Table of Contents

- Step 1: Gather Your Trade Data

- Step 2: Set Up a Simple Audit Sheet

- Step 3: Identify Wins and Losses Objectively

- Step 4: Spot Patterns and Repeated Mistakes

- Step 5: Implement Corrective Actions

- Step 6: Monitor Progress Over Time

- FAQs

Many traders enter and exit positions daily without ever reviewing what worked, what failed, or why.

Over time, this creates a dangerous habit of guessing instead of trading with discipline.

Auditing your trades is the fastest way to stop this cycle. It’s not complicated or technical. It’s about looking at hard data and patterns to see where money is leaking out.

Here’s how to start.

Step 1: Gather Your Trade Data

Before you can fix what’s going wrong in your trading, you need to see exactly what’s been happening, not what you think is happening.

Most traders believe they’re doing “okay” until they look at their trade history and realise how many small, avoidable mistakes have been draining profits.

Gathering your trade data is the foundation of every trade audit. It’s the difference between trading on memory and trading on facts. You can’t improve what you don’t measure.

Why This Step Matters

Every trade you make leaves a digital paper trail: entry price, exit price, fees, time, and result. If you review the numbers properly, you’ll quickly see whether:

- You’re cutting winners too early.

- You’re holding losers for too long.

- You’re paying more in fees than you think.

- You’re trading emotionally instead of strategically.

How to Pull Your Trade History on Obiex

Obiex makes it simple to see your entire trading history in one place. To start your audit, you only need your last 10 trades. Here’s how to find them:

1. Log in to your Obiex account.Go to your dashboard and click on “Trade History”. This section shows all your recent swap and trade transactions.

2. Select your last 10 trades.Focus only on your 10 most recent trades. This keeps your audit short, simple, and manageable, while still giving you enough data to see patterns.

3. Record these key details for each trade:

- Date and Time: When exactly did you enter and exit the trade?

- Trading Pair: For example, BTC/USDT, SOL/USDT, or ETH/NGN.

- Trade Size: How much did you buy or sell?

- Entry Price: The price at which you entered the position.

- Exit Price: The price you sold or closed at.

- Profit/Loss (P/L): The difference between your entry and exit.

- Fees Paid: Include both trading and withdrawal fees.

- Strategy Used: Were you scalping, swing trading, or holding long-term?

- Notes: Any reason or emotion behind the trade (e.g., “entered due to FOMO,” “followed support level,” “rushed entry”).

Pro Tip: If you’ve made trades across multiple pairs (e.g., BTC/USDT, SOL/USDT, and BNB/USDT), don’t mix them all together. Group them by pairs. This makes it easier to spot which coins or setups are consistently giving you trouble.

If You Trade on Multiple Platforms

If you use more than one exchange or wallet, repeat this same process for each platform. Then combine all your trades into a single sheet.

The goal is to have a complete picture of your performance.

You can also export your data as a CSV file or take a screenshot of your trade history for easier reference.

Step 2: Set Up a Simple Audit Sheet

Now that you’ve gathered your last 10 trades, it’s time to make sense of them.

Raw data is only useful if it’s organised clearly, and that’s where your audit sheet comes in.

You don’t need fancy analytics tools or premium trading software. A basic spreadsheet in Google Sheets, Microsoft Excel, or even your phone’s Notes app can do the job perfectly.

The goal here is clarity, not complexity. Your audit sheet should help you see your performance at a glance.

How to Build Your Audit Sheet

Open a Google Sheet or Excel file and create the following columns:

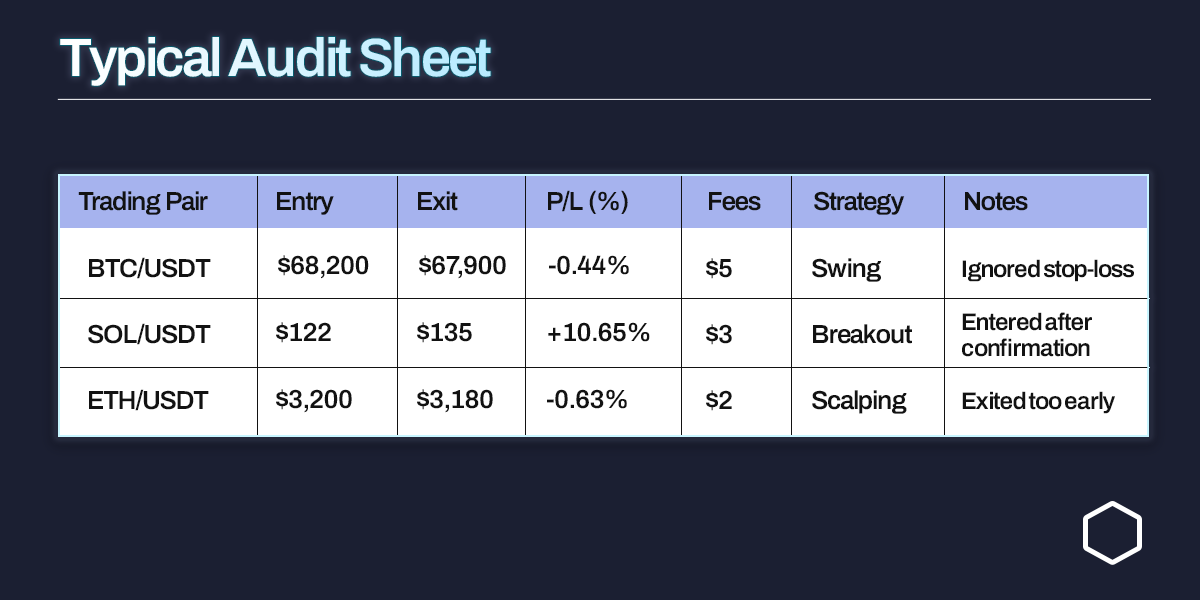

Here’s an example of how it should look once filled in:

Even with just three trades logged, you can already identify where profits came from and where mistakes occurred.

How to Make Your Audit Sheet Easy to Read

Keep it visual. You want to be able to glance at your sheet and instantly understand how you’re doing. Try these simple tricks:

1. Use colour codes:

- 🟢 Green for winning trades

- 🔴 Red for losing trades

- 🟡 Yellow for trades where you broke your rules or made an emotional decision

2. Add a “Rule Break” column:Write “Yes” or “No” beside each trade to indicate whether you followed your trading plan. You’ll quickly notice if rule-breaking is your biggest problem.

3. Include a total summary at the bottom:Add simple formulas to calculate:

- Average P/L per trade

- Total profit/loss across 10 trades

- Win rate (% of profitable trades)

- Total fees paid

Simplify First; Improve Later

Don’t overcomplicate your first audit sheet. You’re not building a financial model; you’re just collecting honest, basic insights. Start small and refine as you go.

Once you get comfortable, you can add extra columns such as:

- Market Condition (bullish, bearish, sideways)

- Time of Entry (morning, afternoon, night — to see when you trade best)

- Emotion (calm, anxious, overconfident)

These help you identify when and how you make your best decisions.

Step 3: Identify Wins and Losses Objectively

This step is where you stop guessing about your performance and start seeing what’s really working versus what’s quietly draining your balance.

A disciplined trader looks at results objectively, not based on how confident they felt, but on what the numbers say.

How to Review Each Trade Objectively

Go through your audit sheet line by line and ask yourself the same three questions for every trade:

1. Did I follow my trading plan?If yes, mark it ✅. If not, write what rule you broke. For example, “moved stop-loss,” or “entered before confirmation.”

2. Was the trade result logical based on my strategy?Did your setup work, or did the market move unexpectedly? This helps separate bad execution from bad market conditions.

3. Was this a profitable or losing trade (after fees)?Include every cost. A small +1% profit may actually be a -0.5% loss after fees.

Practical Example:

Looking at three sample trades from the audit sheet above, now ask:

- Trade 1: Why did it lose? Because you ignored your stop-loss. That’s an execution mistake.

- Trade 2: Why did it win? Because you followed your plan. This shows your strategy works when executed correctly.

- Trade 3: Why did it lose? Poor entry timing. That’s a technical error you can fix with better patience or confirmation rules.

See the difference? The more clearly you can connect the dots between your actions and your results, the faster you’ll improve.

Step 4: Spot Patterns and Repeated Mistakes

The next step is to spot patterns; those habits, conditions, or setups that consistently influence your results.

Every trader has patterns. Some make you money. Others quietly drain it. The goal here is to find both, so you can double down on what works and eliminate what doesn’t.

How to Find Patterns in Your Trades

Start by grouping your trades into categories like these:

Example:

Let’s say your audit sheet shows:

From this small sample, your pattern shows that:

- You perform best on morning trades (10–11 AM).

- Scalping at night leads to repeated losses.

- Breakout setups work only when you wait for confirmation.

The Power of “Mistake Mapping”

Here’s a simple method to create a “mistake map” from your audit sheet:

- List all your losing trades.

- In a separate column, write the reason for each loss.

- Tally how often each mistake appears.

Example:

From this, you’ll quickly see your top three problem areas.These are your profit leaks; the specific mistakes that cost you the most.

Step 5: Implement Corrective Actions

Now it’s time to do the most important thing: act on what you’ve learned.

Every audit should end with a clear plan of action: what you’ll stop doing, what you’ll start doing, and what you’ll adjust to make your trading more consistent and profitable.

1. Define Your Key Lessons

Start by writing down three to five clear lessons from your audit.

Be specific: avoid vague statements like “trade better” or “be more patient.” Instead, define what exactly went wrong and what you’ll do differently.

Example:

2. Adjust Your Strategy and Execution

Your audit results will often show that your trading method isn’t the main issue. It’s your execution or timing.

Here’s how to correct both:

- Refine Your Entry Rules

- Tighten Your Exit Strategy

- Rebalance Position Sizes

- Control Leverage

- Simplify Your Strategy Mix

3. Use Tools That Help You Stay Disciplined

The best traders don’t just rely on discipline. They use systems and tools that enforce it.

Here’s how to make your corrections easier to stick to:

- Set up Stop-Loss and Take-Profit Orders Automatically

- Track Fees in Real-Time:

- Use the Fast Swap Feature: The Obiex Fast Swap feature ensures your trades execute instantly at current rates.

- Create a Weekly Routine:

4. Rebuild Your Emotional Control

Most trading mistakes come from emotional triggers like fear, greed, overconfidence, or frustration.Here’s how to address them directly:

- After a Loss: Step away for a few hours. Don’t try to “win it back.”

- After a Win: Celebrate, but don’t rush into another trade immediately.

- During a Trade: Stick to your plan. If you find yourself adjusting targets mid-trade without logic, you’re trading emotionally.

5. Set Measurable Goals for Improvement

Improvement must be measurable. Otherwise, you won’t know if your corrective actions are working.

Here’s how to quantify your progress:

- Target fewer emotional trades: e.g., from 5 per week to 1 per week.

- Increase win rate: e.g., from 45% to 55% within one month.

- Reduce average loss per trade: e.g., from -3% to -1.5%.

- Achieve consistent journaling: 100% of trades logged weekly.

6. Use Obiex Features to Reinforce Good Habits

Your trading platform can make or break your discipline.Here’s how to use Obiex to support your corrective plan:

- Transparent Trade History

- Zero-Fee Swaps

- Instant Conversions

- Stablecoin Support (USDT, USDC, NGNX)

Pro Tip: Keep auditing and refining. Implementing corrective actions isn’t a one-time fix. It’s a continuous cycle.

Step 6: Monitor Progress Over Time

Auditing once helps you fix short-term issues. Monitoring regularly helps you build long-term consistency and confidence.

Here’s how to stay consistent over time:

- Create a Weekly or Monthly Audit Routine

- Track Key Performance Metrics

- Use a Tracker or Spreadsheet

- Automate What You Can

- Schedule Your Review Time

👉 Audit your last 10 trades now on Obiex and start trading smarter today.

FAQs

Q1. How do I audit my crypto trades effectively?

Start with your last 10 trades. Record entry, exit, fees, and results. Identify where your strategy failed or emotions took over.

Q2. What mistakes should I look for in past trades?

Look for emotional trades, poor timing, ignored stop-losses, and over-leveraging.

Q3. Can I audit trades on Obiex easily?

Yes. Obiex provides a clear trade history, allowing you to download or view all details for easy auditing.

Q4. How often should I review my trades?

Weekly reviews are ideal. Monthly at minimum. The goal is to catch mistakes early.

Q5. What tools can help me improve trading performance after auditing?

Google Sheets, Notion, or simple Excel templates work well. You can also integrate portfolio trackers like CoinMarketCap Portfolio.

Q6. What is a trade review checklist?

It’s a simple list including: entry/exit points, reason for trade, emotional state, and outcome.

Q7. Why do Nigerian traders struggle with consistency?

Many trade impulsively during market volatility or news events without following a plan or reviewing outcomes.

Q8. How can auditing improve my crypto trading performance?

By showing you exactly what’s working and what isn’t — so you can double down on winners and cut recurring losses.

Q9. What’s the best time to audit trades?

At the end of each week or after every 10 trades. Consistency matters more than timing.

Q10. How can Obiex help me audit trades faster?

Obiex offers fast swaps, zero-fee transfers, and a transparent trade history dashboard — making it easy to review trades in minutes.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.