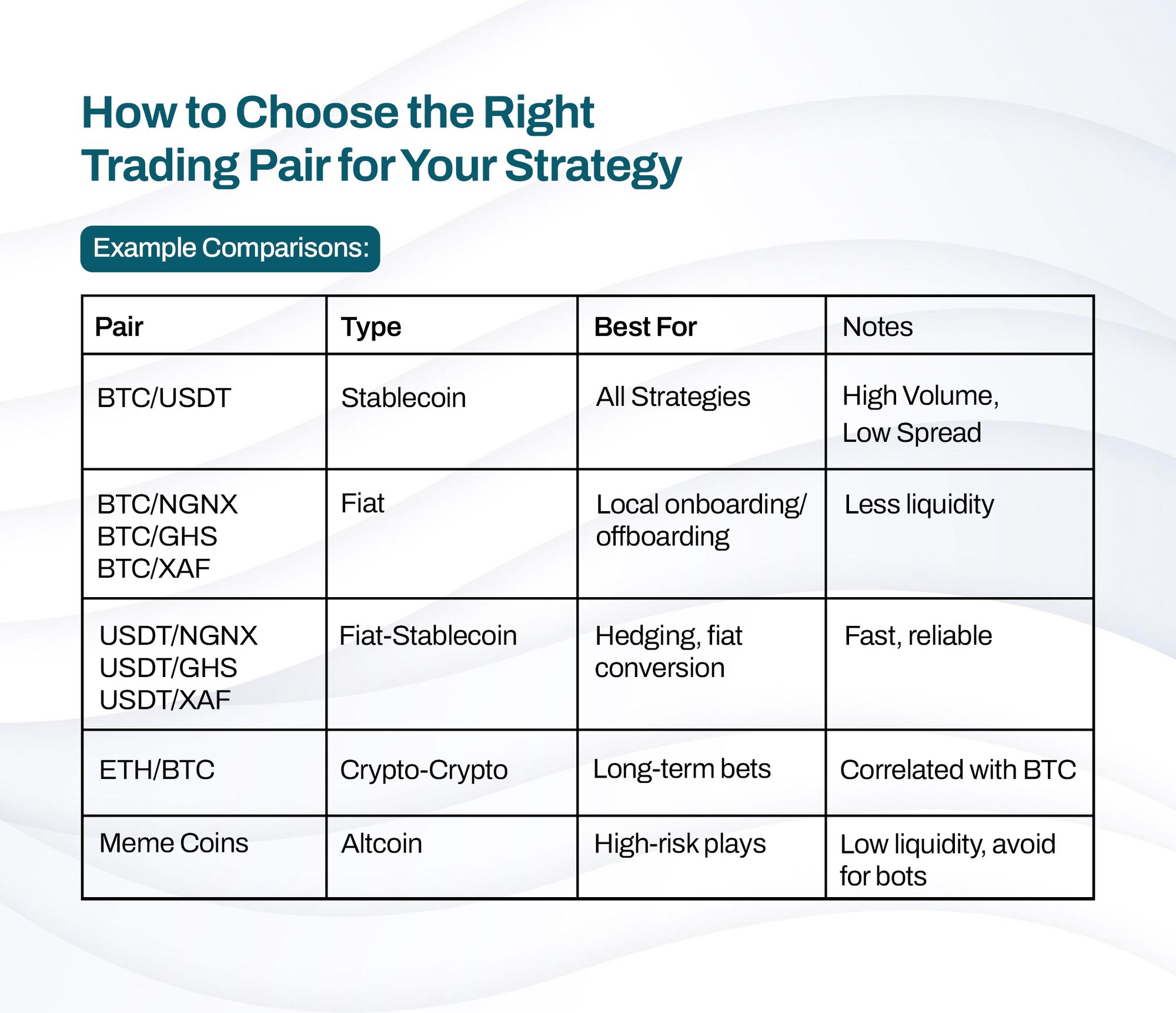

Different strategies are more effective with certain pairs. Check out the match below:

What to Avoid When Picking a Pair

1. Chasing Hype Pairs:

It’s easy to get tempted by trending meme coins or tokens that suddenly pop up on social media.

But just because everyone is talking about them doesn’t mean they’re good for trading. Most of these “hype pairs”, like PEPE/USDT or SHIBA/USDC, have very low liquidity.

This means you might be able to buy in, but struggle to sell without taking a big loss.

For example, if only a few people are trading a token, your order might not get filled quickly, or the price could drop before you exit.

Stick to well-known, liquid pairs like BTC/USDT or USDT/NGNX on Obiex to reduce this risk.

2. Ignoring Trading Fees:

Low-volume pairs often come with higher spreads and extra fees, which can quietly eat into your profits.

The spread is the difference between the buying and selling price. If it’s too wide, you lose money instantly.

Some exchanges charge more for less popular pairs. That’s why it’s better to use platforms like Obiex, where pairs like BTC/USDT or USDT/NGNX have zero fees and tight spreads.

Always check both the fee and the spread before entering a trade, especially if you’re scalping or doing multiple trades a day.

3. Using Exotic Altcoin Pairs for Bots:

If you’re using automated trading bots, don’t make the mistake of choosing random or exotic pairs like BABYDOGE/SHIB or FLOKI/PEPE.

Bots rely on strong liquidity to work effectively. Without enough buyers and sellers, your bot might place orders that never get filled, or worse, trigger losses due to price slippage.

Use high-volume, stable pairs for your bots, such as BTC/USDT or ETH/USDT. These pairs have consistent movement, solid volume, and reliable order matching on platforms like Obiex.

4. Assuming All Stablecoins Behave the Same:

Many traders believe that USDT, USDC, BUSD, and others are always equivalent, but that’s not the case.

While they are all designed to be “stable”, their market prices, trading volumes, and availability can vary.

For example, in certain periods, USDC can trade slightly lower or higher than USDT, especially during market stress or regulatory changes.

If you’re not careful, you might lose value during swaps.

Always check the volume and spread of any stablecoin pair before trading to ensure optimal execution.

On Obiex, pairs like USDT/NGNX and USDC/NGNX are backed with real liquidity and instant swaps, so you don’t have to worry about price differences.

To Recap

- A trading pair consists of two assets that you can trade against each other on a crypto exchange.

- Choosing the right pair can impact your profits, risk, and trading speed.

- Fiat pairs are best for entering or exiting crypto using local currencies like NGN or GHS.

- Stablecoin pairs offer price stability, clear profit tracking, and are ideal for low-risk trading.

- Altcoin pairs are highly volatile, offering high rewards but increased risk, suitable for experienced traders.

- The base asset is the first in a pair; it’s what you buy or sell.

- The quote asset is the second in a pair; it’s what you use to measure value and receive profits in.

- Knowing which is the base vs the quote helps you understand profit calculations and choose the right exit strategy.

- Liquidity and trading volume determine how easily and quickly you can trade without big price changes.

- Some pairs are more active during specific trading hours, depending on regional time zones.

- Match your pair to your risk appetite. Use stablecoin pairs for safer trades and altcoin pairs for bigger risks and rewards.

💡Trade smart, not random.

Use Obiex pairs like BTC/USDT and USDT/NGNX to lock in better entries and exits without stress.

FAQs

Q1. What is a trading pair in crypto?

A trading pair shows two assets you can trade between. For example, BTC/USDT means you’re trading Bitcoin against Tether.

Q2. What’s the best trading pair for crypto?

BTC/USDT is the most popular and liquid crypto pair; great for all strategies.

Q3. How do I choose the best crypto pair?

Look at your strategy, risk level, capital size, and the pair’s liquidity. BTC/USDT and USDT/NGNX are great starting points.

Q4. What are trading pairs for scalping?

Pairs with tight spreads and high liquidity, like BTC/USDT and USDT/NGNX, are ideal for scalping.

Q5. Why is liquidity important in crypto trading?

Liquidity allows you to buy/sell easily without price slippage or delay.

Q6. Are fiat trading pairs good in Africa?

Yes, pairs like USDT/NGNX or GHS/USDT help you convert between crypto and your local currency easily.

Q7. What’s the difference between altcoin and stablecoin pairs?

Altcoin pairs are more volatile and risky, while stablecoin pairs are more predictable and stable.

Q8. Can I use Obiex for fiat and stablecoin pairs?

Yes. Obiex supports pairs like BTC/USDT, ETH/USDT, USDT/NGNX, and USDC/NGNX with low fees and fast swaps.

Q9. Are all stablecoins the same?

No. USDT, USDC, and BUSD have different levels of trust, backing, and market activity. Always check the details.

Q10. What’s the most profitable crypto pair?

There’s no single “most profitable” pair. Profit depends on your strategy. But pairs like BTC/USDT offer high volume and flexibility for most traders.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.