5 Types of Nigerian Traders & How They Each Use Obiex Differently

From day traders to DCA buyers, every Nigerian trader has unique pain points. Discover how Obiex solves them with fast, zero-fee trading and local currency support.

Table of Contents

- The Day Trader

- The Scalper

- The DCA Buyer

- The Swing Trader

- The Range Trader

- To Recap

- FAQs

In a nutshell, not all Nigerian traders trade the same way. Your strategy is personal.

Some traders sleep on charts. Others buy once a week and forget about it. Some want quick wins, others play the long game. That is why different traders get different results.

Here are five types of Nigerian traders and how they apply their different trading techniques using Obiex.

1. The Day Trader

Who They Are:

Day traders in Nigeria are among the most active and agile participants in the crypto market. They do not “buy and hold”, but make the most of intraday market moves.

This means they watch price charts hour by hour, sometimes minute by minute, looking for trade setups on BTC, ETH, or USDT pairs.

Some are full-time traders; others juggle trading with jobs, freelance gigs, or school. However, what they all have in common is the need to enter and exit trades fast, without wasting time or losing money to unnecessary fees.

A typical day trader in Nigeria may run multiple trades between 8AM and 6PM, responding to market volatility or specific news.

For instance, when BTC starts pumping, they’re quick to flip from NGN to USDT or BTC, and then back again once their target is hit. Timing is everything, and they can’t afford any delay caused by on-chain confirmations or network congestion.

How They Use Obiex:

Many of them prefer using Obiex’s instant swap feature. They don’t have to wait for blockchain confirmations, which makes it easier to move in and out of positions without losing margin.

They also prefer the BTC/USDT and USDT/NGNX pairs because these provide them with the necessary liquidity to scale their trade size without significant slippage.

Because day traders open and close many trades in a short period, fees can significantly eat into profits. Even a small 1% fee per trade across 10 trades a day adds up to serious losses over a month.

Most Nigerian day traders who use Obiex choose it specifically because it doesn’t charge trading fees. This means their profit margins remain untouched, even when they’re trading frequently.

Some day traders cash out small portions of their profits daily or weekly, and they need to be able to send that directly to their bank account without delay or hidden charges. Obiex supports this with quick NGN withdrawals, which helps them run their strategy without friction.

2. The Scalper

Who They Are:

Scalpers take speed and precision to the next level. Unlike day traders who might hold a position for hours, scalpers operate in seconds to minutes.

Their entire strategy is based on taking advantage of small price fluctuations in the market, typically ₦50, ₦100, or even less per trade. But they do it many times a day, sometimes over 100 trades, stacking small wins into real income.

Scalping demands focus, a fast internet connection, and tools that don’t get in your way. Nigerian scalpers typically operate with tight spreads, small lot sizes, and strict timing. They know that even the slightest delay or fee can kill a profitable setup.

Many scalpers operate from mobile phones, laptops or lightweight desktops, often trading during peak market hours when liquidity is highest, typically during U.S. and European sessions.

For them, a few seconds of slippage, lag, or network congestion is the difference between a win and a loss.

They also tend to keep a portion of their funds in stablecoins like USDT or NGNX, allowing them to quickly enter and exit trades without having to navigate traditional banking systems or incur unnecessary conversion fees.

Everything about a scalper's trading setup is built around speed, efficiency, and cost control.

How They Use Obiex:

Nigerian scalpers who use Obiex do so because it removes nearly all the barriers that slow down or eat into their strategy.

First, there are zero trading fees. That alone is a game-changer. When your profit margin is just a few naira or cents per trade, even a 0.5% charge can wipe you out. On Obiex, those profits stay intact.

Second, they make use of the instant swap feature. There are no blockchain confirmations or gas fees. This means trades execute immediately, and there’s no risk of prices shifting in those crucial few seconds between decision and execution.

Scalpers also heavily rely on USDT/NGNX stablecoin pairs. These allow them to lock in profits without leaving the crypto ecosystem. For example, after a quick scalp on BTC, a trader might instantly swap back to NGNX to preserve the gain and avoid exposure to market volatility. Later, they can jump back in when the next opportunity arises, all without touching a bank account or paying withdrawal fees.

Another key point is that Obiex supports high-liquidity pairs like BTC/USDT and USDT/NGNX. Scalpers often choose these pairs because they can enter and exit positions without suffering slippage, so their price predictions actually pay off.

3. The DCA Buyer

Who They Are:

The DCA (Dollar Cost Averaging) buyer in Nigeria is focused on long-term growth, not quick profits.

Unlike scalpers or day traders, they’re not concerned with timing the perfect entry. Instead, they invest a fixed amount of money into crypto at regular intervals, daily, weekly, or monthly, regardless of market conditions.

Most DCA buyers have full-time jobs, run their own businesses, or are students looking to build a crypto portfolio over time gradually. They’re not glued to charts. They’re more concerned about consistency and simplicity. Their goal is to accumulate assets over months or years, while spreading out the risk of price volatility.

What makes DCA practical, especially in Nigeria, is that it fits into everyday financial routines. For example, many DCA traders put ₦5,000 to ₦20,000 into crypto every Friday or at the start of each month. They treat it like a savings plan, using crypto as a hedge against inflation, Naira instability, or to prepare for future financial goals.

However, while the strategy is simple, most platforms make it unnecessarily expensive or complicated by charging fees on every small transaction, delaying conversions from NGN to crypto, and providing unclear performance.

How They Use Obiex:

DCA buyers in Nigeria choose Obiex because it makes the process of routine investing stress-free, cost-effective, and easy to track.

The biggest win for them is zero-fee trading. With Obiex, DCA buyers can purchase crypto in NGN without incurring any fees, meaning 100% of their funds go directly into the asset, not into the exchange’s pocket.

They also utilise the manual swap feature, a straightforward process where they log in, select NGN, and choose the desired cryptocurrency (BTC, ETH, USDT), to initiate the swap. There are no delays or confusing steps in this process. Whether they’re topping up weekly or monthly, DCA buyers on Obiex appreciate not having to jump through hoops.

A key part of the DCA approach is tracking your average cost per unit over time. Obiex supports this by providing clear account statements and trade history, so users can easily monitor how much they’ve spent and how much they’ve accumulated. That’s especially useful when evaluating portfolio performance or deciding when to pause or increase contributions.

Many DCA buyers also hold their funds in stablecoins between purchases. This gives them the flexibility to react when the market dips. So, even though they stick to a routine, they can still take advantage of strategic buying moments using Obiex’s instant swap feature.

Lastly, Obiex makes NGN withdrawals simple and fast, which is important for DCA users who occasionally need to access their funds without stress or any penalties.

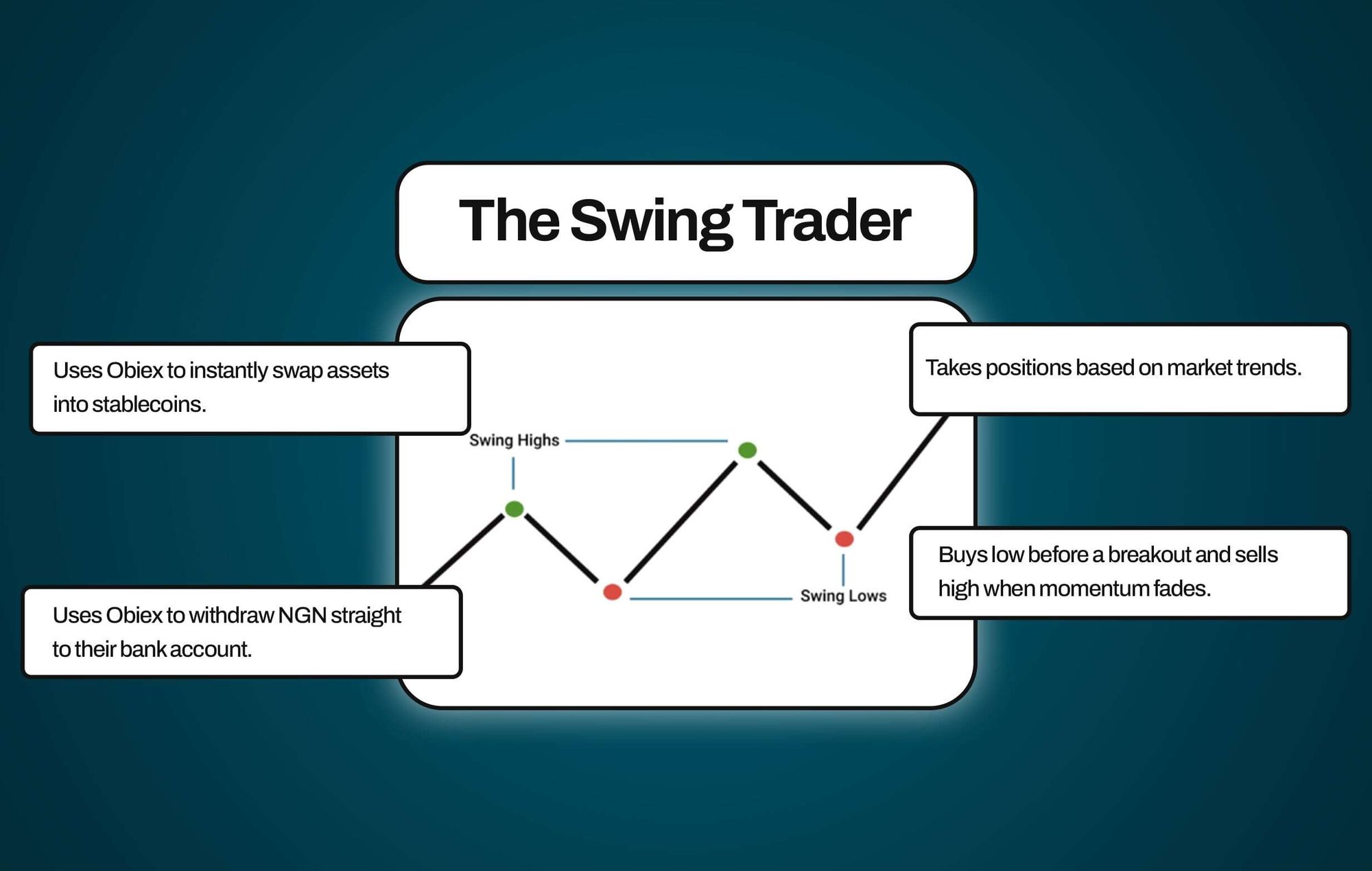

4. The Swing Trader

Who They Are:

Swing traders don’t trade daily like scalpers or day traders, and they don’t buy and hold like DCA buyers. Instead, they take positions based on market trends that play out over a few days to a few weeks. They’re focused on timing; buying low before a breakout and selling high when momentum fades.

Most swing traders study technical indicators, such as the RSI, moving averages, and support/resistance zones. They wait for clear signals and don’t mind holding a position for a week or two. Some swing traders monitor the charts daily, while others check only a few times a week, when they’re waiting for the right setup or watching how a position plays out.

In Nigeria, swing traders often work around price reactions to global news, BTC volatility, or local FX rates. For example, when BTC dips to $57K and shows signs of reversal, a swing trader might enter a position expecting a bounce to $62K. They do not rush because they want a solid profit on a medium-term move, so they’re okay waiting several days or more.

However, their biggest pain points are flexibility, cost, and cashing out. They need a platform that allows them to hold assets without draining fees, quickly convert to stablecoins to protect their gains, and easily off-ramp to NGN when they exit a position.

How They Use Obiex:

Nigerian swing traders use Obiex because it supports this medium-term, flexible trading style without the usual platform friction.

First, they hold crypto positions, BTC, ETH, or USDT, directly on Obiex, knowing they can exit whenever they’re ready. There are no storage fees or withdrawal penalties, so there’s no pressure to exit trades prematurely.

When it's time to take a profit or reduce exposure, swing traders can instantly swap their assets into stablecoins. For example, if they bought BTC at ₦90M and it's now trading at ₦105M, they can lock in gains by swapping to USDT, all in a few taps, with zero fees and no price slippage.

This instant access to Obiex stablecoin pairs is crucial for them. It means they don’t have to move funds to external wallets just to manage risk. It keeps their capital flexible and ready for the next swing setup.

And when they’re ready to pull out profits, they simply withdraw NGN straight to their bank account without hidden charges. Some swing traders do this monthly or after major wins. Others leave some in NGNX, ready to rotate into the next opportunity.

Obiex’s clear trade history and balance overview also help swing traders track their past positions, monitor growth, and plan their next move based on solid numbers.

5. The Range Trader

Who They Are:

Range traders operate in structured price environments. Instead of chasing trends, they focus on assets that move sideways between support and resistance levels. For example, say BTC fluctuates between $58,000 and $62,000. Their job is to buy low within the range, sell high, and repeat the cycle.

Many Nigerian range traders are technical analysts. They use chart patterns, moving averages, and horizontal levels to time entries and exits. They don’t rely on crypto news or hype. They rely on patterns and timing. And while their trades aren’t as rapid as scalpers', they still demand quick execution and tight trade control.

A typical Nigerian range trader might take 2–5 trades per week, targeting profit zones of ₦10K–₦100K per cycle. They need to be able to move in and out of positions instantly, without losing edge to slippage, high fees, or poor NGN access.

How They Use Obiex:

Nigerian range traders on Obiex use the platform to enter, exit, and rebalance positions quickly, without platform limitations interfering with their strategy.

Because they depend heavily on price zones, precision is everything.

If BTC hits ₦92M (support) and they want to enter, they need the platform to execute immediately. If there's a delay, they might miss the bounce. That’s why range traders prefer Obiex’s instant swap feature, which allows them to get in and out without waiting for on-chain confirmations.

They mostly trade between BTC/USDT and USDT/NGNX, depending on whether they’re entering or exiting the trade. These pairs offer high liquidity and tight spreads, allowing traders to execute trades accurately without the market moving against them mid-trade.

Another critical factor is cost. Since range traders operate frequently within defined boundaries, even small fees on each entry and exit can eat into their profits over time. On Obiex, traders can trade without incurring any transaction fees, making every range trade cost-efficient and sustainable in the long term.

They also use Obiex to quickly switch assets based on how the range is performing. For instance, if BTC is nearing the top of the range, they might exit into USDT. If it dips back down, they can instantly re-enter. Obiex’s zero-fee stablecoin swaps make this strategy viable without draining their capital.

And when they’re done for the week or want to take partial profits, they withdraw directly to their NGN account.

To Recap

- Day Traders use Obiex to make fast, repeated trades without losing profit to fees, capitalising on instant swaps and zero trading charges.

- Scalpers rely on Obiex for micro-timeframe trades, using stablecoin pairs and instant execution to protect their slim margins against slippage and delays.

- DCA Buyers buy crypto in small amounts regularly without worrying about costs, because Obiex offers zero-fee crypto swaps.

- Swing Traders use Obiex to switch between crypto and stablecoins, take profits, and withdraw NGN directly without friction or hidden fees.

- Range Traders thrive on quick entries and exits within price zones, using Obiex’s high-liquidity pairs, no slippage, and fee-free swaps.

- Obiex makes every style work due to its fast execution, zero fees, local NGN support, and stablecoin tools specifically designed for Nigerian crypto traders.

Ready to trade your way?

FAQs

Q1. What type of crypto trading strategy works best in Nigeria?

It depends on your goals. Scalping, swing trading, and DCA can all work well, especially when you use a zero-fee platform like Obiex.

Q2. Does Obiex support different trading styles?Yes. Obiex is designed to cater to every Nigerian crypto trader, from day traders to long-term holders.

Q3. Is Obiex good for DCA (Dollar Cost Averaging)?

Absolutely. With zero-fee swaps and NGN-to-crypto options, Obiex is perfect for DCA buyers.

Q4. How can Obiex help me scalp trade in Nigeria?

You get instant swaps, no gas fees, and stablecoin pairs ideal for quick trades and small profit margins.

Q5. What are the best trading pairs for Nigerian traders on Obiex?

BTC/USDT and USDT/NGNX offer top liquidity and tight spreads for fast, reliable trading.

Q6. Can I withdraw profits in NGN on Obiex?Yes. Obiex supports fast, direct NGN withdrawals to Nigerian bank accounts.

Q7. Is there slippage on Obiex?

Slippage is minimal due to high liquidity and instant swaps.

Q8. Can I hold crypto on Obiex long-term?Yes. You can hold BTC, ETH, USDT, or NGNX on Obiex with full flexibility to swap or withdraw when needed.

Q9. Does Obiex charge network or gas fees?

No. All swaps are off-chain and fee-free.

Q10. Is Obiex secure for Nigerian crypto users?

Yes. Obiex uses industry-grade security and encryption protocols to keep your assets and data safe.

Disclaimer: This article was written to provide guidance and understanding. It is not an exhaustive article and should not be taken as financial advice. Obiex will not be held liable for your investment decisions.