Crypto News Highlights (25th March to 29th March 2024)

Here are the top stories that happened in crypto this week.

- The Munchables Hacker Returns Stolen Crypto Assets Worth Over $62 Million

- Robert Kiyosaki Foresees Bitcoin Surging to $100K by September — Plans Buy More BTC Ahead of Halving

- Goldman Sachs Notes Surge in Crypto Interest Among Major Clients

- Vitalik Buterin Introduces Solution for Ethereum Staking Decentralization Concerns

- London Stock Exchange to Launch Market for Bitcoin and Ether ETNs on May 28

The Munchables Hacker Returns Stolen Crypto Assets Worth Over $62 Million

Munchables, a prominent Web3 gaming protocol operating on the Blast network, faced a significant setback on Tuesday, March 26, when it fell victim to an exploit resulting in the loss of more than $62 million.

The development team disclosed the breach in a detailed post, explaining that the platform was compromised while they were actively tracing the hacker's movements and attempting to halt unauthorised transactions.

Following Munchables' announcement, ZachXBT provided insights, revealing that the hacker's address contained approximately 17,415 ETH, valued at $62.25 million based on current Ether prices. ZachXBT further claimed that the attack was orchestrated by an insider, allegedly a developer from North Korea hired by the Munchables team under the alias "Werewolves0493" on GitHub.

Meanwhile, a Solidity developer known as 0xQuit on X, shared additional details in a post, suggesting that the attack on Munchables was premeditated. According to the developer, "The scammer utilised manual manipulation of storage slots to allocate an extensive Ether balance to themselves before switching the contract implementation to one that appears legitimate. Subsequently, they simply withdrew the balance once the Total Value Locked (TVL) reached a lucrative threshold."

Just before the hack occurred, Munchables boasted a TVL exceeding $96 million, as reported by DeFiLlama. However, following the exploit, the project's TVL plummeted to $34 million.

However, there was a twist in the tale on Wednesday, March 27, when Munchables provided an update, revealing that the rogue developer had agreed to return the stolen assets and had indeed shared the private keys holding all funds without any stipulations.

Tiesshun Roquerre, widely known as Pacman, the brains behind the Ethereum layer 2 network Blast and the non-fungible token (NFT) marketplace Blur, confirmed in an X post, "97 million has been secured in a multisig by Blast core contributors."

Pacman emphasised that the former developer returned the funds voluntarily, without demanding any ransom, and assured efforts were underway to redistribute the funds securely back to the affected users.

Prior to the funds' return, there were appeals from users on X urging Blast to initiate a chain rollback — a process that involves reverting the blockchain to a state before the incident occurred, effectively nullifying the hack.

However, such actions contradict the principles of decentralisation, as blockchain transactions are meant to be immutable. Additionally, Blast's governance structure, reliant on a 3/5 multisig, raised concerns about its level of decentralisation.

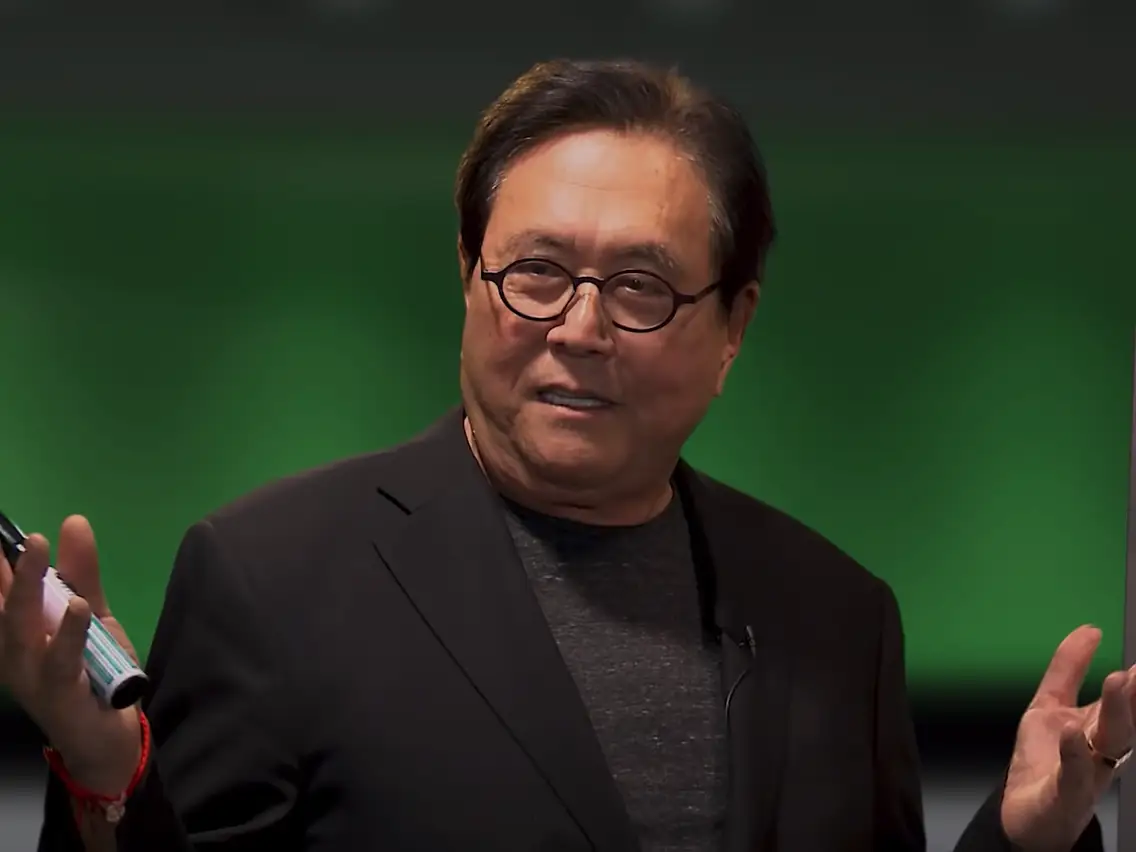

Robert Kiyosaki Foresees Bitcoin Surging to $100K by September — Plans To Buy More BTC Ahead of Halving

Robert Kiyosaki, the author of the renowned book Rich Dad Poor Dad, took to social media platform X on Monday to share his updated bitcoin price forecast. In a detailed post, he not only predicted a substantial rise in Bitcoin's value but also advocated for investors to consider acquiring more BTC, revealing his own intention to do so.

Kiyosaki said: “I am buying 10 more bitcoin before April. Why? The ‘Halving.’ If you can’t afford a whole bitcoin, you may want to consider buying 1/10 of a coin via the new ETFs or satoshi’s. I expect bitcoin to be $100K by September 2024.”

Kiyosaki elaborated on why "smart money" is gravitating towards BTC, highlighting global economic concerns. Kiyosaki has been increasingly vocal in his support for BTC.

Last week, he advocated for investors to purchase as much bitcoin as they can afford, praising its limited supply and positioning the crypto alongside gold and silver as “real assets.” While earlier this month, he forecasted BTC’s price reaching $300K this year, he has now revised his prediction to $100,000 by September.

Goldman Sachs Notes Surge in Crypto Interest Among Major Clients

Goldman Sachs, a leading global investment bank, has disclosed that the recent approval of spot bitcoin exchange-traded funds (ETFs) and the recovery of Bitcoin prices have reignited enthusiasm for cryptocurrencies among its largest hedge fund clients.

Max Minton, Goldman’s head of digital assets for the Asia Pacific region, shared insights in an interview with Bloomberg last week, stating: “The recent ETF approval has triggered a resurgence of interest and activities from our clients.” He further elaborated, saying: “Many of our largest clients are active or considering becoming active in the crypto space.”

Minton described a shift in momentum, noting that while last year was relatively subdued, there has been a noticeable uptick in client interest, onboarding, pipeline, and trading volume since the beginning of this year.

Although Bitcoin remains the primary focus among Goldman Sachs’ clients, the investment bank anticipates a surge in demand for products related to Ethereum if the U.S. Securities and Exchange Commission (SEC) approves spot Ethereum ETFs.

Goldman Sachs established its crypto trading desk in 2021, offering cash-settled Bitcoin and Ethereum option trading, along with futures contracts for Bitcoin and Ethereum listed on the CME.

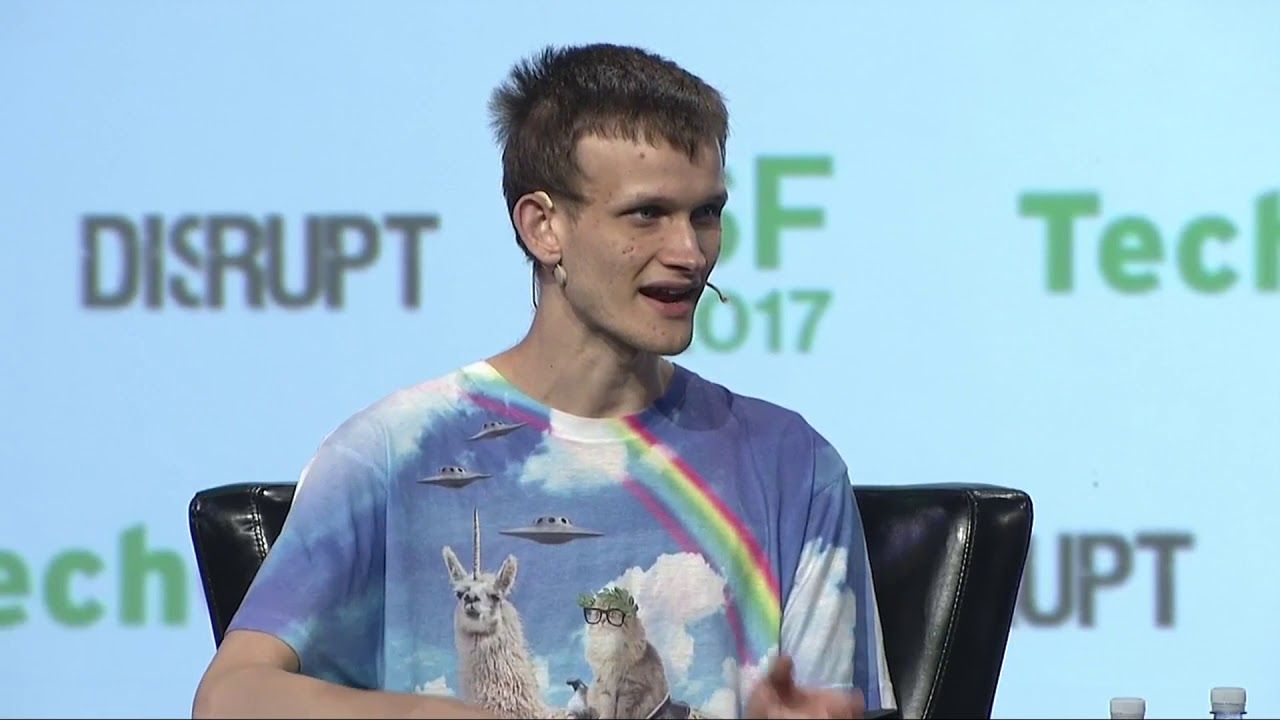

Vitalik Buterin Introduces Solution for Ethereum Staking Decentralization Concerns

Ethereum's staking mechanism faces an imminent challenge of centralisation, prompting Vitalik Buterin, the co-founder of the network, to propose a novel approach to mitigate this issue.

In a detailed blog post, Buterin recommended adjusting the penalty system for Ethereum validators to increase the deterrent against collusive misconduct.

Under this proposed method, substantial penalties would be imposed on validators found to be misbehaving, even unintentionally, particularly if a significant portion of independently staked ETH engages in misconduct simultaneously.

"The rationale behind this approach is that if you are a single dominant entity, any errors you make are more likely to affect all the 'identities' you control, even if your coins are spread across numerous ostensibly separate accounts," Buterin elaborated.

Since September 2022, Ethereum has transitioned to a proof-of-stake consensus mechanism, allowing users to earn rewards by locking their ETH within the protocol. However, this model entrusts block validation and transaction processing primarily to those holding the largest amounts of ETH.

This concentration of power includes centralised exchanges and staking providers like Lido, Coinbase, and Binance, which aggregate smaller investors' ETH for staking. Even institutional players such as Fidelity are considering leveraging users' assets for staking activities.

This trend has sparked concerns within the community regarding the potential for collusion among major Ethereum validators, especially in scenarios involving external pressure, such as governmental influence. Notably, JPMorgan highlighted in October the increased centralisation risk posed by Ethereum's Merge and Shanghai upgrades.

Although larger Ethereum validators already face heightened penalties, known as "slashing," compared to smaller participants, Buterin argued that penalties for such rare events are insufficient in combating centralisation.

"This proposal aims to extend a similar anti-correlation incentive to more routine failures, such as failing to attest, which nearly all validators encounter occasionally," Buterin clarified.

In theory, such a mechanism could create economic disincentives for centralised staking and help mitigate economies of scale in the industry.

Recently, Buterin also floated the idea of a "rainbow staking" system, introducing different classes of Ethereum stakers based on their objectives. This system aims to alleviate the economic and technical burdens associated with independent staking, which has led many ETH investors to opt for centralised services instead.

"We have become overly reliant on 'social pressure + virtue'," Buterin remarked regarding centralised staking providers earlier this month. "If centralization is inevitable, we should be transparent about whether we rely on incentives or social pressure + virtue, rather than excessively relying on the latter."

London Stock Exchange to Launch Market for Bitcoin and Ether ETNs on May 28

The London Stock Exchange (LSE) has announced its intention to introduce a market for exchange-traded notes (ETNs) linked to bitcoin (BTC) and ether (ETH) starting from May 28, as revealed on Monday.

Applications for trading these crypto ETNs will be accepted by the stock exchange from April 8, subject to approval from the U.K. regulator, the Financial Conduct Authority (FCA), according to the announcement.

The FCA had previously stated in March that it would not reject requests from Recognized Investment Exchanges (RIEs) to establish a listed market segment for ETNs. Notably, these products will be accessible exclusively to professional investors. Earlier this year, the London Stock Exchange had indicated its plans to commence applications for bitcoin and ether ETNs by the second quarter.

Regulatory efforts have been underway to foster a more crypto-friendly environment in the country, spurred by several pronouncements from the U.K. government aimed at positioning the nation as a crypto hub.

Disclaimer: The information provided in this crypto news round-up is for informational purposes only and should not be considered financial or investment advice. Obiex will not be held liable for your investment decisions.