5 Cryptocurrency Trading Tips You Need To Know

With these five cryptocurrency trading tips, you will be better equipped to navigate the constantly changing crypto market.

"Luck is preparation meeting opportunity" is a popular quote by the famous Oprah Winfrey, and it suits nearly every situation, including cryptocurrency trading.

The market is full of opportunities, but how prepared are you to take advantage of it as a trader? What tips, tricks, and strategies do you need to know?

Here are five cryptocurrency trading tips you need to know as a trader:

1. There's a significant difference between a trade and an investment.

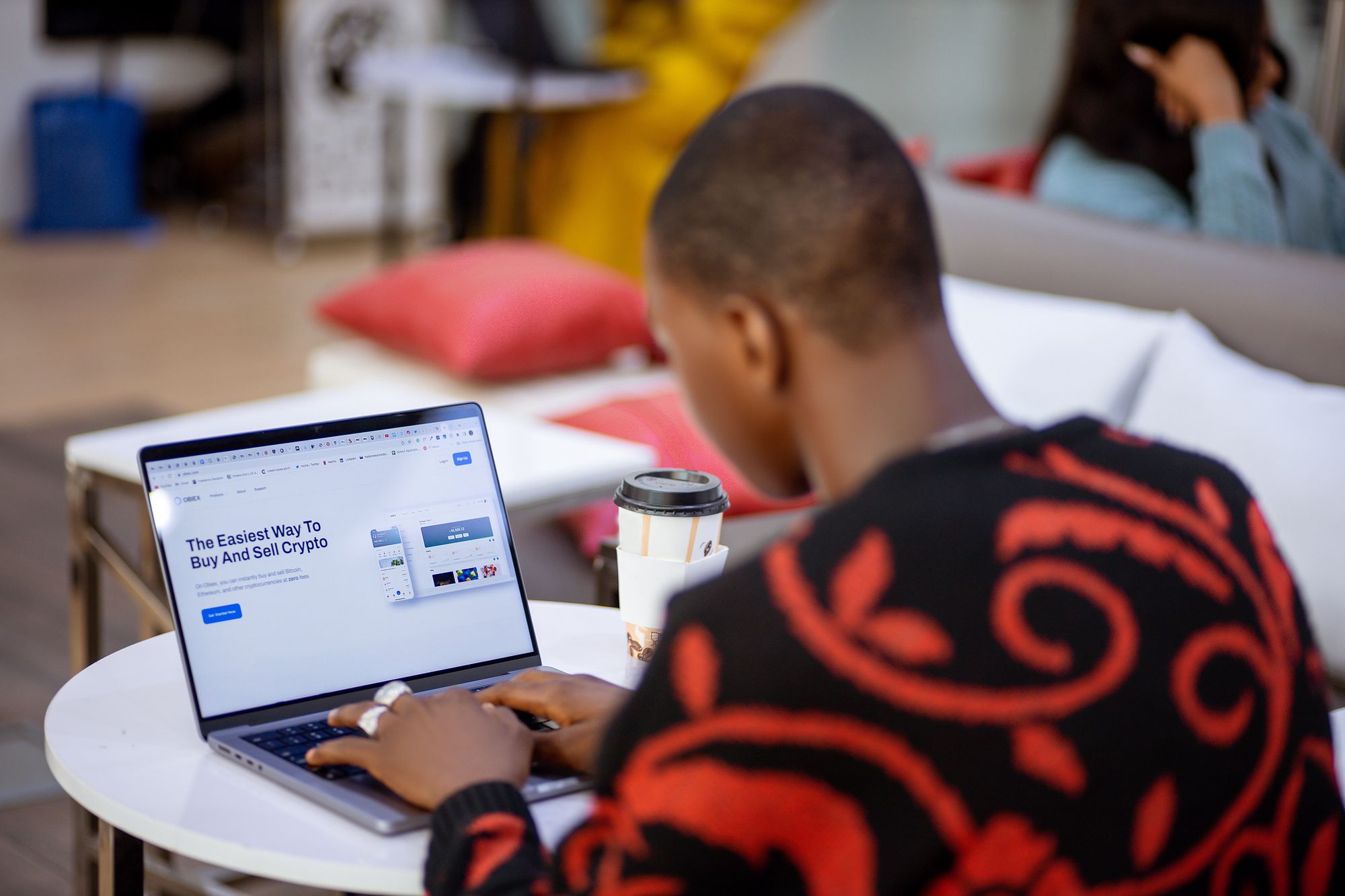

Cryptocurrency trading involves actively buying and selling cryptocurrencies like BTC, ETH, SOL, and XRP with the aim of profiting from short-term price changes.

Traders like you typically use fundamental analysis, technical analysis, and trading charts and pay attention to the market forces/news to identify potential profit opportunities.

For example, you could BUY $100 worth of BTC when you anticipate an upward increase in price and sell it quickly when the price increases to make a profit.

Cryptocurrency investing takes a long-term approach, focusing on the overall potential of specific cryptocurrencies or the broader market.

To invest, you need to conduct thorough research on cryptocurrencies, the creators and teams behind them, use cases, and market trends before selecting the ones to buy and hold for an extended period (like six months, a year, or even up to 3 years).

The main aim of investing is to benefit from the long-term growth and adoption of cryptocurrencies. For instance, if you're convinced that Ethereum has the potential to continue improving blockchain technology, you can buy and hold ETH in your crypto wallet.

In essence, trading tends to be more fast-paced, requiring active monitoring of price changes and quick decision-making, while investing involves a longer-term commitment and focuses on the fundamental value and potential of the cryptocurrency.

2. You can't control the market, but you can control your entries, trade size, and exits.

Crypto prices fluctuate fast, influenced by various factors like news events, market sentiment, and investor behavior. The market will do what it does, but there are specific aspects that you can control as a trader or investor.

Let's break it down:

Entries: You have control over when and at what price you start a trade or purchase a cryptocurrency. By carefully analyzing the market, you can identify the best points to start a trade. The more trades you make, the better you understand how to make the market work for you.

Trade Size: You have control over the size of your trades or investments. This means you choose how much you trade with or invest in a cryptocurrency. Managing your trade size is essential as it directly affects how much you could potentially make or lose. It is advisable to determine how much you are putting into trades based on your risk tolerance and trading goals.

Exits: You have control over when and how to sell a cryptocurrency or close a trade. It will help you greatly to have a plan for exiting trades and limits to reach before selling a coin. This will help you manage potential losses and secure profits.

3. You can't take advantage of every trade, but Crypto is a constantly open market; you will always find another trading opportunity.

With so many trading opportunities and fast-paced price changes in the crypto market, it's practically impossible to catch every single opportunity. You might miss out on certain trades due to reasons such as sleep, work commitments, or simply because you didn't spot a particular opportunity in time.

Unlike traditional financial markets, the crypto market operates 24 hours a day, 7 days a week, and 365 days a year. This means there are always trading opportunities, so even if you miss a trade, another one is right around the corner.

New market trends and price changes are constantly happening, offering traders like you the chance to make a profit.

So, if you happen to miss a trade, remember that there will be countless opportunities in the future to participate in the market. The key is to develop a solid trading or investment strategy, stay informed, and be ready to make the best out of the opportunities that come your way.

I have been trading for decades, and I am still standing. I have seen a lot of traders come and go. They have a system or a program that works in some specific environments and fails in others. In contrast, my strategy is dynamic and ever-evolving. I constantly learn and change." – Thomas Busby

4. A market can survive a "bubble." Bitcoin has faced over six big bubbles and still increased in price

A cryptocurrency bubble happens when many people start buying a particular cryptocurrency because they think the price will keep increasing and they can make lots of money from it. But, as often happens, the price gets too high and starts falling. Everyone panics and starts selling off that Crypto, causing the price to fall even lower.

While bubbles can be a cause for concern, it's important to note that just because a market is experiencing a bubble doesn't necessarily mean the market won't survive.

Let's take a look at Bitcoin as an example:

Bitcoin has indeed experienced several significant price bubbles throughout its history. These bubbles were characterized by sharp and rapid price increases, often followed by substantial price corrections.

A crypto price correction is when the price of a cryptocurrency decreases after a significant rise. It's like a reset button for the market, bringing some balance and stability. Price corrections are a normal part of the market cycle and pave the way for potential future growth.

Despite these bubbles, Bitcoin has demonstrated the ability to recover from price corrections and even increase in the long run. This can be attributed to various factors, including increased adoption, growing institutional/investor interest, and widening mainstream acceptance.

As Bitcoin and the cryptocurrency market continue to mature, fluctuations and periods of volatility are to be expected.

While bubbles can lead to short-term price instability, they don't necessarily mean the end of a market. In fact, they can help the crypto ecosystem develop by bringing attention to areas such as regulation, which will ultimately contribute to Crypto's long-term growth.

5. Beware of get-rich-quick experts in the crypto community

The cryptocurrency ecosystem/industry/community is full of all kinds of people, and unfortunately, some of them are to be avoided. These people often present themselves as experts who claim to have secret strategies or insider information about the market that can give you huge profits.

They often target people new to Crypto or traders looking for quick and easy profit. To avoid falling for their scams, Do Your Own Research. Take the time to learn about crypto/blockchain technology, how the crypto market works, and practical investment and trading strategies.

By educating yourself, you can make informed decisions and avoid falling into the trap of get-rich-quick schemes.

"You never know what kind of setup market will present to you; your objective should be to find an opportunity where risk-reward ratio is best." – Jaymin Shah

Final Word

The cryptocurrency market is full of potential for profit, yet your readiness as a trader to seize those opportunities determines your success.

With the five essential cryptocurrency trading tips shared above, you're better equipped to navigate the constantly changing market.

Disclaimer: This article was written by the writer to provide guidance and understanding of cryptocurrency trading. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.