Table of Contents

- Why Should You Consider Using Crypto Payouts For Your Business and Fintech Products?

- How to Add Crypto Payouts to Your Fintech

- Who Uses Crypto Payouts in Africa Today?

- What Obiex Offers With Our Crypto Payouts

- To Recap

- FAQs

For African fintech companies building cross-border remittance apps, payroll platforms, or global treasury systems, the demand for crypto payouts, especially in USDT (Tether), has become a growing necessity.

More users, contractors, and gig workers are asking to be paid in crypto. Why? Because traditional payment systems are too slow, too expensive, or simply don’t work across many corridors.

This shift is driven by practical needs, including faster settlement times, inflation resistance, and borderless access to value.

At the same time, local fintechs are under pressure to support reliable and scalable payouts to remote teams, freelancers, and global vendors.

But building this infrastructure from scratch is complex and costly.

That’s where Obiex comes in. Obiex offers ready-to-integrate APIs and compliant crypto payout rails that allow fintechs to add USDT and other crypto payouts to their platforms quickly and securely, without the regulatory and technical headaches of going solo.

In this guide, we will show you exactly how to integrate crypto payouts into your product stack and explain why doing so is key to staying competitive in Africa’s rapidly growing fintech landscape.

Why Should You Consider Using Crypto Payouts For Your Business And Fintech Products?

Crypto payouts mean sending digital currencies, like USDT (Tether), BTC (Bitcoin), or USDC (USD Coin), directly to end-users, contractors, businesses, or service providers as a form of settlement or payment.

For African fintech platforms, this solution addresses several longstanding problems, including slow cross-border payments, high transaction fees, foreign exchange losses, and regulatory bottlenecks tied to local banking systems, all at once.

This is especially game-changing for platforms paying remote workers, freelancers, or gig economy participants across multiple countries.

Businesses like cross-border e-commerce platforms, global payroll providers, and B2B merchants are already adopting stablecoin payouts as a faster, cheaper, and more scalable alternative.

For treasury and operations teams, crypto payouts also mean real-time settlement without being tied to business hours, plus easier reconciliation through blockchain transparency.

How to Add Crypto Payouts to Your Fintech

1. Understand Your Use Case and Payout Volume:

Start by defining your specific needs. Before writing a single line of code, start by identifying what kind of payouts you’re enabling. Next, map out the currencies and corridors you want to support. Ask:

- Are you paying users (B2C), businesses (B2B), or enabling peer-to-peer (P2P) transfers?

- How many payouts do you handle daily or weekly? (e.g., 500 daily payouts vs. 2,000 weekly)

- What currencies do your recipients prefer? (USDT is most requested in Nigeria, Ghana, and Kenya)

- What corridors are you serving—local, intra-Africa, or global?

- What are your compliance obligations per country?

Example: A gig platform paying 2,000 freelancers weekly in Nigeria and Ghana would need:

- USDT support with adequate liquidity

- Wallet features for users

- Nigeria and Ghana-specific KYC and AML checks

2. Choose the Right Crypto Infrastructure Provider:

Building crypto payout systems from scratch can cost $200K+ in engineering, take 4–6 months, and introduce regulatory risks you may not have sufficient capacity to handle.

Instead, find a provider that fits your needs. It is advisable to evaluate providers based on:

- Liquidity: Can they process $100K+ in USDT payouts without slippage?

- Compliance: Are KYB/KYC tools and AML screenings built-in?

- Reliability: Is their API uptime 99.9%? How long does a payout take?

- Support: Do they offer SDKs, docs, and real-time technical help?

Obiex, as a provider, offers:

- Deep liquidity in USDT, BTC, ETH across Africa

- Built-in KYC, KYB, and AML tools that meet regional compliance

- Trusted by high-volume fintechs moving over $5M/month

- 24/7 technical support + dedicated onboarding engineers

3. Integrate APIs for Crypto Wallets and Payouts:

Use developer-first APIs to plug crypto wallets and payouts directly into your platform in under two weeks.

These APIs Must Have:

- Create wallets per user or merchant

- Trigger payouts in real-time (e.g., pay 1,000 users in minutes)

- Automate KYC and KYB flows

- Monitor balances, fees, and transaction statuses via dashboard or API

4. Build in Compliance and Auditability:

Crypto compliance is mandatory.

Here are three things you need for compliance:

- KYB/KYC workflows for both individuals and businesses

- Ongoing AML monitoring on wallet activity

- Audit-ready transaction logs for financial reporting or regulator reviews

How Obiex Supports Businesses with Compliance:

- Built-in KYC/KYB flows

- Exportable transaction logs

- Configurable AML screening tools

- Optional webhooks for real-time flagging of suspicious activity

You can fetch full payout histories, trace wallet activity, and generate reports directly through the Obiex dashboard or API.

This protects your business and simplifies financial audits, licensing renewals, or due diligence requests.

5. Test, Monitor, Launch:

Once integrated, you need a structured testing and monitoring process to ensure smooth operations.

Pre-Launch:

- Use the sandbox environment to simulate live transactions and payout conditions.

- Monitor for failed transactions, payout delays, and liquidity thresholds.

- Set up alerts for real-time error tracking and issue resolution.

Launch:

- Validate real-time transactions with a limited user group before full rollout.

- Ensure your compliance, liquidity, and payout thresholds are ready for live operations.

- Confirm third-party integrations (like KYC/AML, wallet providers, and liquidity partners) are stable.

Post-Launch Monitoring:

- Track transaction success rates and error logs through a real-time dashboard.

- Monitor crypto wallet balances and liquidity usage across payout corridors.

- Continuously test system resilience and optimise for cost, speed, and user experience.

- Use 24/7 technical support with Slack or email escalation for rapid issue resolution.

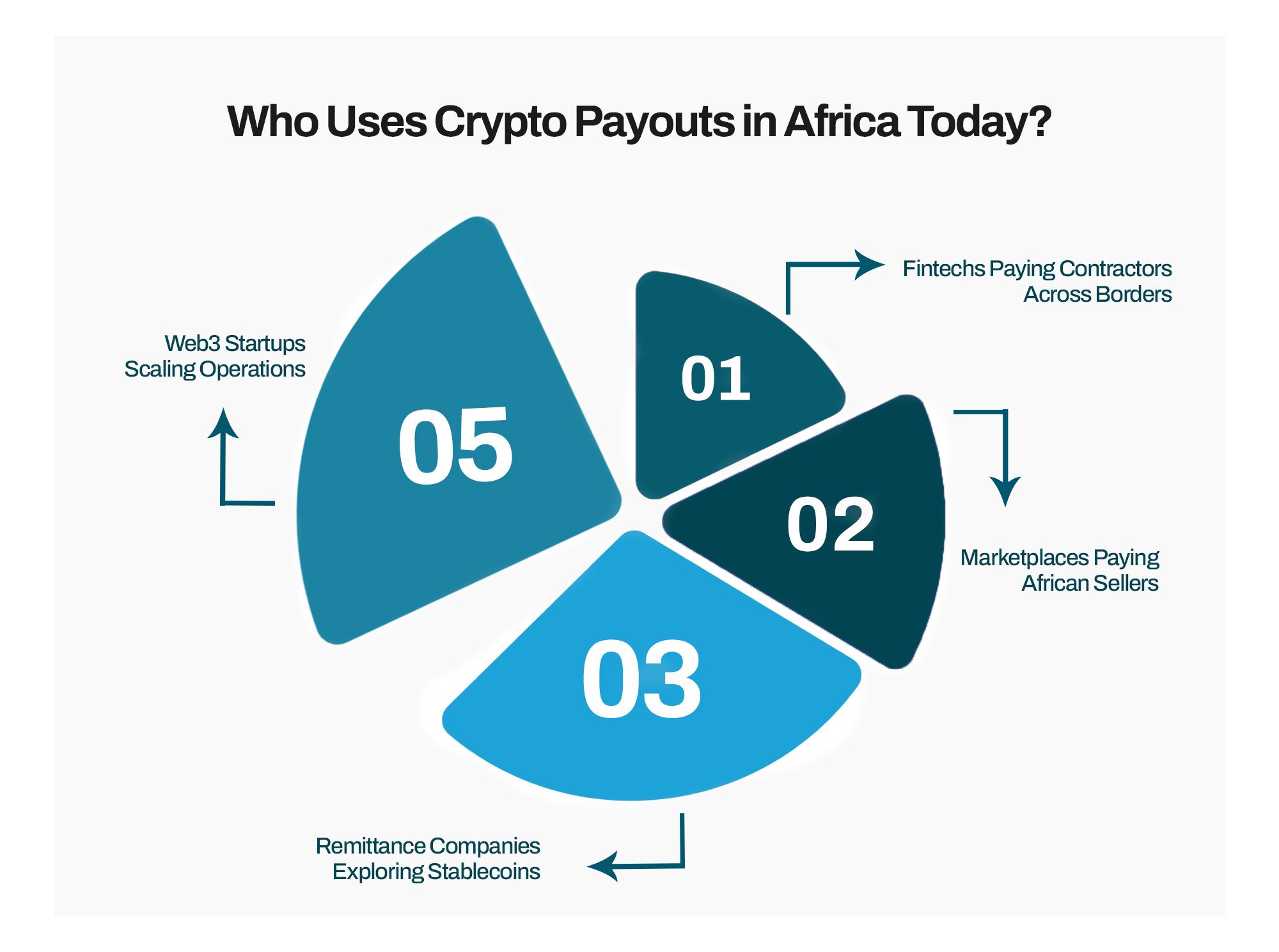

Who Uses Crypto Payouts in Africa Today?

1. Fintechs Paying Contractors Across Borders:

Fintech platforms that work with remote teams across different African countries, especially in Nigeria, Kenya, Ghana, and South Africa, are under pressure to pay contractors in USD or USDT.

Many developers, customer support representatives, and back-office workers now prefer to be paid in stablecoins due to currency depreciation in their local economies.

Tip: Obiex’s crypto infrastructure solves this by enabling instant, USDT-based payouts, reducing costs and improving contractor retention.

2. Marketplaces Paying African Sellers:

E-commerce and digital marketplaces serving African sellers often struggle with cross-border payments.

Sellers prefer payouts in stable currencies like USDT, which maintain their value, especially when selling to international buyers. Traditional payout methods often involve high conversion fees, delayed processing times, and foreign exchange (FX) issues.

3. Remittance Companies Exploring Stablecoins:

Remittance providers are actively exploring stablecoin-based remittances as an alternative to the costly SWIFT or MoneyGram systems.

In Africa, remittance inflows surpassed $54 billion in 2023, with Nigeria accounting for over $20 billion. Yet, sending $200 to sub-Saharan Africa still costs more than 8% in fees.

Crypto rails enable these companies to settle in seconds, not days, and at a fraction of the cost.

4. Web3 Startups Scaling Operations:

Africa’s Web3 scene is growing rapidly, with startups launching DAOs, DeFi products, and NFT platforms.

These teams typically hire developers, marketers, and community managers across borders and pay in crypto by default.

For these startups, crypto-native settlement infrastructure isn’t optional. It is foundational. However, building that infrastructure in-house is costly and time-consuming.

While this approach offers full control and customisation, it also requires significant technical expertise, ongoing maintenance, and upfront capital investment.

To reduce costs and maximise efficiency, these Web3 teams could utilise a plug-and-play solution for scalable, compliant payout APIs with deep USDT liquidity in key African markets.

5. B2B Payment Aggregators Seeking New Rails:

B2B payment aggregators serving small businesses, freelancers, or merchant platforms are constantly seeking faster and more cost-efficient tracks.

Many of their clients now request crypto settlement options, particularly when dealing with international customers. Instead of building everything from scratch, aggregators can contract crypto payout providers to integrate ready-to-use, regulated rails with a single API.

This reduces operational complexity and enables them to offer new value-added services, such as instant USDT settlements and lower FX exposure for clients.

What Obiex Offers With Our Crypto Payouts

1. Instant Liquidity Across Major Tokens (USDT, BTC, ETH):

Obiex gives you direct access to deep liquidity for major cryptocurrencies like USDT, BTC, and ETH—available instantly, 24/7.

This means your platform can process high-volume payouts at any time without delays or price slippage.

In markets where stablecoins have become a significant part of digital commerce, particularly in Nigeria, Ghana, and Kenya, this access is crucial.

2. Built-in Compliance Tools and Audit Trails:

The Obiex platform features built-in compliance layers, including automated KYC/AML verification, wallet risk scoring, and audit-ready transaction histories.

This ensures that your platform can meet local and international regulatory standards without needing to build these complex systems in-house.

Whether you're reporting to partners, regulators, or internal finance teams, Obiex provides transparent, exportable audit logs for every transaction, ready when you need them.

3. Trusted by Top African Fintechs:

Leading African fintech key players already rely on Obiex to power their crypto infrastructure, including startups and scale-ups in remittance, payroll, and digital commerce.

This is not just about brand trust. It’s about proven reliability in live production environments.

Obiex has helped fintechs reduce payout times and lower transaction costs, especially in high-volume corridors like Nigeria–Ghana and South Africa–Kenya.

4. Easy Integration with Developer-First APIs:

Obiex was built with developers in mind. Its RESTful APIs are well-documented, fast to integrate, and designed for flexibility. Your engineering team can go from sandbox to production in days, not months.

With SDKs, webhook support, and clear test environments, Obiex minimises integration time, allowing you to focus on product execution.

5. Handles High-Volume Transactions with Enterprise SLAs:

Scalability and reliability are non-negotiable for modern fintechs, and Obiex delivers.

The platform supports millions of dollars in daily volume with 99.99% uptime and real-time transaction monitoring.

Enterprise-grade SLAs ensure that your payout flows remain uninterrupted, even during peak transaction hours or network congestion.

Whether you’re paying 50 contractors or 50,000 gig workers, Obiex is built to handle it at scale.

To Recap

- Crypto payouts, especially in USDT, offer faster settlement, borderless access, and protection from inflation.

- They work 24/7, with low fees and no reliance on bank hours or intermediaries.

- Businesses like e-commerce platforms and payroll providers are adopting stablecoins for cost efficiency and scalability.

- Fintechs should first define their payout use case, currency needs, and regulatory requirements before integrating crypto payouts.

- Choosing the right provider requires checking for liquidity, compliance tools, reliability, and developer support.

- Obiex offers deep liquidity, built-in KYC/AML, 24/7 support, and fast integration for crypto payouts.

- Obiex APIs support wallet creation, real-time payouts, transaction monitoring, and compliance reporting.

- Testing and monitoring via sandbox environments and real-time dashboards ensure smooth operation pre- and post-launch.

- Fintechs that pay remote teams across multiple countries utilise crypto payouts to reduce costs and retain contractors.

- Remittance providers use crypto rails to cut fees and speed up transfers for unbanked users.

- Obiex ensures instant liquidity in major tokens (USDT, BTC, ETH) for high-volume use.

- The platform features solid compliance and audit capabilities to meet regulatory requirements.

- Obiex supports enterprise-grade volumes with 99.99% uptime and SLA guarantees.

💡Ready to offer fast, scalable crypto payouts?

Build with Obiex, your trusted partner for compliant, high-volume settlements.

FAQs

Q1. What are crypto payouts for African fintechs?

Sending digital currencies like USDT to users or partners.

Q2. How do I add USDT payouts to my fintech platform? Use Obiex APIs to integrate wallets and crypto settlement flows.

Q3. Is crypto settlement infrastructure legal in Africa?

It varies. Obiex works with partners to stay compliant across countries.

Q4. How does Obiex help with crypto payout integration?

Through liquidity, APIs, KYC tools, and compliance features.

Q5. Can I use the Obiex API for USDT payouts?

Yes. Obiex supports full-featured payout APIs for stablecoins and crypto.

Q6. Is it expensive to use Obiex crypto infrastructure?

No. It’s more affordable than building from scratch and reduces transaction costs.

Q7. What is Obiex for fintechs?

A crypto infrastructure platform that helps fintechs launch crypto payouts.

Q8. Can Obiex handle large-volume crypto settlements?

Yes. Obiex supports enterprise-grade transaction volumes.

Q9. Can I monitor and audit transactions on Obiex?

Yes. All transactions are logged with clear visibility and audit trails.

Q10. What’s the first step to build with Obiex infrastructure?

Start by downloading the app.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.