Diversification vs. Concentration: Which Investment Type Works Better?

Diversification means investing in a broad range of assets, while Concentration means investing in a limited number of assets.

Table of Contents

- What Is Diversification In Investing?

- Example Of Diversification

- Take The Risk Tolerance Quiz

- What Is Concentration In Investing?

- Example Of Concentration

- Real-Life Opinions: Diversification Vs Concentration

- Diversification Vs. Concentration: Making The Decision For Your Money

- Extra: Finance Films, Documentaries and Books You Should Check Out

Investing can be a complex journey, but understanding key strategies like diversification and concentration can significantly improve how your money works for you (since you work hard for it as well).

In this article, I will explain :

- diversification and concentration as investment strategies,

- give you a list of (reusable and practical) questions to ask yourself to simplify the investment decision process and,

- throw in some curated opinions about both strategies from one of the best places to ask questions—Reddit.

Let's get to it.

What is Diversification in Investing?

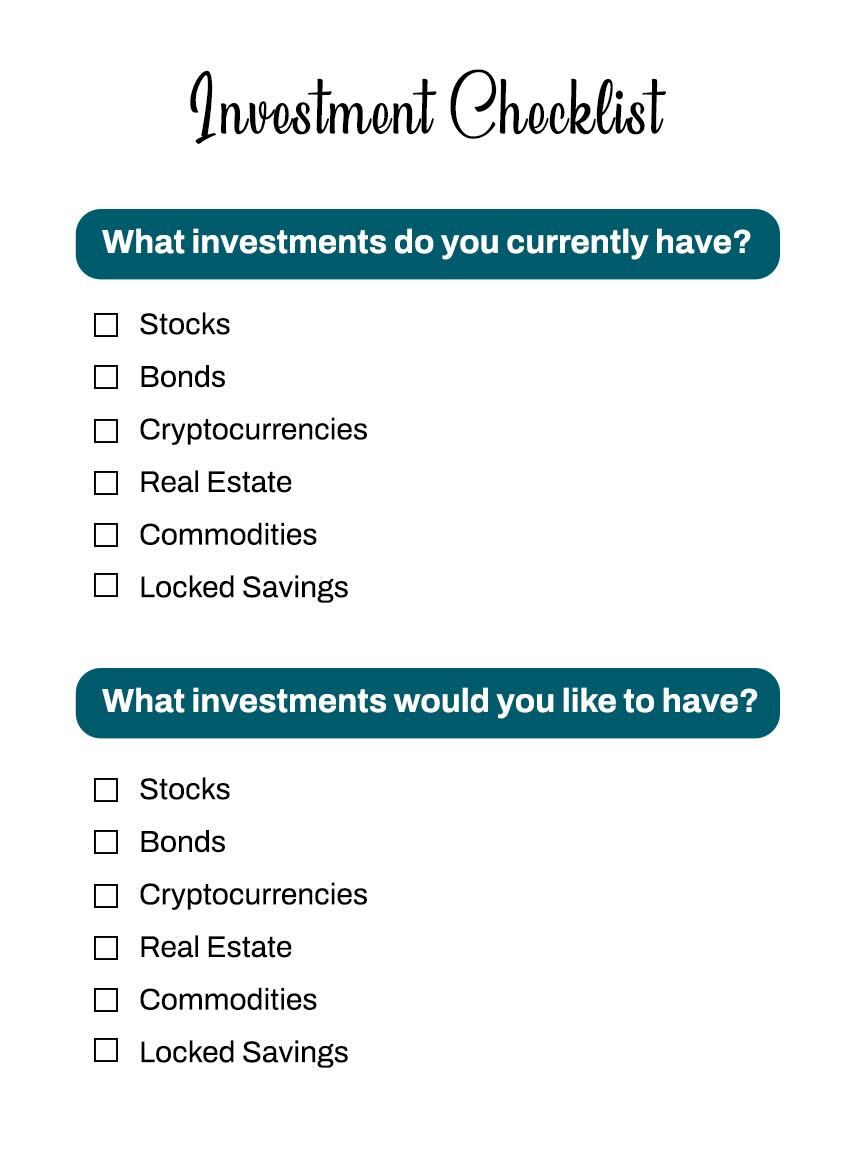

Diversification means investing in a broad range of assets (such as stocks, cryptocurrencies, bonds, digital currencies, and real estate) across multiple industries.

The guiding principle behind diversification in investment is “not putting all your eggs in one basket.”

Here’s a hypothetical example of a diversified portfolio for a middle-income Nigerian:

1. Stocks (50%)

Nigerian Large Cap Stocks (10%): Nigerian Stock Exchange (NSE) 30 Index Fund

Nigerian Small Cap Stocks (5%): (small-cap companies with strong growth potential)

International Stocks (25%):

- Apple (AAPL)

- Tesla (TSLA)

- Nvidia (NVDA)

- Amazon (AMZN)

- Microsoft (MSFT)

Emerging Market Stocks (10%): Vanguard Emerging Markets ETF)

2. Bonds (20%)

Nigerian Government Bonds (10%): Federal Government of Nigeria (FGN) Bonds

Corporate Bonds (5%): Corporate Bond Funds or specific corporate bonds from reputable Nigerian companies

International Bonds (5%): iShares International Treasury Bond ETF

3. Cryptocurrencies (10%)

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

4. Real Estate (10%)

- Real Estate Investment Trusts (REITs)

5. Commodities (5%)

- Gold ETFs

- Investments in agriculture

6. Savings(5%)

- Locked Savings in Naira.

- Locked Savings in Dollars.

Pros of a Diversified Portfolio/Diversification

1. Risk Reduction: It helps reduce the impact of unpredictable market swings on your overall portfolio since different types of investments react differently to economic changes.

2. More Balanced Returns: A diversified portfolio tends to have more stable returns over time. When some investments are doing poorly, others may be doing well, helping to balance things out.

3. Capital Preservation: Diversifying can protect a significant chunk of your money from significant losses, which is great for those who are not comfortable taking big risks.

4. Increased Potential For Financial Growth: By investing in different sectors, you can take advantage of multiple industries' growth potential and benefit from market upswings overall.

“Behind every stock is a company. Find out what it’s doing.” Peter Lynch

Cons of Diversified Portfolio/Diversification

1. Limited High Returns: Although diversification helps lower risk, it might also cap the potential for really high returns. This is because you're spreading your money across different investments, so you may not hit jackpot gains on any single one.

2. Asset Performance Lag: Having underperforming assets in a diversified portfolio can drag down your overall returns. So, while it might reduce risk, it could also mean you don't see as much growth as possible if you only invested in top-performing assets.

3. Takes Time and Research: Keeping a diversified portfolio in check requires ongoing monitoring and research to ensure everything performs as it should. It demands more attention than a less diversified portfolio, which could be a hassle for some investors.

“Price is what you pay; value is what you get.” Ben Graham

Four Categories To Split Your Diversified Portfolio

You can split your portfolio into these four categories:

1. Asset Classes: By including various asset classes like stocks, crypto, bonds, real estate, and commodities, you can diversify your portfolio's risk exposure. Different assets react differently to economic changes, helping to minimise overall risk.

2. Industries: Investing in stocks across different sectors and industries (like AI, Automobiles, Food Delivery, and Real Estate) that are not highly correlated can further diversify your portfolio. This means that if one industry faces challenges, another sector may still perform well.

3. Individual Stocks: Having a mix of individual stocks that perform differently in various market conditions, as in how their price changes, is another layer of diversification. This way, the performance of one stock won't have a huge impact on your entire portfolio.

4. Geographical Areas: Diversifying geographically by investing in markets outside your home country can help reduce risk. For example, if you live in Nigeria, spreading your investments between Nigerian, Rwandan and U.S. stocks can provide exposure to different economies and lessen the impact of any single market downturn.

Risk Tolerance Quiz

What is Concentration in Investing?

Concentration means investing in a limited number of assets, industries, or sectors. The guiding principle behind this is that investing in a few carefully chosen asset classes can offer better returns. Or, according to Warren Buffett, “If you find three wonderful businesses in your life, you’ll get very rich” (at this point, I have to take a quick break to say terms and conditions apply to this statement, please🤓. Okay, let’s carry on. Thank you).

Here’s a hypothetical example of a concentrated portfolio for a middle-income Nigerian:

1. Stocks (60%)

- Nigerian Large Cap Stocks (20%)

- International Stocks (40%):

Apple (AAPL)

Tesla (TSLA)

Nvidia (NVDA)

Microsoft (MSFT)

Amazon (AMZN)

2. Cryptocurrencies (20%)

- Bitcoin (BTC) (10%)

- Ethereum (ETH) (10%)

3. Real Estate (20%)

- Real Estate Investment Trusts (REITs)

Pros of a Concentrated Portfolio/Concentration

1. Higher Returns: Concentrated portfolios can offer the potential for bigger returns since a small number of carefully chosen investments can really drive overall performance. If those picks do well, they can boost your portfolio and net worth significantly.

2. Simplified Management: Handling a concentrated portfolio can be less time-consuming because you're dealing with fewer investments. This gives you the chance to dive deeply into research and analysis on those select few, making it easier to keep track and make informed decisions.

“The big money is not in the buying and selling, but in the waiting.” Charlie Munger

Cons of a Concentrated Portfolio/Concentration

1. Increased Risk: Concentrating your investments in a few assets can expose you to higher levels of risk. Your entire portfolio could suffer major losses if those chosen investments don't perform well.

2. Vulnerability to Market Volatility: Since concentrated portfolios lack the diversification that would spread out risk, they're more sensitive to market ups and downs. This means they can be hit harder by market fluctuations compared to diversified portfolios.

3. Missed Opportunities for Growth: By focusing all your resources on just a few assets, you might miss out on opportunities for growth in other sectors or asset classes.

Diversification vs. Concentration: Making the Better Decision for Your Money

I will break down this decision between diversification and concentration investment strategies into two parts:

- Self-Assessment

- Seek professional advice/consider hiring a financial advisor

Part 1: Self-Assessment

When deciding between a diversification or concentration strategy for investment, it is compulsory to ask yourself practical questions to ensure your decision aligns with your financial goals, risk tolerance, and investment knowledge.

Here are some key questions to consider:

1. What are my financial goals?

- Am I investing for long-term growth, short-term gains, retirement, or a specific financial goal?

2. What is my risk tolerance?

- How much risk am I willing to take with my investments?

- Can I handle significant fluctuations in the value of my portfolio?

3. What is my investment holding forecast?

- How long do I plan to keep my investments before needing to access my funds?

4. How much do I know about the markets and industries I'm investing in?

- Do I have the expertise to identify high-potential investments?

5. How much time can I dedicate to managing my investments?

- Do I have the time and resources to regularly monitor and adjust my portfolio?

6. What is my current financial situation?

- Do I have a stable income and emergency funds in place?

- Do I have debts to pay?

- Do I have recurring commitments like black tax?

- How would a significant loss impact my financial stability?

7. What is my comfort level with potential losses?

- Am I prepared to potentially lose money if the investments don’t work?

- What plan do I have to manage the loss if it happens?

8. What are the potential pros and cons of diversification and concentration?

- What are the advantages of diversification (e.g. exposure to multiple assets/industries) versus concentration (e.g., potential for higher returns)?

9. How do I handle market volatility?

- Can I stay calm and adhere to my investment strategy during market downturns?

- Do I have healthy coping mechanisms to regulate my emotions in case the market crashes or rises in my favour?

10. What are the tax implications of each strategy?

- How will dividends and other taxes from my country of residence, as well as internationally, affect my overall returns?

11. What are my ethical or personal preferences in investing?

- Are there specific industries or companies I want to support or avoid?

Part 2: Seek professional advice/Consider hiring a financial advisor

Sometimes, a financial advisor can help you bridge the gap between your current and future financial goals.

✋🏾Before going further, here’s a list of people who are NOT financial advisors:

Friends and Family: While they may offer advice or share their experiences, they are not qualified financial advisors unless they have the necessary certifications.

Online Influencers: Many people share (helpful) financial tips and investment strategies online, but unless they have the proper certifications, they are not financial advisors.

Accountants and Tax Preparers: Although they have expertise in tax matters and accounting, they are not necessarily financial advisors unless they hold specific financial advisory qualifications.

Bank Employees: While they can offer advice about the bank’s products, they are not independent financial advisors unless they hold the necessary certifications.

Real Estate Agents: They can provide advice on property investments but are not certified to give broad financial advice.

So, who is a financial advisor?

A financial advisor is a qualified and certified professional who provides expert advice and can help you create a personalised investment plan that aligns with your financial goals and risk tolerance.

When selecting a financial advisor, here are some key tips to consider:

1. Qualifications: Look for advisors with relevant certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These qualifications indicate, at the very least, a basic level of expertise and professionalism.

2. Experience: Consider the advisor's experience in the financial industry and whether they have worked with clients with backgrounds, needs, or goals similar to yours.

3. Fee Structure: Understand how the advisor is compensated. Some may charge a flat fee, while others earn commissions on the financial products they recommend. Ensure you're comfortable with the fee structure and how it is paid.

4. Fiduciary Duty: It is advisable to choose advisors who have a fiduciary duty to act in your best interests. This means they are legally obligated to prioritise your financial well-being over their own. Read more about fiduciary duty here.

5. Communication Style: Choose an advisor who communicates clearly and listens to your concerns. Working with someone who understands your financial goals and keeps you informed about your investments is better and mentally and financially healthier.

6. Reviews and Recommendations: Check client reviews on the advisor’s website, for instance, and ask for recommendations from friends or family members who have had positive experiences with financial advisors.

To Wrap Up

Should you diversify your investments across a broad range of assets or focus on a few asset classes?

On a base level, the answer depends on your financial goals and risk tolerance.

Diversification might be a good option if you are a risk-averse person who likes long-term investments, as it offers more stability.

On the other hand, if you want higher returns and are willing to do deep research into industries, you may opt for concentration.

One last thing before you go, here's a short list of finance and investment films, curated from Reddit (yes, Reddit again😏) you could check out:

- The Big Short

- Trading Places

- Enron the Smartest Guys in the Room

- Boiler Room

If you prefer documentaries, check out:

- Becoming Warren Buffet

- The Inside Job

If you would rather read a book, check out:

- The Intelligent Investor by Benjamin Graham

- The Little Book of Common Sense Investing by John Bogle

- You Have More Than You Think by David & Tom Gardner

- The Simple Path to Wealth by JL Collins

Disclaimer: This article was written by the writer to provide guidance and understanding of finance. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.