6 Biggest Bitcoin Crashes That Have Happened in Crypto History

In this article, we will share some of the biggest Bitcoin crashes in history and how traders like you can navigate market crashes.

Table of Contents:

- The 6 Biggest Bitcoin Crashes in Crypto History

- How to Navigate Crypto Market Crashes

- Conclusion

- FAQs

Although volatility is a known characteristic of cryptocurrency, price declines still cause a significant stir among crypto traders, enthusiasts, critics, and the general public.

In this article, we will share some of the biggest Bitcoin crashes in history and how traders like you can navigate market crashes.

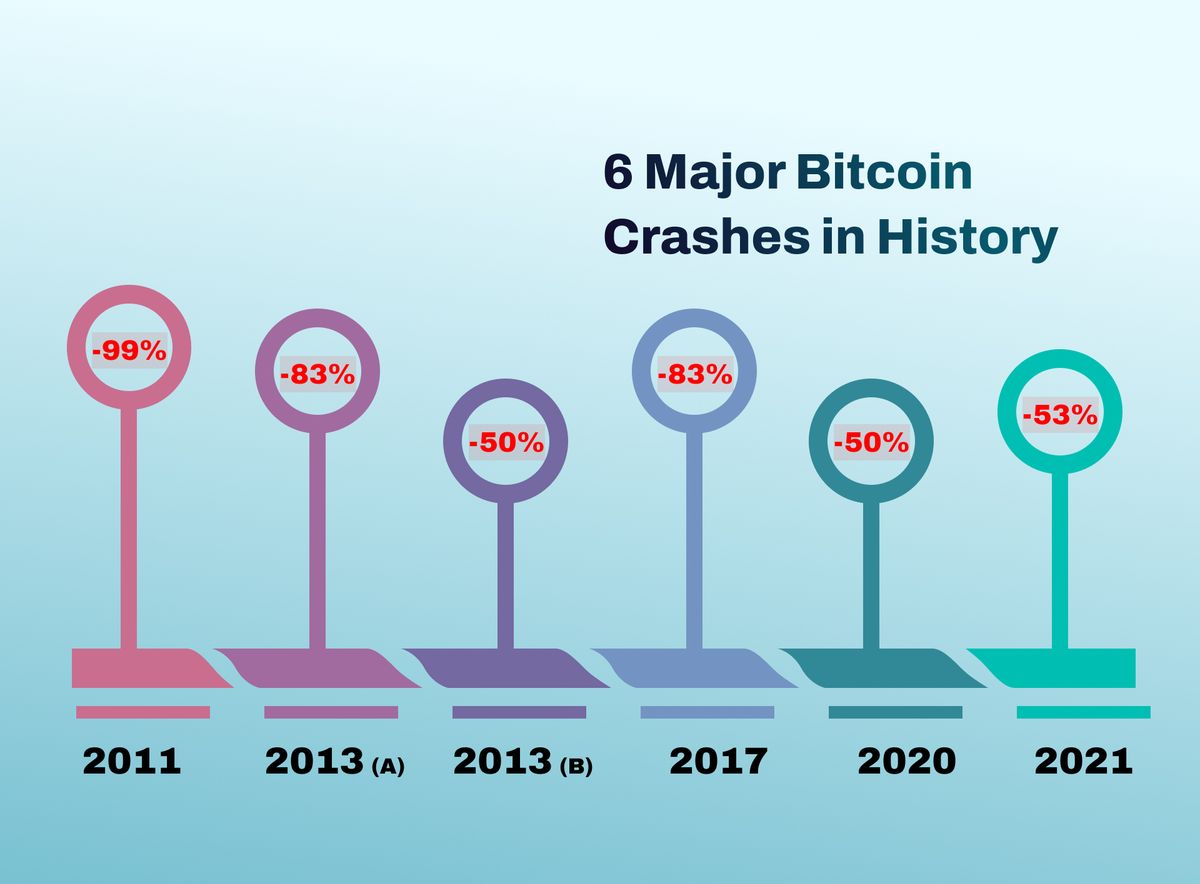

The 6 Biggest Bitcoin Crashes in Crypto History

Here are the most prominent Bitcoin crashes that have taken place since its launch in 2009:

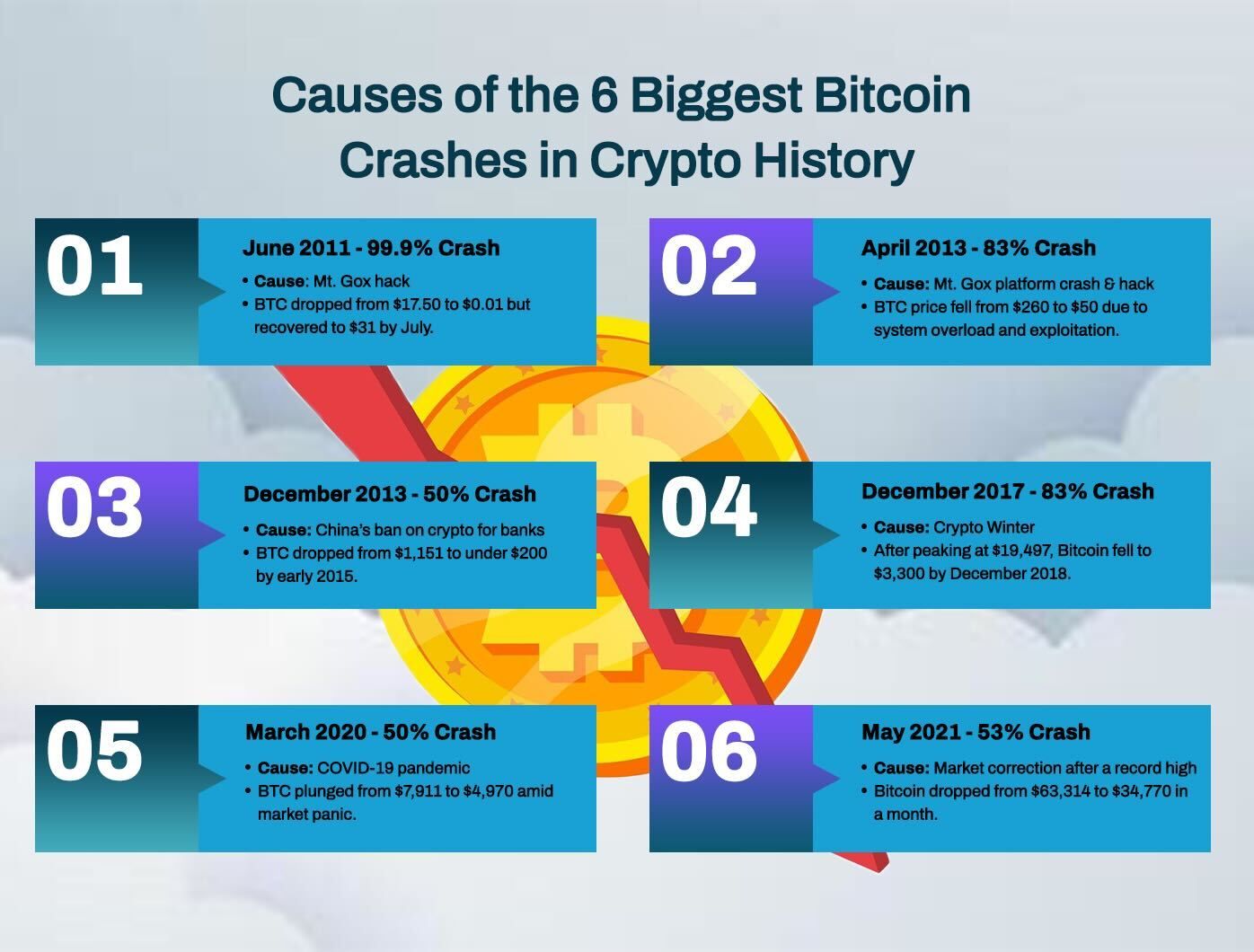

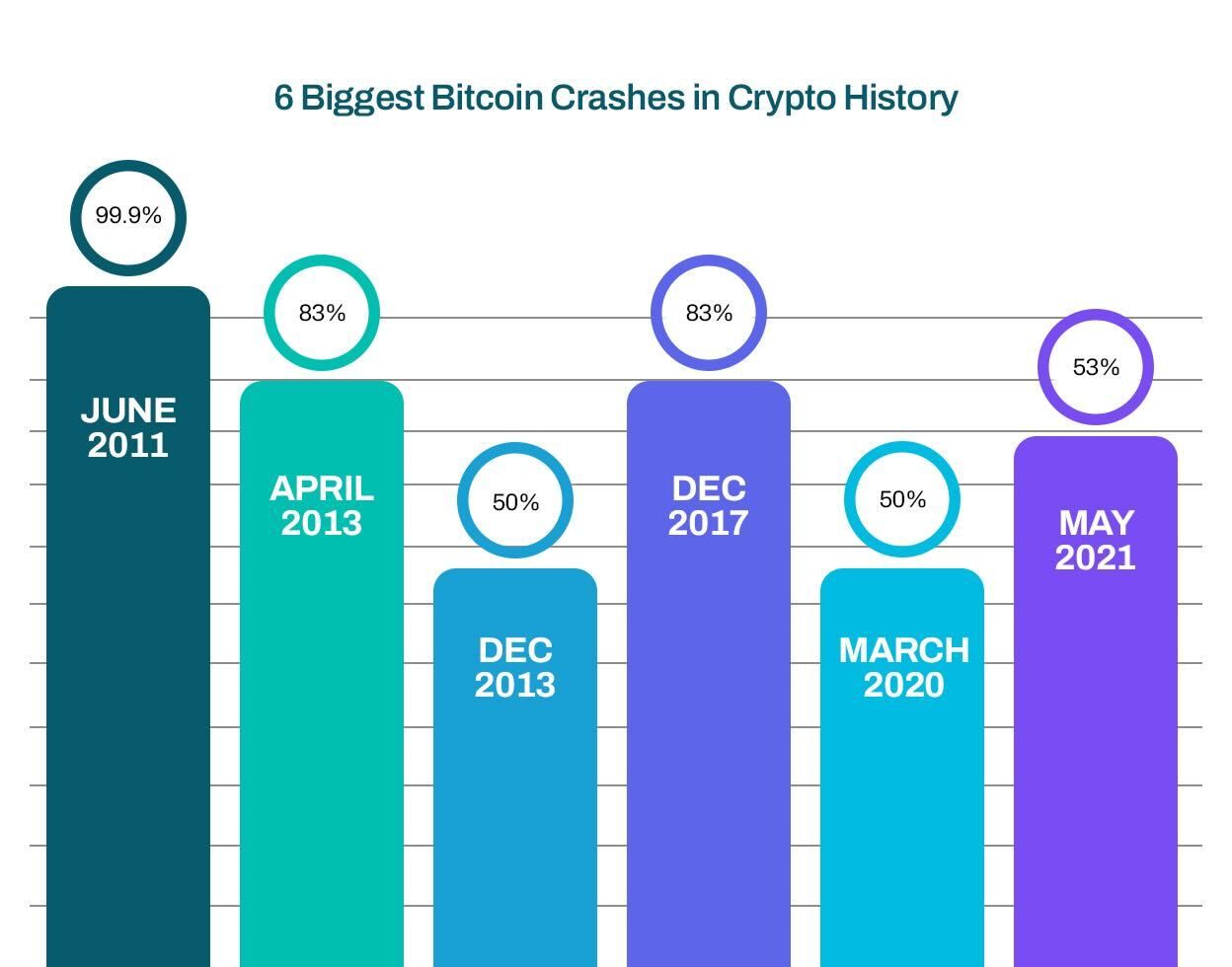

1. June 2011 - 99.9% Price Crash:

This crash happened in 2011 when Mt. Gox was still a functional trading exchange and the primary platform for trading Bitcoin. BTC rose from $2 to $32 in the first half of that year.

Then, on June 19th, 2011, BTC was trading at $17.50 when Mt. Gox was hacked, causing Bitcoin to be sold for a single penny.

This 99.9% price crash was probably the worst in crypto history. Fortunately, it didn't last long, and by July 2011, BTC had risen again and was trading at $31.

2. April 2013 - 83% Price Crash:

This occurred when Bitcoin had just entered the mainstream market as a significant new investment opportunity.

Mt. Gox experienced extremely high trading volumes, which caused the platform to crash. Hackers exploited the vulnerable state of the trading platform, shutting down Mt. Gox completely.

This unfortunate situation caused BTC to plummet from about $260 to $50.

3. December 2013 - 50% Price Crash:

Bitcoin started trading a little above $200 in November 2013. By December 3rd, the price of BTC peaked at $1,151.

The price crashed by over half by the 17th of that same month. The main reason behind this price decline was China's first strike at crypto, when it banned its banks from dealing in Bitcoin.

The following year, 2014, saw BTC fighting to stay afloat and failing to hit its December 3rd peak.

In January 2015, BTC was still struggling but had managed to land under $200. It would take three more years to peak again at $1,191 on January 5th, 2017.

4. December 2017 - 83% Price Crash:

December 2017 is infamously known as the Crypto Winter.

From January to November 2017, BTC enjoyed a good price run. Its price went up nearly 20x, and the coin hit a new peak of $19,497 on December 15th.

Six days later, Bitcoin experienced a 29% decline, causing the price to fall to $13,831. This was the start of one of the most challenging times in crypto history.

In February 2018, the price of Bitcoin fell under $7,000, then swayed between $6,000 and $10,000 for the following nine months.

By the second week of November, Bitcoin was trading at $6,359. In December, it fell even lower than $3,300.

The Crypto Winter lasted from December 2017 to December 2018, and Bitcoin fell a whopping 83% during that period.

5. March 2020 - 50% Price Crash:

The COVID pandemic and the ensuing lockdowns sent world economies into a shutdown.

The stock and crypto markets were hit with freezes as investors began hoarding financial assets.

On March 10th, Bitcoin experienced a 37% price decline, going from .$7,911 to $4,970. As March came to an end, BTC was trading at $6,791.

6. May 2021 - 53% Price Crash:

Bitcoin opened the year 2021 trading at $32,810 in January, reached a high of $41,946, and closed the month trading at $38,356.

The crypto bubble seemed to hold firm despite being hit by the Crypto Winter and the COVID-19 pandemic effects.

Investors, traders, and founders were going full throttle in the early months of 2021, and the record high of $63,314, which Bitcoin reached on April 14th, was a sweet victory.

However, by May 22nd, BTC fell to $34,770. In addition, the overall crypto market cap lost more than one-third of its value, falling from $2.39 trillion to $1.58 trillion.

How to Navigate Crypto Market Crashes

Markets need time to mature and evolve. The crypto market is no exception, particularly when considering cryptocurrency, which is a little over a decade old.

Also, market declines/bearish runs tend to be followed by bull runs and booms. Conversely, market booms tend to be followed by steep falls. It is the market's way of balancing itself.

Over the past ten years, the innovations and inventions seen in the crypto/blockchain space have been a solid pointer toward this industry's long-term potential.

As the market grows, volatility may likely lessen, and prices may stabilise. In the meantime, here are five ways to navigate a crypto market crash.

1. Apply Logic:

It is natural for emotions to run high when a crypto crash of any kind happens. Nevertheless, being agitated and giving in to fear, uncertainty, and doubt can lead you to make imprudent decisions.

When the market crashes and prices fall, take a deep breath, calm yourself, and check on your trading portfolio (the coins/tokens you bought or are holding).

Look at the numbers and the trends. Spot a pattern, then set up an entry and exit strategy. Establish what price you're going to sell at, what coins you will hold and when you will exit the market to protect your finances.

2. Monitor Onchain Metrics:

On-chain analysis is based on a technical analysis of significant cryptocurrency trends of a crypto coin or token and comparing different coins or tokens to gauge their value.

On-chain metrics offer insight into the market devoid of sentiment, social media hype, or market hearsay.

Monitor these metrics consistently, whether the market is bullish or bearish. This will give you solid backing when choosing what coins to invest in, sell, or hold.

3. Educate Yourself:

Learn how Cryptocurrency, blockchain, and defi work.

Properly understanding these concepts will help filter the noise from people who regard cryptocurrency as a "quick riches scheme" rather than a long-term economic investment.

Countless resources online, like this blog, explain different crypto concepts in simple terms.

Social media can also be a good resource material. However, the hype and bias on these platforms can obscure whatever knowledge you may be searching for.

Take whatever information you receive from places like Twitter and Reddit with a pinch of salt. Always do your research.

4. Use Dollar-Cost Averaging:

The main aim of dollar-cost averaging (DCA) is to ensure that bear markets are exploited without committing too many funds to one particular trade by taking advantage of market drops and then flipping that investment into a quick profit once the value climbs.

5. Pay Attention to Macroeconomic Trends:

Macroeconomics concentrates on the overall economic performance and analyses how the economic sectors interact.

Macroeconomic trends evaluate variables such as inflation and unemployment. Paying attention to these trends helps you maximise your trading position in the crypto market.

To Recap

Cryptocurrency market crashes are challenging for both new and old traders to manoeuvre.

However, the trick to surviving a bear market without too many financial scars is to do your research, make a market plan and follow it.

Don't take the social media hype, headlines, and reactions to heart because they're mostly incendiary or clickbait.

The blockchain-crypto industry has its ups and downs like any other market.

Dips and crashes are natural economic patterns for market growth. What matters is how you react to it and the moves you make during and after market crashes.

FAQs

Q1. What is a Bitcoin crash?

A Bitcoin crash is when the price of Bitcoin drops significantly in a short period.

Q2. Why do Bitcoin crashes happen?

Crashes can happen due to market panic, regulatory news, large sell-offs, or economic factors.

Q3. What was the first major Bitcoin crash?

The first major crash occurred in 2011 when Bitcoin dropped from $32 to $2 in a few months.

Q4. What caused the 2013 Bitcoin crash?

The 2013 crash was caused by the closure of the Silk Road marketplace and issues with the Mt. Gox exchange.

Q5. How did the 2017 Bitcoin crash unfold?

In 2017, Bitcoin reached nearly $20,000 but then dropped to around $6,000 due to regulatory concerns and market speculation.

Q6. What was the impact of the 2018 Bitcoin crash?

The 2018 crash saw Bitcoin fall from $17,000 to below $3,500, mainly due to regulatory fears and market corrections.

Q7. What triggered the 2020 Bitcoin crash?

The 2020 crash was triggered by the COVID-19 pandemic, causing Bitcoin to drop from $10,000 to $4,000.

Q8. How did the 2021 Bitcoin crash occur?

In 2021, Bitcoin fell from $64,000 to $30,000 due to China's crackdown on crypto and environmental concerns about mining.

Q9. Can Bitcoin recover after a crash?

Yes, Bitcoin has historically recovered after crashes, often reaching new highs eventually.

Q10. Should I be worried about Bitcoin crashes?

While crashes can be alarming, they are part of the market's volatility. It's important to do thorough research and invest wisely.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.